Certificate of Conversion From a Delaware Partnership to a Non-delaware Entity - Delaware

Certificate of Conversion From a Delaware Partnership to a Non-delaware Entity is a legal document that was released by the Delaware Department of State - a government authority operating within Delaware.

FAQ

Q: What is a Certificate of Conversion?

A: A Certificate of Conversion is a legal document used to convert a Delaware Partnership into a non-Delaware entity.

Q: Why would a Delaware Partnership want to convert to a non-Delaware entity?

A: There could be various reasons to convert, such as expanding into other states or jurisdictions, changing the legal structure, or taking advantage of different tax or regulatory benefits.

Q: What is the process for converting a Delaware Partnership to a non-Delaware entity?

A: The process typically involves filing a Certificate of Conversion with the Delaware Secretary of State, along with other required documentation, and complying with the conversion requirements of the destination state or jurisdiction.

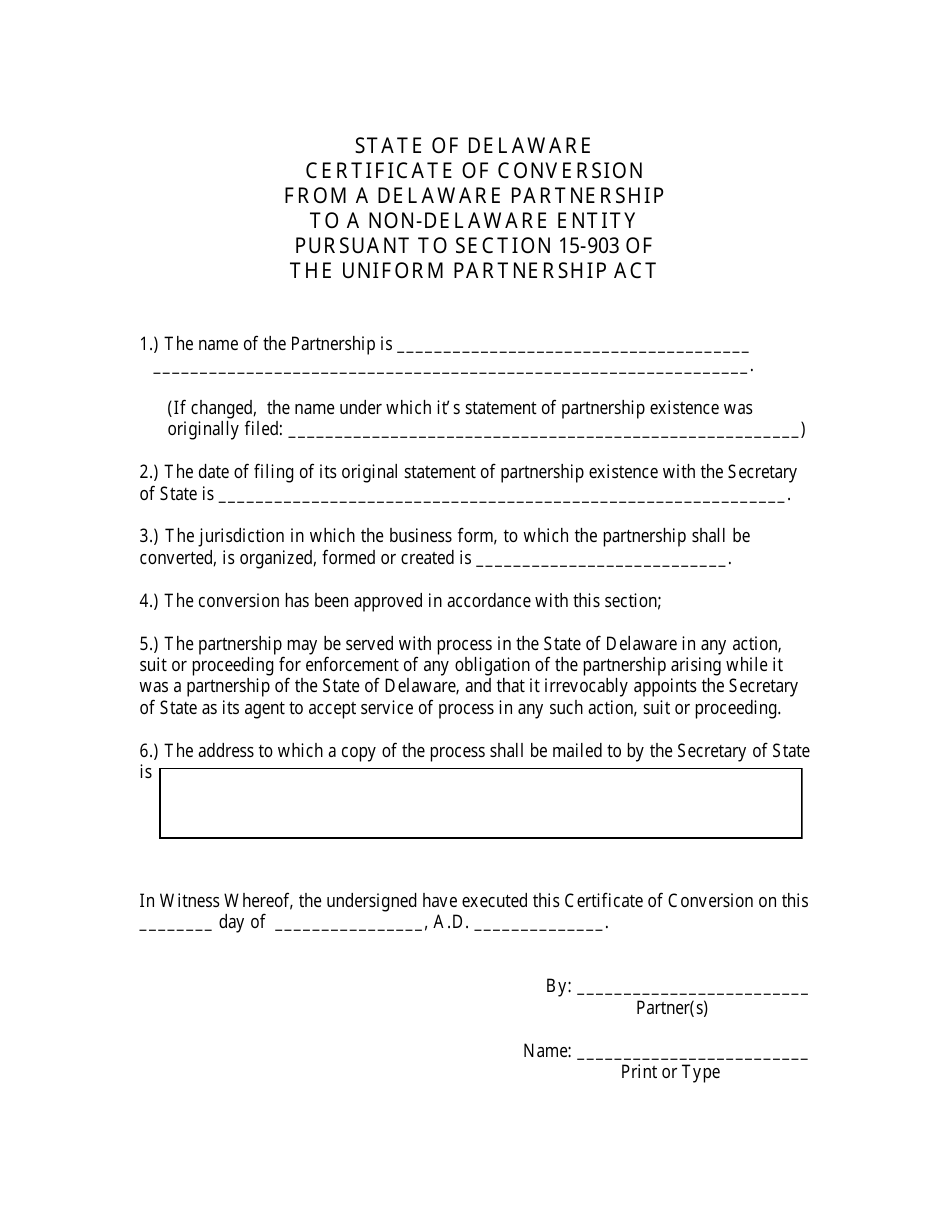

Q: What information is needed to file a Certificate of Conversion?

A: The specific information required may vary depending on the destination state or jurisdiction, but generally, you will need to provide details about the partnership, its owners, the new entity, and the terms of conversion.

Q: How long does the conversion process take?

A: The processing time can vary, but it typically takes several weeks to complete the conversion process.

Q: Are there any fees associated with filing a Certificate of Conversion?

A: Yes, there are usually filing fees associated with the conversion process, which can vary depending on the state or jurisdiction.

Q: Do I need legal assistance to file a Certificate of Conversion?

A: While it is not required, it is recommended to consult with a knowledgeable attorney or business professional to ensure compliance with the relevant laws and regulations.

Q: Can a converted entity continue to operate under the same name?

A: It depends on the laws of the destination state or jurisdiction. In some cases, you may need to register the new entity under a different name or obtain a fictitious name filing.

Q: What happens to the partnership's assets and liabilities during the conversion?

A: Typically, the assets and liabilities of the partnership are transferred to the new entity as part of the conversion process, but the specific details may vary depending on the terms of conversion and applicable laws.

Q: Can a converted entity transfer its existing contracts and agreements?

A: In most cases, the converted entity can transfer its existing contracts and agreements to the new entity, but it is important to review the terms and seek legal advice if necessary.

Form Details:

- Released on September 1, 2005;

- The latest edition currently provided by the Delaware Department of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of State.