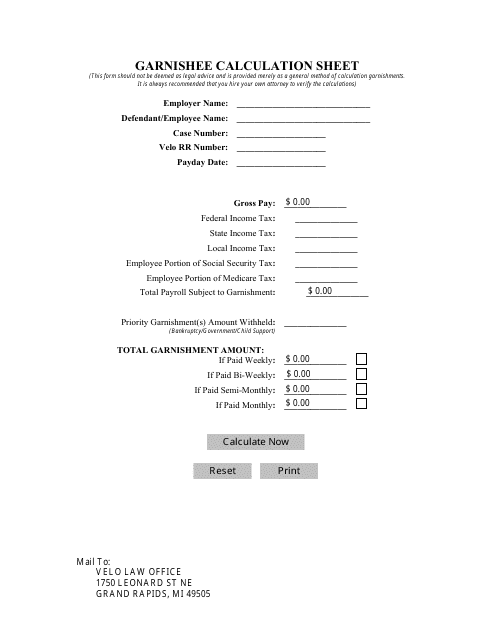

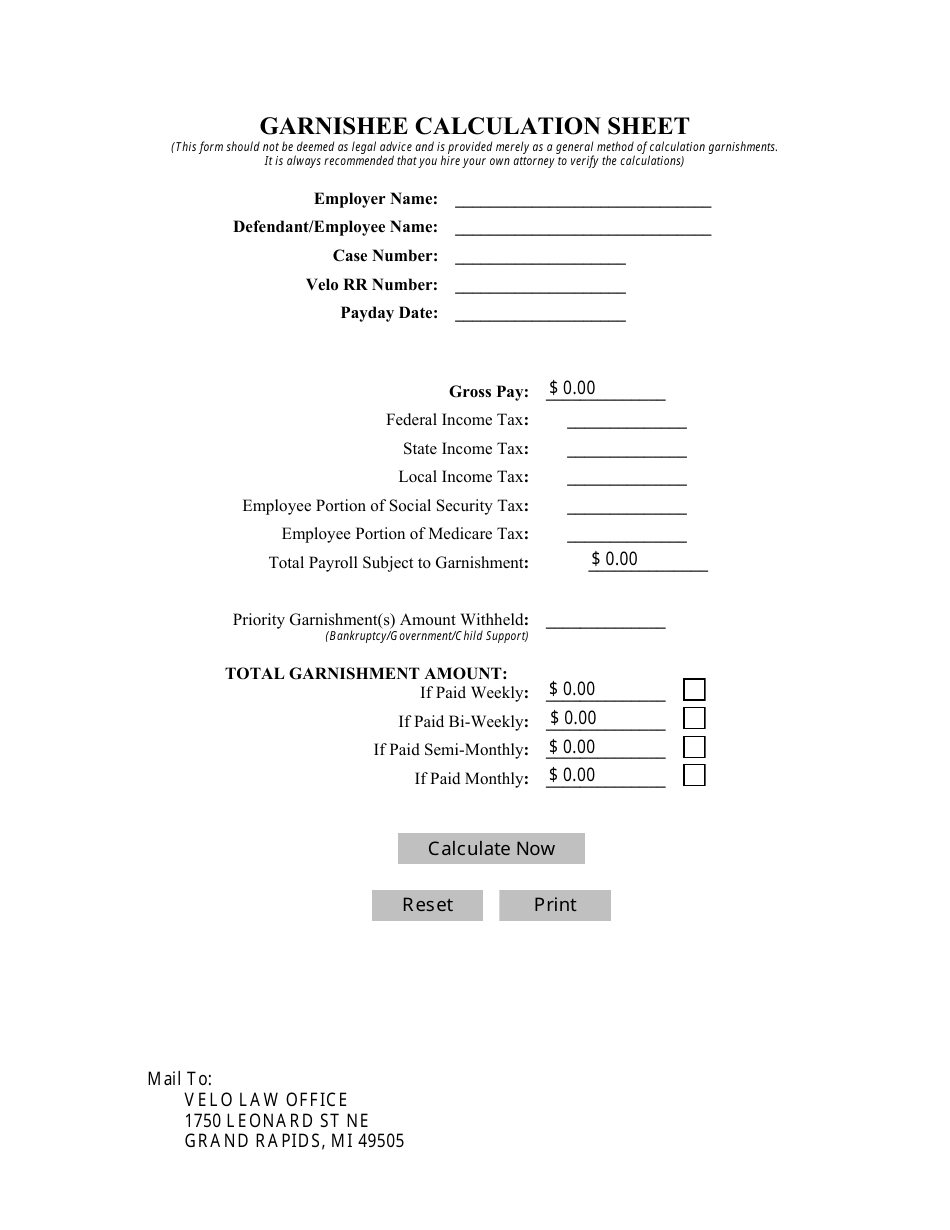

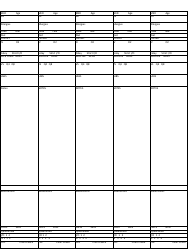

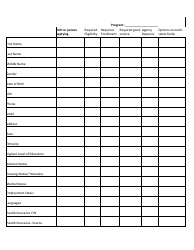

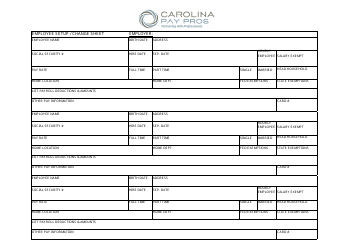

Garnishee Calculation Sheet - Velo Law Office

The Garnishee Calculation Sheet is a document used by the Velo Law Office to calculate the amount of money that can be legally withheld from a person's wages or bank account to satisfy a debt owed to a creditor. It helps determine the maximum amount that can be garnished from the debtor's income.

FAQ

Q: What is a garnishee calculation sheet?

A: A garnishee calculation sheet is a document used by the Velo Law Office to determine the amount that can be legally taken from a person's wages or bank account to satisfy a debt.

Q: When is a garnishee calculation sheet used?

A: A garnishee calculation sheet is used when a person has a debt and the creditor wants to collect the debt by garnishing their wages or bank account.

Q: How does a garnishee calculation sheet work?

A: A garnishee calculation sheet takes into account the person's income and allowable deductions to calculate the maximum amount that can be taken to satisfy the debt.

Q: Who prepares a garnishee calculation sheet?

A: The Velo Law Office prepares the garnishee calculation sheet to ensure that the collection of the debt through garnishment is legal and follows the appropriate calculations.

Q: What information is needed for a garnishee calculation sheet?

A: The garnishee calculation sheet requires information such as the person's income, deductions, and details of the debt in question.

Q: Can a person challenge a garnishee calculation sheet?

A: Yes, a person can challenge a garnishee calculation sheet if they believe it is inaccurate or if they have valid reasons as to why the amount being garnished should be reduced.