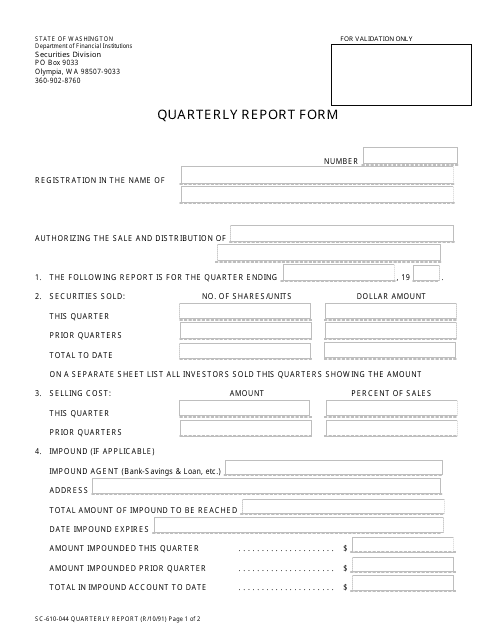

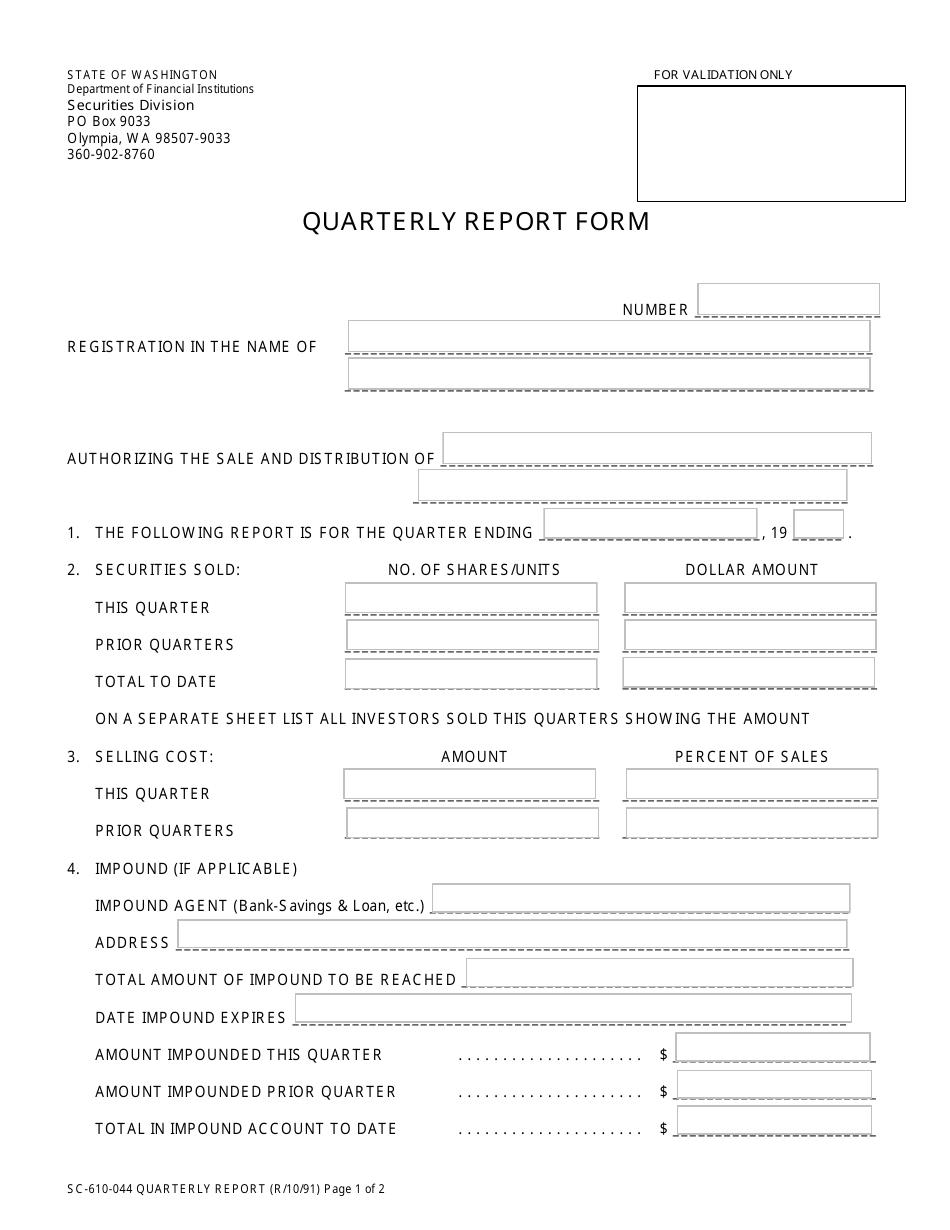

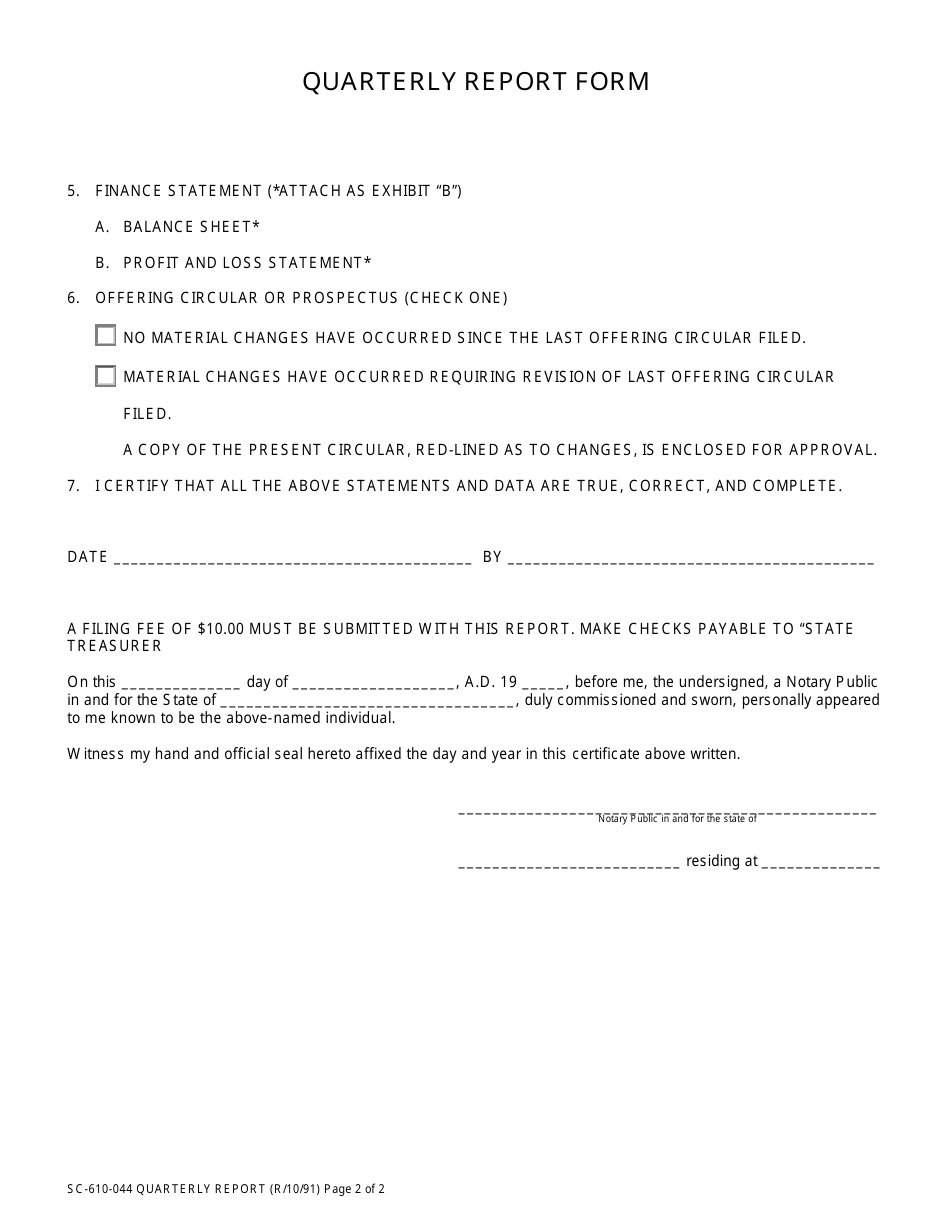

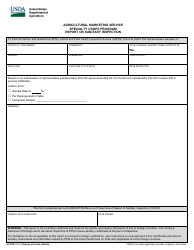

Form SC-610-044 Quarterly Report Form - Washington

What Is Form SC-610-044?

This is a legal form that was released by the Washington State Department of Financial Institutions - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form SC-610-044?

A: Form SC-610-044 is the Quarterly Report Form for Washington.

Q: Who needs to file form SC-610-044?

A: Businesses in Washington are required to file form SC-610-044.

Q: What is the purpose of form SC-610-044?

A: Form SC-610-044 is used to report quarterly financial information for businesses in Washington.

Q: When is form SC-610-044 due?

A: Form SC-610-044 is due on a quarterly basis, typically on the last day of the month following the end of the quarter.

Q: What information is required on form SC-610-044?

A: Form SC-610-044 requires information such as gross sales, taxable sales, and deductions for the quarter.

Q: Are there any penalties for late filing of form SC-610-044?

A: Yes, there may be penalties for late filing of form SC-610-044, including interest on any unpaid taxes.

Q: Is there a fee to file form SC-610-044?

A: No, there is no fee to file form SC-610-044.

Q: Is form SC-610-044 only for businesses in Washington?

A: Yes, form SC-610-044 is specifically for businesses operating in Washington state.

Form Details:

- Released on October 1, 1991;

- The latest edition provided by the Washington State Department of Financial Institutions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SC-610-044 by clicking the link below or browse more documents and templates provided by the Washington State Department of Financial Institutions.