This version of the form is not currently in use and is provided for reference only. Download this version of

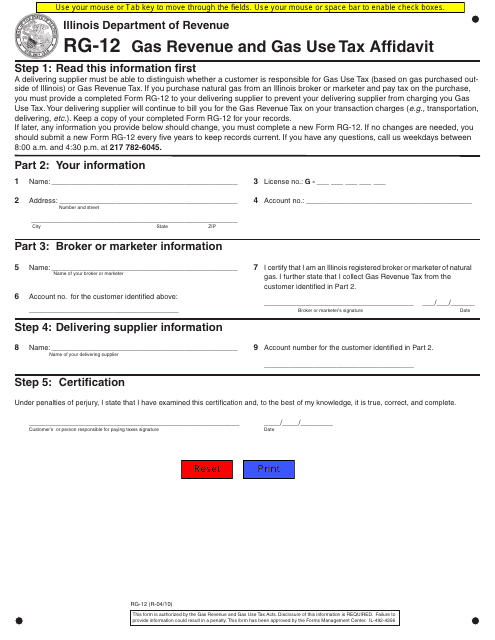

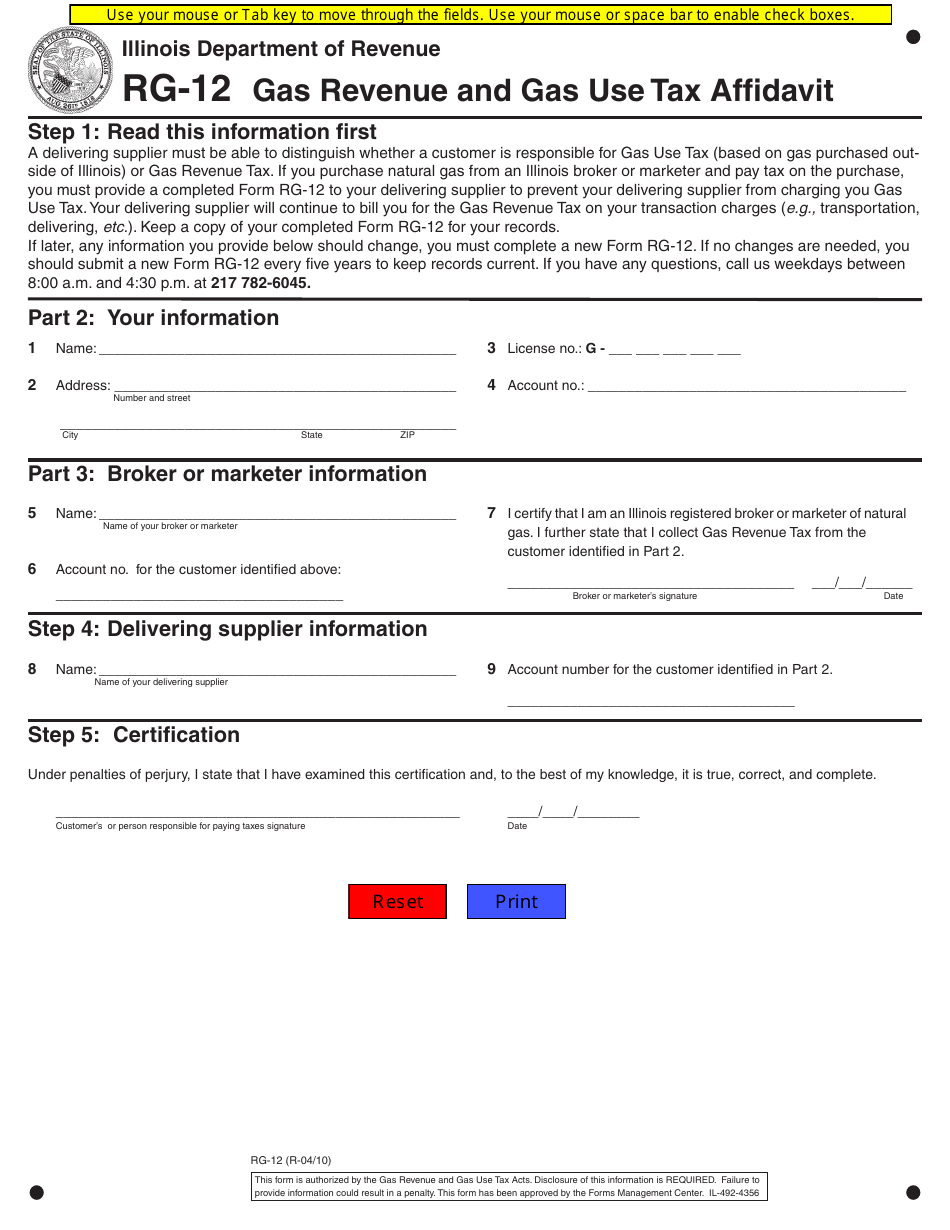

Form RG-12

for the current year.

Form RG-12 Gas Revenue and Gas Use Tax Affidavit - Illinois

What Is Form RG-12?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RG-12?

A: Form RG-12 is a Gas Revenue and Gas Use Tax Affidavit.

Q: What is the purpose of form RG-12?

A: The purpose of form RG-12 is to report gas revenue and gas use tax in Illinois.

Q: Who needs to file form RG-12?

A: Businesses and individuals who are responsible for paying gas revenue and gas use tax in Illinois need to file form RG-12.

Q: What information is required on form RG-12?

A: Form RG-12 requires information such as the taxpayer's name, address, and account number, as well as details of gas sales and use tax.

Q: When is form RG-12 due?

A: The due date for filing form RG-12 varies depending on the reporting period. It is typically due on a monthly or quarterly basis.

Q: Is there a penalty for late filing of form RG-12?

A: Yes, there may be penalties for late filing of form RG-12. It is important to file on time to avoid any penalties or interest charges.

Q: Are there any exemptions or deductions available on form RG-12?

A: Yes, there may be exemptions or deductions available on form RG-12. It is recommended to consult the instructions or a tax professional for more information.

Q: What should I do if I need help with form RG-12?

A: If you need help with form RG-12, you can contact the Illinois Department of Revenue for assistance.

Form Details:

- Released on April 1, 2010;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RG-12 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.