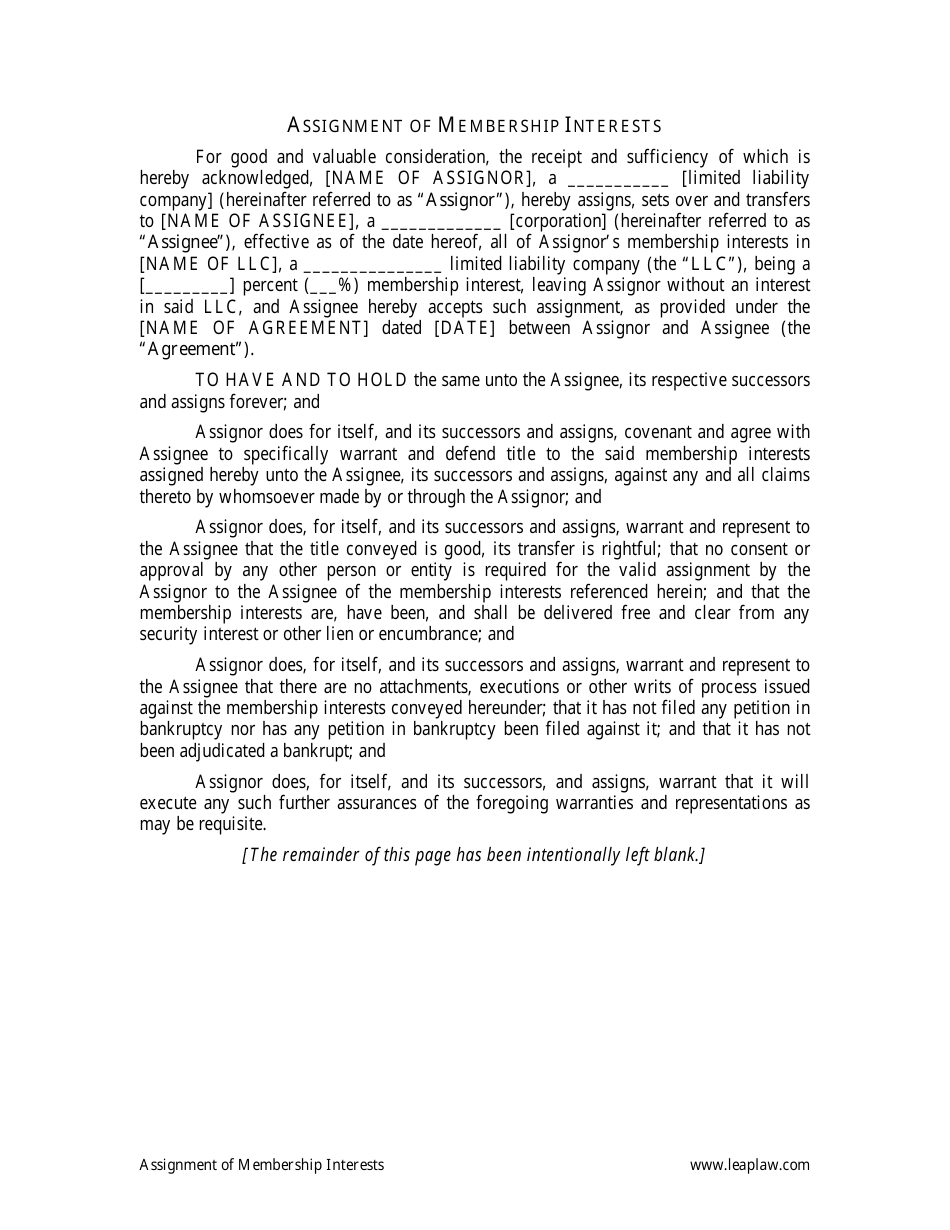

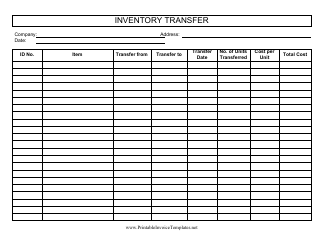

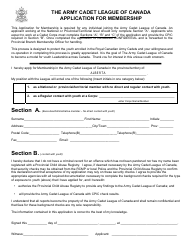

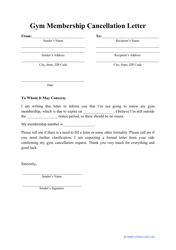

Sample Transfer of Membership Interest Template

A Sample Transfer of Membership Interest Template is a document that outlines the terms and conditions for transferring ownership or interest in a membership of a business or organization. It helps facilitate the legal transfer of ownership between parties involved in the transfer.

In the United States, the person or entity transferring the membership interest typically files the sample transfer of membership interest template.

FAQ

Q: What is a transfer of membership interest?

A: A transfer of membership interest refers to the sale or assignment of ownership rights in a limited liability company (LLC).

Q: Why would someone want to transfer their membership interest?

A: There are several reasons why someone may want to transfer their membership interest, such as: retiring from the business, selling their stake for financial reasons, or pursuing other opportunities.

Q: Do all LLCs allow for the transfer of membership interest?

A: Not all LLCs allow for the transfer of membership interest. It depends on the operating agreement of the LLC.

Q: What is an operating agreement?

A: An operating agreement is a legal document that outlines the rights, responsibilities, and operating procedures of an LLC.

Q: Is a transfer of membership interest taxable?

A: A transfer of membership interest may have tax implications. It is advisable to consult with a tax professional to understand the specific tax consequences.

Q: What is included in a transfer of membership interest template?

A: A transfer of membership interest template typically includes the names of the parties involved, details of the membership interest being transferred, and any conditions or considerations for the transfer.

Q: Do I need a lawyer to complete a transfer of membership interest?

A: While it is not required to have a lawyer, it is recommended to consult with a lawyer to ensure that the transfer is done correctly and in compliance with applicable laws and the operating agreement of the LLC.