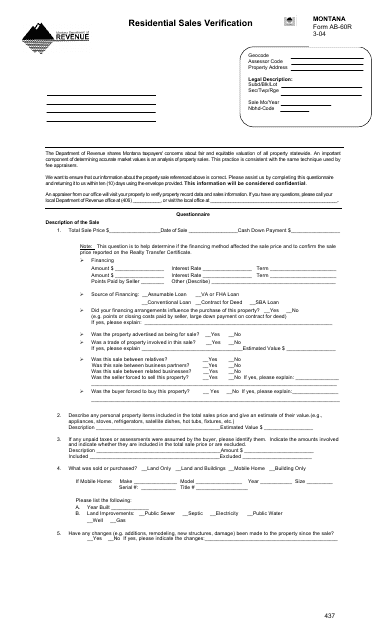

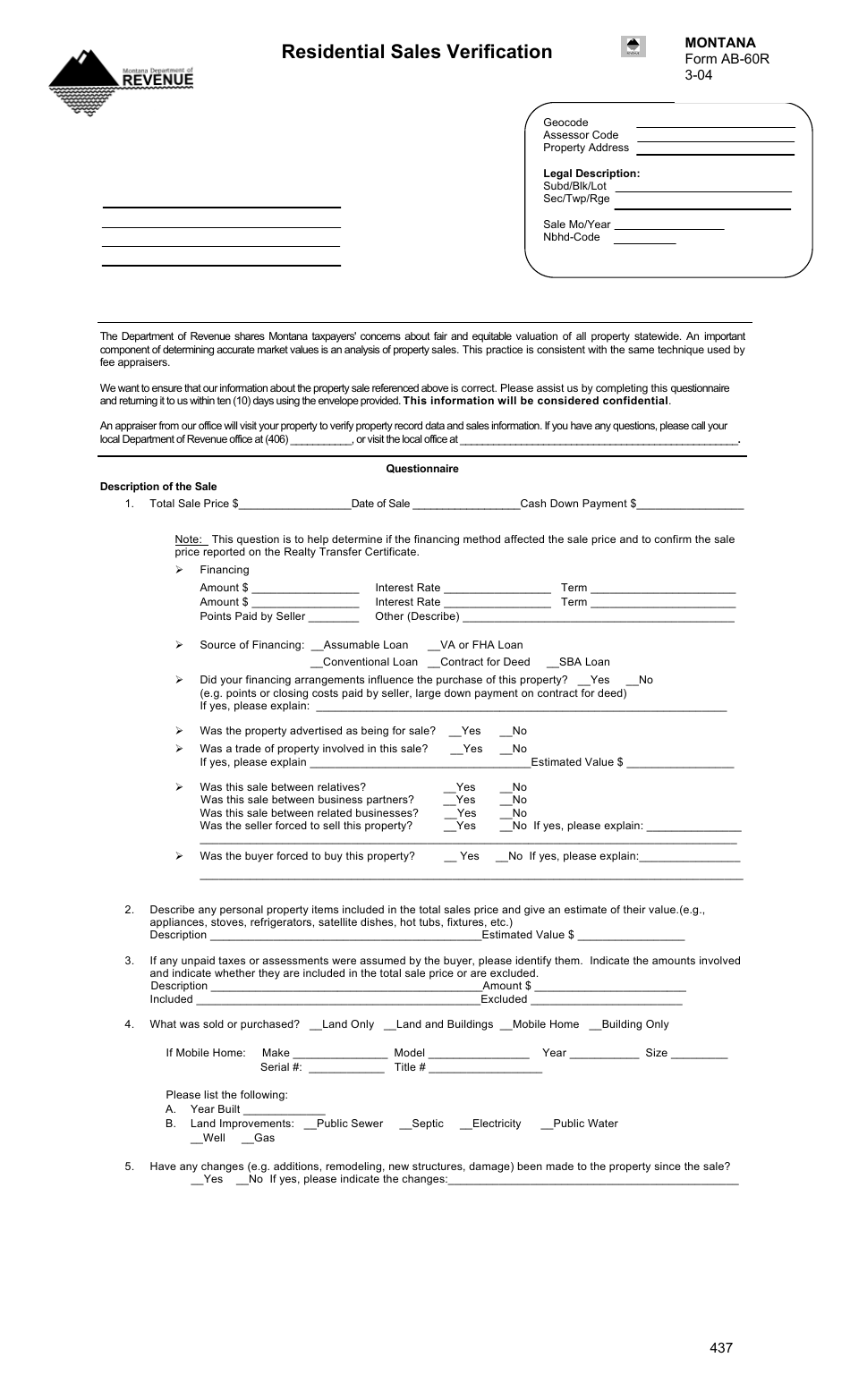

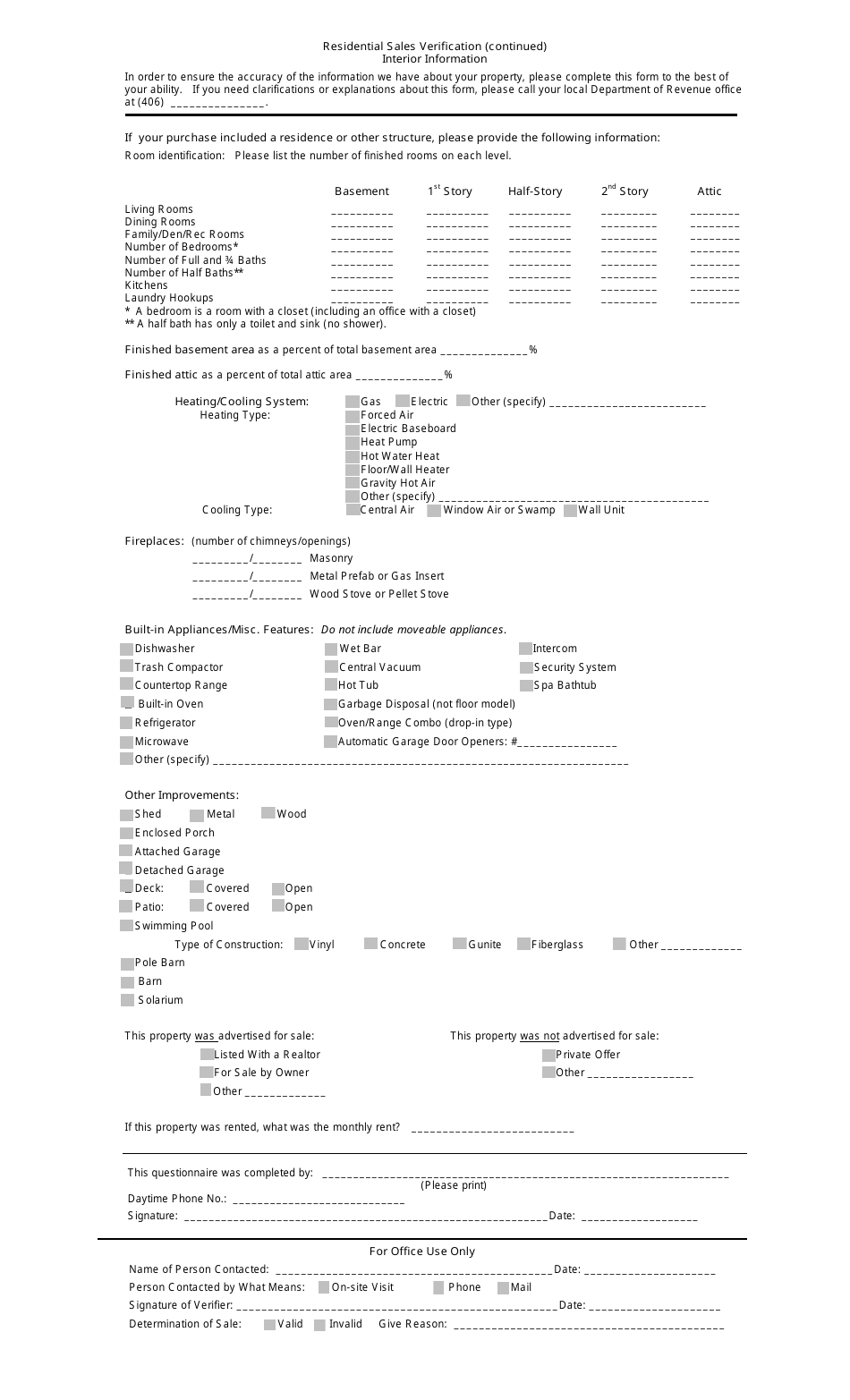

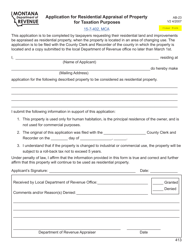

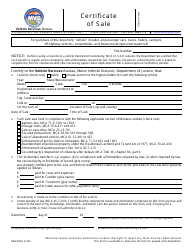

Form AB-60r Residential Sales Verification Form - Montana

What Is Form AB-60r?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AB-60r?

A: Form AB-60r is the Residential Sales Verification Form in Montana.

Q: What is the purpose of Form AB-60r?

A: The purpose of Form AB-60r is to verify the sales information related to residential properties.

Q: Who needs to fill out Form AB-60r?

A: The seller or their representative is required to fill out Form AB-60r.

Q: What information is required on Form AB-60r?

A: Form AB-60r requires information such as the property address, sale price, and buyer's name.

Q: When is Form AB-60r due?

A: Form AB-60r must be submitted within 30 days after the date of sale.

Q: Are there any fees associated with Form AB-60r?

A: No, there are no fees associated with Form AB-60r.

Q: What happens after submitting Form AB-60r?

A: After submitting Form AB-60r, the Montana Department of Revenue will review the information and update their records accordingly.

Q: Is Form AB-60r mandatory in Montana?

A: Yes, Form AB-60r is mandatory when selling residential properties in Montana.

Form Details:

- Released on March 1, 2004;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AB-60r by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.