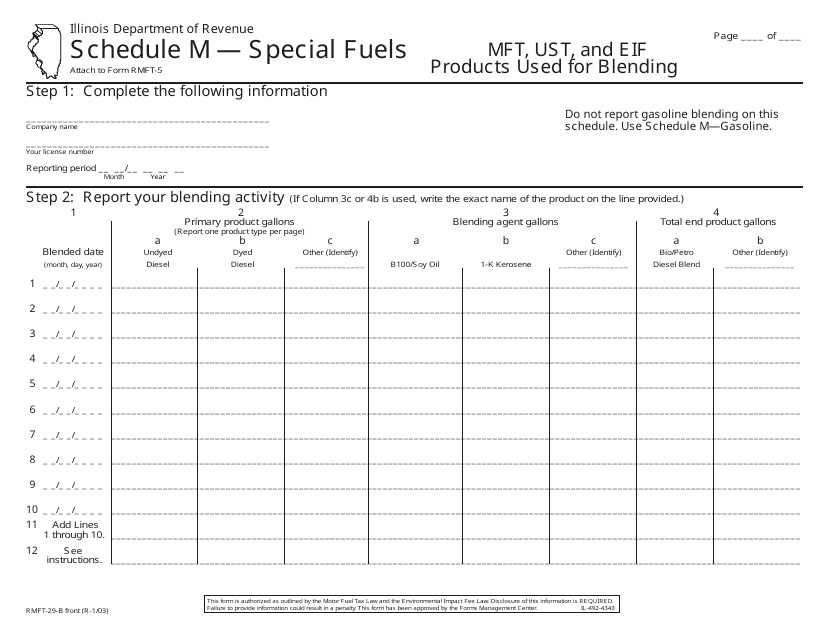

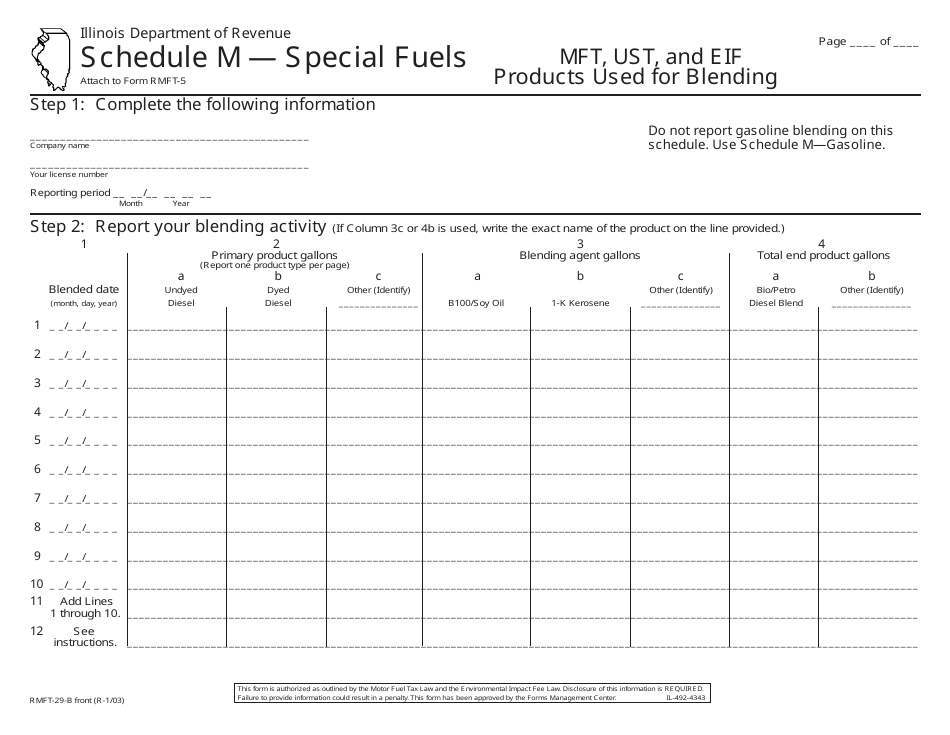

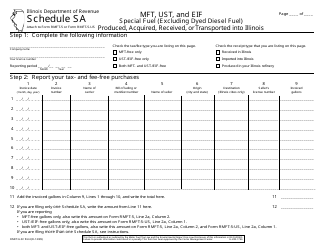

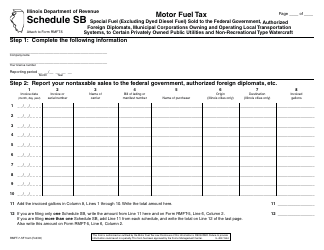

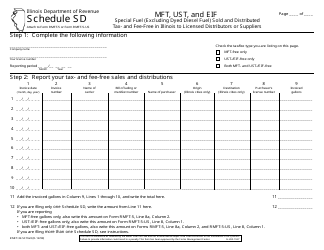

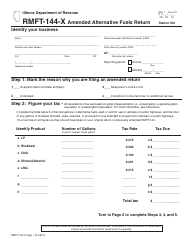

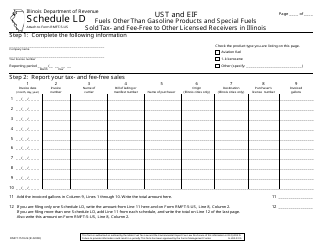

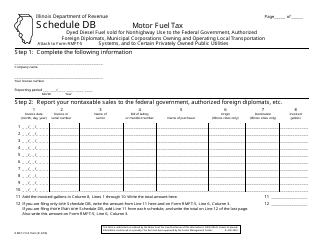

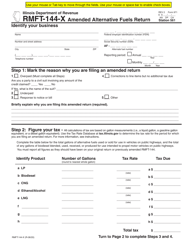

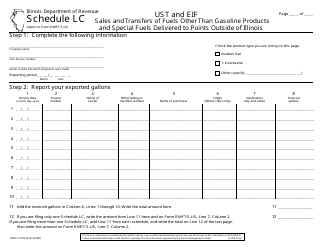

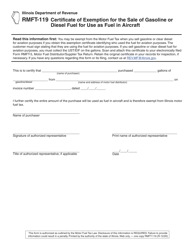

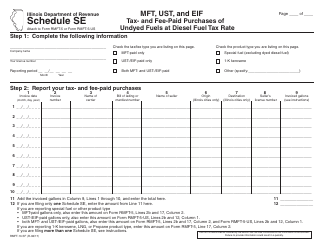

Form RMFT-29-B Schedule M Special Fuels - Illinois

What Is Form RMFT-29-B Schedule M?

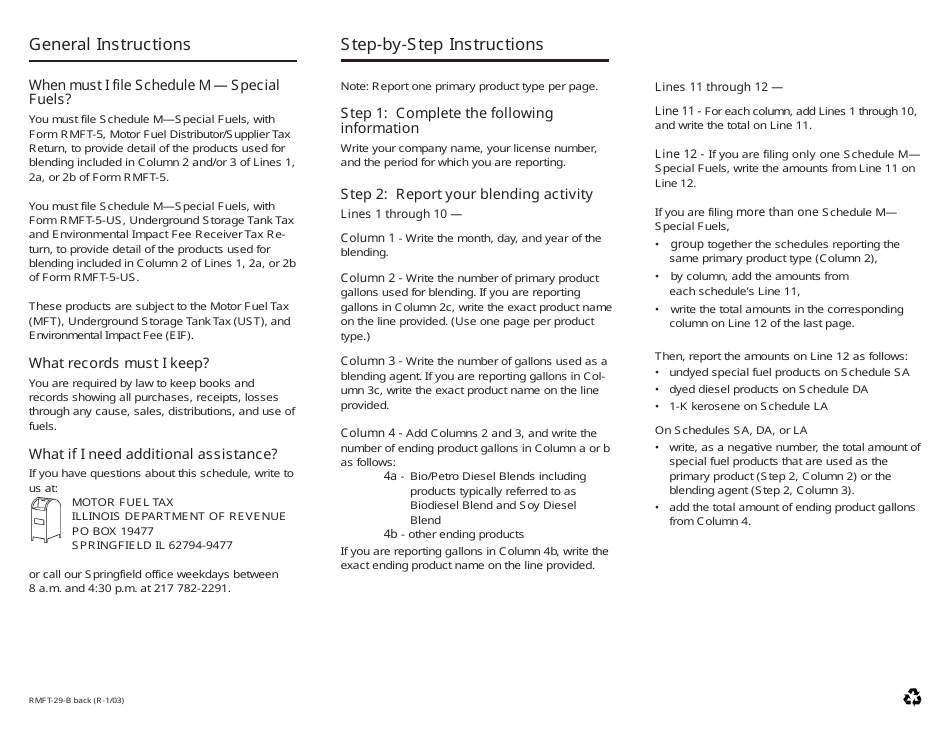

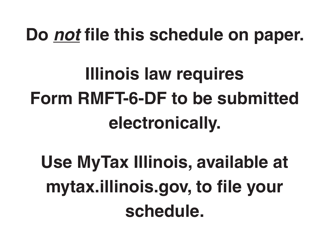

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RMFT-29-B Schedule M Special Fuels?

A: Form RMFT-29-B Schedule M Special Fuels is a form used in Illinois for reporting special fuel tax information.

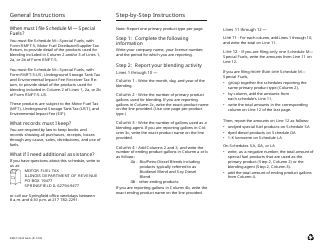

Q: Who needs to file Form RMFT-29-B Schedule M Special Fuels?

A: Any person or entity that imports, manufactures, or receives special fuels in Illinois needs to file Form RMFT-29-B Schedule M Special Fuels.

Q: What information is required on Form RMFT-29-B Schedule M Special Fuels?

A: Form RMFT-29-B Schedule M Special Fuels requires information such as the name and address of the filer, details about the special fuels received or imported, and the amount of tax due.

Q: When is Form RMFT-29-B Schedule M Special Fuels due?

A: Form RMFT-29-B Schedule M Special Fuels is due on a quarterly basis, with due dates falling on the last day of the month following the end of the quarter.

Q: Are there any penalties for not filing Form RMFT-29-B Schedule M Special Fuels?

A: Yes, there are penalties for failure to file or late filing of Form RMFT-29-B Schedule M Special Fuels, including monetary fines and potential legal consequences.

Form Details:

- Released on January 1, 2003;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-29-B Schedule M by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.