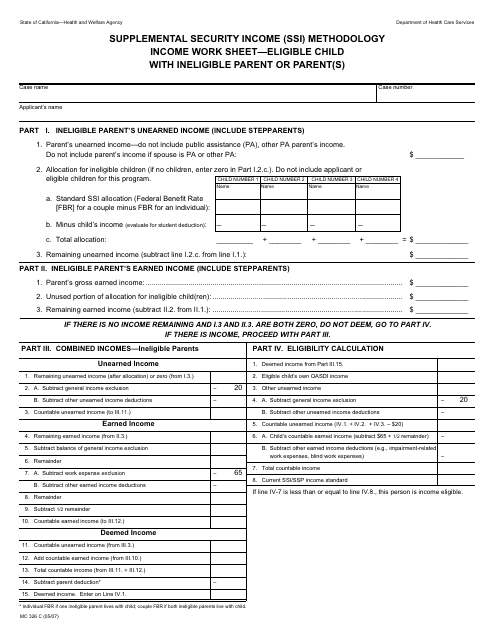

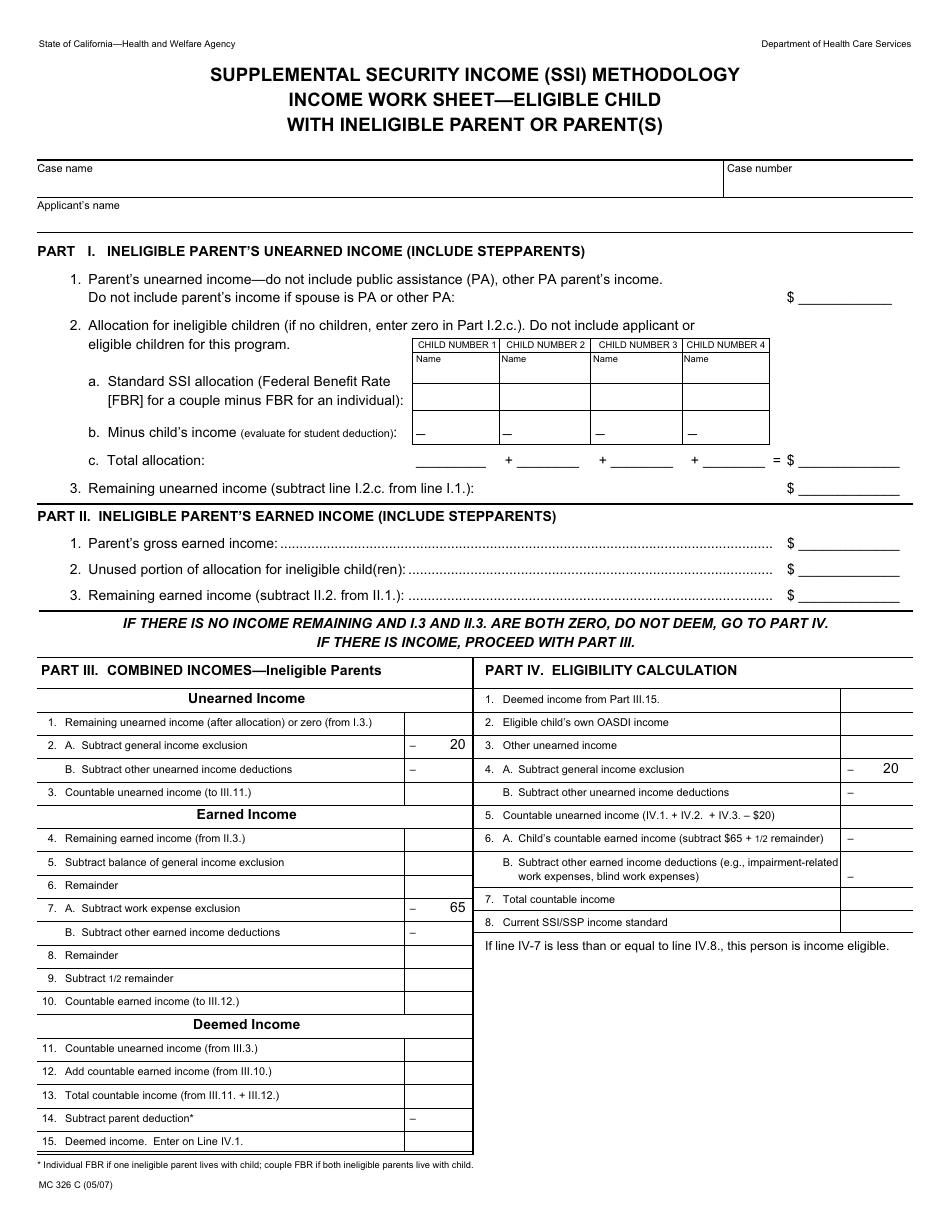

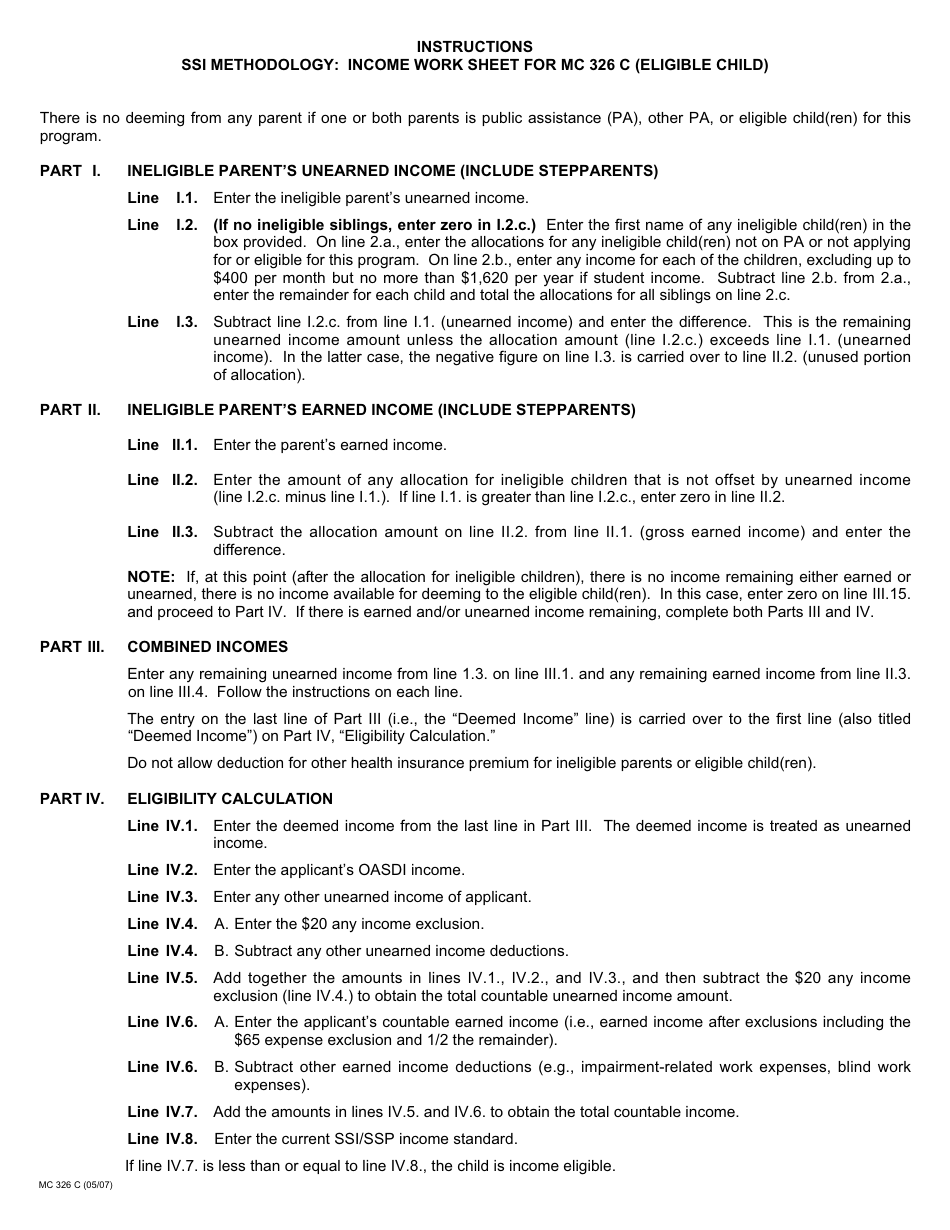

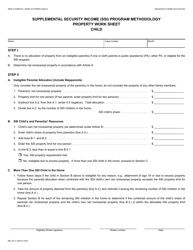

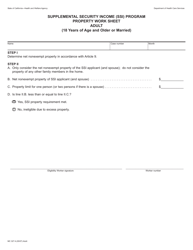

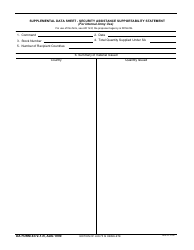

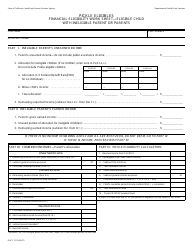

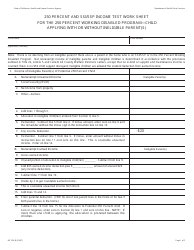

Form MC326 C Supplemental Security Income (Ssi) Methodology Income Work Sheet - Eligible Child With Ineligible Parent or Parent(S) - California

What Is Form MC326 C?

This is a legal form that was released by the California Department of Health Care Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MC326 C?

A: MC326 C is a supplemental security income (SSI) methodology income work sheet for an eligible child with an ineligible parent or parent(s) in California.

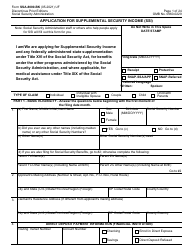

Q: What is Supplemental Security Income (SSI)?

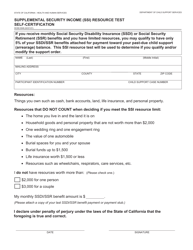

A: Supplemental Security Income (SSI) is a program that provides cash assistance to people with limited income and resources who are aged, blind, or disabled.

Q: Who is eligible for SSI?

A: People who are aged (65 and older), blind, or disabled, including children, may be eligible for SSI.

Q: What is the purpose of the MC326 C form?

A: The purpose of the MC326 C form is to calculate the income of an eligible child with an ineligible parent or parent(s) in California for the purpose of determining eligibility for supplemental security income (SSI).

Q: What information does the MC326 C form require?

A: The MC326 C form requires information about the child's income, the income of the ineligible parent or parent(s), and any allowable deductions.

Q: Who should fill out the MC326 C form?

A: The MC326 C form should be filled out by the parent or guardian of the eligible child with the assistance of a Social Security representative if needed.

Q: What happens after the MC326 C form is completed?

A: After the MC326 C form is completed, it will be used to calculate the child's countable income and determine their eligibility for supplemental security income (SSI).

Q: What if I have questions about the MC326 C form?

A: If you have questions about the MC326 C form, you can contact the Social Security Administration for assistance.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the California Department of Health Care Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MC326 C by clicking the link below or browse more documents and templates provided by the California Department of Health Care Services.