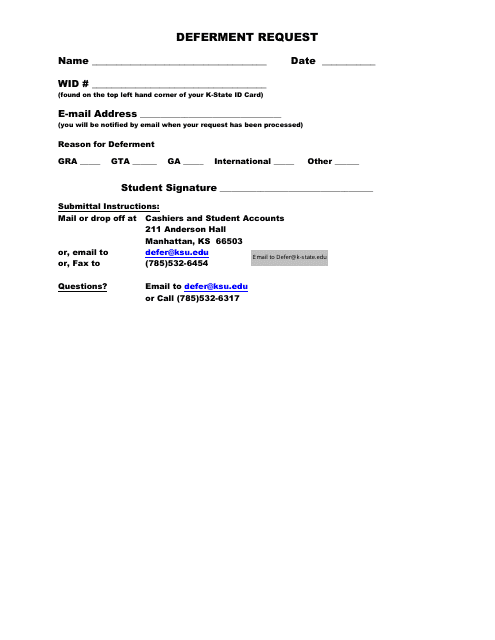

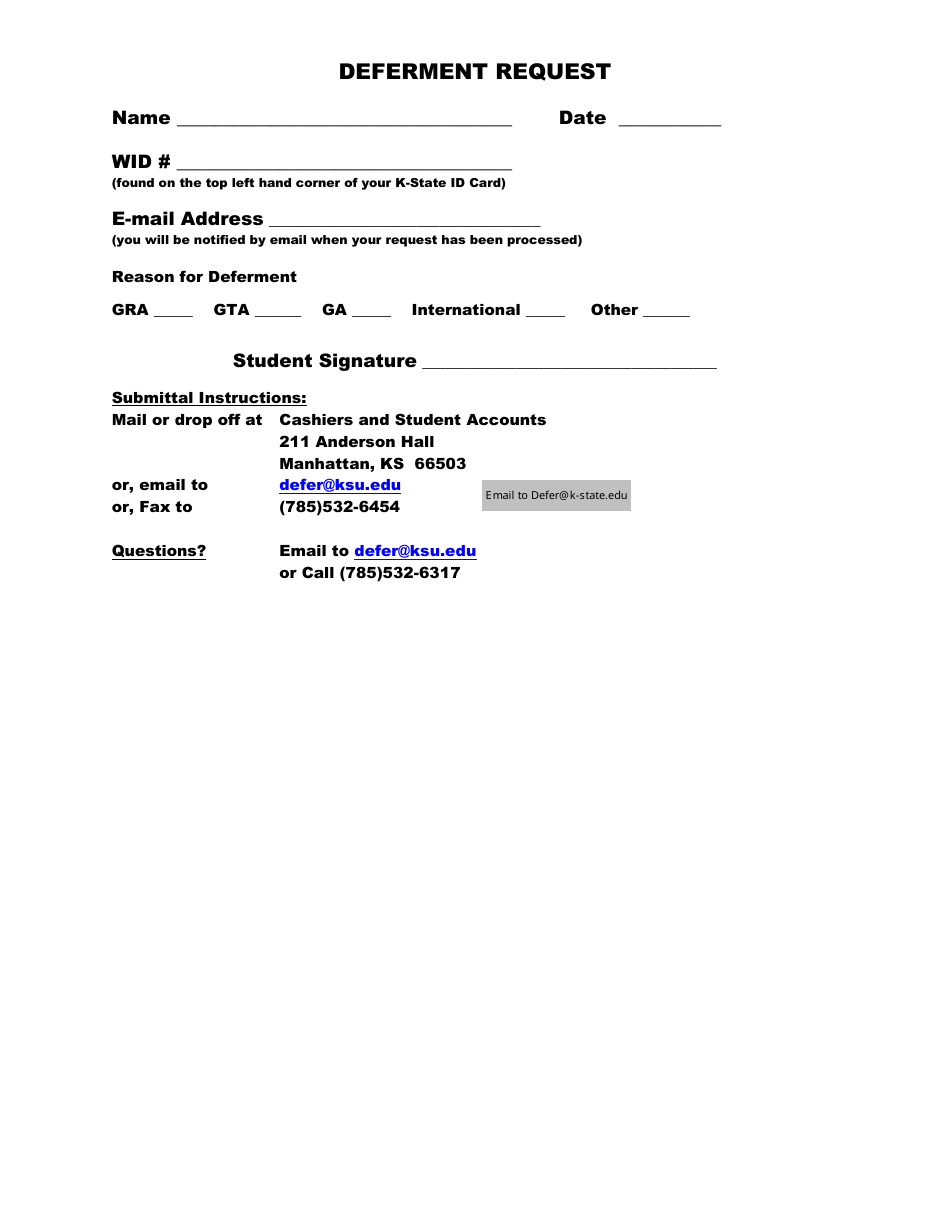

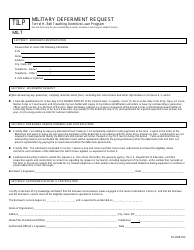

Deferment Request Template

A Deferment Request Template is typically used to ask for a temporary suspension or delay in making payments for a loan or a financial obligation. It provides a standardized format for requesting deferment and includes important information such as personal details, loan details, and reasons for the deferment.

The deferment request template is typically filed by the individual seeking to defer a certain obligation or payment.

FAQ

Q: What is a deferment request?

A: A deferment request is a formal request to delay repayment of a loan or to temporarily suspend any loan obligations.

Q: How do I write a deferment request letter?

A: When writing a deferment request letter, include your name, contact information, loan details, reason for the deferment, requested deferment period, and any supporting documentation.

Q: What are valid reasons for a deferment request?

A: Valid reasons for a deferment request may include unemployment, economic hardship, enrollment in school, active military duty, or health-related issues.

Q: Do I have to pay interest during a deferment period?

A: Whether or not you are required to pay interest during a deferment period depends on the type of loan you have.

Q: How long can a deferment period last?

A: The length of a deferment period can vary depending on the type of loan and individual circumstances. It can range from a few months to several years.

Q: Can I apply for a deferment if I am already delinquent on my loan payments?

A: It is still possible to apply for a deferment if you are already delinquent on your loan payments, but it is best to do so as soon as possible to avoid further consequences.

Q: Is a deferment request guaranteed to be approved?

A: The approval of a deferment request depends on various factors, including the type of loan, the reason for the deferment, and the individual circumstances. There is no guarantee of approval.

Q: What should I do if my deferment request is denied?

A: If your deferment request is denied, you may explore alternative options such as income-driven repayment plans, loan consolidation, or seeking assistance from a loan counselor.

Q: Can I request a deferment for all types of loans?

A: Deferment options may vary depending on the type of loan. It is best to contact your loan servicer or lender to inquire about deferment options for your specific loan.

Q: How often can I apply for a deferment?

A: The frequency with which you can apply for a deferment depends on the type of loan and the specific terms and conditions outlined by your lender or loan servicer.