Certificate of Conversion From a Non-delaware Limited Liability Partnership to a Delaware Partnership - Delaware

Certificate of Conversion From a Non-delaware Limited Liability Partnership to a Delaware Partnership is a legal document that was released by the Delaware Department of State - a government authority operating within Delaware.

FAQ

Q: What is a Certificate of Conversion?

A: A Certificate of Conversion is a legal document that allows a non-Delaware Limited Liability Partnership to convert into a Delaware Partnership.

Q: What is a Non-Delaware Limited Liability Partnership?

A: A Non-Delaware Limited Liability Partnership is a type of business structure that is formed and governed by the laws of a state other than Delaware.

Q: What is a Delaware Partnership?

A: A Delaware Partnership is a business entity formed and governed by the laws of the state of Delaware.

Q: Why would a Non-Delaware Limited Liability Partnership want to convert to a Delaware Partnership?

A: There are various reasons a Non-Delaware Limited Liability Partnership may want to convert to a Delaware Partnership, such as taking advantage of Delaware's favorable business laws and well-established legal system.

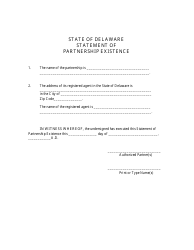

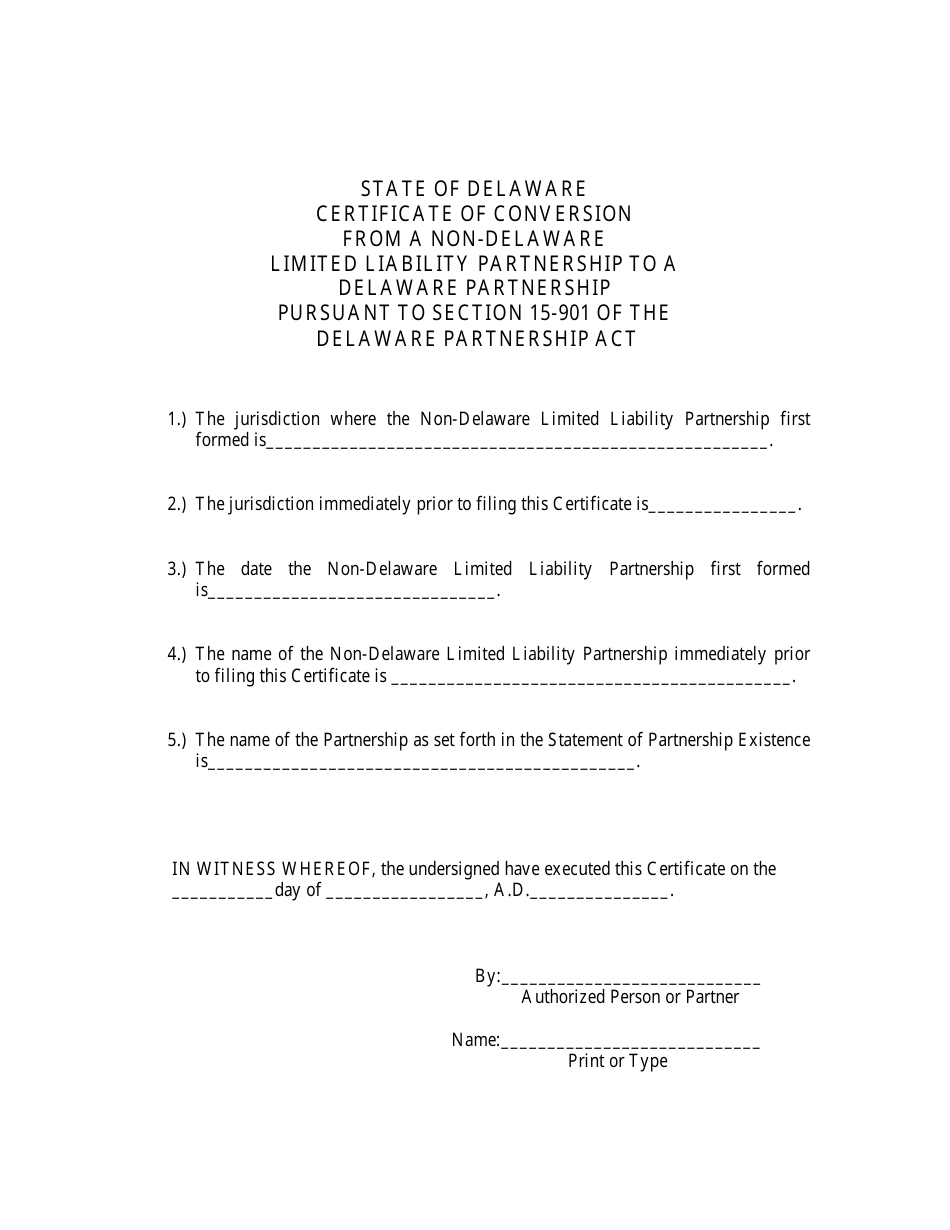

Q: What information is typically included in a Certificate of Conversion?

A: A Certificate of Conversion usually includes the name of the partnership, the state of formation, the new Delaware partnership name, and a statement of conversion.

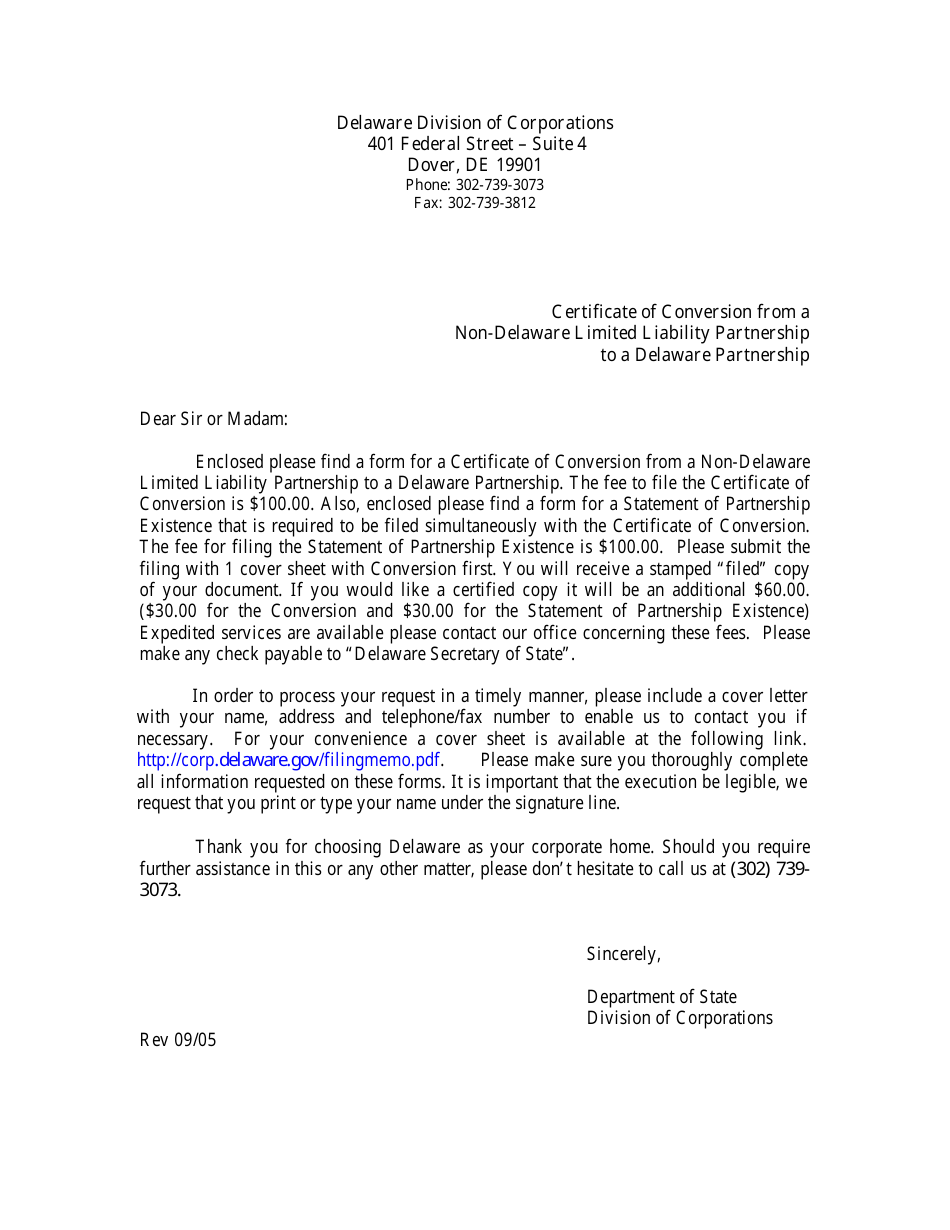

Q: How can a Non-Delaware Limited Liability Partnership convert to a Delaware Partnership?

A: To convert to a Delaware Partnership, a Non-Delaware Limited Liability Partnership must file a Certificate of Conversion with the Delaware Secretary of State and comply with any additional requirements.

Q: Are there any fees associated with the conversion process?

A: Yes, there are usually fees associated with filing a Certificate of Conversion with the Delaware Secretary of State.

Q: Can the partners of a Non-Delaware Limited Liability Partnership continue their existing partnership after conversion?

A: Yes, the partners of a Non-Delaware Limited Liability Partnership can continue their partnership after conversion to a Delaware Partnership.

Q: Are there any tax implications of converting to a Delaware Partnership?

A: Tax implications may vary depending on the specific circumstances and should be discussed with a tax professional.

Q: Is legal assistance required for the conversion process?

A: While legal assistance is not required, it may be beneficial to consult with an attorney familiar with Delaware partnership laws to ensure compliance.

Form Details:

- Released on September 1, 2005;

- The latest edition currently provided by the Delaware Department of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of State.