This version of the form is not currently in use and is provided for reference only. Download this version of

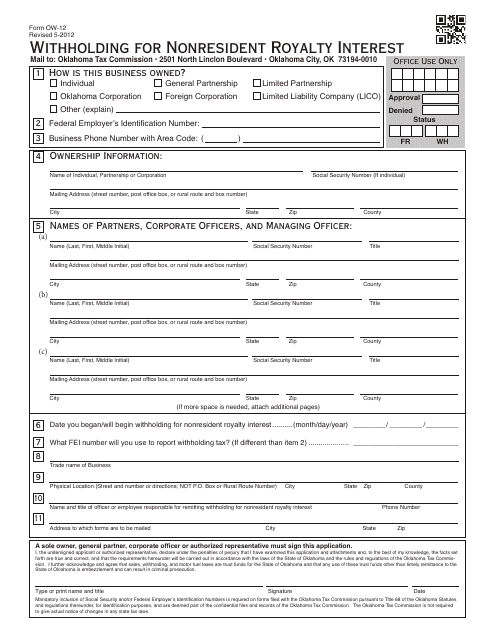

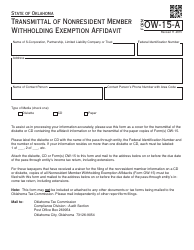

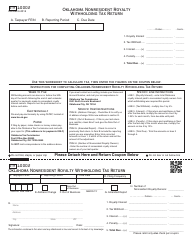

Form OW-12

for the current year.

Form OW-12 Withholding for Nonresident Royalty Interest - Oklahoma

What Is Form OW-12?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form OW-12?

A: Form OW-12 is a withholding form used by Oklahoma to collect taxes on nonresident royalty interest.

Q: Who needs to file a Form OW-12?

A: Nonresidents who receive royalty payments from Oklahoma need to file a Form OW-12.

Q: What is the purpose of Form OW-12?

A: The purpose of Form OW-12 is to calculate and report the amount of tax withheld from nonresident royalty interest.

Q: When is Form OW-12 due?

A: Form OW-12 is due on or before the 15th day of the 4th month following the end of the tax year.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OW-12 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.