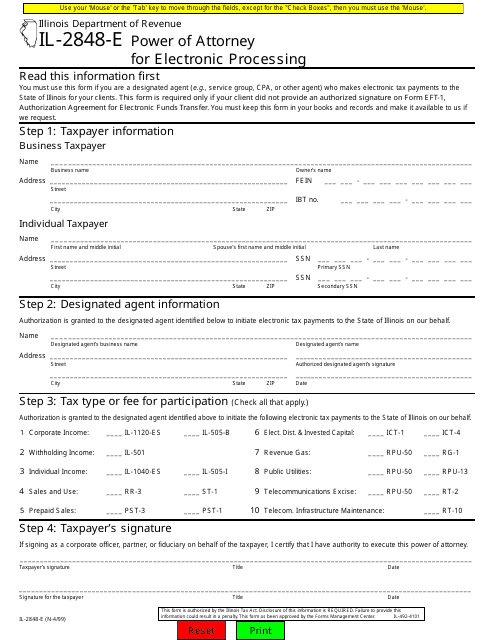

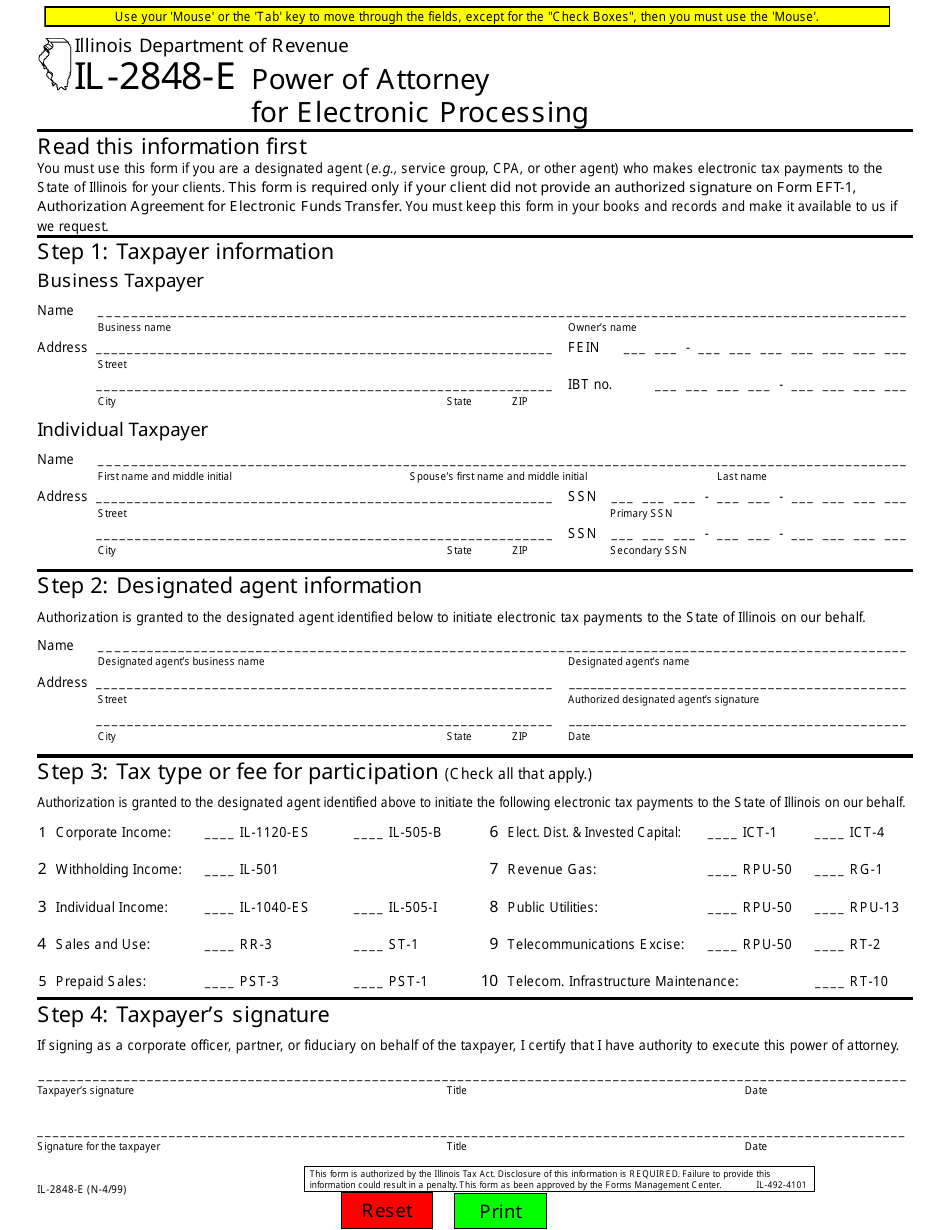

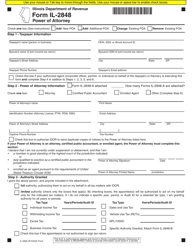

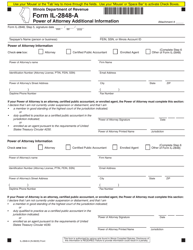

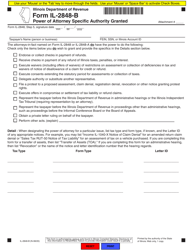

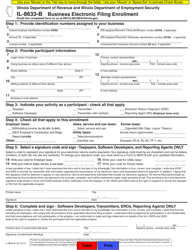

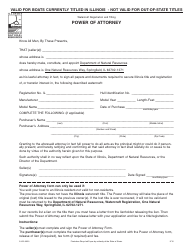

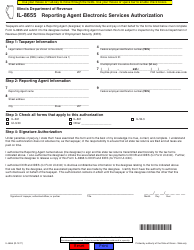

Form IL-2848-E Power of Attorney for Electronic Processing - Illinois

What Is Form IL-2848-E?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-2848-E?

A: Form IL-2848-E is a Power of Attorney for Electronic Processing in Illinois.

Q: What is the purpose of Form IL-2848-E?

A: The purpose of Form IL-2848-E is to authorize someone to access your tax information electronically on your behalf.

Q: Who can use Form IL-2848-E?

A: Any individual or entity who wants to grant electronic access to their tax information in Illinois can use Form IL-2848-E.

Q: What information is required on Form IL-2848-E?

A: Form IL-2848-E requires the taxpayer's name, address, tax identification number, and the name and contact information of the authorized representative.

Q: Is there a fee to submit Form IL-2848-E?

A: No, there is no fee to submit Form IL-2848-E.

Q: How long does it take to process Form IL-2848-E?

A: The processing time for Form IL-2848-E may vary, but it is generally processed within a few weeks.

Q: Can I revoke a Power of Attorney granted using Form IL-2848-E?

A: Yes, you can revoke a Power of Attorney granted using Form IL-2848-E by submitting a written statement to the Illinois Department of Revenue.

Q: Can I use Form IL-2848-E for federal taxes?

A: No, Form IL-2848-E is specifically for granting electronic access to tax information in Illinois and cannot be used for federal taxes.

Q: Are there any specific instructions for completing Form IL-2848-E?

A: Yes, Form IL-2848-E comes with detailed instructions that should be followed carefully when completing the form.

Form Details:

- Released on April 1, 1999;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-2848-E by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.