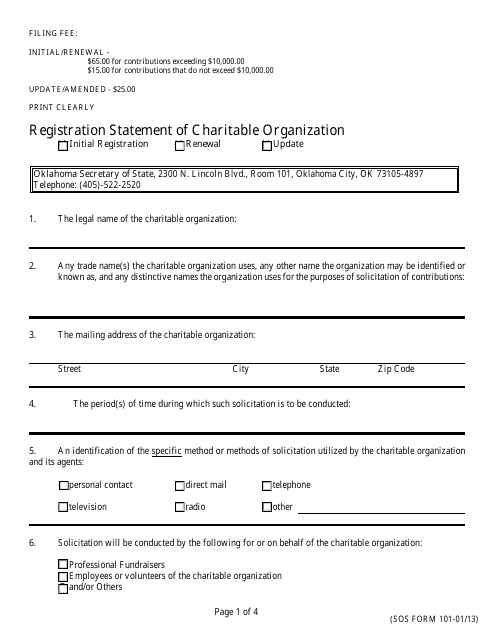

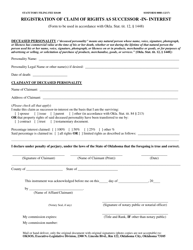

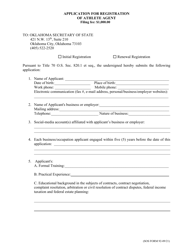

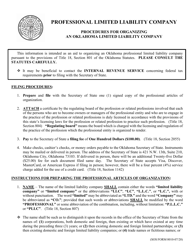

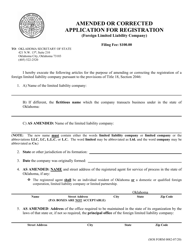

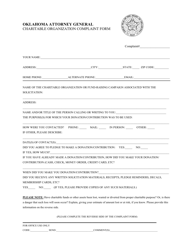

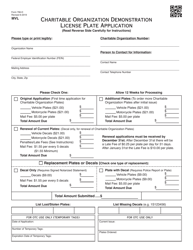

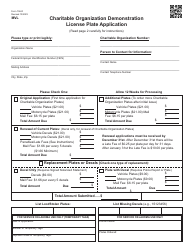

SOS Form 101 Registration Statement of Charitable Organization - Oklahoma

What Is SOS Form 101?

This is a legal form that was released by the Oklahoma Secretary of State - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 101?

A: Form 101 is the Registration Statement of Charitable Organization in Oklahoma.

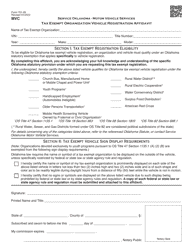

Q: Who needs to file Form 101?

A: Charitable organizations operating in Oklahoma need to file Form 101.

Q: What is the purpose of Form 101?

A: The purpose of Form 101 is to register and provide information about the charitable organization to the Oklahoma Secretary of State.

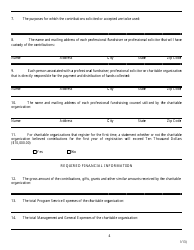

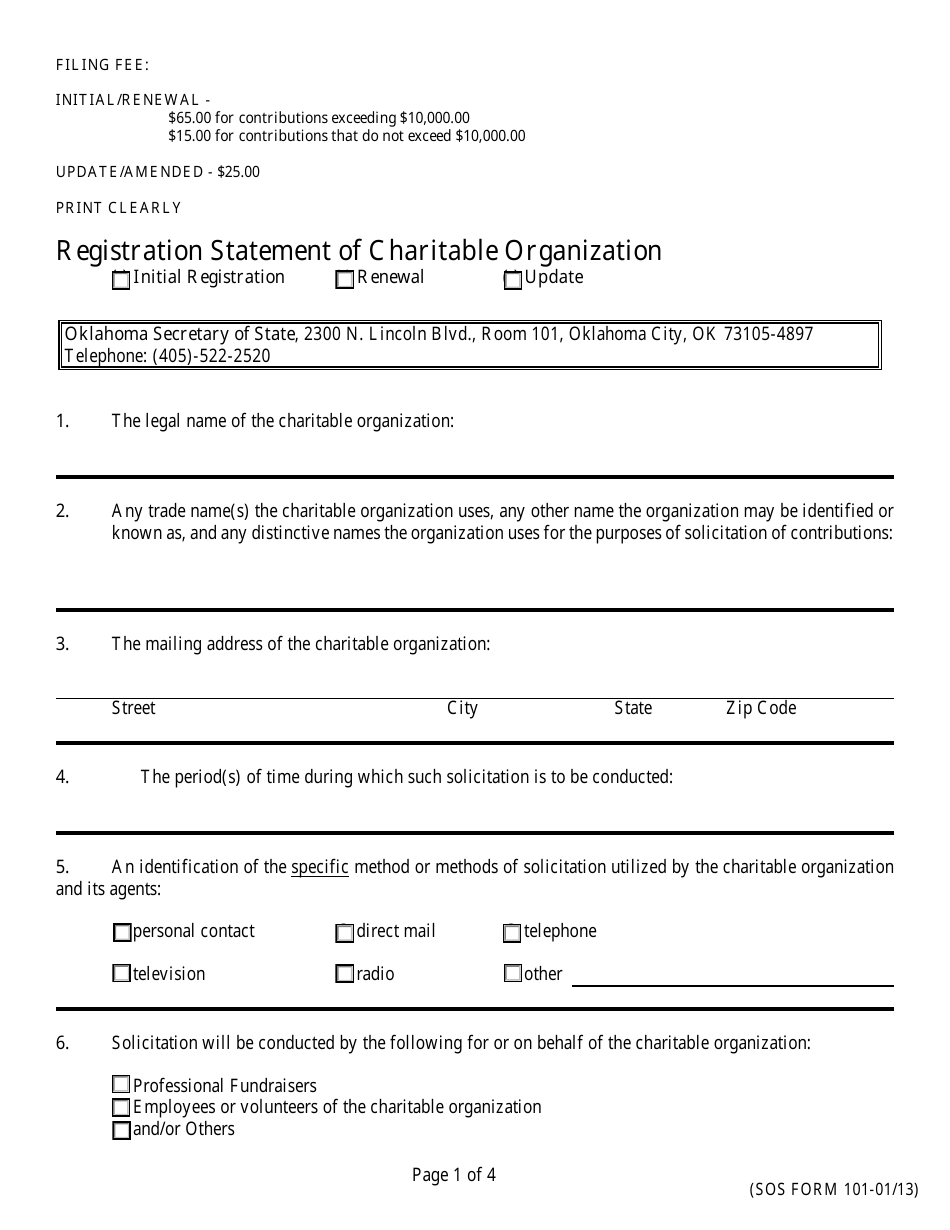

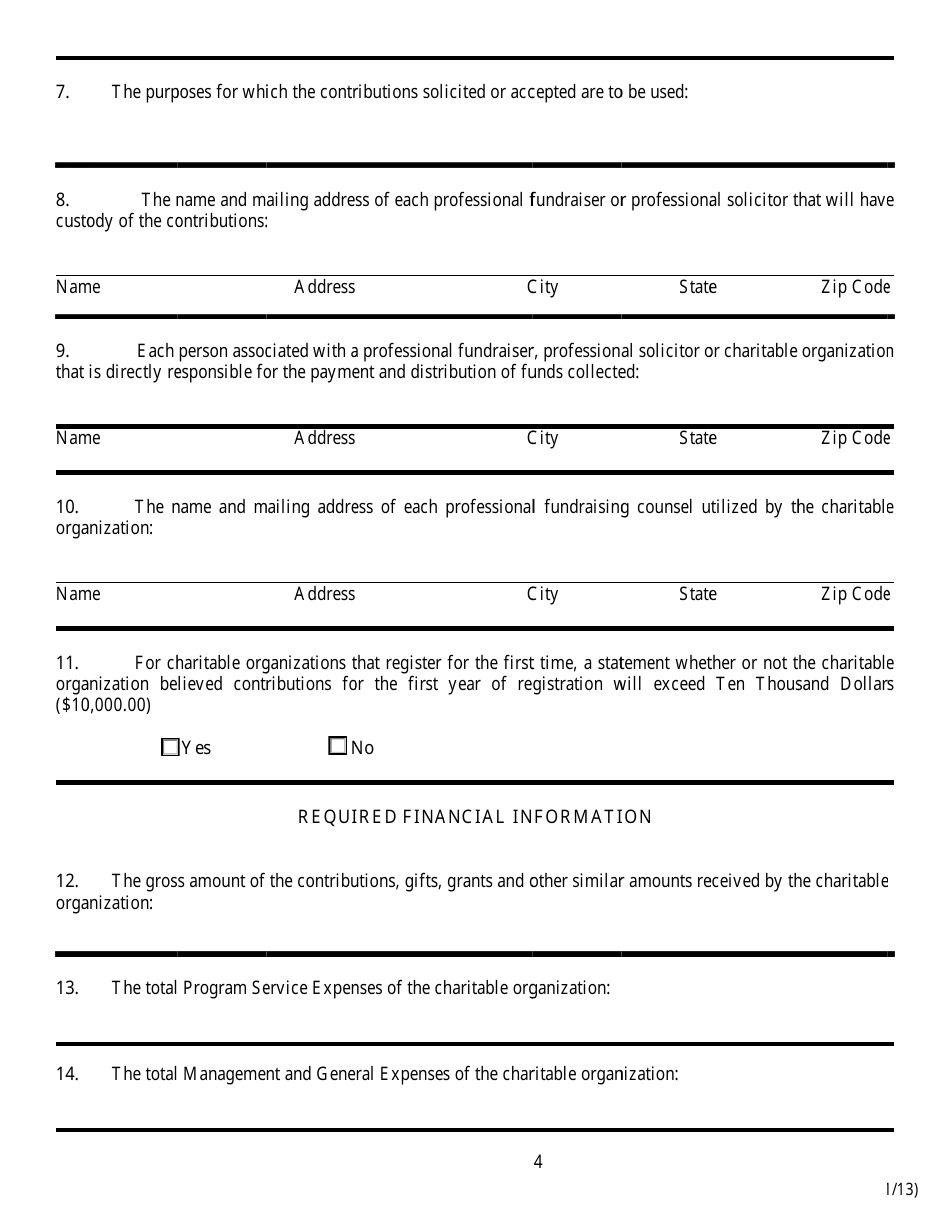

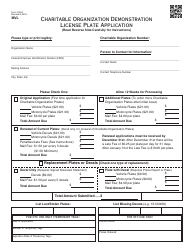

Q: What information is required on Form 101?

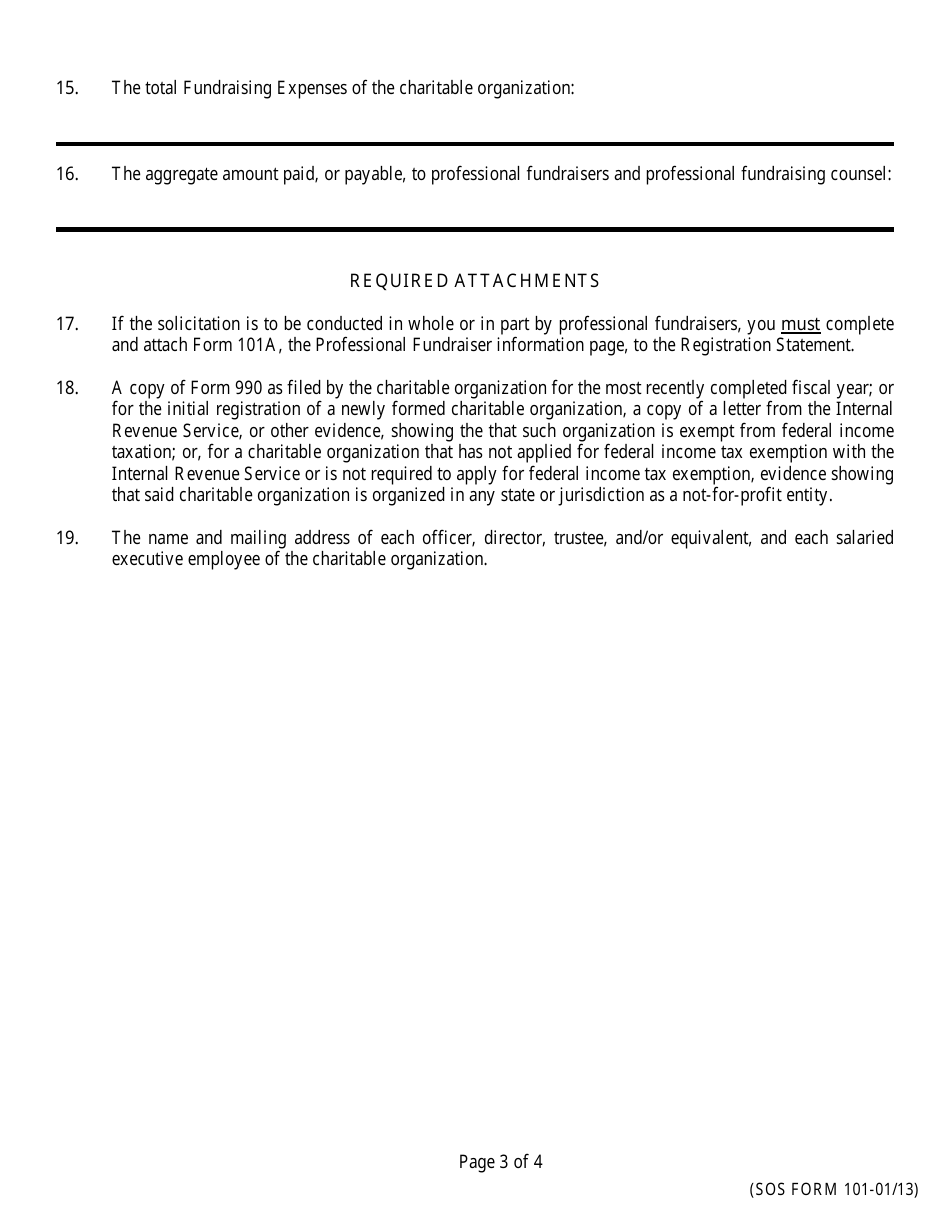

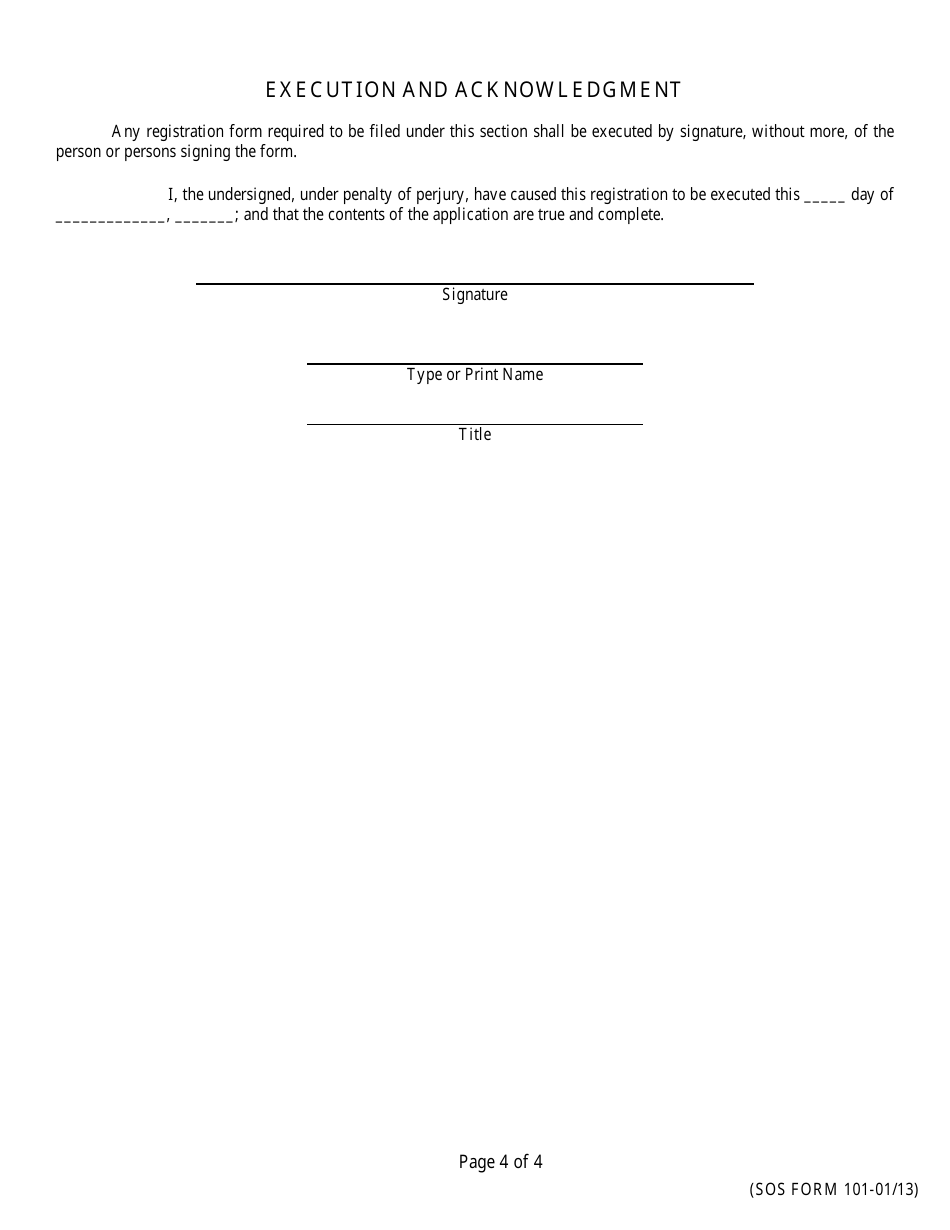

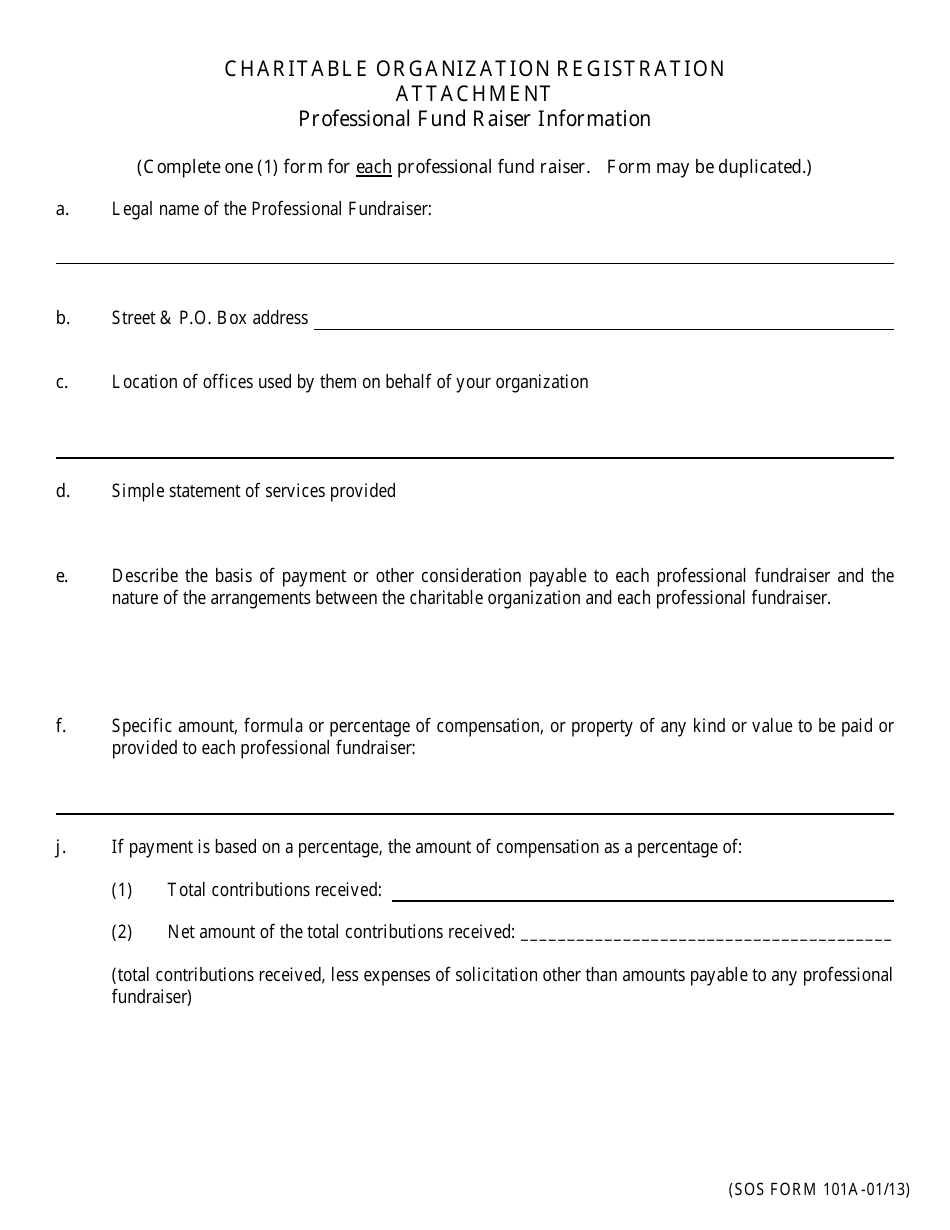

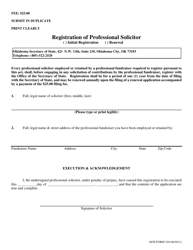

A: Form 101 requires information such as the organization's name, address, purpose, governing body, financial information, and disclosure of any professional solicitors used.

Q: Is there a filing fee for Form 101?

A: Yes, there is a filing fee associated with Form 101. The fee amount is determined by the total contributions received by the organization in the previous fiscal year.

Q: When should Form 101 be filed?

A: Form 101 should be filed within 90 days of the organization's fiscal year end.

Q: What happens if Form 101 is not filed?

A: Failure to file Form 101 may result in penalties and the organization may lose its tax-exempt status in Oklahoma.

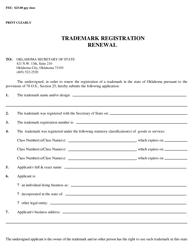

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Oklahoma Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SOS Form 101 by clicking the link below or browse more documents and templates provided by the Oklahoma Secretary of State.