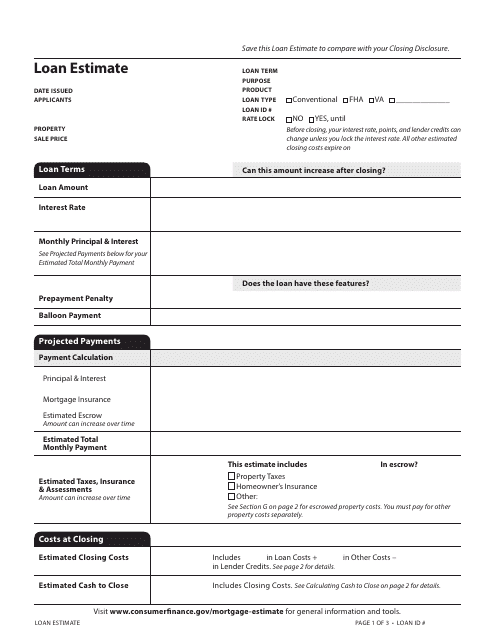

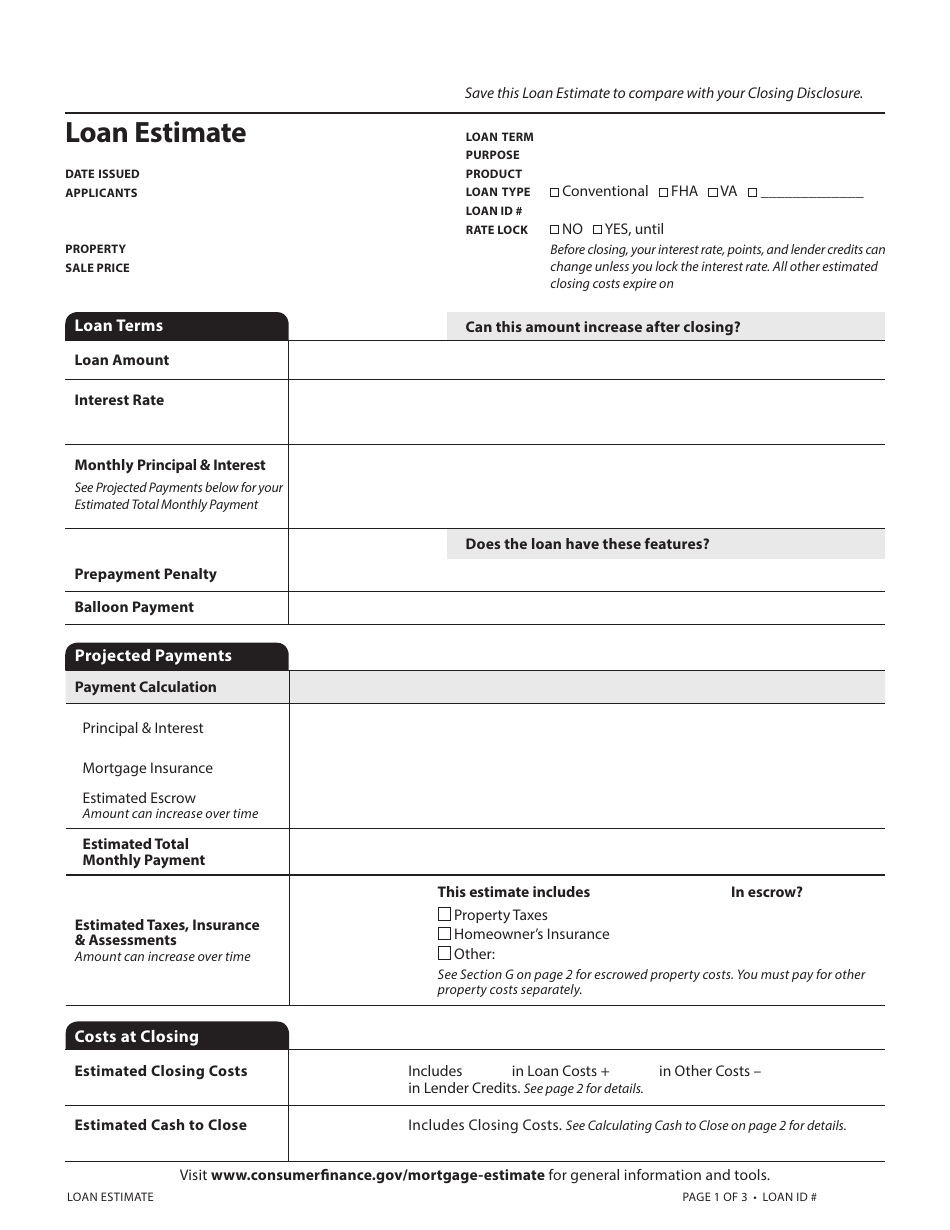

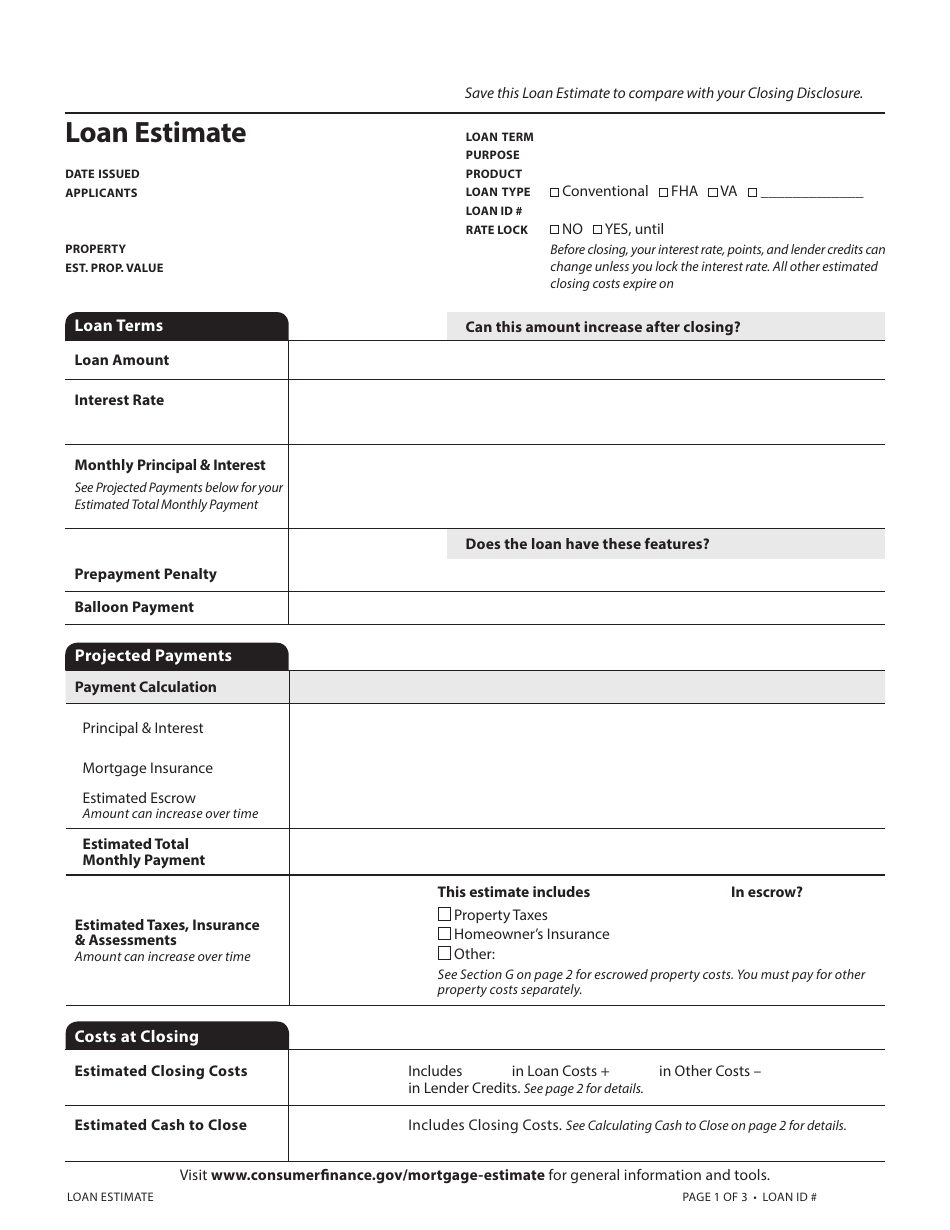

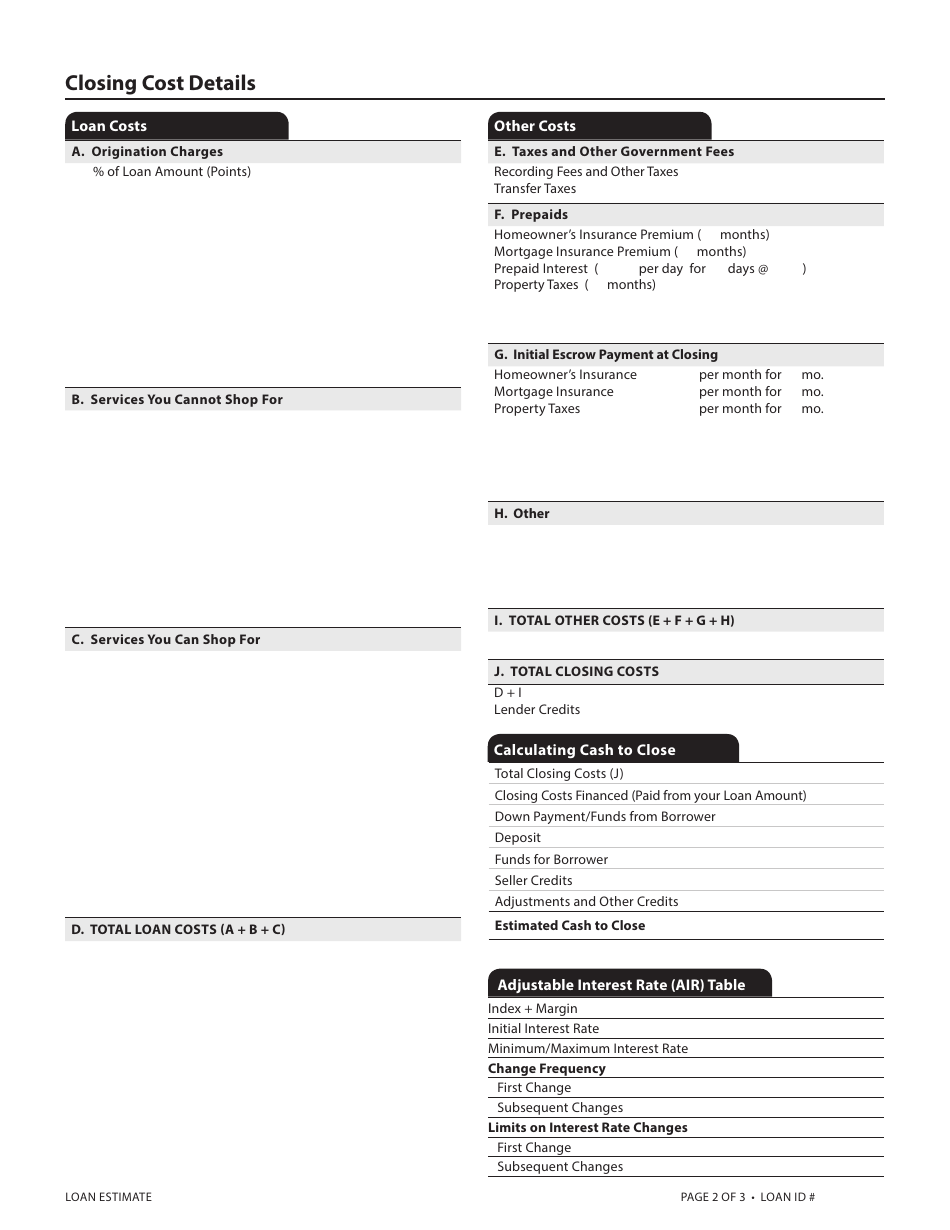

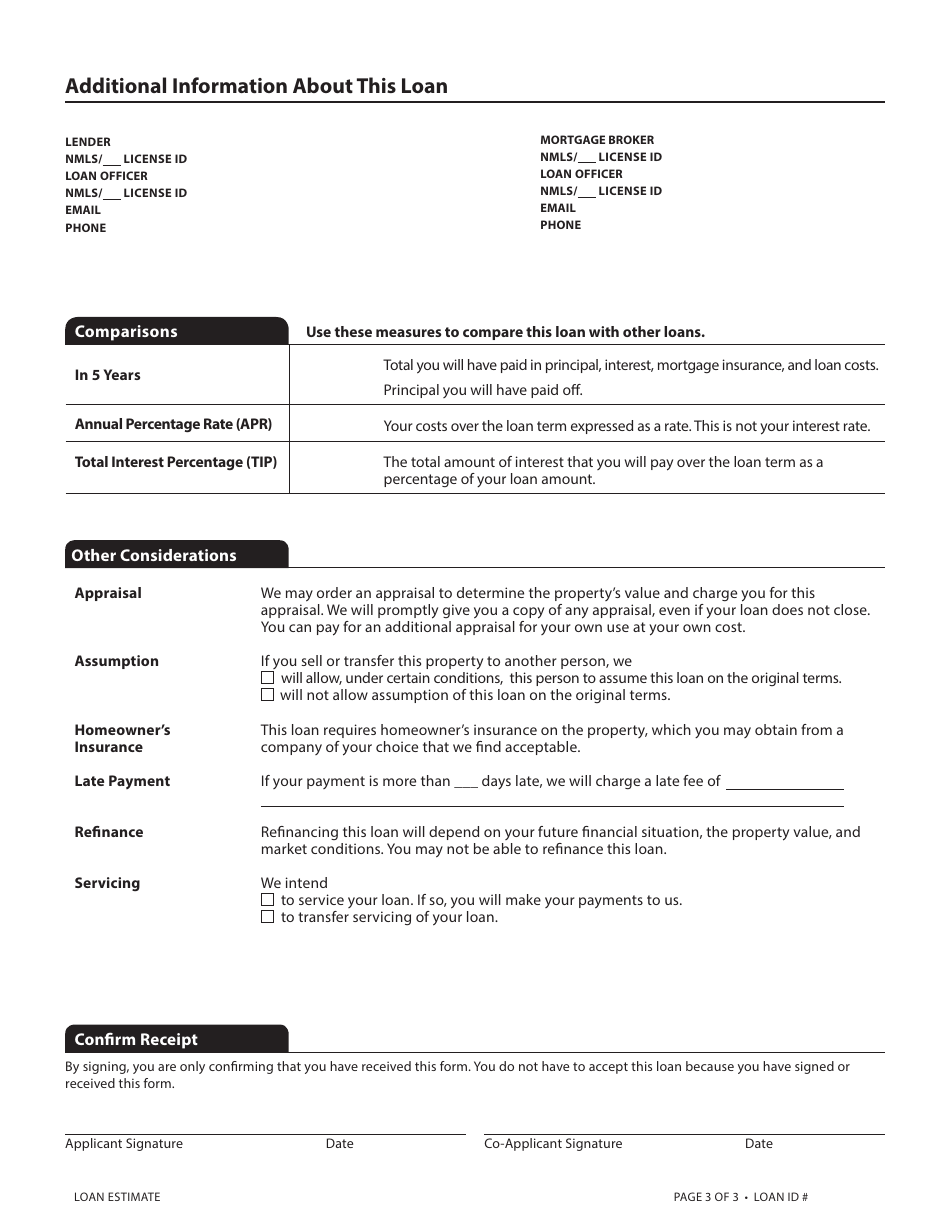

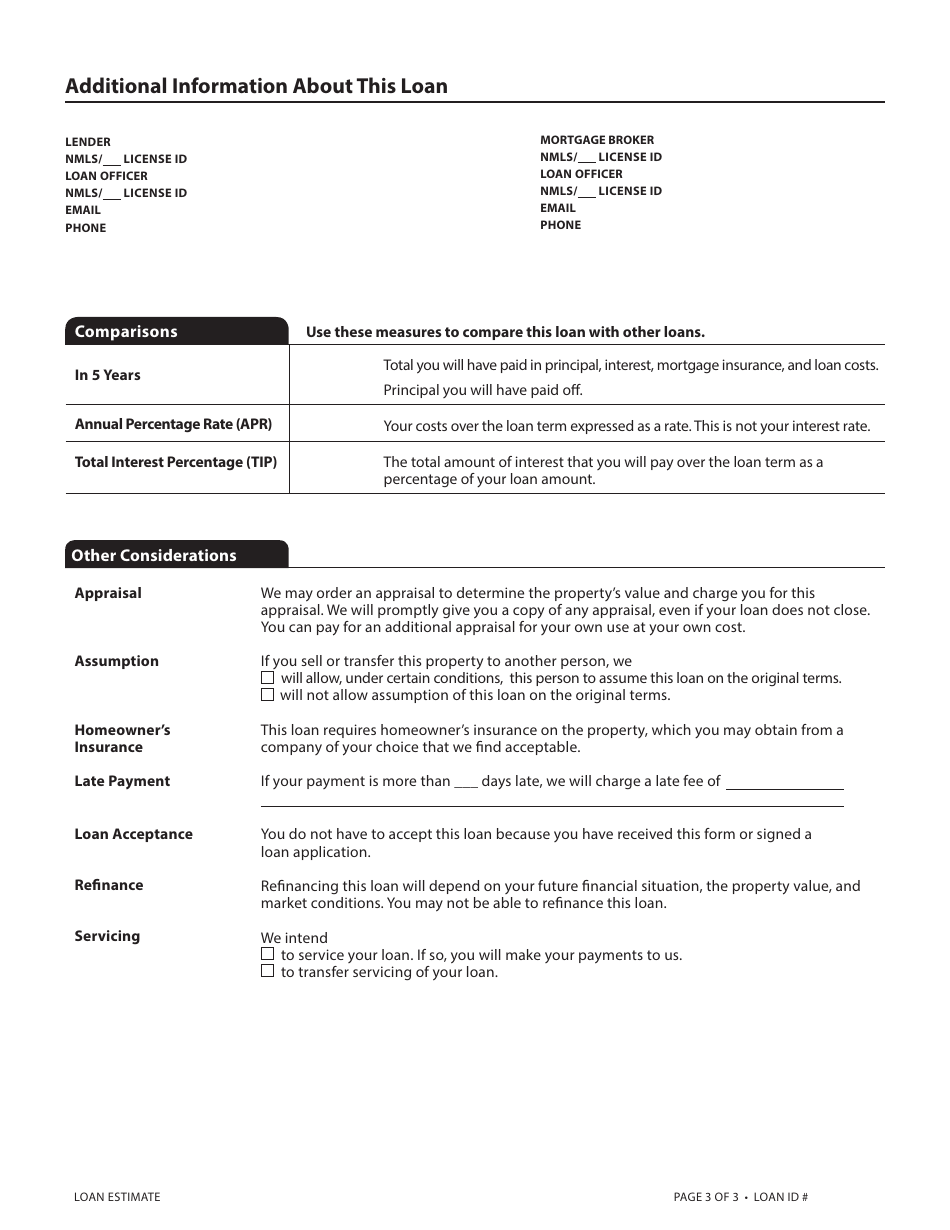

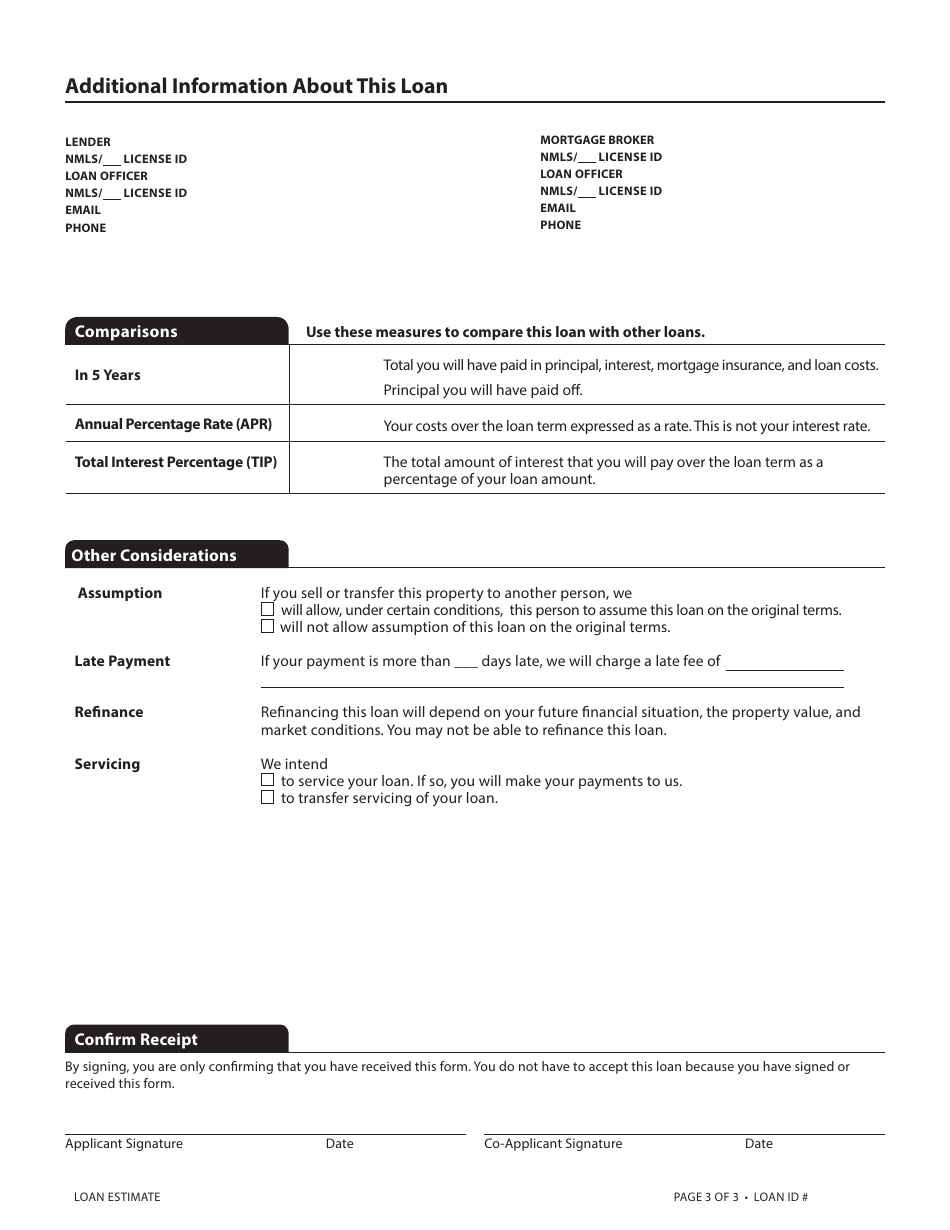

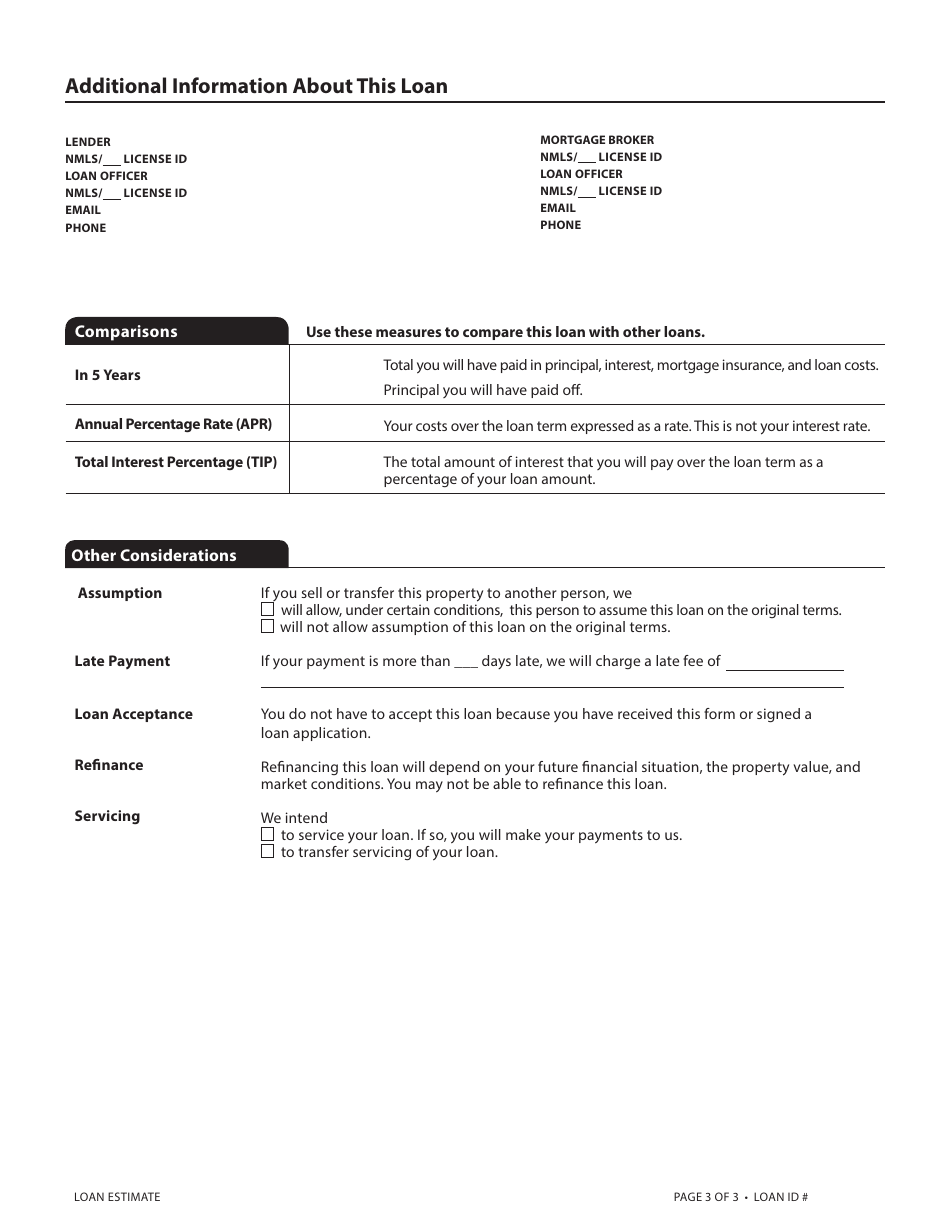

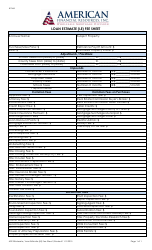

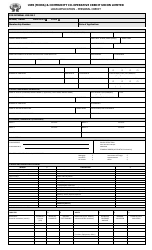

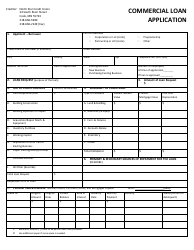

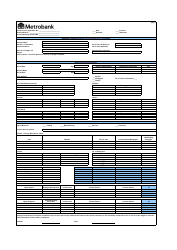

Loan Estimate Form

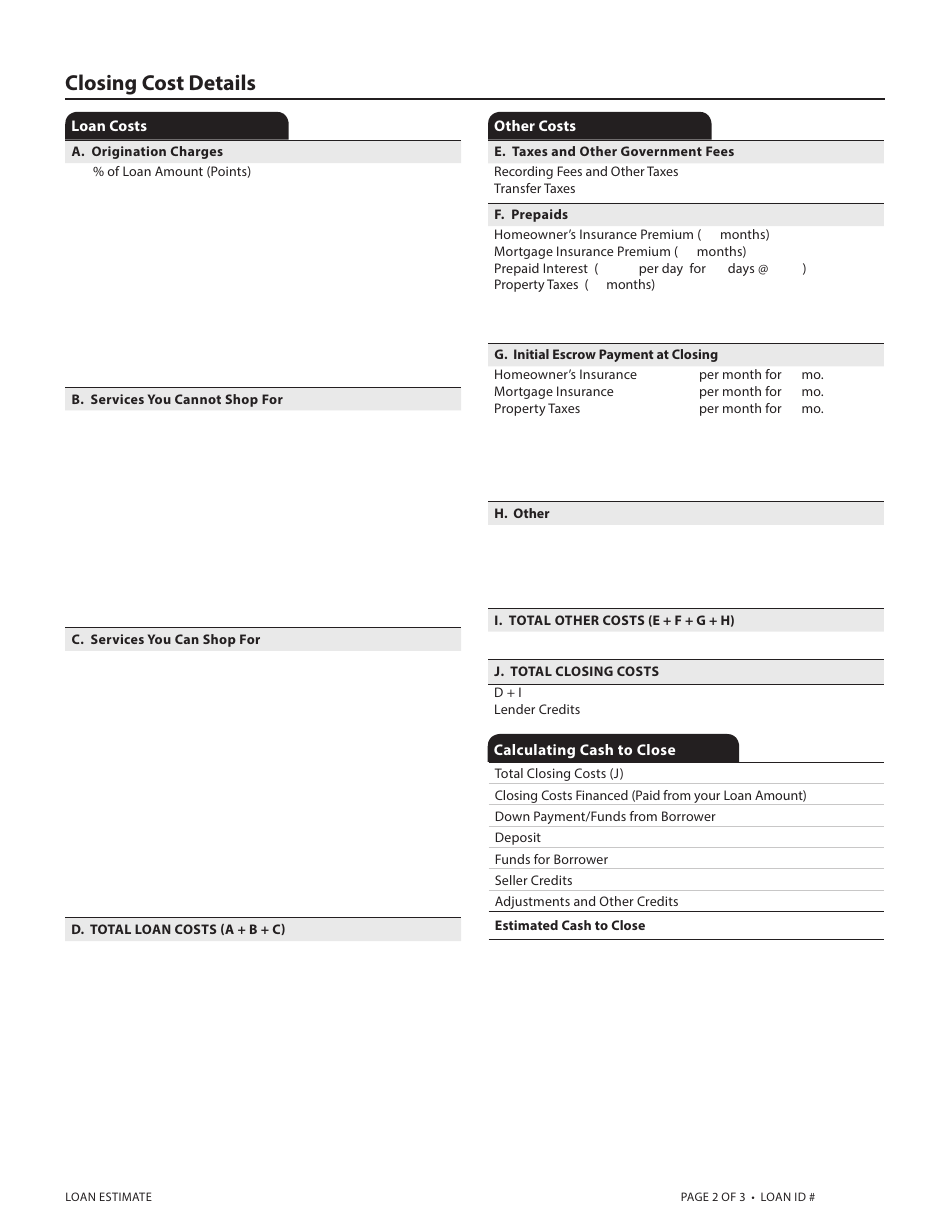

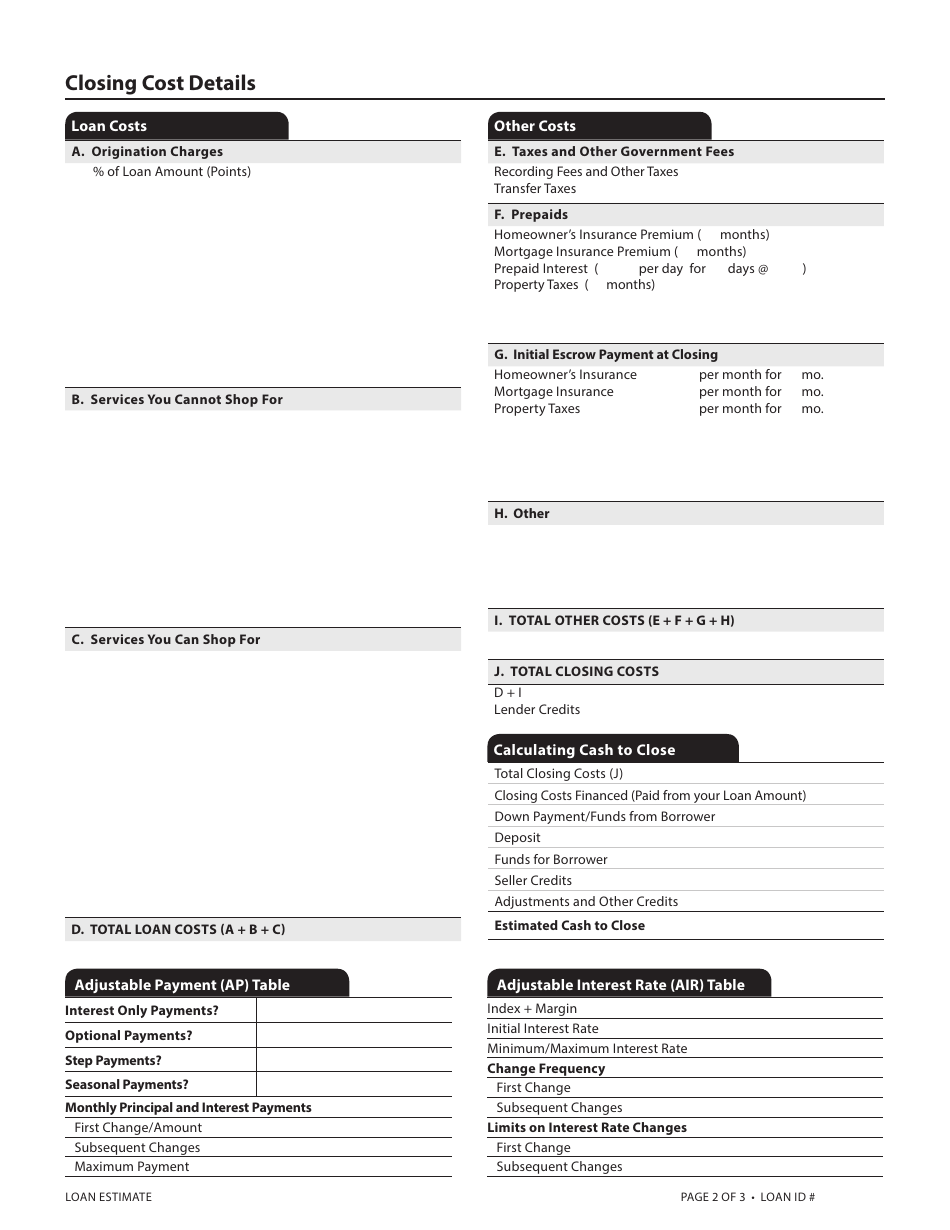

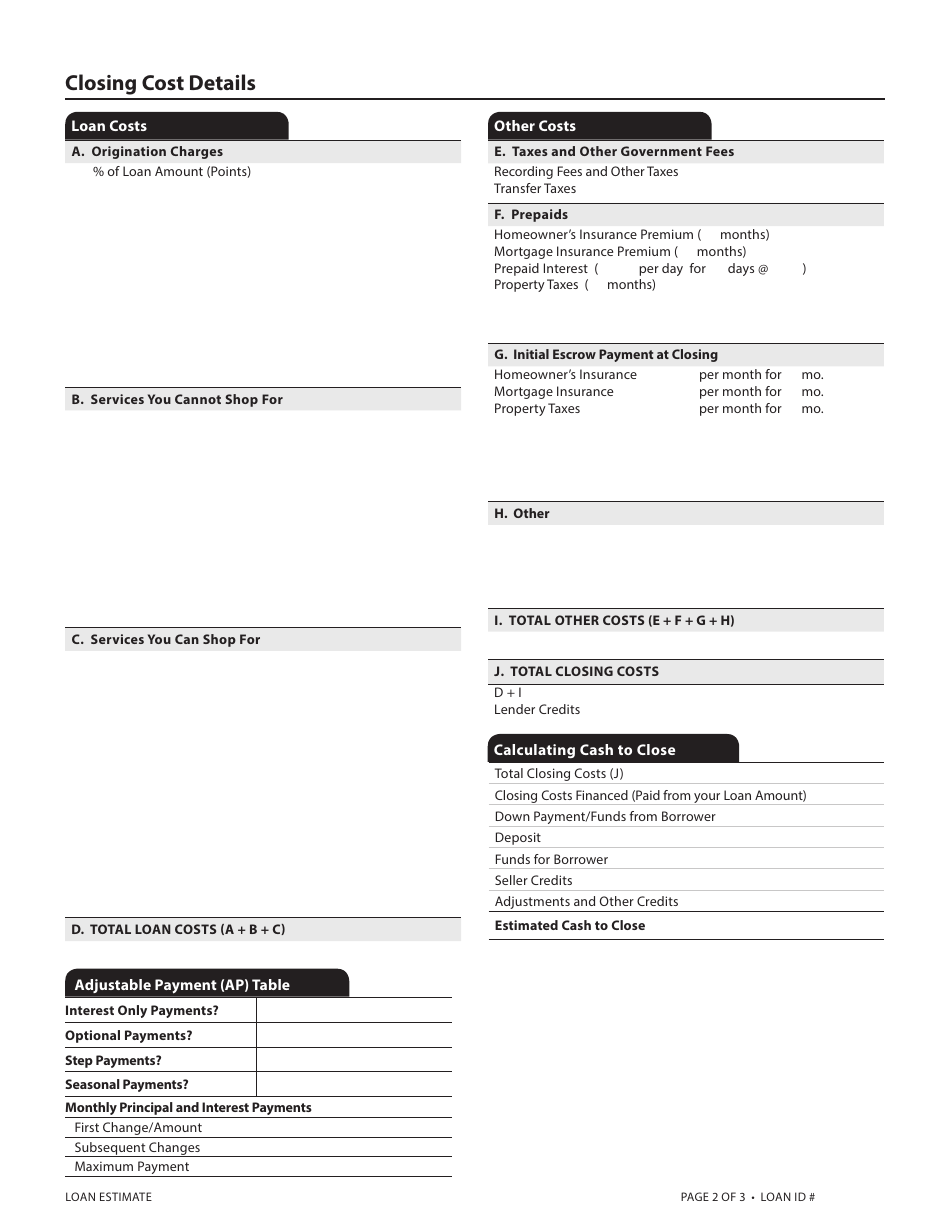

The Loan Estimate Form is a document used to provide borrowers with important information about a mortgage loan they are considering. It includes details about the loan amount, interest rate, estimated monthly payment, closing costs, and other terms and fees associated with the loan. It helps borrowers compare loan offers from different lenders and make informed decisions.

The Loan Estimate Form is typically filed by the lender or the mortgage broker.

FAQ

Q: What is a Loan Estimate form?

A: A Loan Estimate form is a document provided by a lender to a borrower that outlines the terms and costs associated with a mortgage loan.

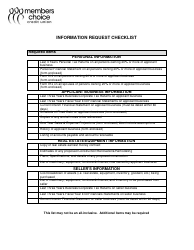

Q: What information is included in a Loan Estimate form?

A: A Loan Estimate form provides information on the loan amount, interest rate, monthly payment, closing costs, and other fees associated with a mortgage loan.

Q: Why is a Loan Estimate form important?

A: A Loan Estimate form is important because it helps borrowers understand the costs and terms of their mortgage loan, allowing them to compare offers from different lenders and make informed decisions.

Q: When should I receive a Loan Estimate form?

A: You should receive a Loan Estimate form within three business days of applying for a mortgage loan.

Q: Can the costs listed on a Loan Estimate form change?

A: Yes, some costs listed on a Loan Estimate form can change, while others are guaranteed not to change. The lender is required to provide a Closing Disclosure form at least three business days before closing, which will outline any changes in costs since the Loan Estimate was provided.

Q: Can I shop around and get multiple Loan Estimate forms?

A: Yes, it is recommended to shop around and get Loan Estimate forms from multiple lenders to compare loan offers and choose the best option for you.