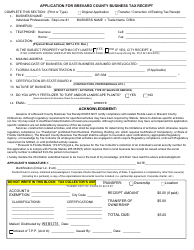

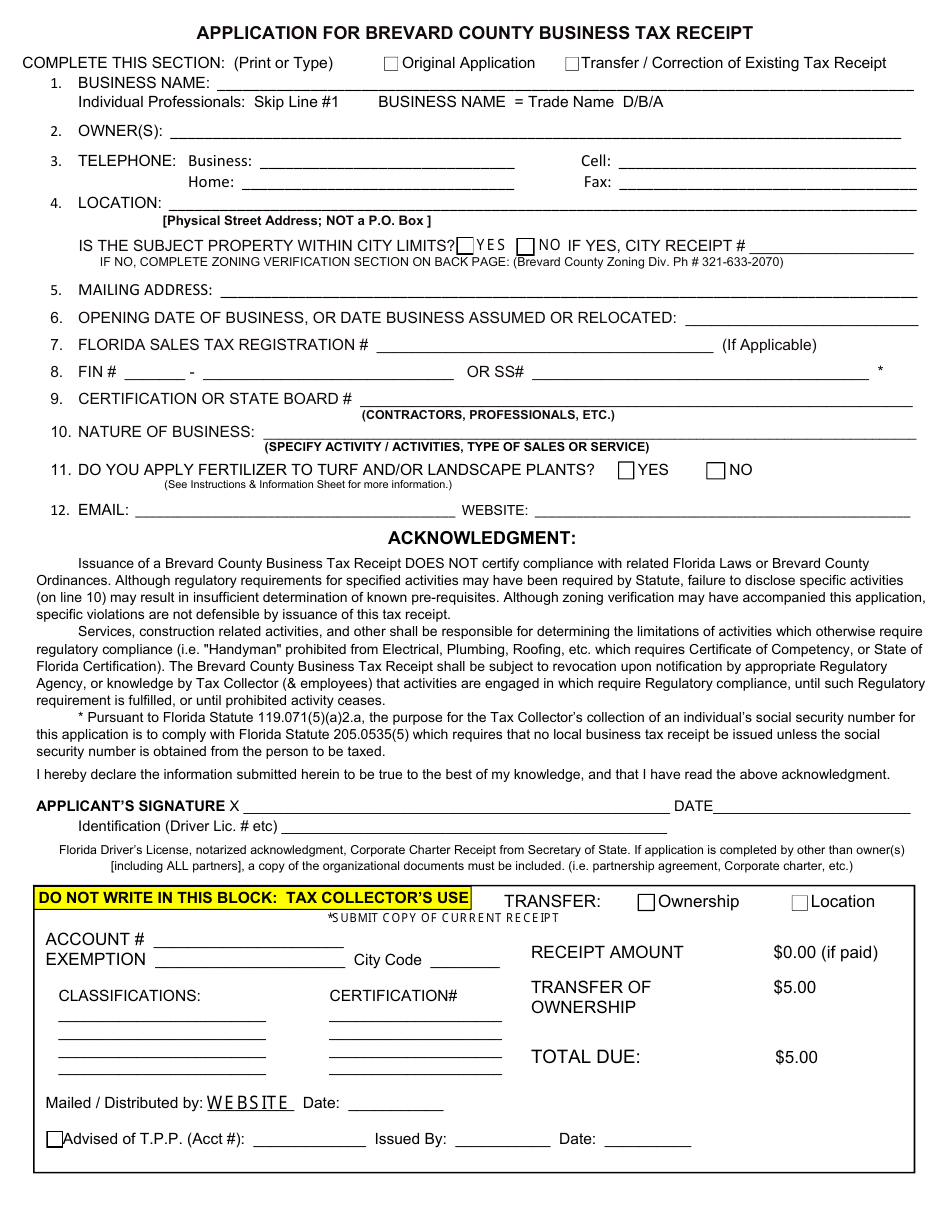

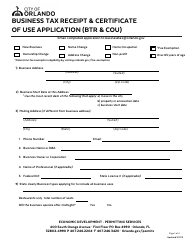

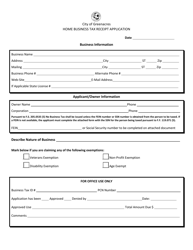

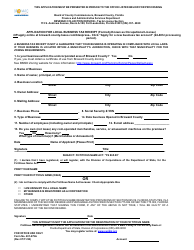

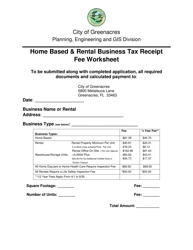

Application for Brevard County Business Tax Receipt - Brevard County, Florida

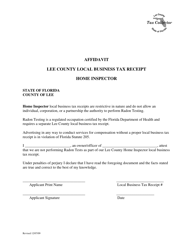

Application for Brevard County Business Tax Receipt is a legal document that was released by the Florida Department of Revenue - a government authority operating within Florida. The form may be used strictly within Brevard County.

FAQ

Q: What is a Brevard County Business Tax Receipt?

A: A Brevard County Business Tax Receipt is a license required for anyone operating a business in Brevard County, Florida.

Q: Who needs to apply for a Brevard County Business Tax Receipt?

A: Anyone operating a business in Brevard County, Florida needs to apply for a Brevard County Business Tax Receipt.

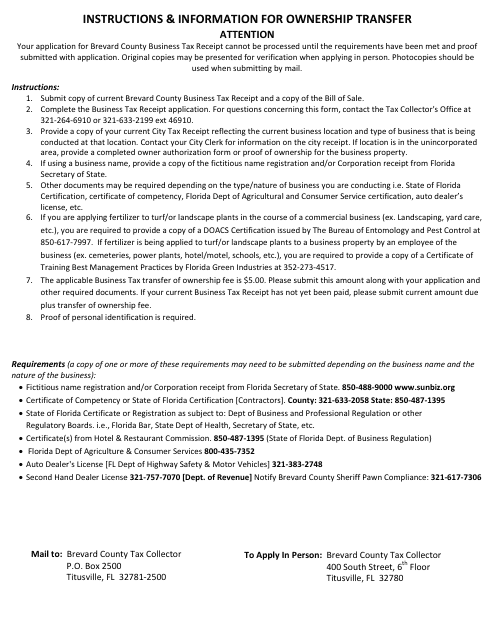

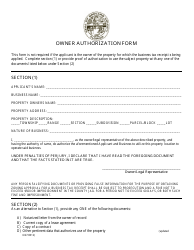

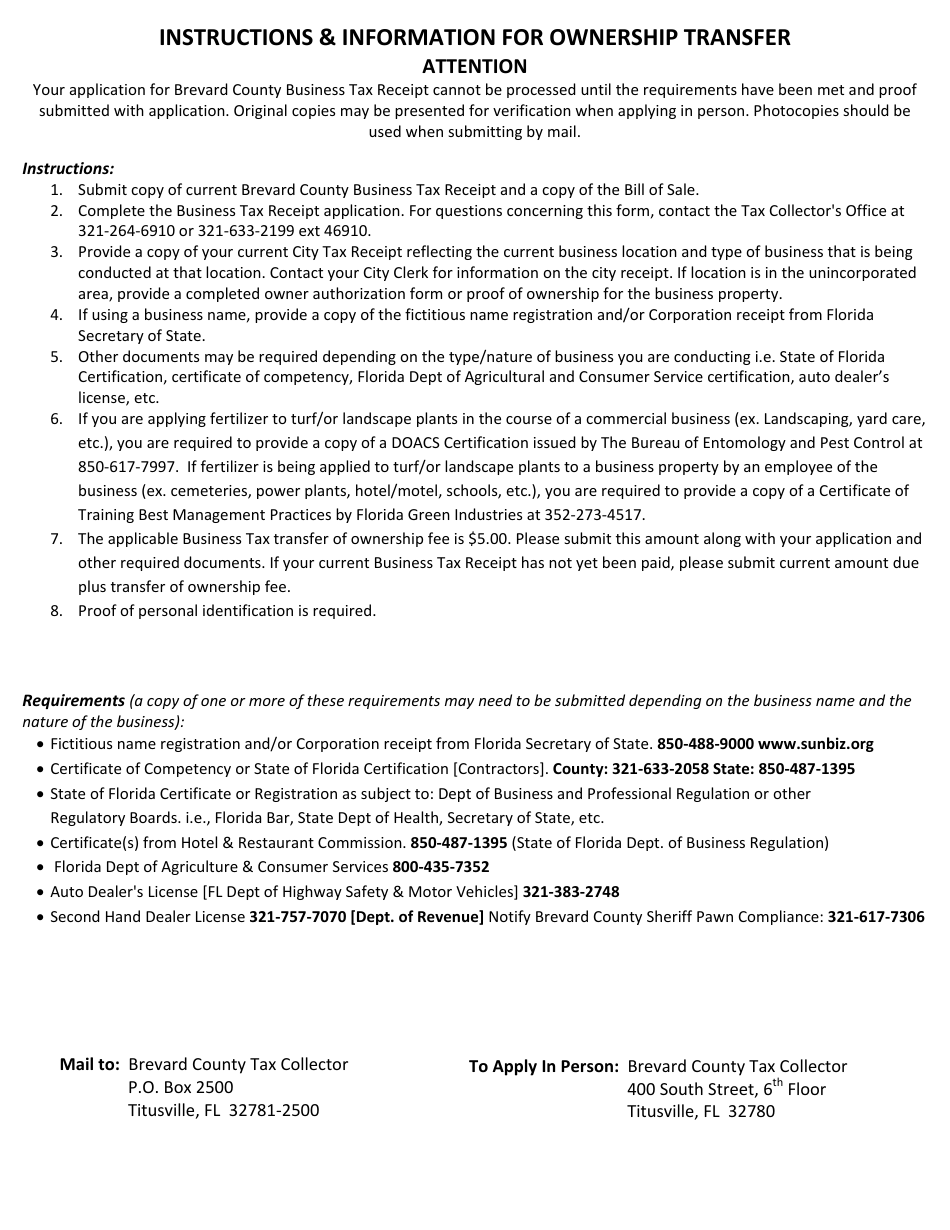

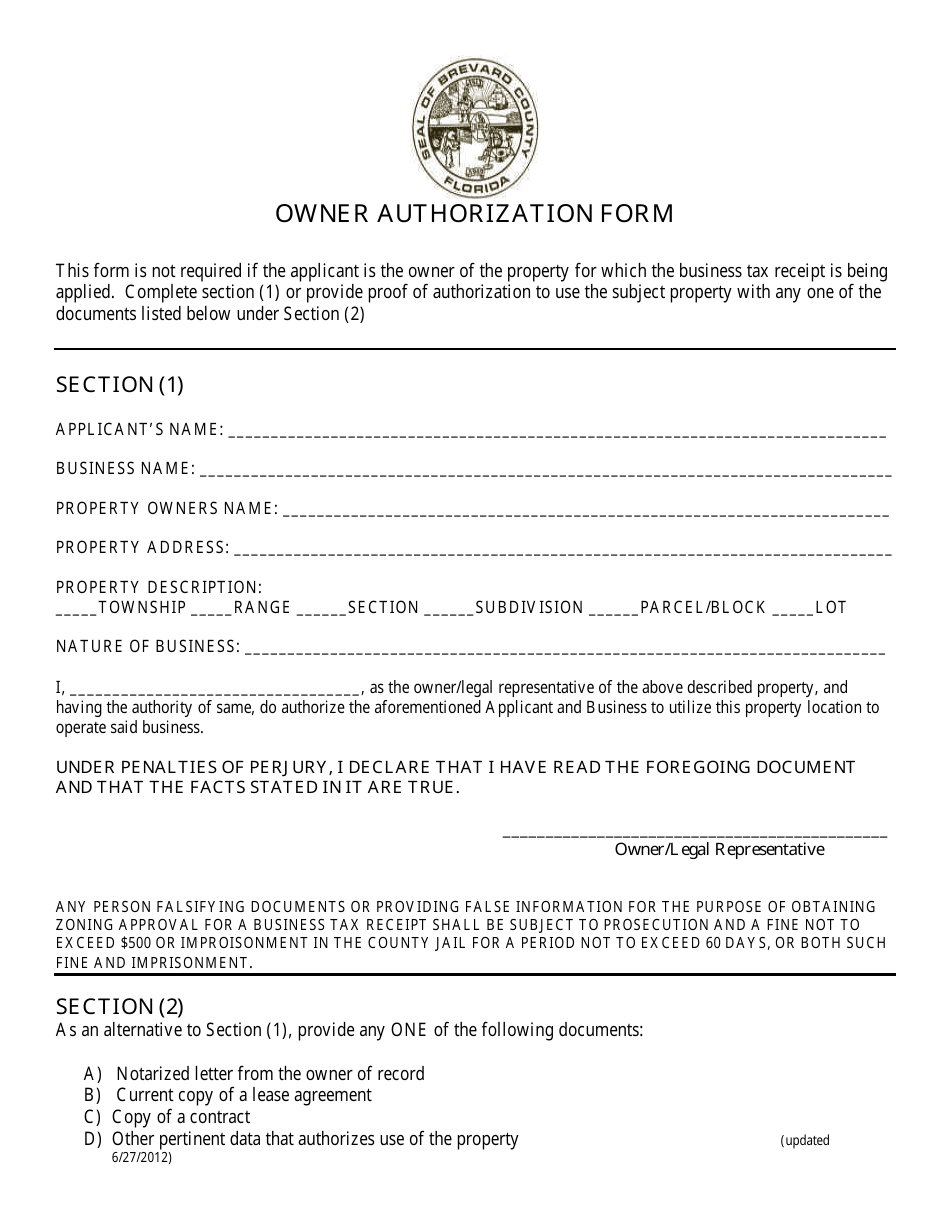

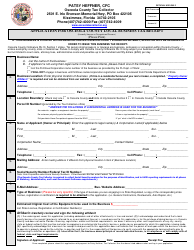

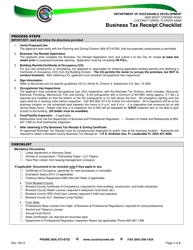

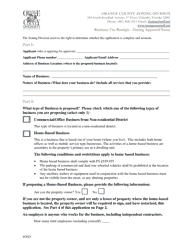

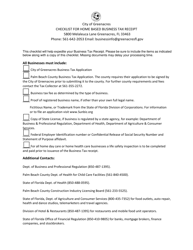

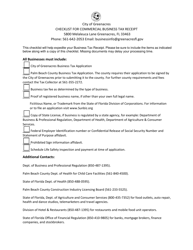

Q: What documents are required to apply for a Brevard County Business Tax Receipt?

A: The required documents may vary depending on the type of business, but generally you will need a completed application form, proof of ownership or occupancy, and payment for the required fees.

Q: How much does a Brevard County Business Tax Receipt cost?

A: The cost of a Brevard County Business Tax Receipt varies depending on the type of business and the gross receipts or number of employees. It is best to contact the Brevard County Tax Collector's Office for specific fee information.

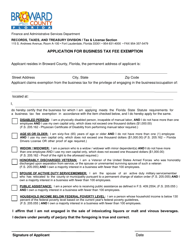

Q: Are there any exemptions or discounts available for the Brevard County Business Tax Receipt?

A: Yes, certain exemptions and discounts may be available for specific types of businesses or situations. It is recommended to contact the Brevard County Tax Collector's Office for more information.

Q: How long is a Brevard County Business Tax Receipt valid for?

A: A Brevard County Business Tax Receipt is typically valid for one year from the date of issuance.

Q: What happens if I operate a business without a Brevard County Business Tax Receipt?

A: Operating a business without a valid Brevard County Business Tax Receipt is a violation of the law and may result in penalties and fines.

Q: Can I transfer my Brevard County Business Tax Receipt if I sell my business?

A: Yes, in most cases the Brevard County Business Tax Receipt can be transferred to a new owner upon sale of the business. You should contact the Brevard County Tax Collector's Office for the specific requirements and process.

Q: How can I renew my Brevard County Business Tax Receipt?

A: You can renew your Brevard County Business Tax Receipt by submitting a renewal application and paying the required fees. It is recommended to contact the Brevard County Tax Collector's Office for the renewal process details and deadlines.

Form Details:

- Released on June 27, 2012;

- The latest edition currently provided by the Florida Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.