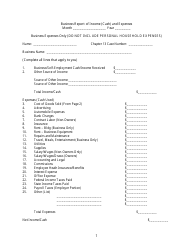

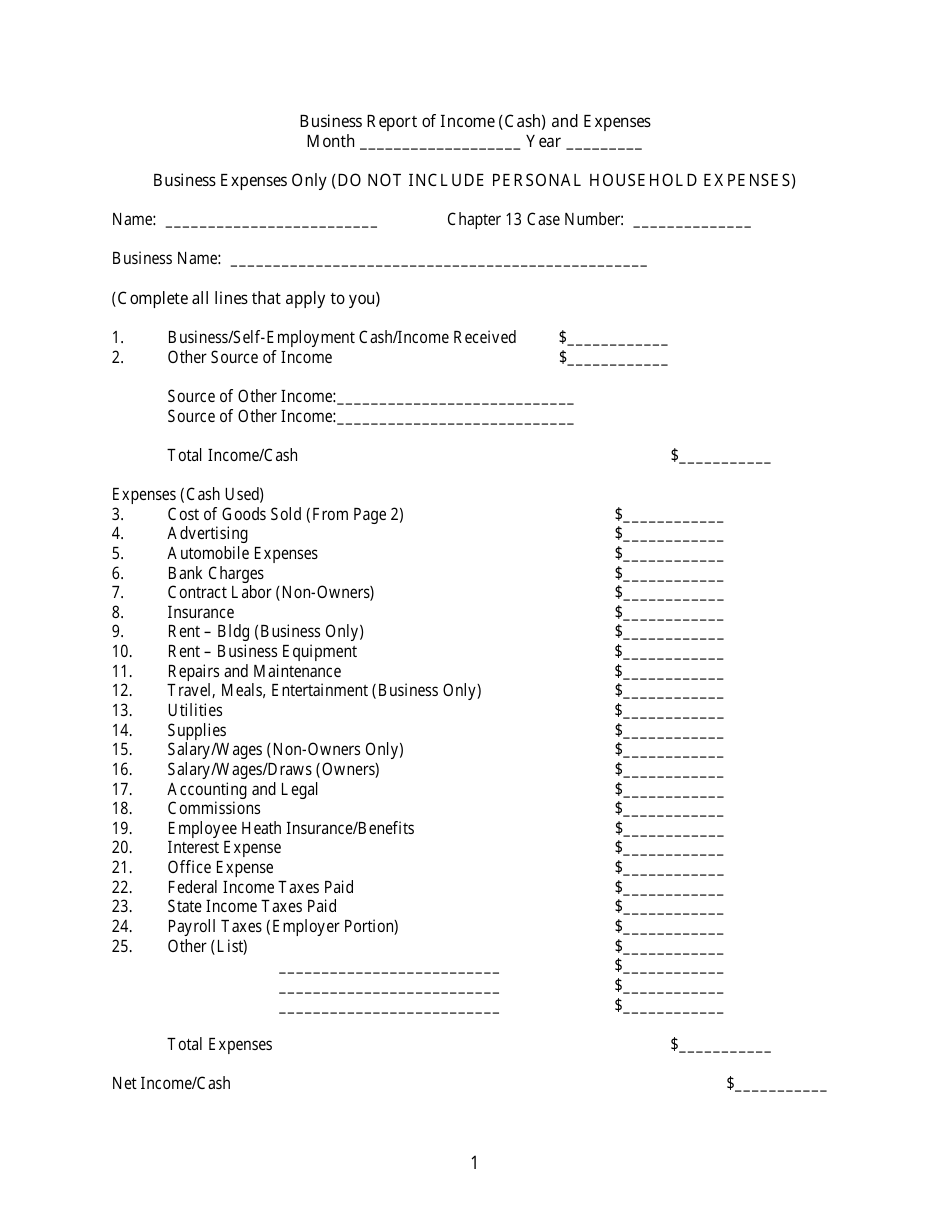

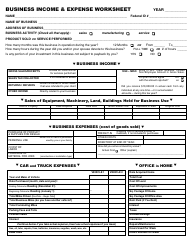

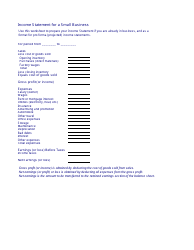

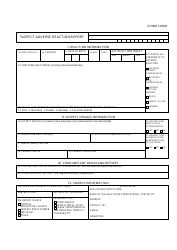

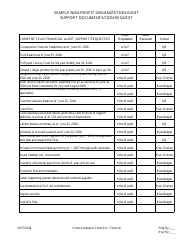

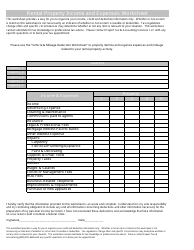

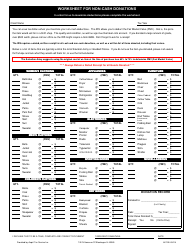

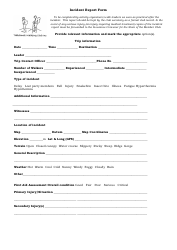

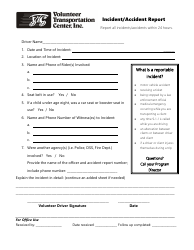

Business Report of Income (Cash) and Expenses Form

The Business Report of Income (Cash) and Expenses Form is used to track and record the cash flow of a business. It helps in keeping a record of income generated and expenses incurred by the business.

The Business Report of Income (Cash) and Expenses form is typically filed by the owner or operator of the business.

FAQ

Q: What is the Business Report of Income (Cash) and Expenses Form?

A: The Business Report of Income (Cash) and Expenses Form is a document used to organize and record the financial transactions of a business.

Q: Why is the Business Report of Income (Cash) and Expenses Form important?

A: The form is important because it helps track the income and expenses of a business, which is necessary for adequate financial management.

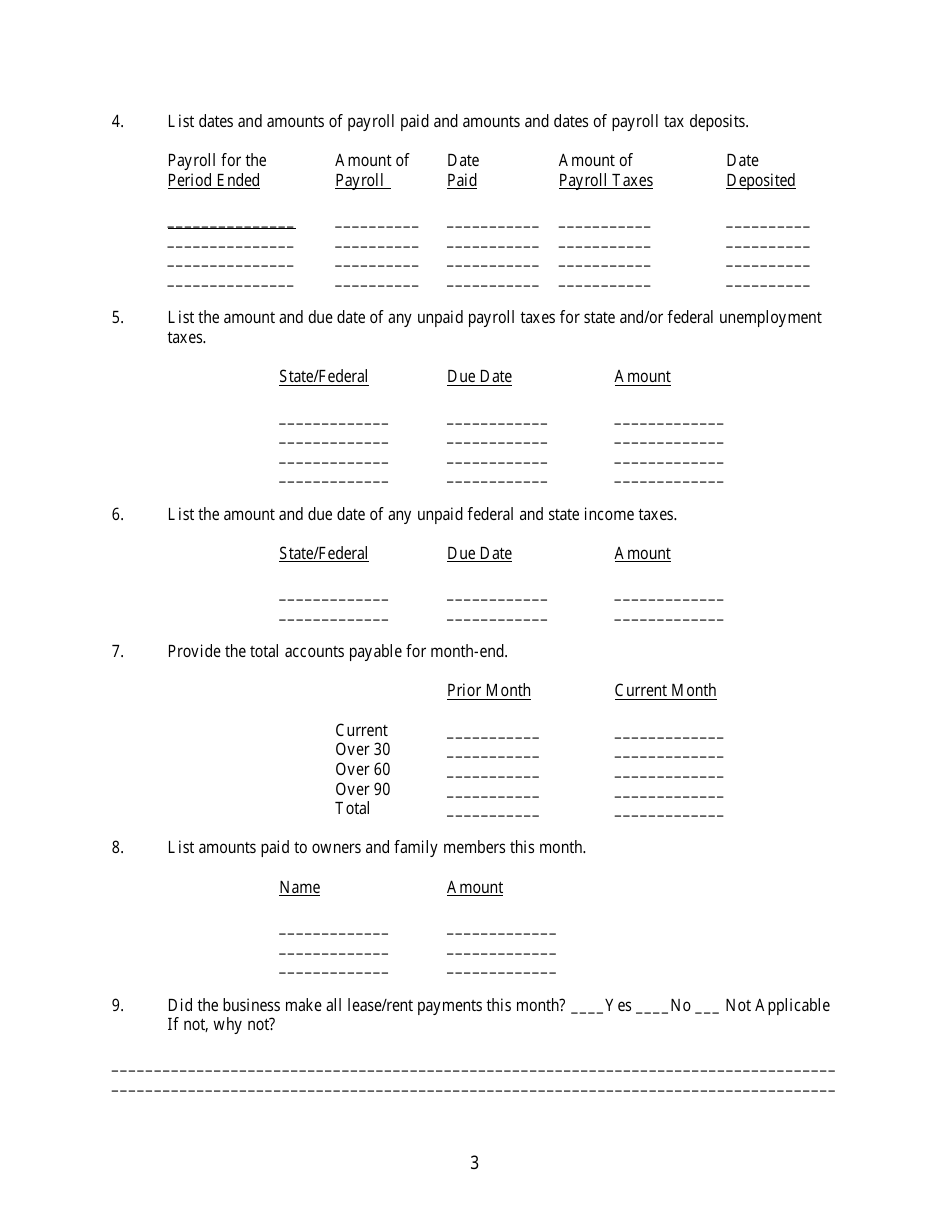

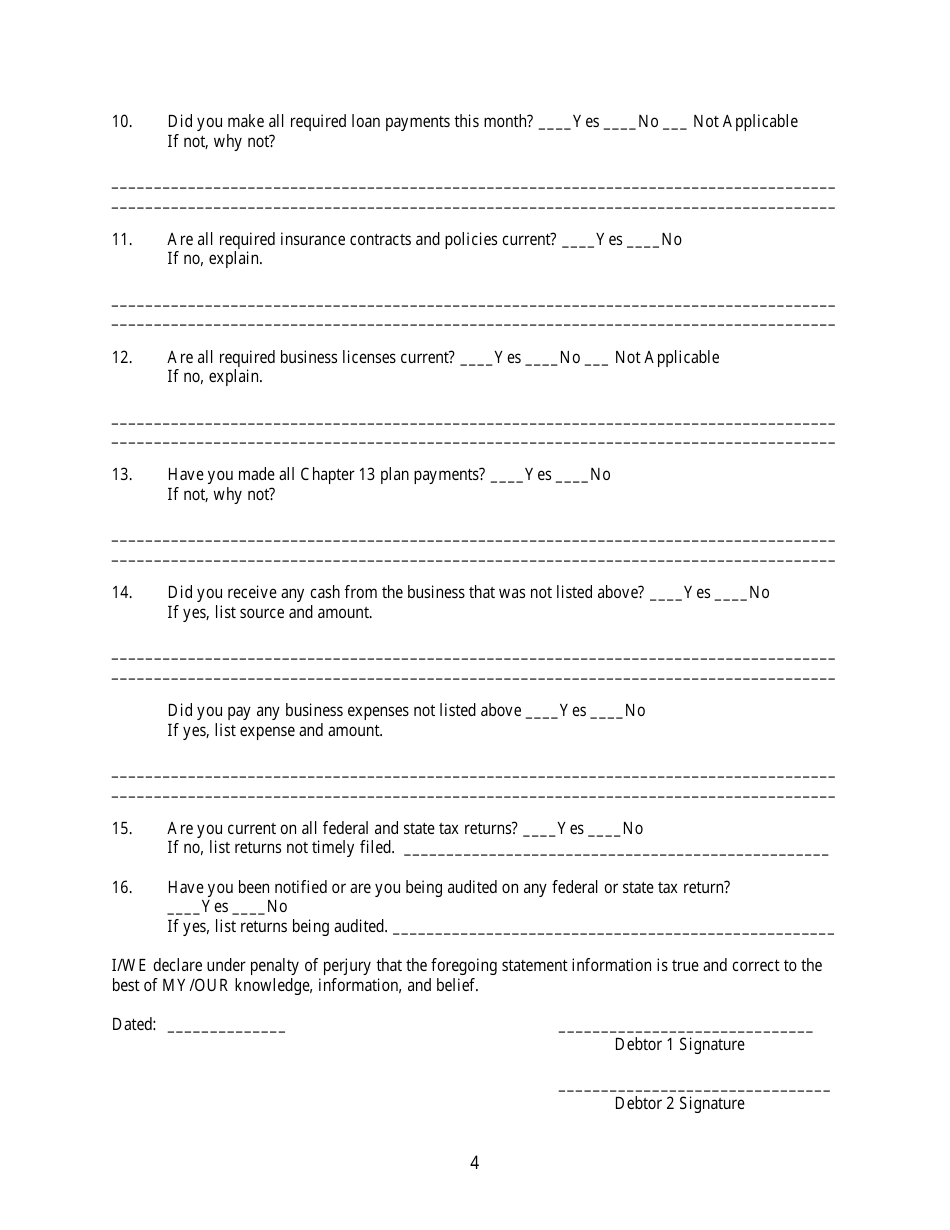

Q: How do I fill out the Business Report of Income (Cash) and Expenses Form?

A: To fill out the form, you need to input the details of your business's income and expenses, including the amounts and the dates of the transactions.

Q: Do I need to submit the Business Report of Income (Cash) and Expenses Form?

A: It depends on your business structure and local regulations. In some cases, you may be required to submit the form to the tax authorities.

Q: Can I use accounting software instead of the Business Report of Income (Cash) and Expenses Form?

A: Yes, using accounting software can simplify the process of tracking and reporting income and expenses, but you may still need to provide the information in a similar format.

Q: What should I do with the completed Business Report of Income (Cash) and Expenses Form?

A: You should keep a copy of the completed form for your records and use it to help prepare your financial statements and tax returns.

Q: Is it necessary to hire an accountant to fill out the Business Report of Income (Cash) and Expenses Form?

A: It is not always necessary, but professional assistance from an accountant can ensure accuracy and compliance with applicable tax laws.

Q: What happens if I make a mistake on the Business Report of Income (Cash) and Expenses Form?

A: If you make a mistake, you should make the necessary corrections and provide the accurate information. In case of major errors, consult with an accountant or tax professional.

Q: How often should I fill out the Business Report of Income (Cash) and Expenses Form?

A: The frequency of filling out the form depends on your business's needs and local regulations. It can be done monthly, quarterly, or annually, as required.