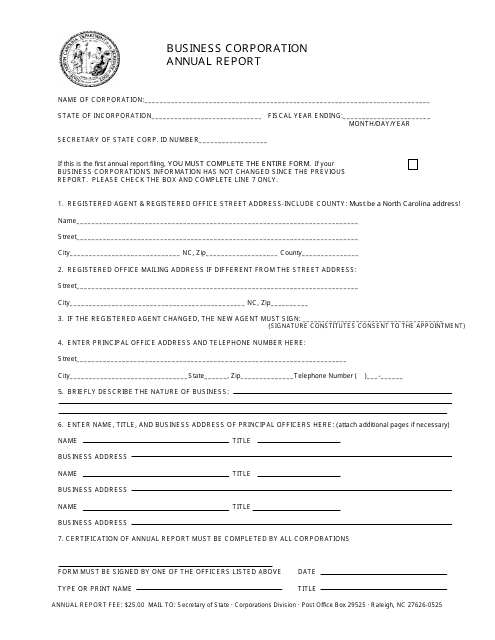

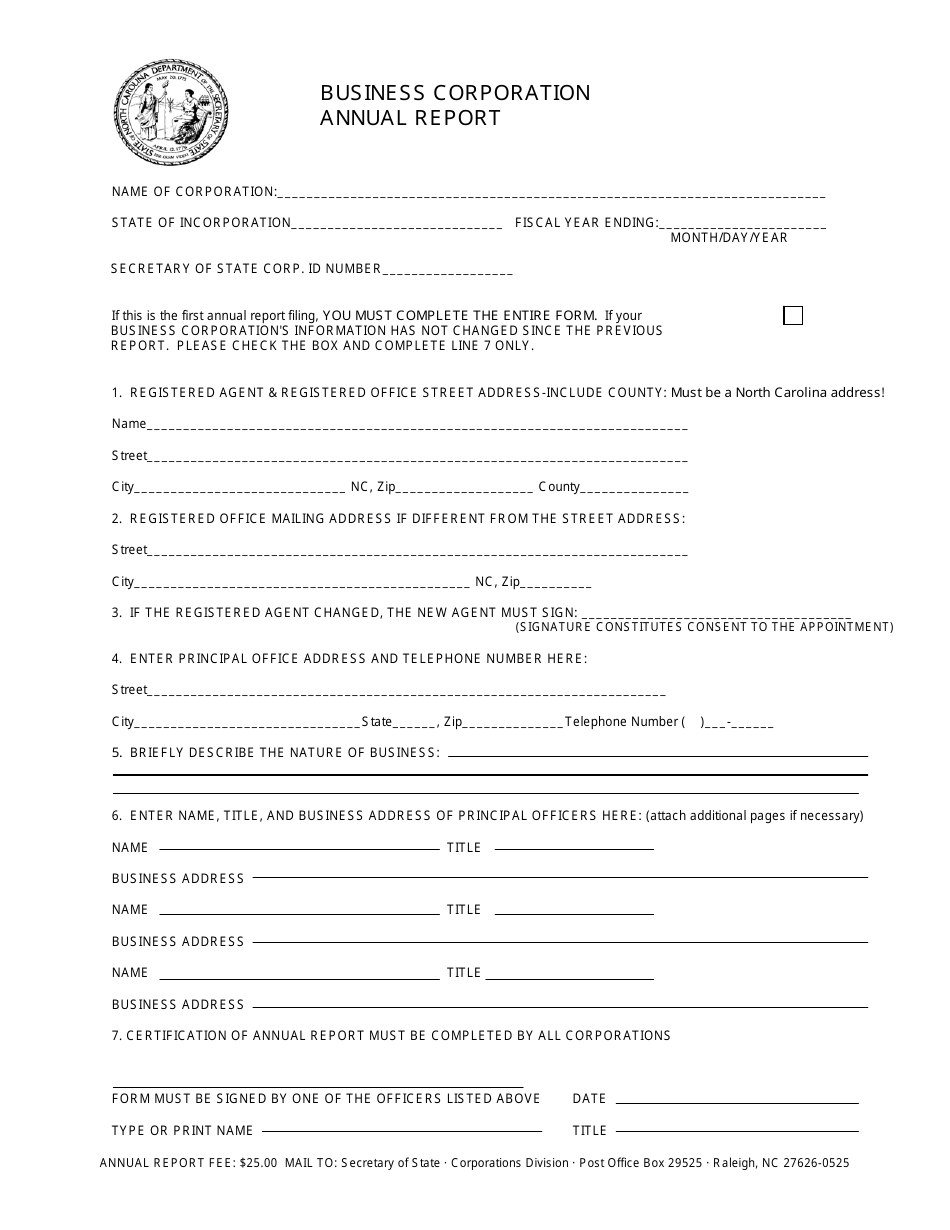

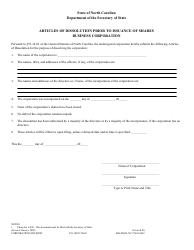

Business Corporation Annual Report Form - North Carolina

Business Corporation Annual Report Form is a legal document that was released by the North Carolina Secretary of State - a government authority operating within North Carolina.

FAQ

Q: What is a Business Corporation Annual Report?

A: A Business Corporation Annual Report is a document that business corporations in North Carolina are required to file every year.

Q: Who needs to file a Business Corporation Annual Report in North Carolina?

A: All business corporations registered in North Carolina need to file an Annual Report.

Q: When is the deadline for filing a Business Corporation Annual Report in North Carolina?

A: The deadline for filing a Business Corporation Annual Report in North Carolina is the fifteenth day of the fourth month following the end of the corporation's fiscal year.

Q: What information is required in a Business Corporation Annual Report?

A: The Business Corporation Annual Report requires information such as the corporation's name, registered agent, principal office address, and details of the corporation's directors and officers.

Q: Is there a fee for filing a Business Corporation Annual Report in North Carolina?

A: Yes, there is a fee for filing a Business Corporation Annual Report in North Carolina. The current fee is $25.

Q: What happens if a Business Corporation fails to file its Annual Report in North Carolina?

A: If a Business Corporation fails to file its Annual Report in North Carolina, it may be subject to penalties, such as administrative dissolution or revocation of its certificate of authority to transact business in the state.

Form Details:

- The latest edition currently provided by the North Carolina Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Secretary of State.