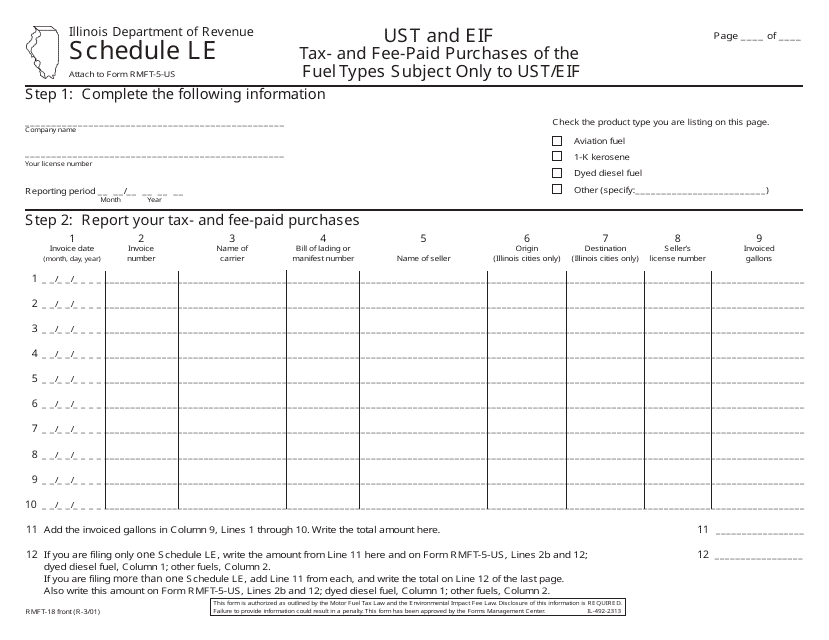

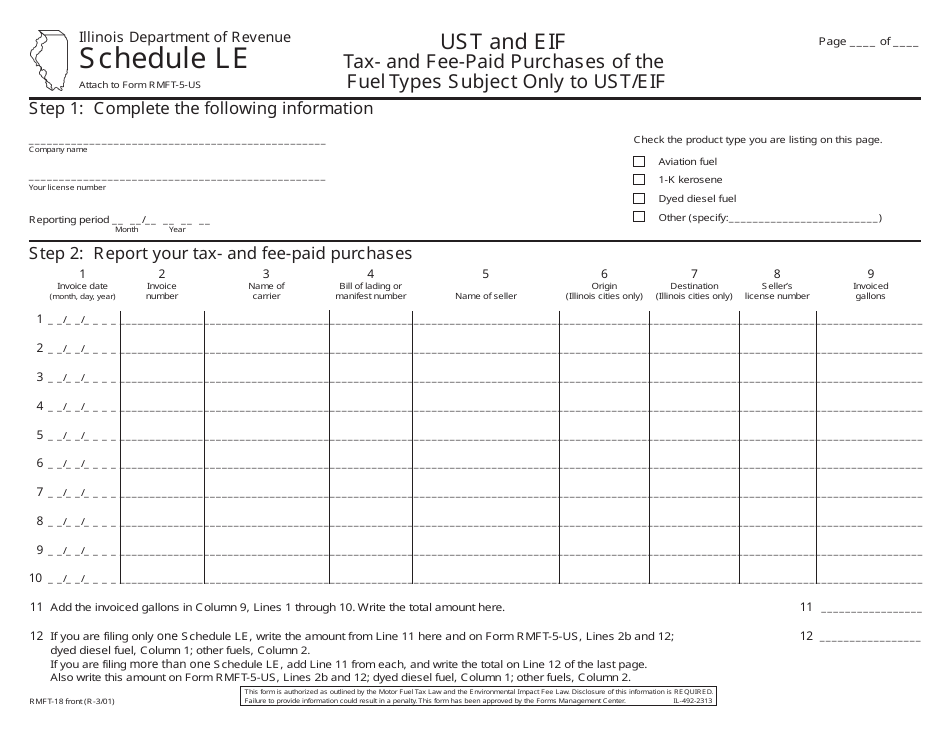

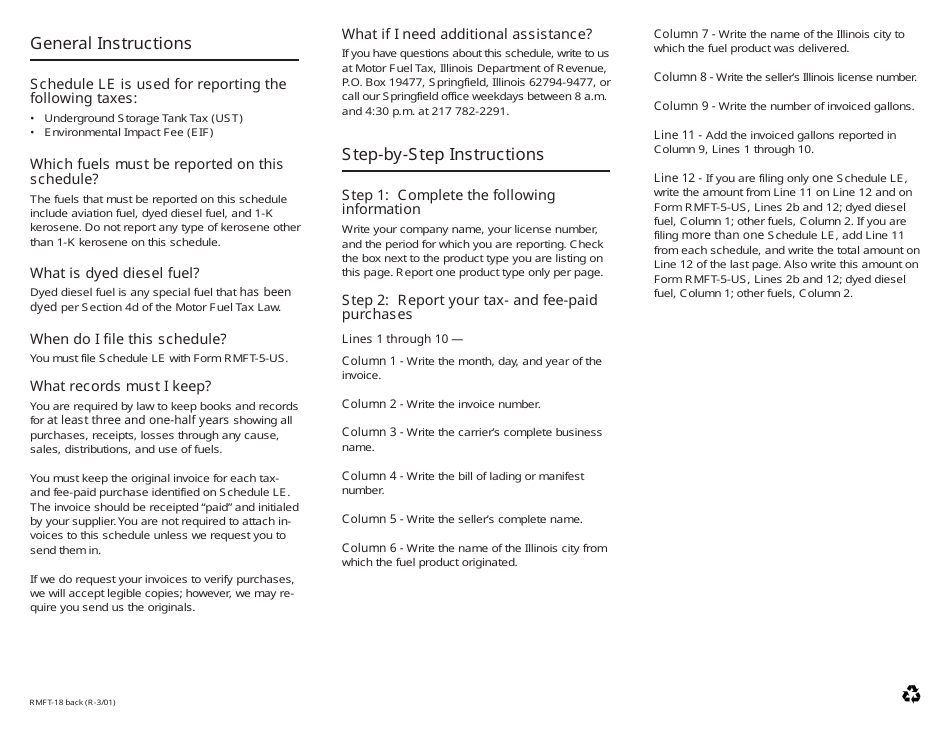

Form RMFT-18 Schedule LE Ust and Eif Tax- and Fee-Paid Purchases of the Fuel Types Subject Only to Ust / Eif - Illinois

What Is Form RMFT-18 Schedule LE?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RMFT-18?

A: Form RMFT-18 is a tax form used in Illinois.

Q: What does RMFT-18 Schedule LE stand for?

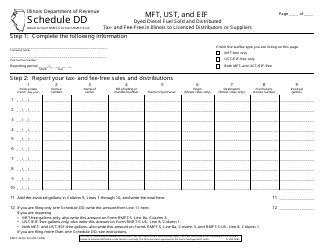

A: RMFT-18 Schedule LE stands for Report of Motor Fuel Tax (MFT) and Environmental Impact Fee (EIF) Tax- and Fee-Paid Purchases of the Fuel Types Subject Only to Underground Storage Tank (UST) / Environmental Impact Fee (EIF) Tax in Illinois.

Q: What is the purpose of Form RMFT-18 Schedule LE?

A: The purpose of Form RMFT-18 Schedule LE is to report tax and fee-paid purchases of fuel types subject only to UST/EIF tax in Illinois.

Q: What are some examples of the fuel types subject to UST/EIF tax in Illinois?

A: Some examples of fuel types subject to UST/EIF tax in Illinois include gasoline, diesel fuel, aviation gasoline, and compressed natural gas (CNG).

Q: Who is required to file Form RMFT-18 Schedule LE?

A: Any person or entity who has tax and fee-paid purchases of fuel types subject only to UST/EIF tax in Illinois is required to file Form RMFT-18 Schedule LE.

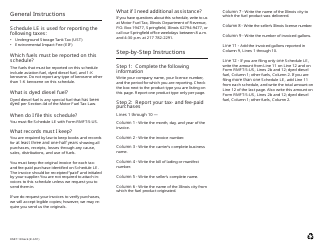

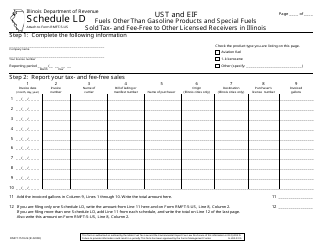

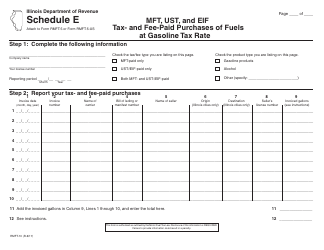

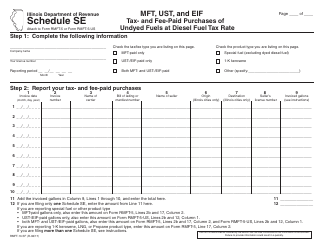

Q: What information is required to be reported on Form RMFT-18 Schedule LE?

A: Form RMFT-18 Schedule LE requires the reporting of detailed information about the tax and fee-paid purchases of fuel, including the type of fuel, purchase date, vendor name and address, and quantity of fuel purchased.

Q: When is the deadline for filing Form RMFT-18 Schedule LE?

A: The deadline for filing Form RMFT-18 Schedule LE is typically the last day of the month following the end of the reporting period.

Form Details:

- Released on March 1, 2001;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-18 Schedule LE by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.