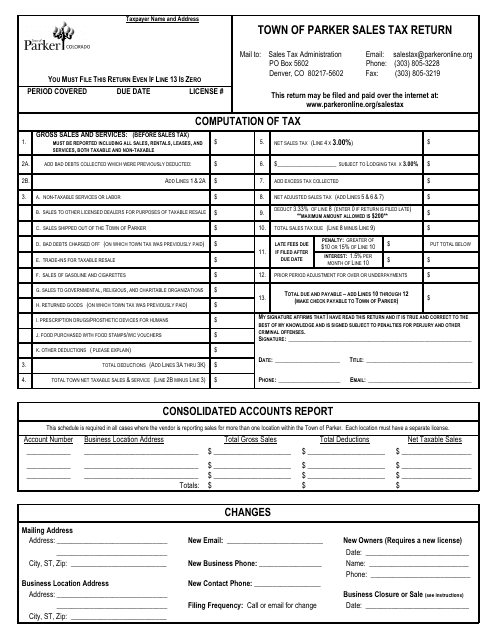

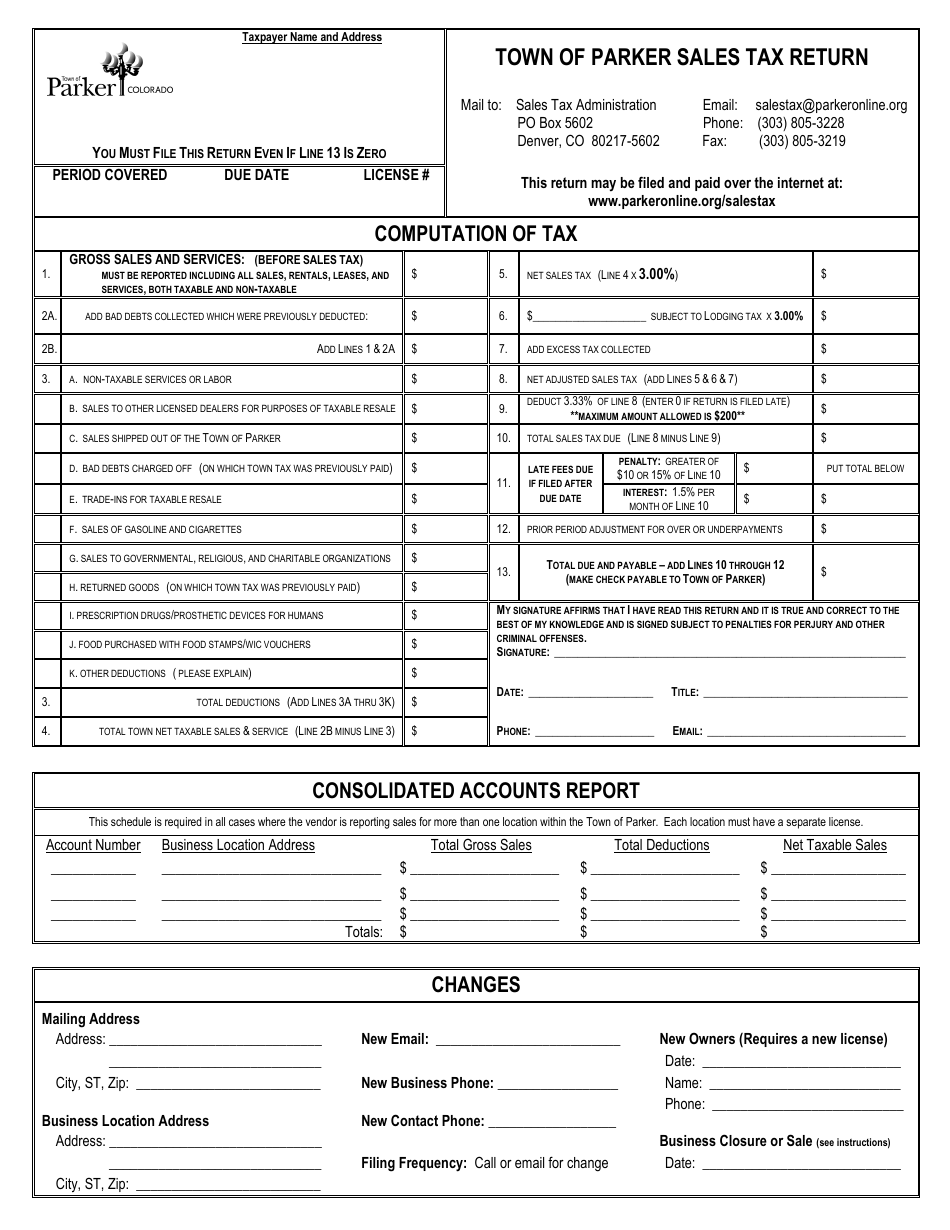

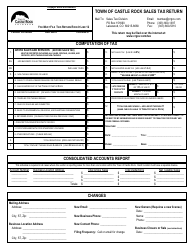

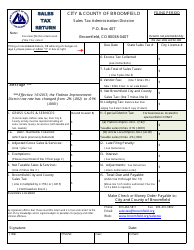

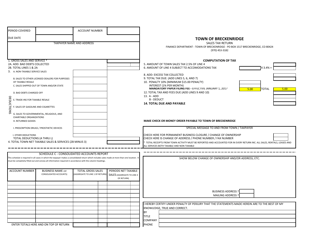

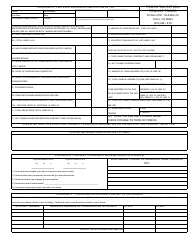

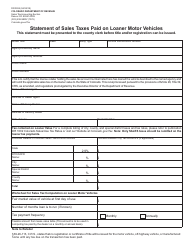

Sales Tax Return Form - Town of Parker, Colorado

Sales Tax Return Form is a legal document that was released by the Colorado Department of Revenue - a government authority operating within Colorado. The form may be used strictly within Town of Parker.

FAQ

Q: What is the sales tax rate in Parker, Colorado?

A: The sales tax rate in Parker, Colorado is 8.5%.

Q: How often do I need to file a sales tax return in Parker, Colorado?

A: Sales tax returns in Parker, Colorado must be filed monthly.

Q: What information is required on the sales tax return form in Parker, Colorado?

A: The sales tax return form in Parker, Colorado requires information such as total sales, taxable sales, and sales tax collected.

Q: When is the deadline to file a sales tax return in Parker, Colorado?

A: The deadline to file a sales tax return in Parker, Colorado is the 20th of each month.

Q: Are there any penalties for late filing of sales tax returns in Parker, Colorado?

A: Yes, there are penalties for late filing of sales tax returns in Parker, Colorado. The penalty is 10% of the tax due or $25, whichever is greater.

Q: Who can I contact for more information about sales tax returns in Parker, Colorado?

A: For more information about sales tax returns in Parker, Colorado, you can contact the Town of Parker's Finance Department.

Form Details:

- The latest edition currently provided by the Colorado Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.