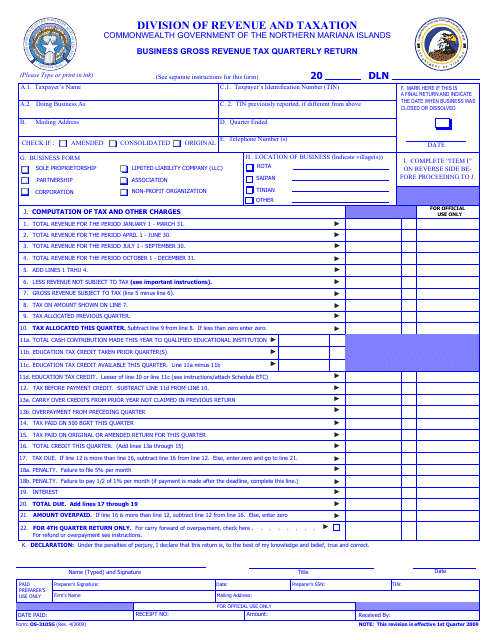

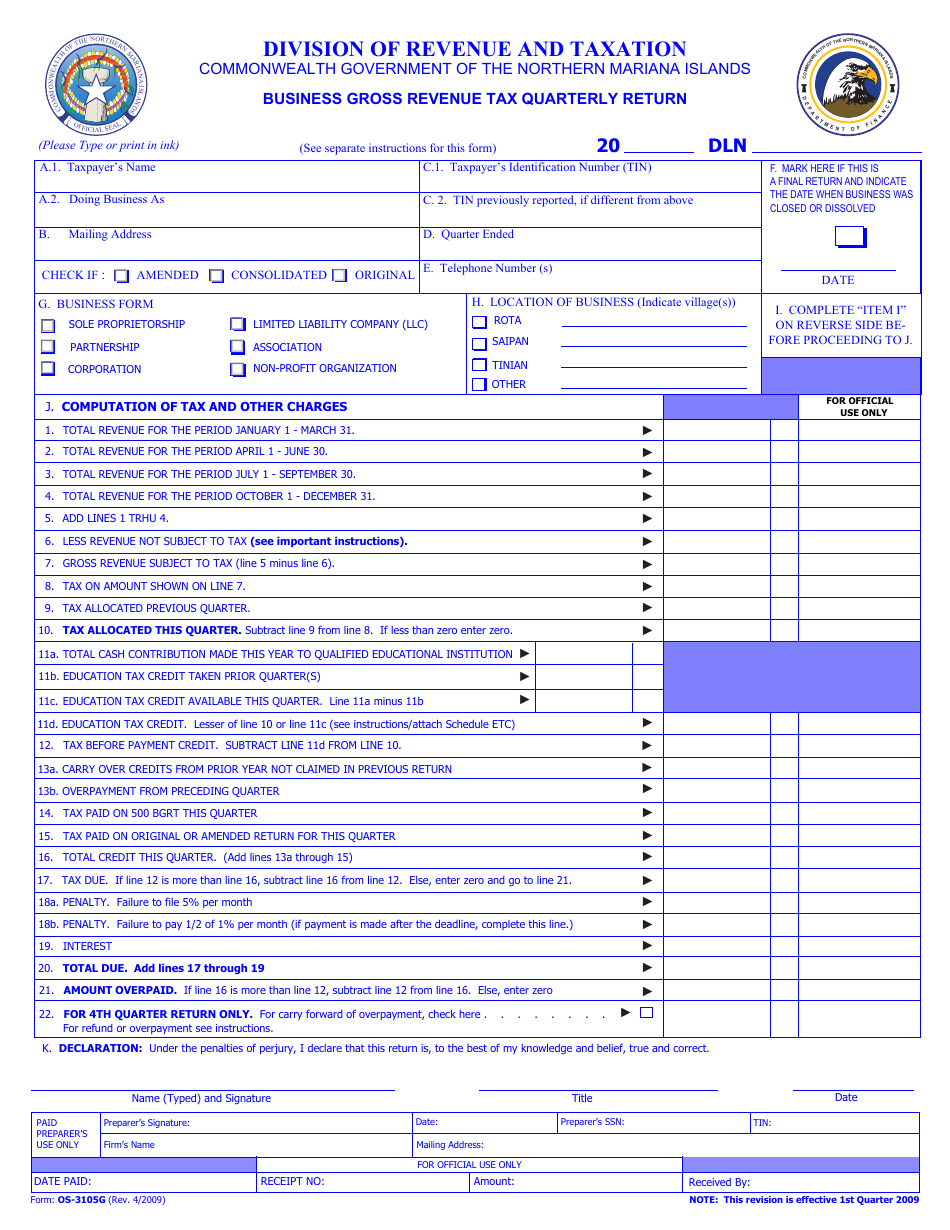

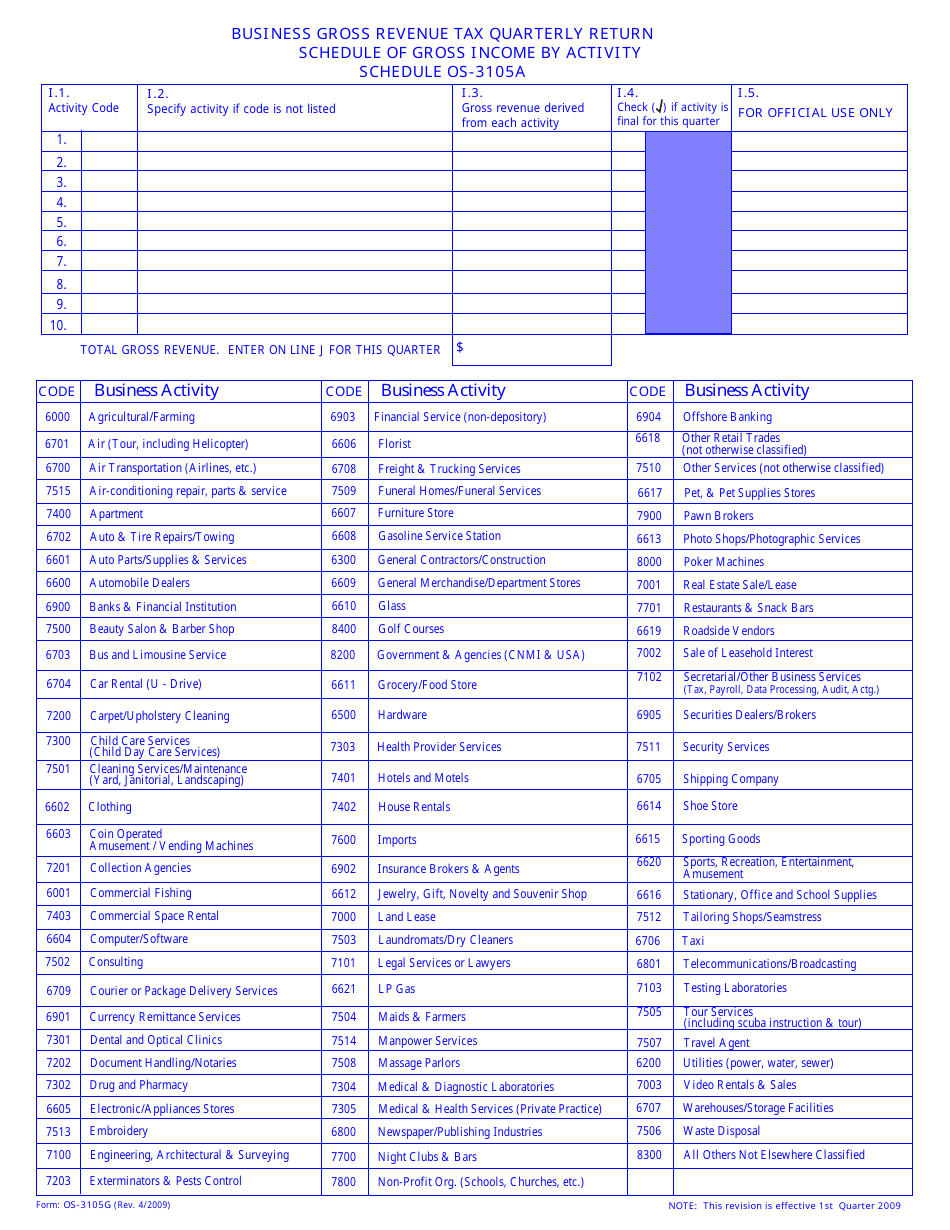

Form OS-3105G Business Gross Revenue Tax Quarterly Return - Northern Mariana Islands

What Is Form OS-3105G?

This is a legal form that was released by the Commonwealth of the Northern Mariana Islands Department of Finance - a government authority operating within Northern Mariana Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OS-3105G?

A: Form OS-3105G is the Business Gross Revenue Tax Quarterly Return for businesses in the Northern Mariana Islands.

Q: Who needs to file Form OS-3105G?

A: Businesses in the Northern Mariana Islands who are subject to the Business Gross Revenue Tax need to file Form OS-3105G.

Q: What is the Business Gross Revenue Tax?

A: The Business Gross Revenue Tax is a tax imposed on businesses in the Northern Mariana Islands based on their gross revenue.

Q: When should Form OS-3105G be filed?

A: Form OS-3105G should be filed quarterly, by the end of the following month after each quarter.

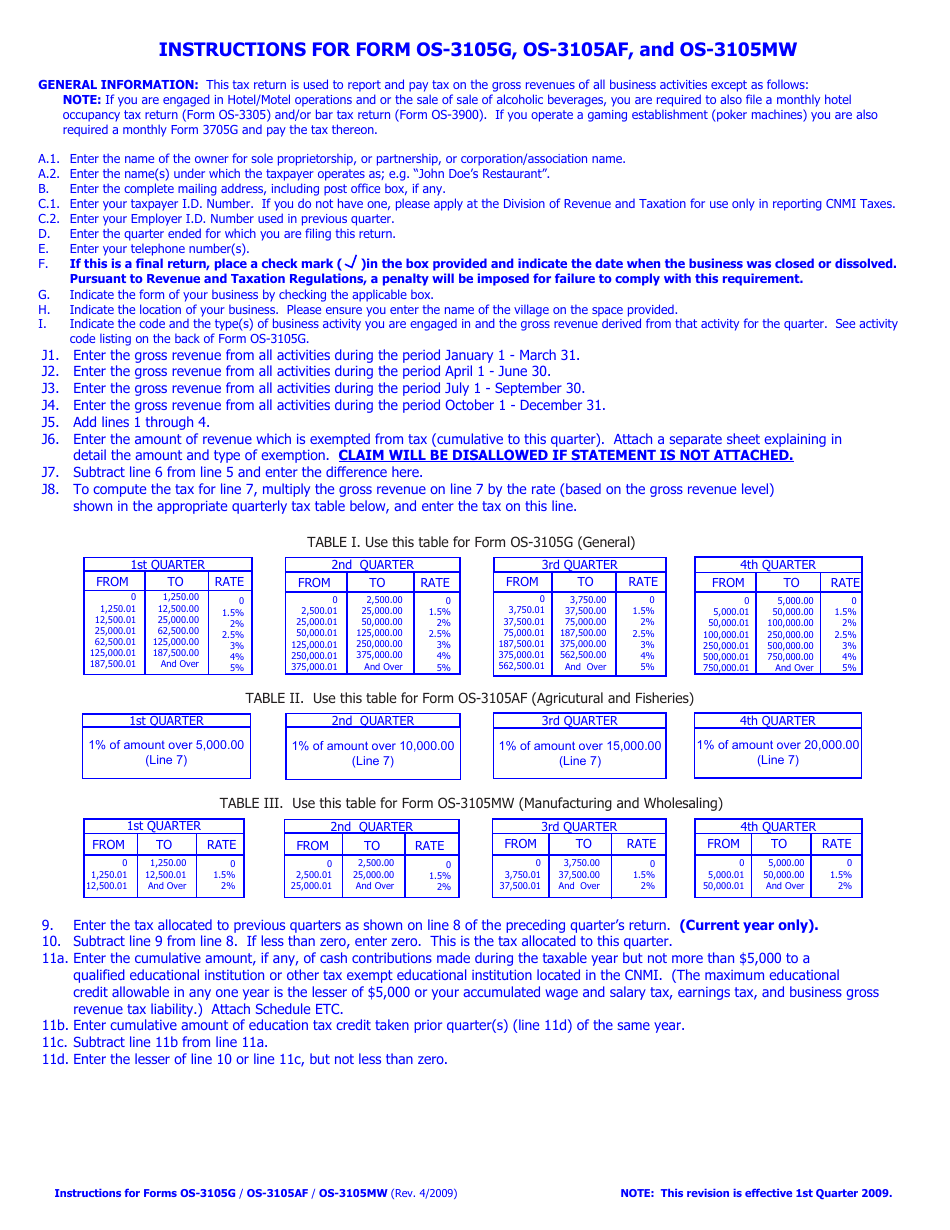

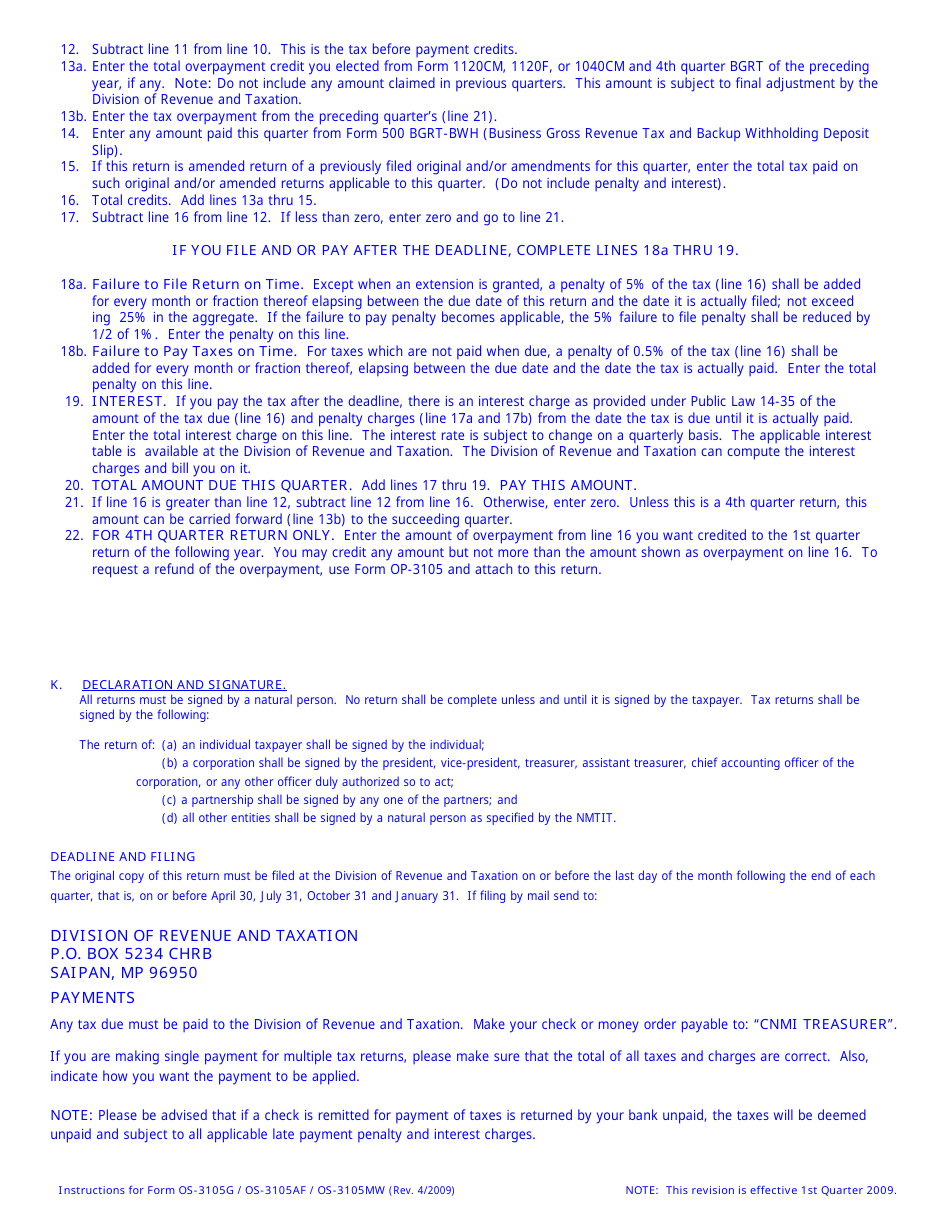

Q: Are there any penalties for late filing of Form OS-3105G?

A: Yes, there are penalties for late filing of Form OS-3105G, including interest on the unpaid tax amount.

Form Details:

- Released on April 1, 2009;

- The latest edition provided by the Commonwealth of the Northern Mariana Islands Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OS-3105G by clicking the link below or browse more documents and templates provided by the Commonwealth of the Northern Mariana Islands Department of Finance.