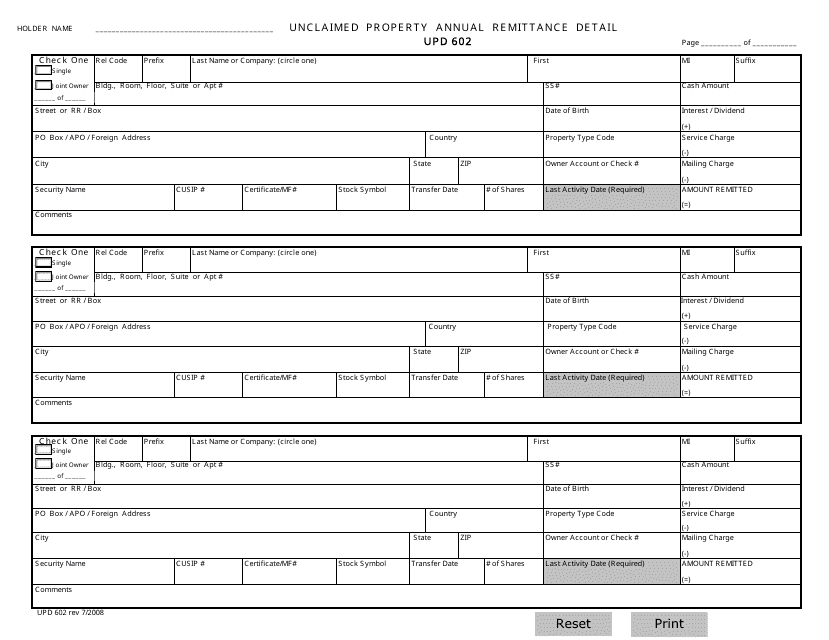

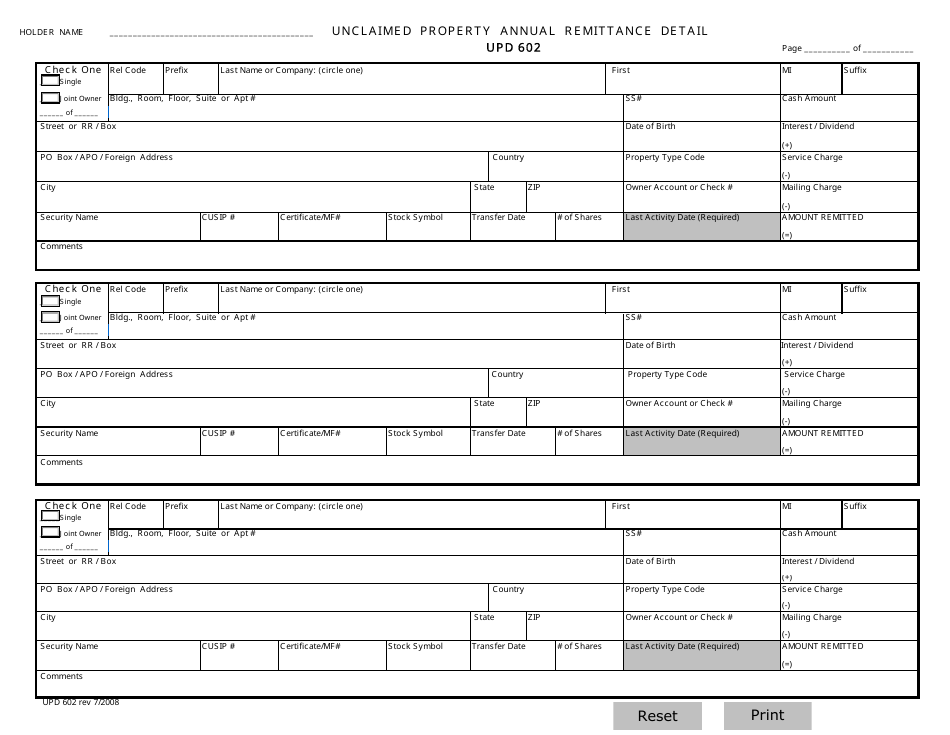

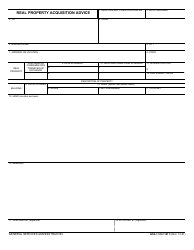

Form UPD602 Unclaimed Property Annual Remittance Detail Form - Illinois

What Is Form UPD602?

This is a legal form that was released by the Illinois State Treasurer - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UPD602?

A: Form UPD602 is the Unclaimed Property Annual Remittance Detail Form for Illinois.

Q: What is unclaimed property?

A: Unclaimed property refers to financial assets that have been abandoned by their rightful owners.

Q: Who needs to file Form UPD602?

A: Any holder of unclaimed property in Illinois is required to file Form UPD602.

Q: What information is required on Form UPD602?

A: Form UPD602 requires the holder to provide details of the unclaimed property being remitted, including the owner's name, last known address, and the amount of the property.

Q: When is Form UPD602 due?

A: Form UPD602 is due on or before November 1st of each year.

Q: Is there a fee for filing Form UPD602?

A: No, there is no fee for filing Form UPD602.

Q: What if I fail to file Form UPD602?

A: Failure to file Form UPD602 or filing false or incomplete information may result in penalties and interest.

Q: Are there any exemptions to filing Form UPD602?

A: Certain holders of unclaimed property may be exempt from filing Form UPD602, but they must still report and remit the property to the Illinois State Treasurer's Office.

Form Details:

- Released on July 1, 2008;

- The latest edition provided by the Illinois State Treasurer;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UPD602 by clicking the link below or browse more documents and templates provided by the Illinois State Treasurer.