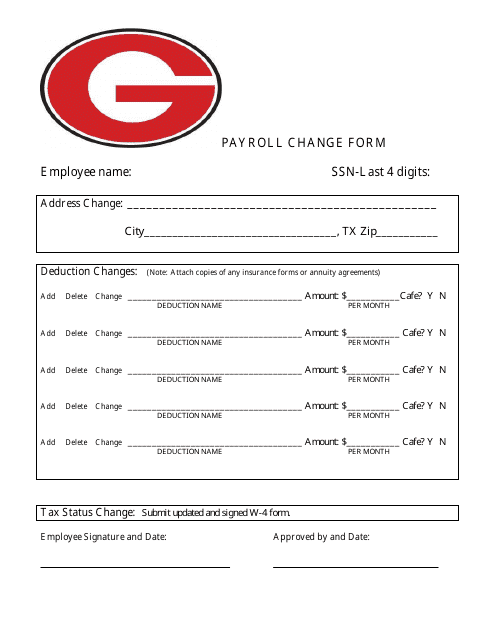

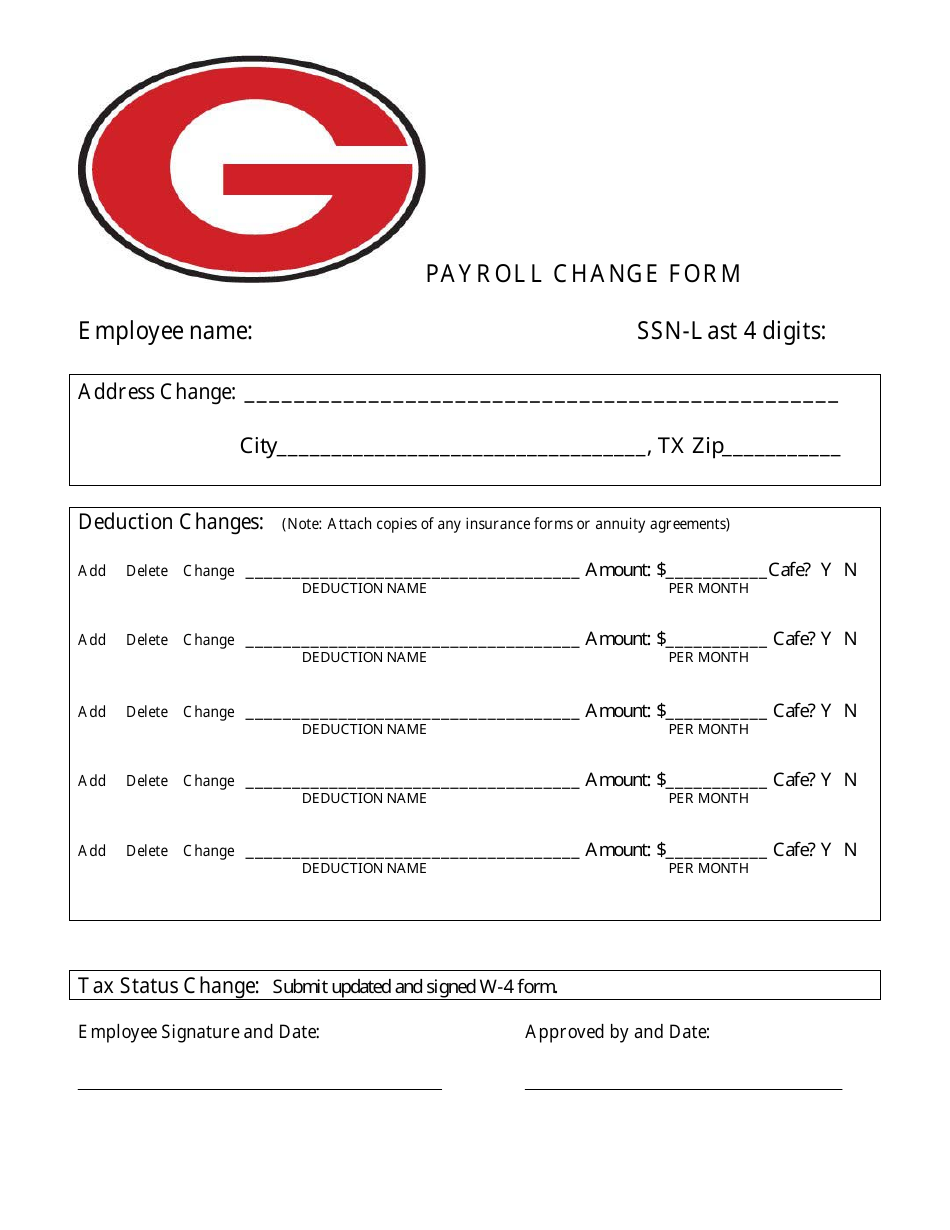

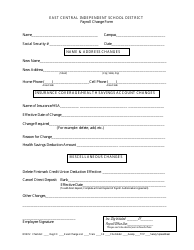

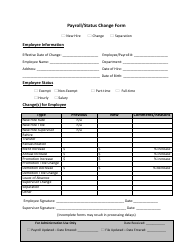

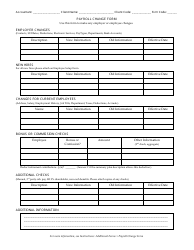

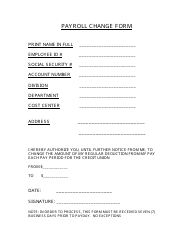

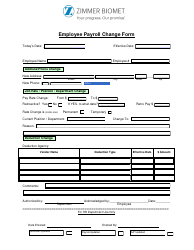

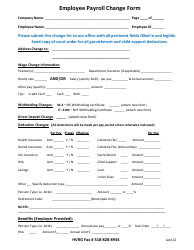

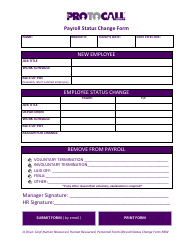

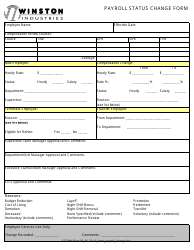

Payroll Change Form - Texas

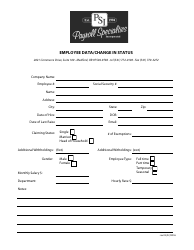

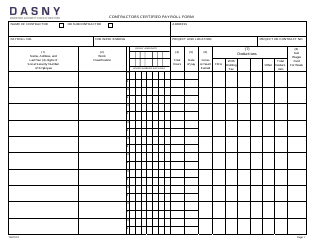

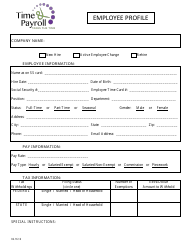

The Payroll Change Form - Texas is used to request changes to an employee's payroll information, such as changes in tax withholdings, deductions, or personal information. It ensures that the employee's payroll records are accurate and up-to-date.

The Payroll Change Form in Texas is typically filed by the employer or the HR department of the company.

FAQ

Q: What is the Payroll Change Form?

A: The Payroll Change Form is a document used to request changes to payroll information in Texas.

Q: Who needs to use the Payroll Change Form?

A: Employees in Texas who need to make changes to their payroll information.

Q: What information can be changed using the Payroll Change Form?

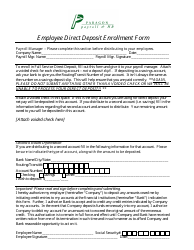

A: The Payroll Change Form can be used to update personal information, banking information, tax withholdings, and direct deposit preferences.

Q: How can I obtain the Payroll Change Form?

A: You can usually obtain the Payroll Change Form from your employer's human resources department.

Q: Is there a deadline for submitting the Payroll Change Form?

A: The deadline for submitting the Payroll Change Form may vary depending on your employer's policies. It is best to check with your human resources department for the specific deadline.