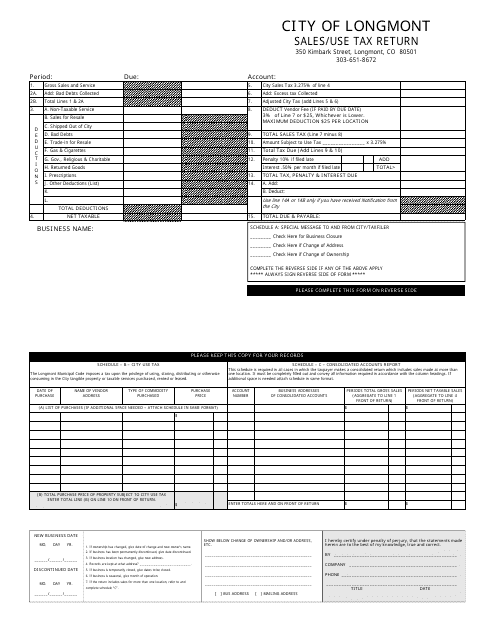

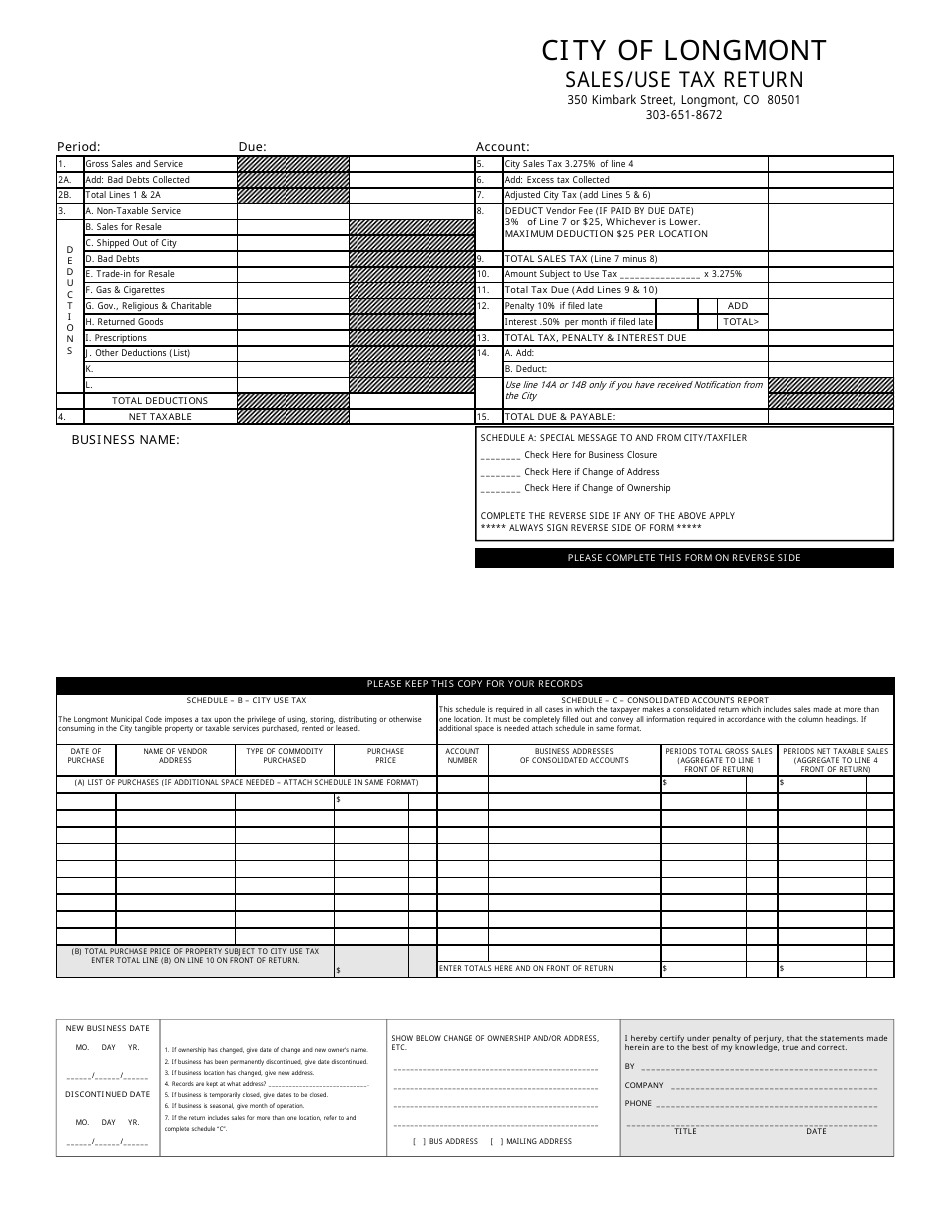

Sales / Use Tax Return Form - LONGMONT, Colorado

The Sales/Use Tax Return Form in Longmont, Colorado is used for reporting and remitting sales and use taxes collected by businesses operating in the city.

In LONGMONT, Colorado, the sales/use tax return form is typically filed by the business or individual who is responsible for collecting and remitting sales taxes on taxable goods or services.

FAQ

Q: What is the Sales/Use Tax Return Form?

A: The Sales/Use Tax Return Form is a document used for reporting sales and use tax owed by businesses in LONGMONT, Colorado.

Q: Who needs to file the Sales/Use Tax Return Form?

A: Businesses operating in LONGMONT, Colorado are required to file the Sales/Use Tax Return Form.

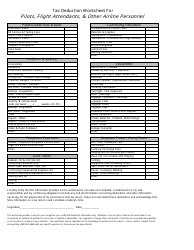

Q: What is included in the Sales/Use Tax?

A: The Sales/Use Tax includes taxes on retail sales, rentals, repairs, and certain services.

Q: When is the Sales/Use Tax Return Form due?

A: The due date for filing the Sales/Use Tax Return Form depends on the reporting period and is usually on a monthly or quarterly basis.

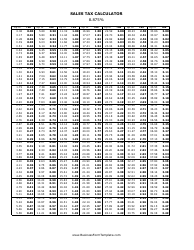

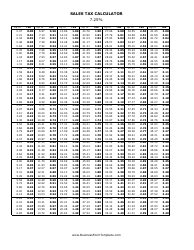

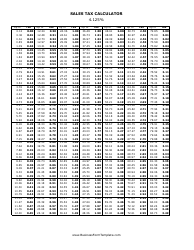

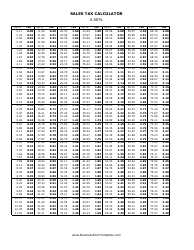

Q: How do I calculate the Sales/Use Tax?

A: The Sales/Use Tax is calculated based on the taxable sales made by a business during a specific period.

Q: Are there any penalties for late filing of the Sales/Use Tax Return Form?

A: Yes, there may be penalties for late filing of the Sales/Use Tax Return Form, including interest charges and late payment penalties.