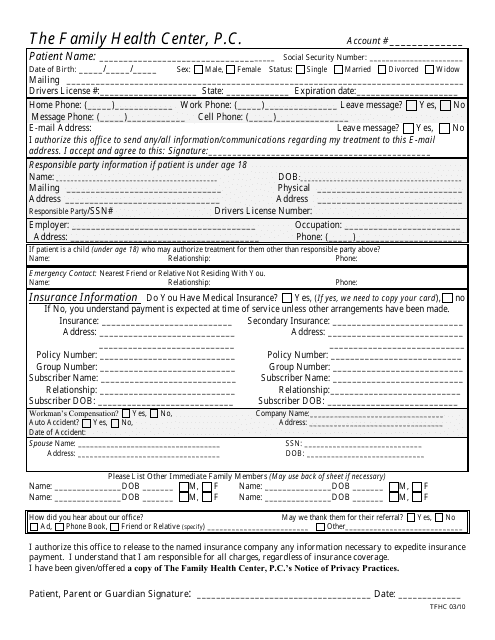

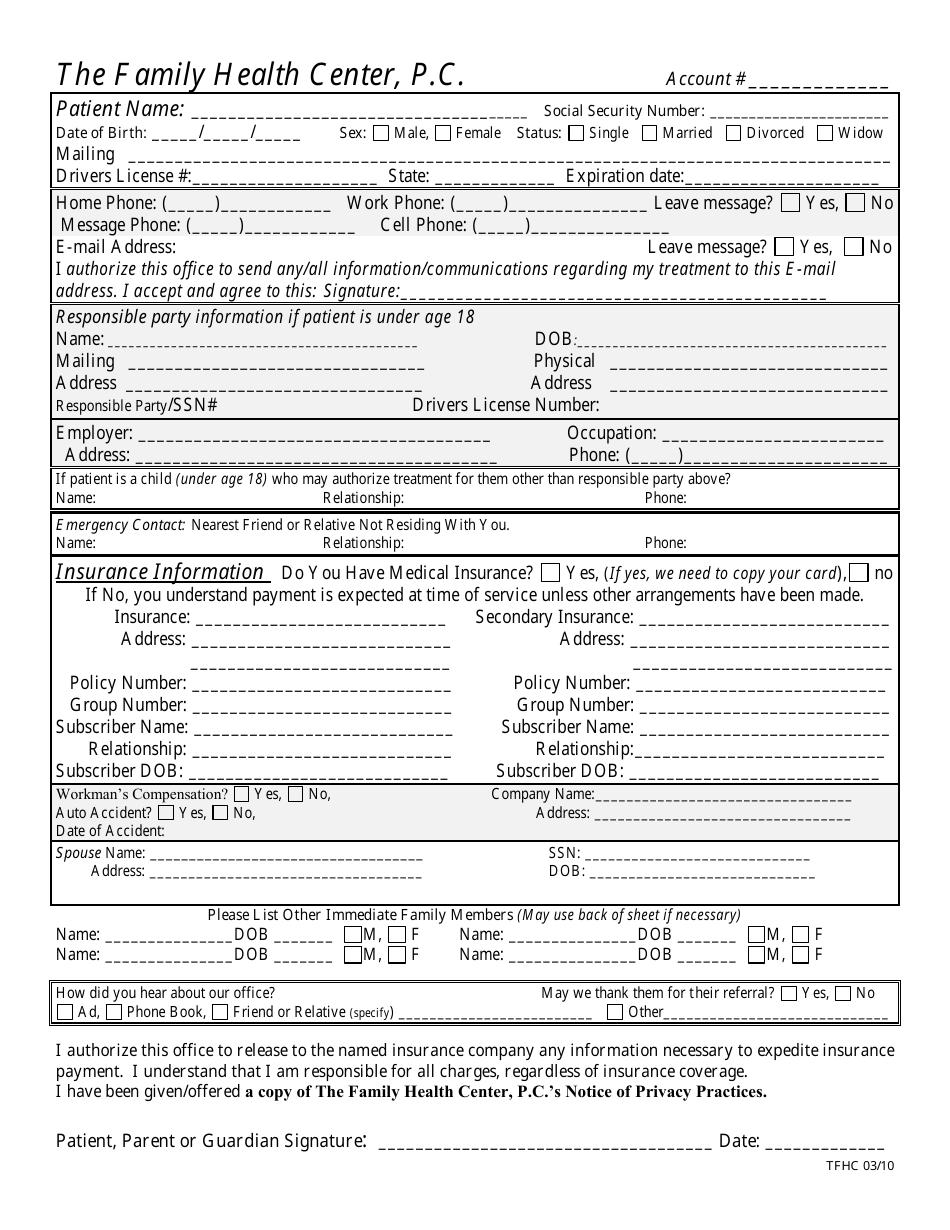

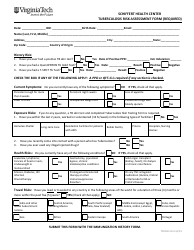

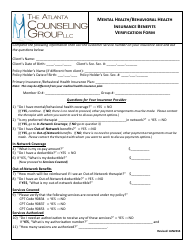

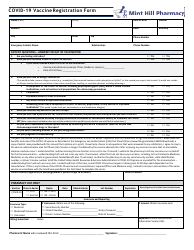

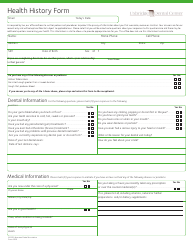

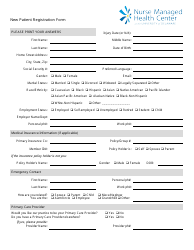

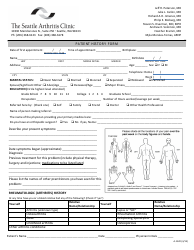

Health Insurance Application Form - Family Health Center, P.c.

The Health Insurance Application Form - Family Health Center, P.C. is used for individuals or families to apply for health insurance coverage at the Family Health Center, P.C. It helps gather the necessary information required to process and evaluate the application for health insurance services provided by the center.

Typically, the individual or head of the family would file the health insurance application form with Family Health Center, P.C. However, the specific instructions may vary based on the policies and procedures of the center. It is always best to reach out to Family Health Center, P.C. directly for accurate information regarding the filing process.

FAQ

Q: What is the Family Health Center?

A: The Family Health Center is a medical practice that provides healthcare services to families.

Q: What is a health insurance application form?

A: A health insurance application form is a document that individuals or families fill out to apply for health insurance coverage.

Q: Why would I need to fill out a health insurance application form?

A: You would need to fill out a health insurance application form if you want to apply for health insurance coverage for yourself and your family.

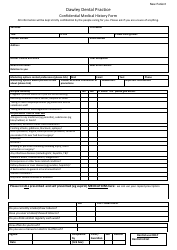

Q: What information is typically required in a health insurance application form?

A: A health insurance application form typically asks for personal information such as your name, address, date of birth, social security number, and information about your family members.

Q: Is completing a health insurance application form a guarantee of coverage?

A: No, completing a health insurance application form does not guarantee that you will be approved for health insurance coverage. The insurance company will review your application and determine if you meet their eligibility requirements.

Q: Are there any fees associated with filling out a health insurance application form?

A: There are generally no fees associated with filling out a health insurance application form. However, you will have to pay premiums for the health insurance coverage once you are approved.

Q: Can I apply for health insurance coverage at any time?

A: In the United States, there is an annual open enrollment period during which individuals can apply for health insurance coverage. However, there are also certain qualifying life events that allow you to apply for coverage outside of the open enrollment period.

Q: What happens after I submit my health insurance application form?

A: After you submit your health insurance application form, the insurance company will review your information and notify you of their decision. If approved, you will receive information about your coverage and the premiums you need to pay.

Q: What should I do if my health insurance application is denied?

A: If your health insurance application is denied, you can inquire about the reason for the denial and explore alternative options for obtaining health insurance coverage, such as through Medicaid or other government programs.

Q: Can I change my health insurance plan after enrollment?

A: In some cases, you may be able to change your health insurance plan after enrollment. This would typically be allowed during the annual open enrollment period or if you experience a qualifying life event.

Q: Is health insurance coverage mandatory in the United States?

A: No, health insurance coverage is not mandatory for all individuals in the United States. However, there may be penalties or tax implications for not having health insurance.

Q: What are the benefits of having health insurance coverage?

A: Having health insurance coverage provides financial protection against medical expenses, allows access to healthcare services and preventive care, and can help in managing and treating medical conditions.

Q: What are the different types of health insurance plans available?

A: There are various types of health insurance plans available, including HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), POS (Point of Service), and EPO (Exclusive Provider Organization) plans. These plans differ in terms of cost, provider networks, and flexibility.

Q: How much does health insurance coverage typically cost?

A: The cost of health insurance coverage can vary depending on factors such as your age, location, the insurance carrier, and the level of coverage you choose. It is recommended to compare different plans and their associated costs before making a decision.

Q: Do health insurance plans cover pre-existing conditions?

A: Under the Affordable Care Act, health insurance plans are required to cover pre-existing conditions. This means that insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions.

Q: Can I include my family members in my health insurance coverage?

A: Yes, you can include your family members in your health insurance coverage. Most health insurance plans offer options for dependent coverage.

Q: What is a deductible in health insurance?

A: A deductible is the amount of money you must pay out of pocket for covered medical expenses before your health insurance plan starts to pay.

Q: What is a copayment?

A: A copayment, or copay, is a fixed amount you pay for a covered healthcare service at the time of receiving the service. For example, you may have a copay of $20 for a doctor's visit.

Q: What is a premium in health insurance?

A: A premium is the amount of money you pay to the insurance company for your health insurance coverage. It is usually paid monthly, quarterly, or annually.

Q: What is an out-of-pocket maximum?

A: An out-of-pocket maximum is the limit on the amount of money you have to pay for covered medical expenses in a plan year. Once you reach this limit, the insurance company pays 100% of the covered expenses.

Q: What is a health savings account (HSA)?

A: A health savings account (HSA) is a tax-advantaged savings account that allows individuals with high-deductible health plans to save money for medical expenses. Contributions to an HSA are tax-deductible and withdrawals for qualified medical expenses are tax-free.

Q: What is a network provider?

A: A network provider is a healthcare professional, facility, or supplier that has an agreement with your health insurance plan to provide services at discounted rates. It is usually more cost-effective to receive care from network providers.

Q: What is an in-network vs out-of-network provider?

A: An in-network provider is a healthcare professional, facility, or supplier that has a contractual agreement with your health insurance plan to provide services at discounted rates. An out-of-network provider does not have a contract with your insurance plan and may result in higher out-of-pocket costs for you.

Q: What is a primary care physician?

A: A primary care physician is a doctor who provides general healthcare services and coordinates other medical care for patients. They are often the first point of contact for individuals seeking medical treatment.

Q: Can I use my health insurance for prescription medication?

A: Yes, most health insurance plans provide coverage for prescription medications. The coverage may vary depending on the specific plan and may involve copayments or coinsurance.

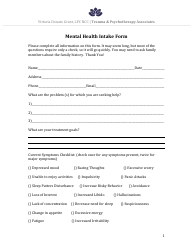

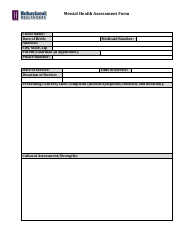

Q: Can I use my health insurance for mental health services?

A: Yes, most health insurance plans provide coverage for mental health services, including therapy and counseling. Coverage may vary depending on the specific plan.

Q: Can I use my health insurance for preventive care?

A: Yes, most health insurance plans cover preventive care services, such as vaccinations, screenings, and annual check-ups. Preventive care is often covered at no cost or with a low copayment.

Q: Can I use my health insurance for emergency care?

A: Yes, health insurance plans typically provide coverage for emergency care services. However, it is important to understand the specific terms and conditions of your plan regarding emergency care.

Q: What is the difference between health insurance and medical assistance programs?

A: Health insurance is a form of coverage that individuals buy to help shoulder the costs associated with medical care. Medical assistance programs, such as Medicaid or Medicare, are government-sponsored programs that provide healthcare coverage to eligible individuals.

Q: Can I have both health insurance and medical assistance?

A: Yes, in some cases individuals may qualify for both health insurance and medical assistance programs. This is known as dual eligibility and can provide additional coverage and benefits.

Q: What if I am unable to afford health insurance?

A: If you are unable to afford health insurance, you may qualify for government-sponsored programs like Medicaid or the Children's Health Insurance Program (CHIP), which provide coverage for low-income individuals and families.

Q: What should I consider when choosing a health insurance plan?

A: When choosing a health insurance plan, you should consider factors such as the cost of premiums and deductibles, the provider network, the coverage offered, and any specific healthcare needs you may have.

Q: How can I compare different health insurance plans?

A: You can compare different health insurance plans by looking at the cost of premiums and deductibles, the provider network, the coverage offered, and any additional benefits or features of the plans. Many health insurance companies and healthcare marketplaces provide tools for comparing plans.

Q: Will I lose my health insurance if I change jobs?

A: If you change jobs, you may lose your current health insurance coverage. However, many employers offer health insurance benefits to their employees, so you may be able to enroll in a new health insurance plan through your new employer.

Q: What is COBRA and how does it relate to health insurance?

A: COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. It allows individuals who have lost their job or experienced a reduction in work hours to continue their health insurance coverage for a limited period of time by paying the full premium themselves.

Q: Can I use my health insurance when traveling outside of the United States?

A: Health insurance coverage for international travel varies depending on the specific plan. Some plans may provide limited coverage for emergency medical expenses while traveling, while others may require additional travel insurance.

Q: What is the Affordable Care Act (ACA)?

A: The Affordable Care Act (ACA) is a healthcare reform law in the United States that was enacted in 2010. It introduced various provisions to expand access to affordable health insurance coverage and protect consumers.