Certificate of Conversion From a Non-delaware Limited Partnership to a Delaware Limited Partnership - Delaware

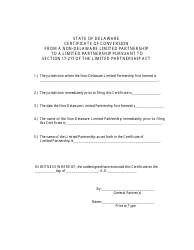

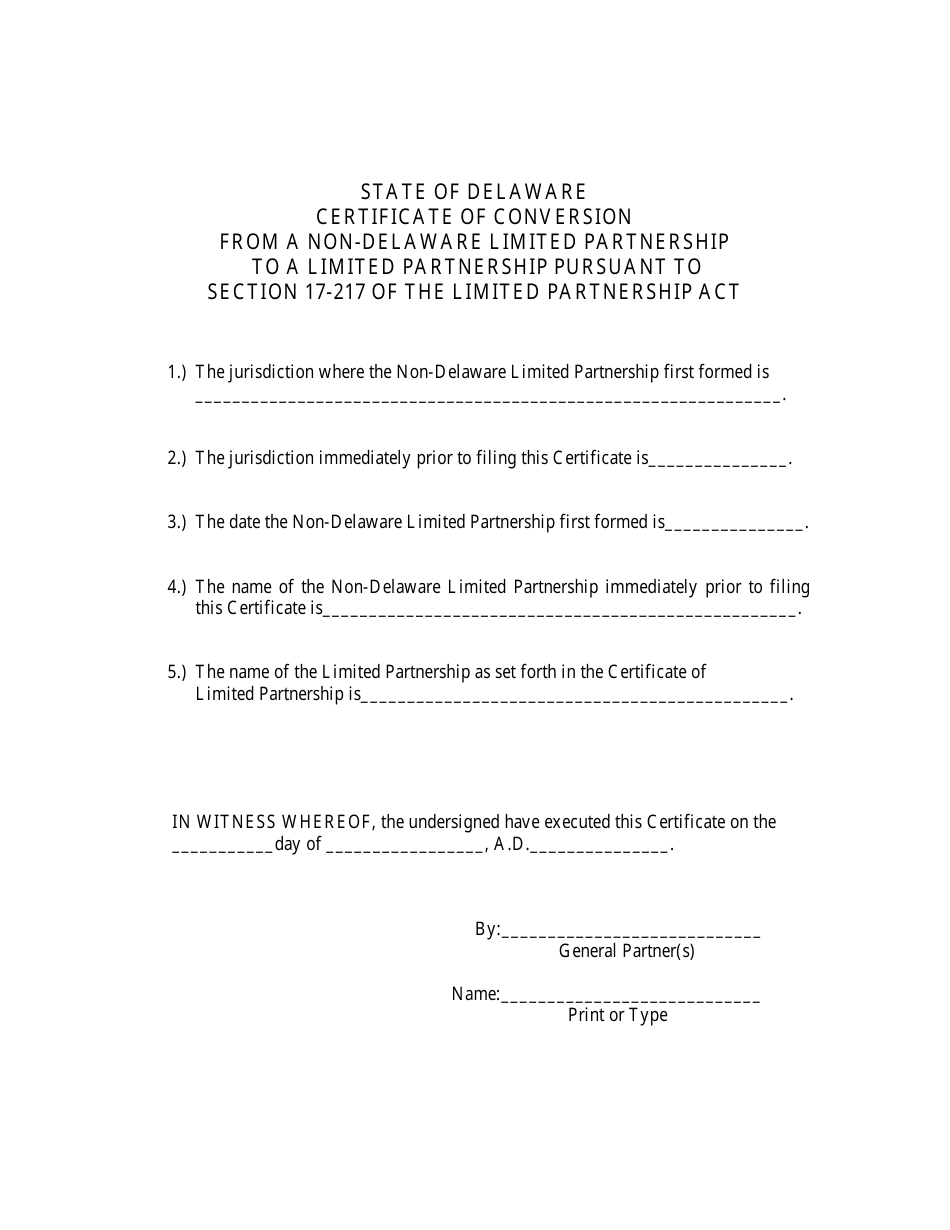

Certificate of Conversion From a Non-delaware Limited Partnership to a Delaware Limited Partnership is a legal document that was released by the Delaware Department of State - a government authority operating within Delaware.

FAQ

Q: What is a Certificate of Conversion?

A: A Certificate of Conversion is a legal document used to convert a non-Delaware limited partnership into a Delaware limited partnership.

Q: Why would a non-Delaware limited partnership want to convert to a Delaware limited partnership?

A: Converting to a Delaware limited partnership offers various benefits, such as a favorable business environment, flexible business laws, and access to Delaware's well-established legal system.

Q: What are the requirements for converting a non-Delaware limited partnership to a Delaware limited partnership?

A: The specific requirements may vary, but generally, the partnership must file a Certificate of Conversion with the Delaware Secretary of State, pay the required fees, and comply with any additional state-specific requirements.

Q: How long does it take to complete the conversion process?

A: The processing time can vary, but it generally takes several weeks for the Delaware Secretary of State to review and approve the Certificate of Conversion.

Q: What happens after the conversion is approved?

A: Once the conversion is approved, the non-Delaware limited partnership becomes a Delaware limited partnership and must comply with the laws and regulations governing Delaware limited partnerships.

Q: Are there any tax implications associated with the conversion?

A: Tax implications may vary depending on jurisdiction and specific circumstances. It is advisable to consult with a tax professional to understand the potential tax consequences of converting to a Delaware limited partnership.

Q: Can a non-Delaware limited partnership continue its operations during the conversion process?

A: Yes, in most cases, the non-Delaware limited partnership can continue its operations during the conversion process, as long as it complies with the applicable laws and regulations of the state where it is currently registered.

Q: Is legal assistance required for the conversion process?

A: While legal assistance is not always required, it is highly recommended to consult with an attorney who specializes in business law to ensure compliance with all necessary requirements and to navigate any legal complexities that may arise.

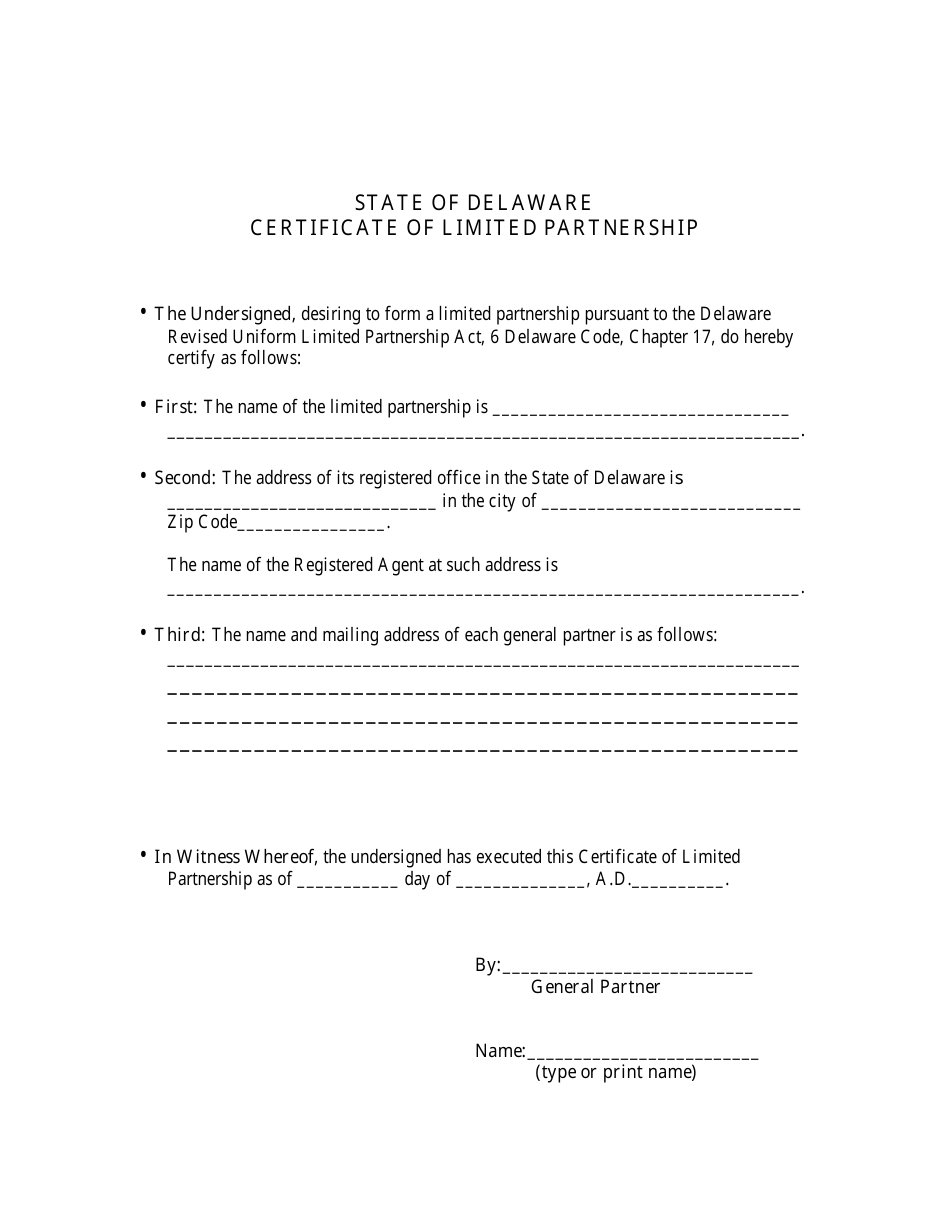

Q: What documents are typically required for the conversion?

A: The specific documents required may vary, but generally, the partnership will need to submit a completed Certificate of Conversion, along with any supporting documents or information requested by the Delaware Secretary of State.

Q: Can a foreign limited partnership convert to a Delaware limited partnership?

A: Yes, a foreign limited partnership can typically convert to a Delaware limited partnership by filing a Certificate of Conversion with the Delaware Secretary of State and meeting any additional requirements set forth by the state.

Form Details:

- Released on September 1, 2005;

- The latest edition currently provided by the Delaware Department of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of State.