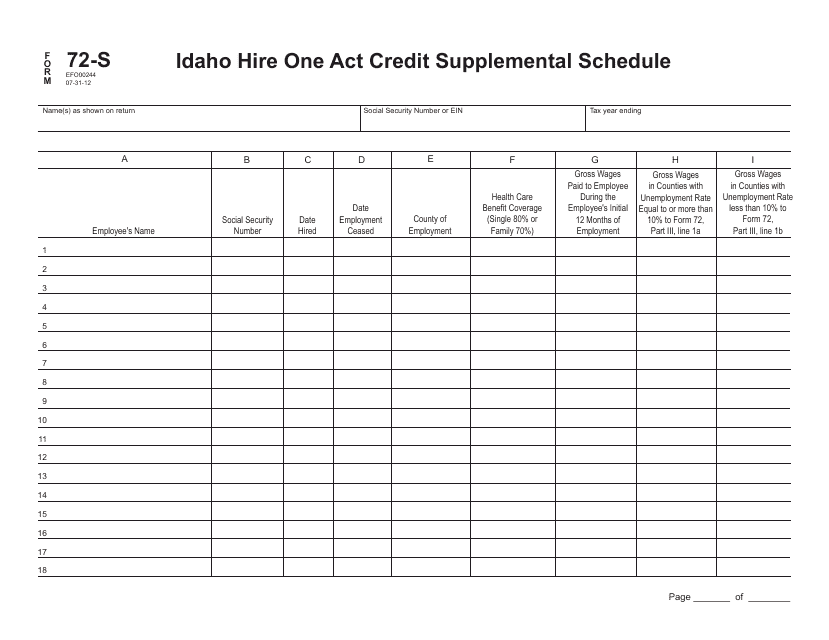

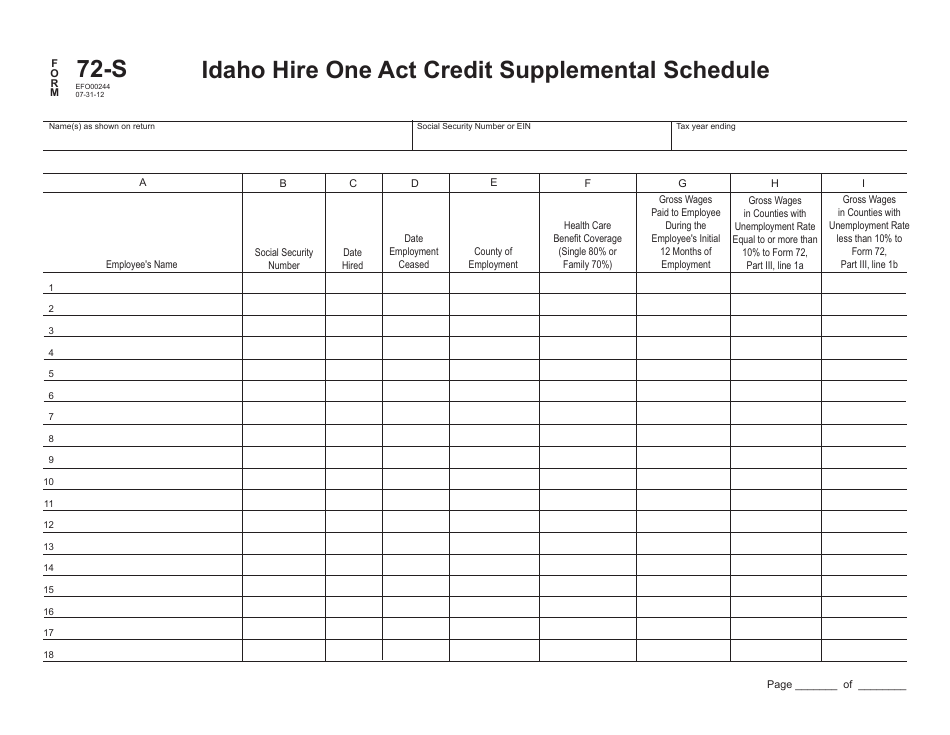

Form 72-S (EFO00244) Idaho Hire One Act Credit Supplemental Schedule - Idaho

What Is Form 72-S (EFO00244)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72-S (EFO00244)?

A: Form 72-S (EFO00244) is the Idaho Hire One Act Credit Supplemental Schedule.

Q: What is the purpose of Form 72-S (EFO00244)?

A: The purpose of Form 72-S (EFO00244) is to claim the Idaho Hire One Act Credit.

Q: Who needs to file Form 72-S (EFO00244)?

A: Employers who are claiming the Idaho Hire One Act Credit need to file Form 72-S (EFO00244).

Q: What is the Idaho Hire One Act Credit?

A: The Idaho Hire One Act Credit is a tax credit available to employers who hire eligible employees in Idaho.

Form Details:

- Released on July 31, 2012;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 72-S (EFO00244) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.