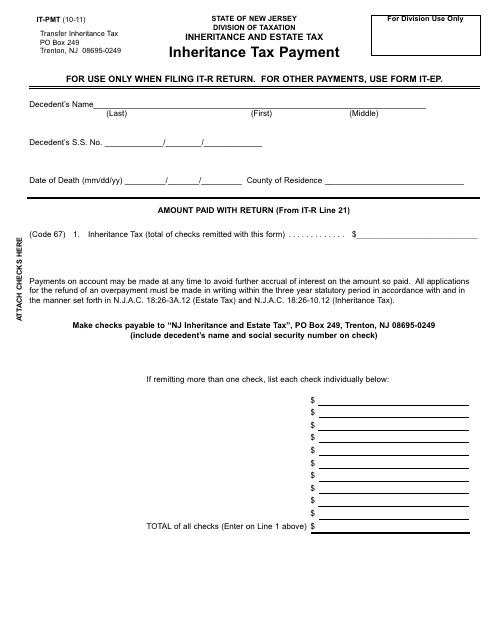

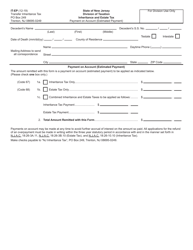

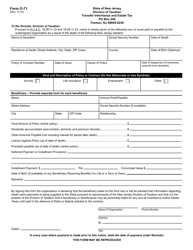

Form IT-PMT Inheritance Tax Payment - New Jersey

What Is Form IT-PMT?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-PMT?

A: Form IT-PMT is a form used to make inheritance tax payments in New Jersey.

Q: What is inheritance tax?

A: Inheritance tax is a tax imposed on the transfer of assets from a deceased person to their beneficiaries.

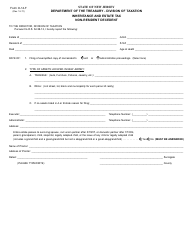

Q: Who is required to file Form IT-PMT?

A: The executor or administrator of an estate is responsible for filing Form IT-PMT.

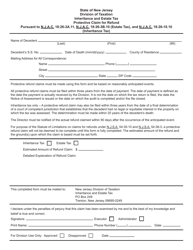

Q: When is Form IT-PMT due?

A: Form IT-PMT is typically due within 8 months after the decedent's death.

Q: What information is required on Form IT-PMT?

A: Form IT-PMT requires information about the decedent, the estate, and the beneficiaries.

Q: Are there any penalties for late payment of inheritance tax?

A: Yes, there are penalties for late payment of inheritance tax. It is important to file and pay on time to avoid penalties and interest.

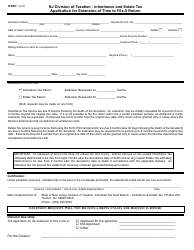

Q: Can I request an extension to file Form IT-PMT?

A: No, there is no extension available for filing Form IT-PMT. It must be filed by the due date.

Q: Is there a minimum threshold for inheritance tax in New Jersey?

A: Yes, there is a minimum threshold for inheritance tax in New Jersey. The threshold depends on the relationship between the decedent and the beneficiary.

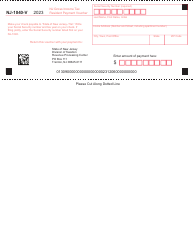

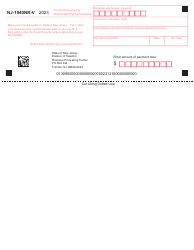

Form Details:

- Released on October 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-PMT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.