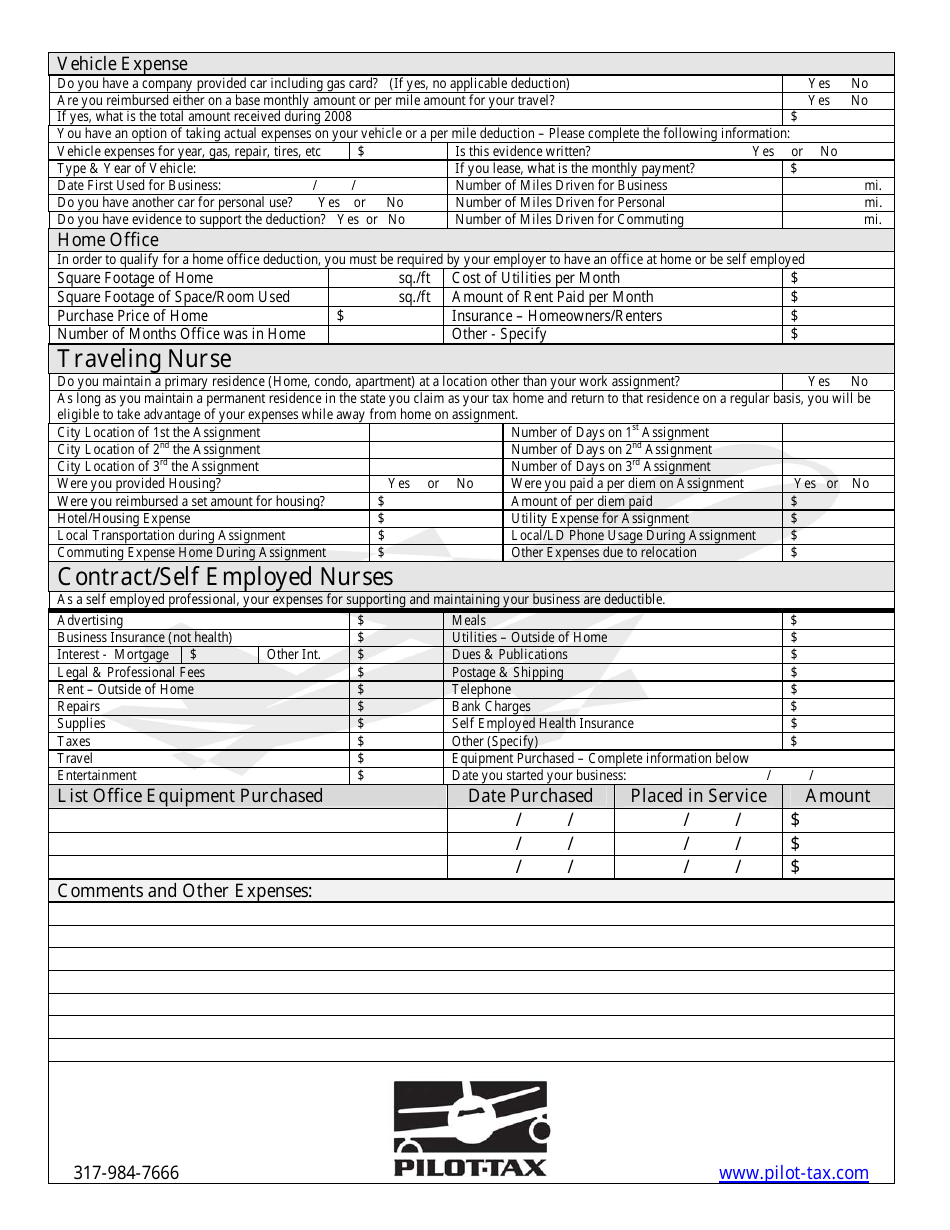

Nursing Professional Deductions Form - Pilot Tax

FAQ

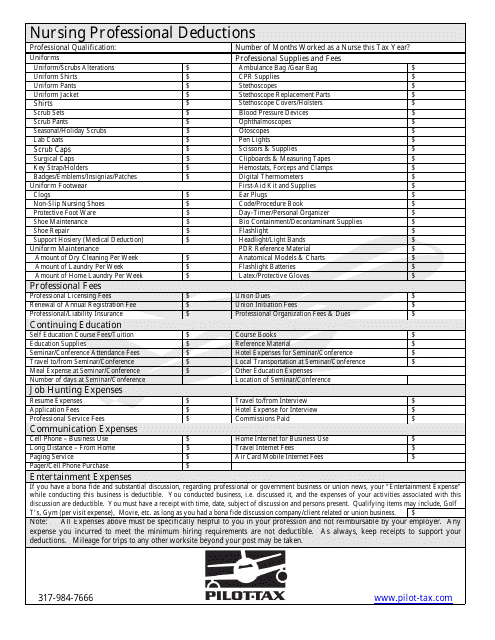

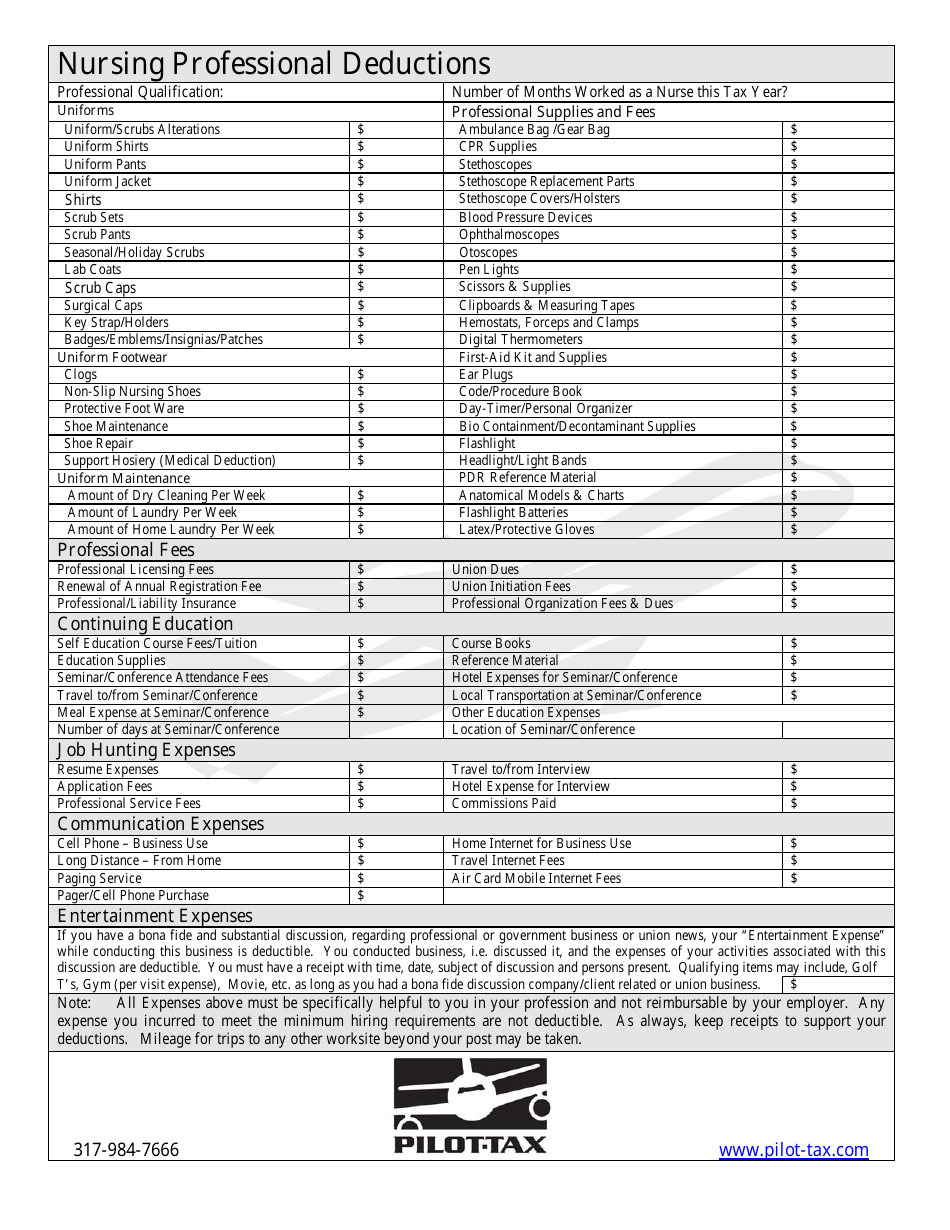

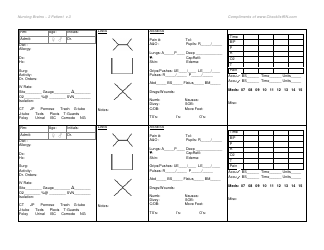

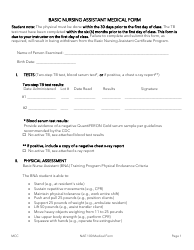

Q: What is the Nursing Professional Deductions Form?

A: The Nursing Professional Deductions Form is a tax form used by nurses to claim deductions related to their profession.

Q: What deductions can nurses claim using this form?

A: Nurses can claim deductions for expenses such as uniforms, continuing education, professional association fees, and travel expenses.

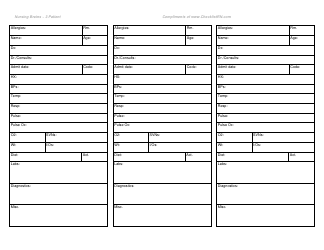

Q: Who is eligible to use the Nursing Professional Deductions Form?

A: Any nurse who incurs eligible expenses related to their profession can use this form to claim deductions.

Q: Is there a specific requirement for the type of nurse who can use this form?

A: No, this form can be used by registered nurses, licensed practical nurses, and other nursing professionals.

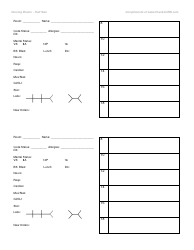

Q: Are there any limits on the deductions that can be claimed using this form?

A: Yes, there may be certain limits and restrictions on the deductions that can be claimed. It is recommended to consult a tax professional for specific guidance.