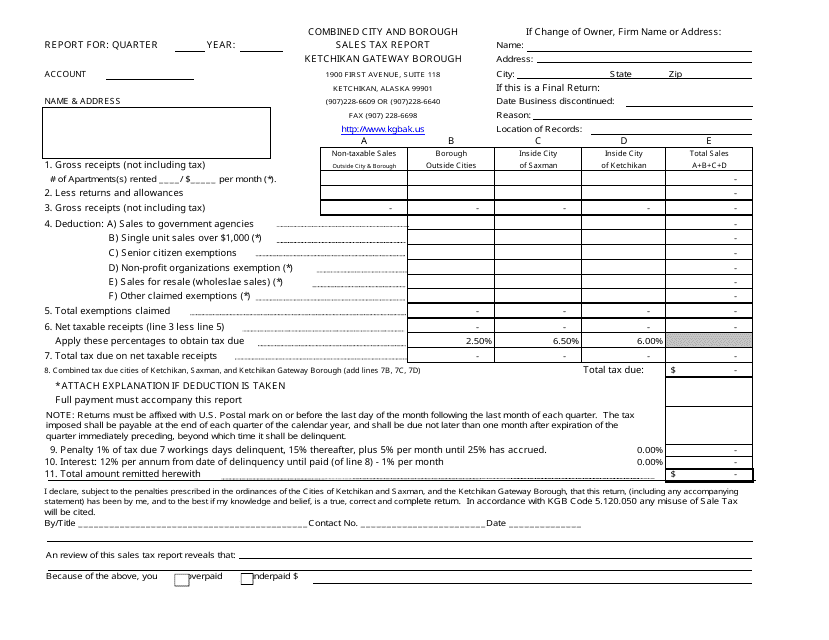

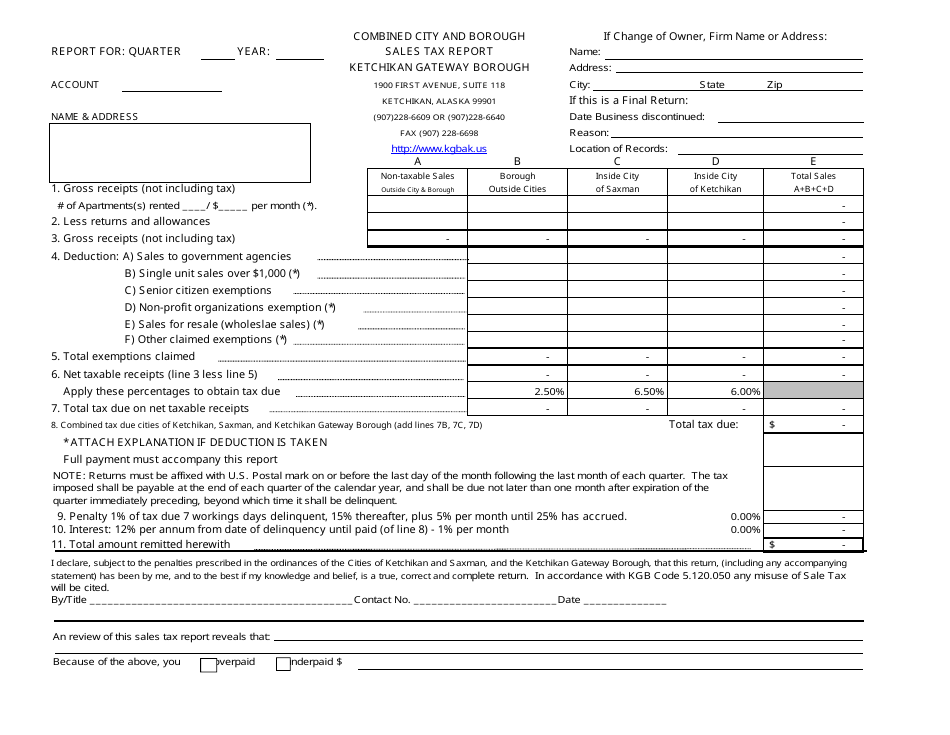

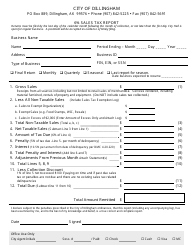

Combined City and Borough Sales Tax Report - Ketchikan Gateway Borough, Alaska

Combined City and Borough Sales Tax Report is a legal document that was released by the Alaska Department of Revenue - a government authority operating within Alaska. The form may be used strictly within Ketchikan Gateway Borough.

FAQ

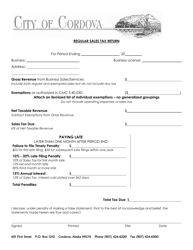

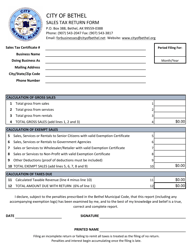

Q: What is the Combined City and Borough Sales Tax Report?

A: The Combined City and Borough Sales Tax Report is a report that provides information about the sales tax collected in Ketchikan Gateway Borough, Alaska.

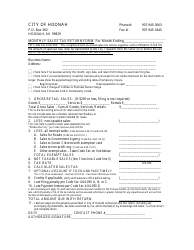

Q: Who is responsible for collecting the sales tax in Ketchikan Gateway Borough?

A: The sales tax in Ketchikan Gateway Borough is collected by the city and borough government.

Q: How is the sales tax calculated in Ketchikan Gateway Borough?

A: The sales tax in Ketchikan Gateway Borough is calculated as a percentage of the purchase price of goods and services.

Q: What is the current sales tax rate in Ketchikan Gateway Borough?

A: The current sales tax rate in Ketchikan Gateway Borough is determined by the city and borough government.

Q: Why is the Combined City and Borough Sales Tax Report important?

A: The Combined City and Borough Sales Tax Report is important because it provides transparency and accountability for the sales tax revenue collected in Ketchikan Gateway Borough.

Q: What is the purpose of the sales tax in Ketchikan Gateway Borough?

A: The purpose of the sales tax in Ketchikan Gateway Borough is to generate revenue for the city and borough government.

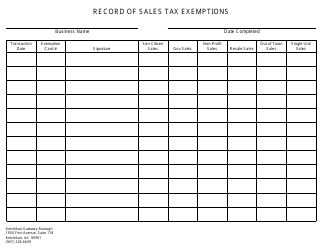

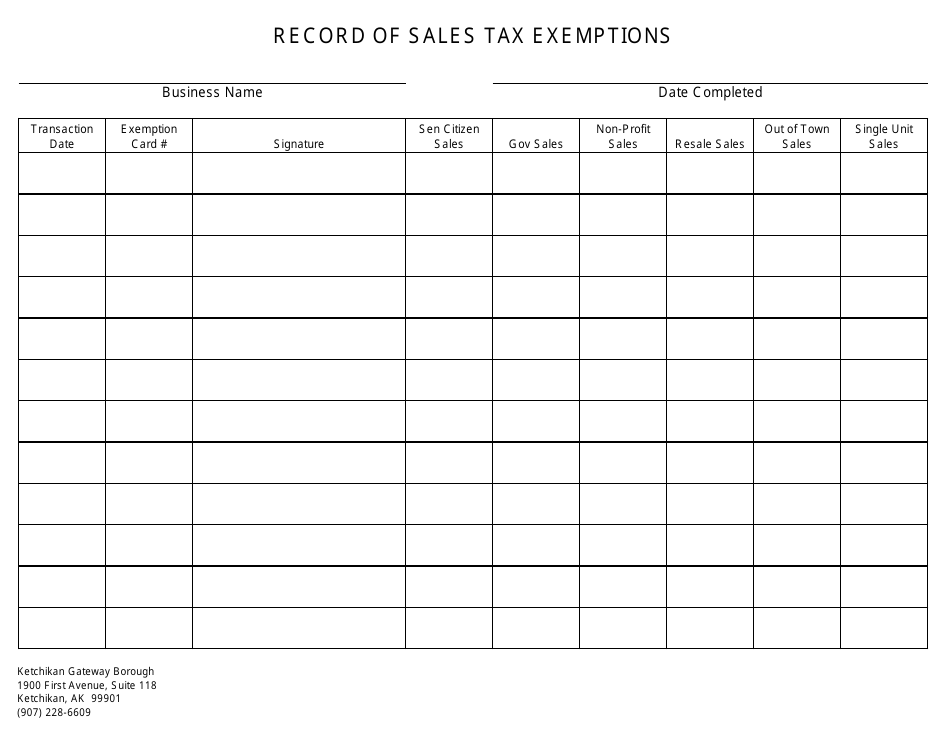

Q: Are there any exemptions or deductions for the sales tax in Ketchikan Gateway Borough?

A: There may be exemptions or deductions for certain items or categories of goods and services. The specific exemptions and deductions are determined by the city and borough government.

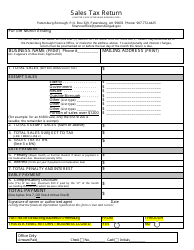

Form Details:

- The latest edition currently provided by the Alaska Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Alaska Department of Revenue.