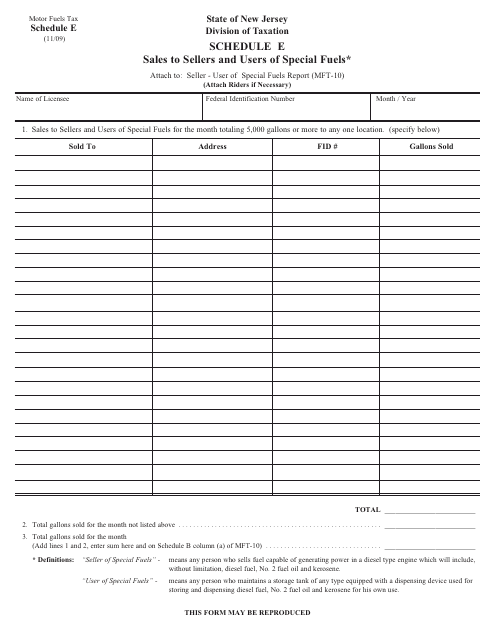

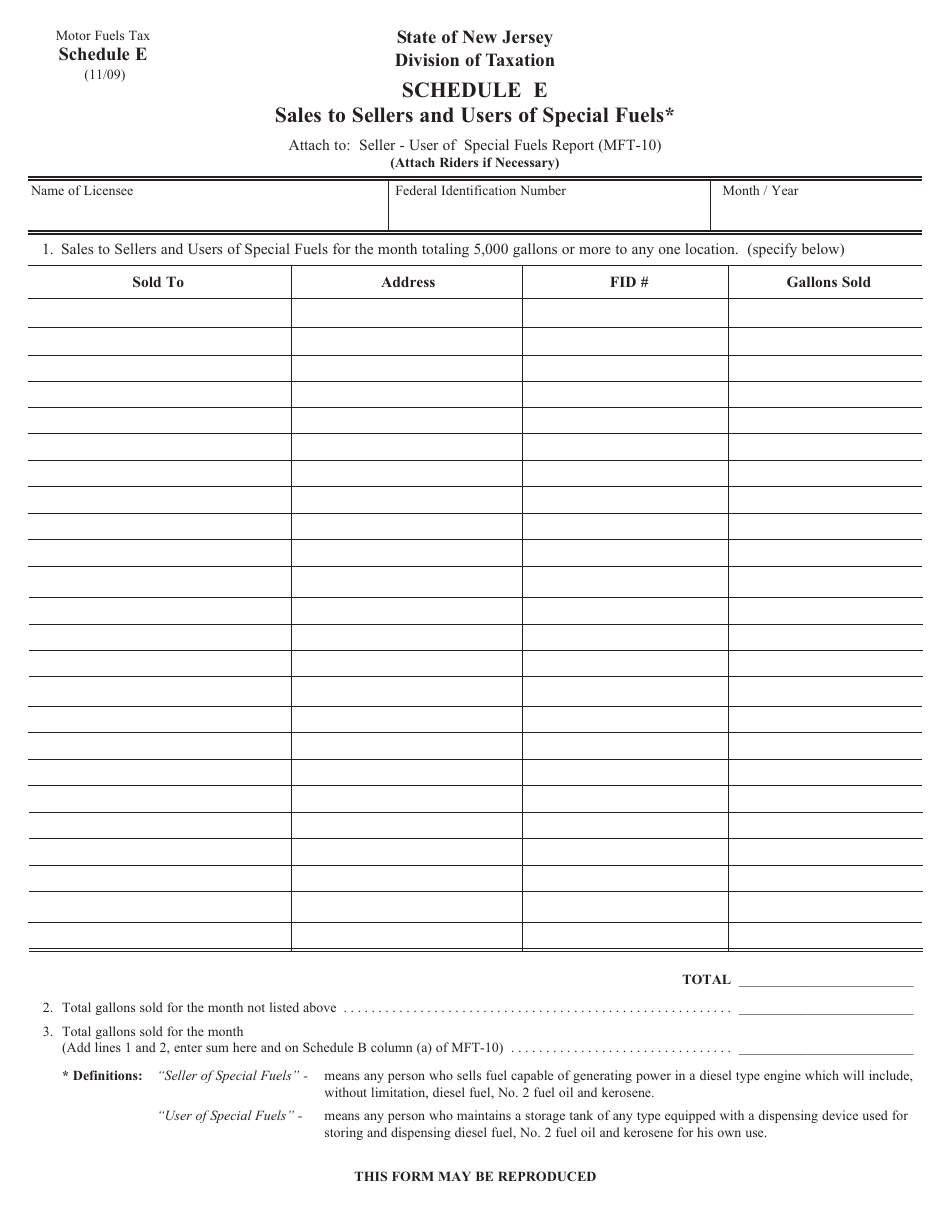

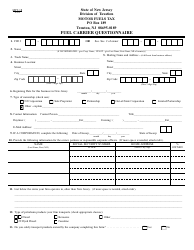

Form MFT-10 Schedule E Sales to Sellers and Users of Special Fuels - New Jersey

What Is Form MFT-10 Schedule E?

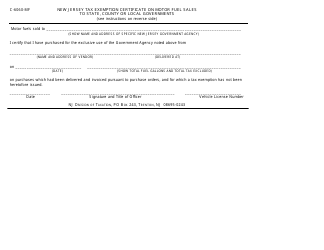

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form MFT-10, Seller-User of Special Fuels Report. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MFT-10 Schedule E?

A: Form MFT-10 Schedule E is a tax form used in New Jersey to report sales to sellers and users of special fuels.

Q: Who needs to file Form MFT-10 Schedule E?

A: Any individual or business that sells or uses special fuels in New Jersey needs to file Form MFT-10 Schedule E.

Q: What are special fuels?

A: Special fuels include motor fuel, diesel fuel, kerosene, and any other combustible liquid that is used to propel a motor vehicle.

Q: Why is Form MFT-10 Schedule E important?

A: Form MFT-10 Schedule E is important because it helps the state of New Jersey track and collect the appropriate taxes on the sale and use of special fuels.

Q: When is the deadline to file Form MFT-10 Schedule E?

A: The deadline to file Form MFT-10 Schedule E in New Jersey is typically the last day of the month following the end of the reporting period.

Form Details:

- Released on November 1, 2009;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MFT-10 Schedule E by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.