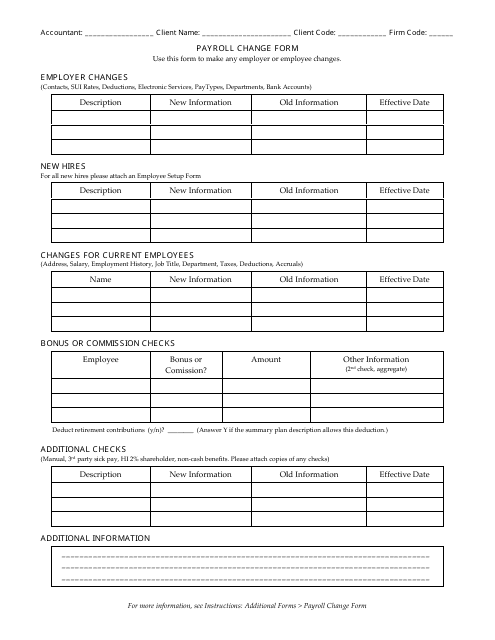

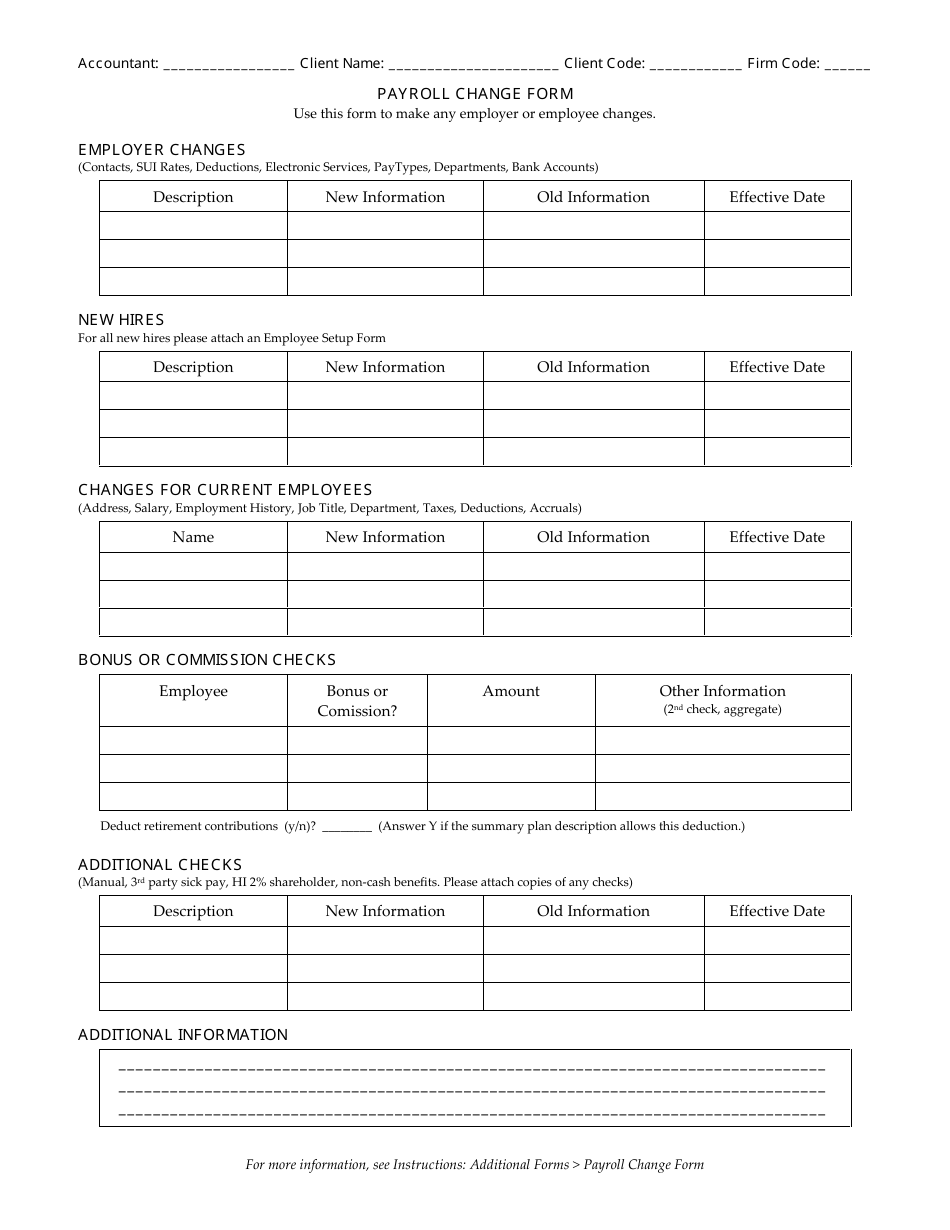

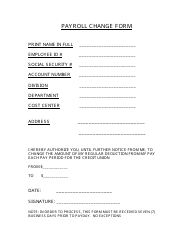

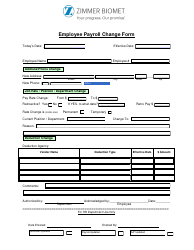

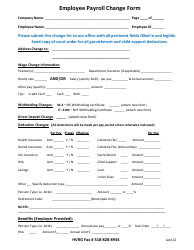

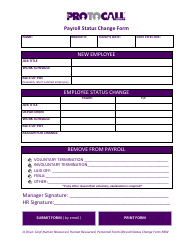

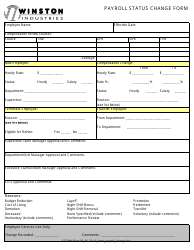

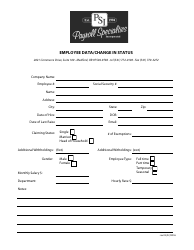

Payroll Change Form - Table

The Payroll Change Form - Table is used to make changes to an employee's payroll information, such as their salary, deductions, or tax withholding.

The Payroll Change Form - Table is typically filed by the employer or the human resources department within a company.

FAQ

Q: What is a payroll change form?

A: A payroll change form is a document used to request changes to an employee's payroll information.

Q: Why would I need to fill out a payroll change form?

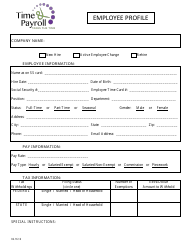

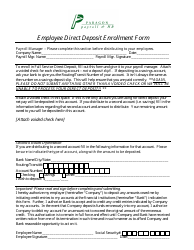

A: You would need to fill out a payroll change form to update your personal or bank account information, adjust your tax withholding, or make changes to your direct deposit settings.

Q: What information do I need to provide on a payroll change form?

A: You will need to provide your full name, employee ID or social security number, the type of change you are requesting, and any supporting documentation, such as a voided check for bank account changes.

Q: How long does it take for payroll changes to take effect?

A: The time it takes for payroll changes to take effect can vary depending on your employer's payroll processing timetable. It is best to check with your employer for specific timelines.