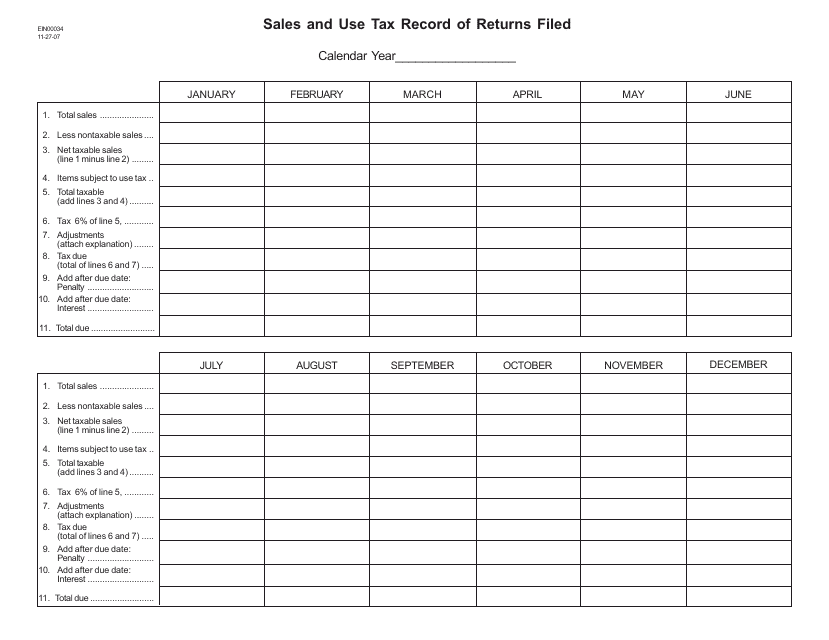

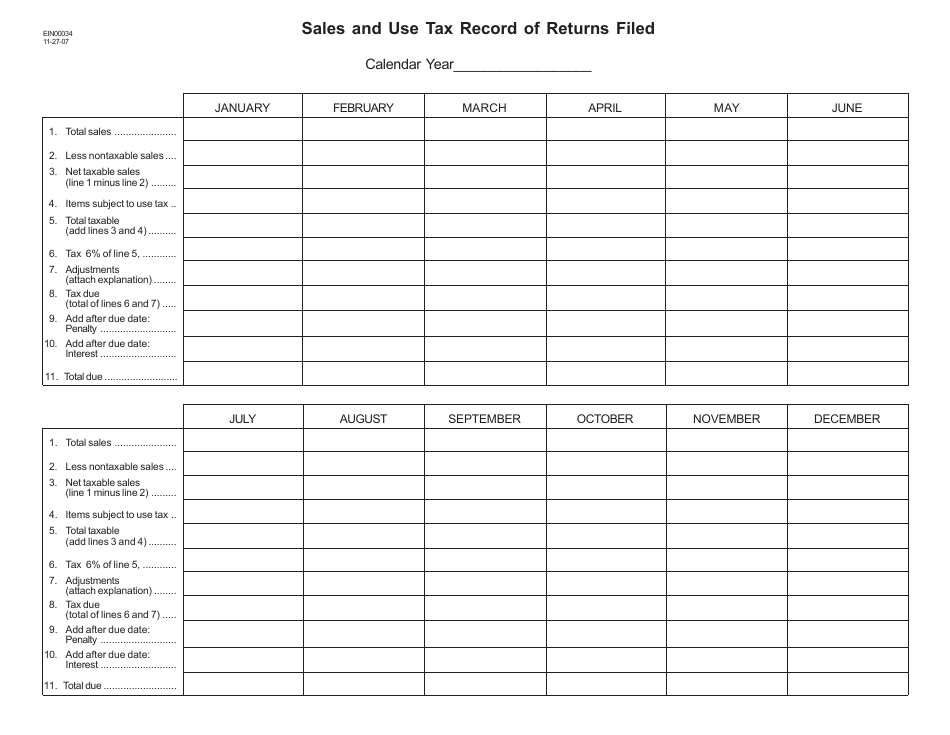

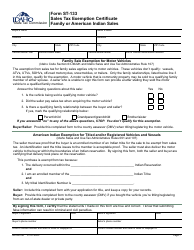

Form EIN00034 Sales and Use Tax Record of Returns Filed - Idaho

What Is Form EIN00034?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form EIN00034?

A: Form EIN00034 is used to record sales and use tax returns filed in Idaho.

Q: What is the full name of the form?

A: The full name of the form is Sales and Use Tax Record of Returns Filed - Idaho.

Q: Who needs to file Form EIN00034?

A: Businesses in Idaho that collect and remit sales and use tax need to file this form.

Q: Is this form mandatory?

A: Yes, if you are a business in Idaho that collects and remits sales and use tax, filing this form is mandatory.

Q: What information is required on Form EIN00034?

A: The form requires information such as the reporting period, sales and use tax amounts collected, and any adjustments or credits applied.

Q: When is the deadline to file Form EIN00034?

A: Form EIN00034 is due on or before the 20th day of the month following the reporting period.

Form Details:

- Released on November 27, 2007;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form EIN00034 by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.