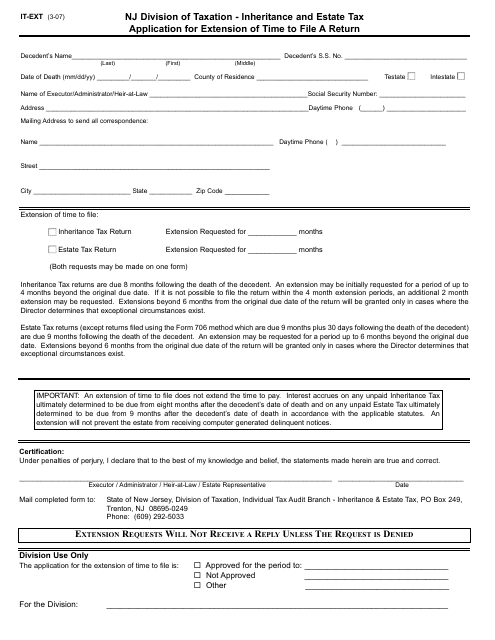

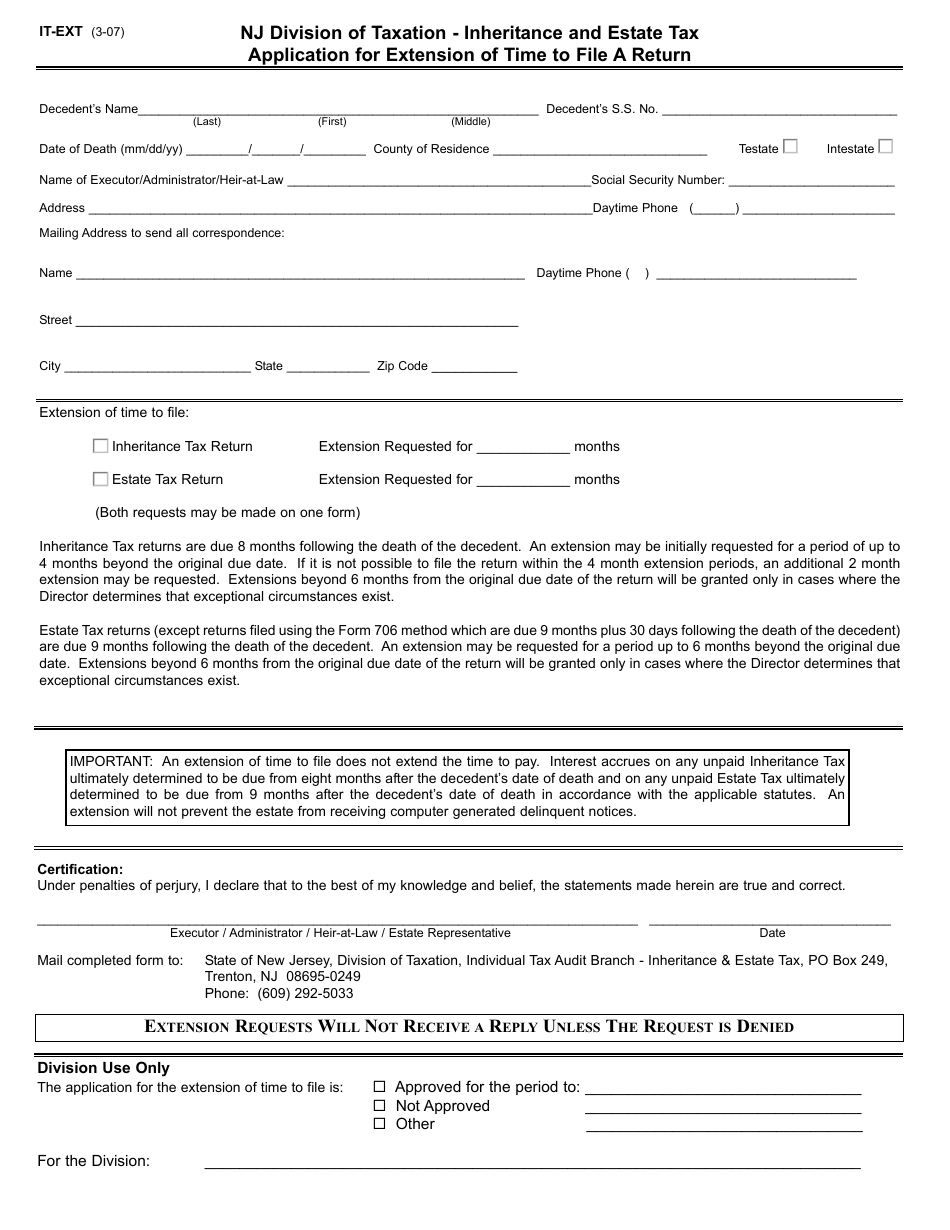

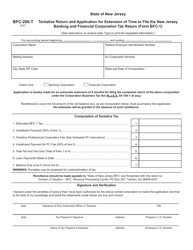

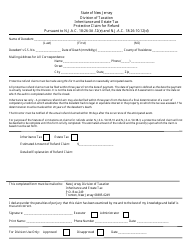

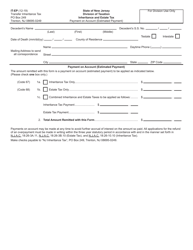

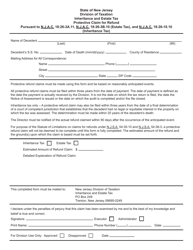

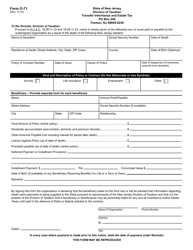

Form IT-EXT Inheritance and Estate Tax Application for Extension of Time to File a Return - New Jersey

What Is Form IT-EXT?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-EXT?

A: Form IT-EXT is an application for extension of time to file an inheritance and estate tax return in the state of New Jersey.

Q: Who should file Form IT-EXT?

A: Individuals or their representatives who need more time to file an inheritance and estate tax return in New Jersey should file Form IT-EXT.

Q: What is the purpose of filing Form IT-EXT?

A: The purpose of filing Form IT-EXT is to request an extension of time to file an inheritance and estate tax return in New Jersey.

Q: What is the deadline for filing Form IT-EXT?

A: Form IT-EXT must be filed on or before the original due date of the inheritance and estate tax return, which is nine months after the decedent's date of death.

Q: Is there a penalty for late filing of Form IT-EXT?

A: Yes, if Form IT-EXT is not filed on or before the original due date of the inheritance and estate tax return, penalties and interest may apply.

Q: What documents should be included with Form IT-EXT?

A: Form IT-EXT should be accompanied by a copy of the federal extension, a copy of the estate tax payment voucher (if applicable), and a copy of the federal return (if one is filed).

Q: Can I file Form IT-EXT electronically?

A: No, Form IT-EXT cannot be filed electronically. It must be filed by mail.

Q: How long does the extension granted by Form IT-EXT last?

A: The extension granted by Form IT-EXT is generally for an additional six months beyond the original deadline to file the inheritance and estate tax return.

Q: What should I do if I am unable to pay the full amount of the tax by the original due date?

A: If you are unable to pay the full amount of the tax by the original due date, you should still file Form IT-EXT to request an extension of time to file. However, you may be subject to penalties and interest on any unpaid tax.

Q: Is it possible to request an additional extension beyond the one granted by Form IT-EXT?

A: Yes, it is possible to request an additional extension by filing Form IT-EXT-B, but it must be done before the original extension period expires.

Q: Are there any exceptions or special circumstances for filing Form IT-EXT?

A: Yes, there are certain exceptions and special circumstances that may affect the filing of Form IT-EXT. It is recommended to consult the instructions for Form IT-EXT or contact the New Jersey Division of Taxation for more information.

Q: What happens if I do not file Form IT-EXT?

A: If you do not file Form IT-EXT and fail to file the inheritance and estate tax return by the original due date, you may be subject to penalties and interest.

Form Details:

- Released on March 1, 2007;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-EXT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.