Certificate of Organization - Nebraska Limited Liability Company - LLC University - Nebraska

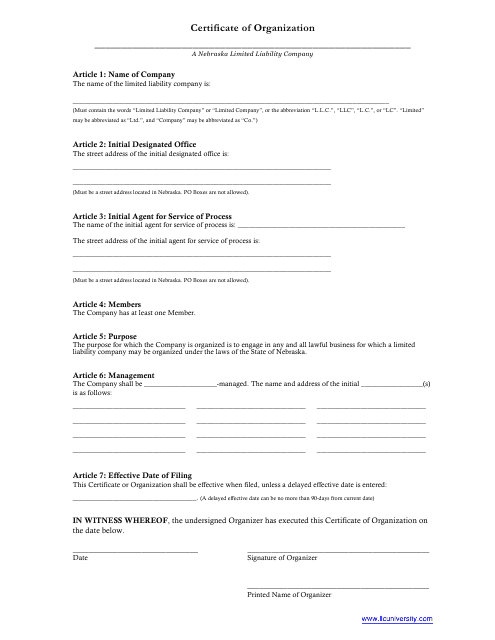

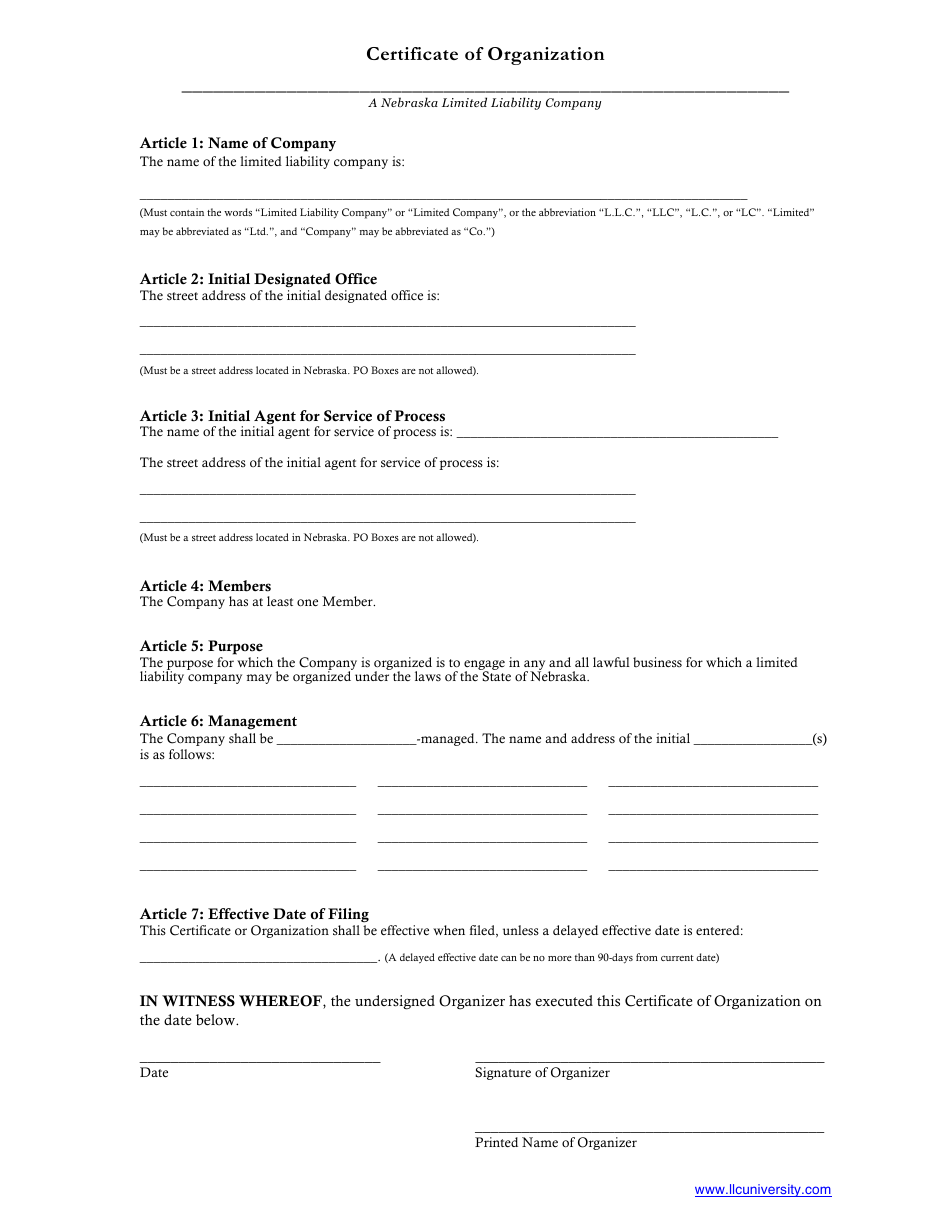

The Certificate of Organization for a Nebraska Limited Liability Company (LLC) is a legal document filed with the state of Nebraska to establish the LLC as a separate legal entity. It provides important details about the company such as its name, address, registered agent, and the purpose for which it is formed.

The Certificate of Organization for a Nebraska Limited Liability Company (LLC) is typically filed by the members or the organizers of the LLC.

FAQ

Q: What is a Certificate of Organization?

A: A Certificate of Organization is a legal document used to form a Limited Liability Company (LLC) in Nebraska.

Q: What is a Limited Liability Company (LLC)?

A: An LLC is a type of business structure that provides limited liability protection to its owners while allowing for flexible management and pass-through taxation.

Q: Why should I form an LLC in Nebraska?

A: Forming an LLC in Nebraska offers limited liability protection, flexibility in management, and potential tax benefits.

Q: How do I file a Certificate of Organization in Nebraska?

A: To file a Certificate of Organization in Nebraska, you must submit the necessary formation documents and pay the required filing fees to the Nebraska Secretary of State.

Q: What information is required in a Certificate of Organization?

A: The Certificate of Organization must include the LLC's name, registered agent information, business address, and the names of the organizers.

Q: What is a registered agent?

A: A registered agent is an individual or business entity that is designated to receive legal documents on behalf of the LLC.

Q: How much does it cost to file a Certificate of Organization in Nebraska?

A: The filing fee for a Certificate of Organization in Nebraska is $100.

Q: Can I form an LLC in Nebraska without a lawyer?

A: Yes, you can form an LLC in Nebraska without a lawyer by following the necessary steps and submitting the required documents.

Q: How long does it take to get a Certificate of Organization?

A: The processing time for a Certificate of Organization in Nebraska is typically 3-5 business days.

Q: Is an operating agreement required for an LLC in Nebraska?

A: While not legally required, it is highly recommended to have an operating agreement in place for an LLC in Nebraska to establish the rights and responsibilities of the members.