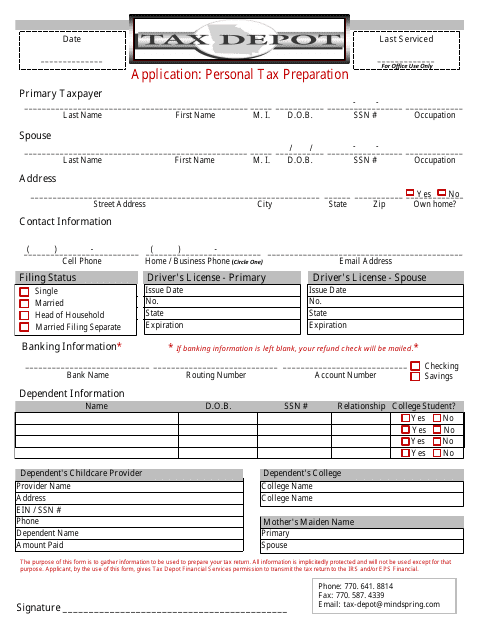

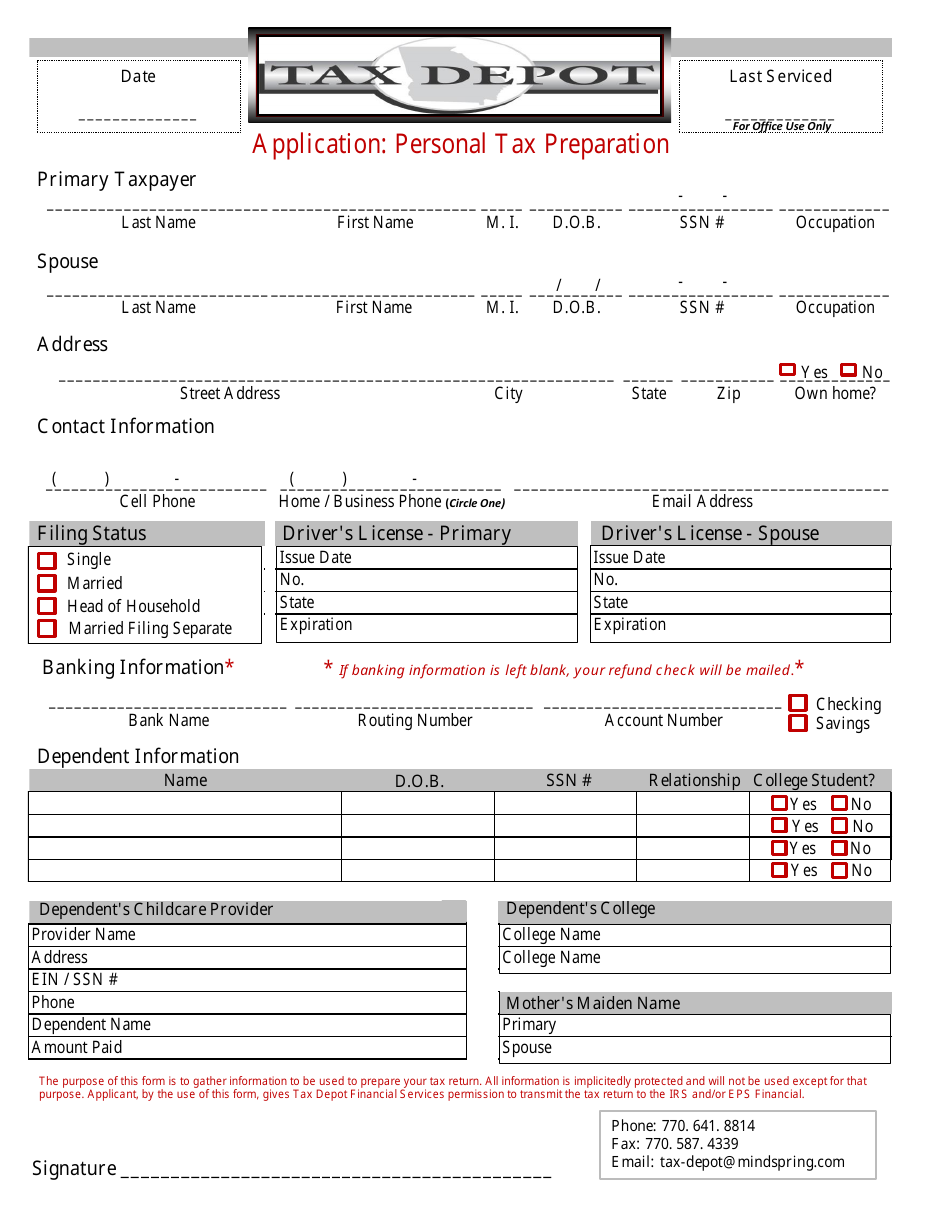

Personal Tax Preparation Application Form - Tax Depot

The Personal Tax Preparation Application Form - Tax Depot is used to provide personal information and details needed for filing income tax returns.

FAQ

Q: What is the tax depot?

A: Tax Depot is a personal tax preparation application form.

Q: Who can use the tax depot?

A: Any individual can use Tax Depot to prepare their personal tax returns.

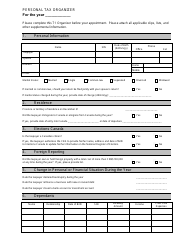

Q: What information do I need to fill out the tax depot form?

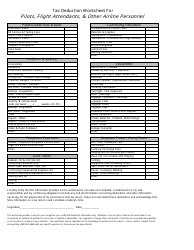

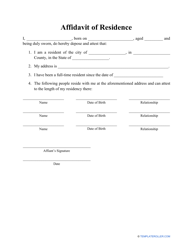

A: You will need to provide personal information such as your name, address, and social security number, as well as details about your income and deductions.

Q: Is the tax depot form for both US and Canadian residents?

A: Yes, the Tax Depot form can be used by both US and Canadian residents.

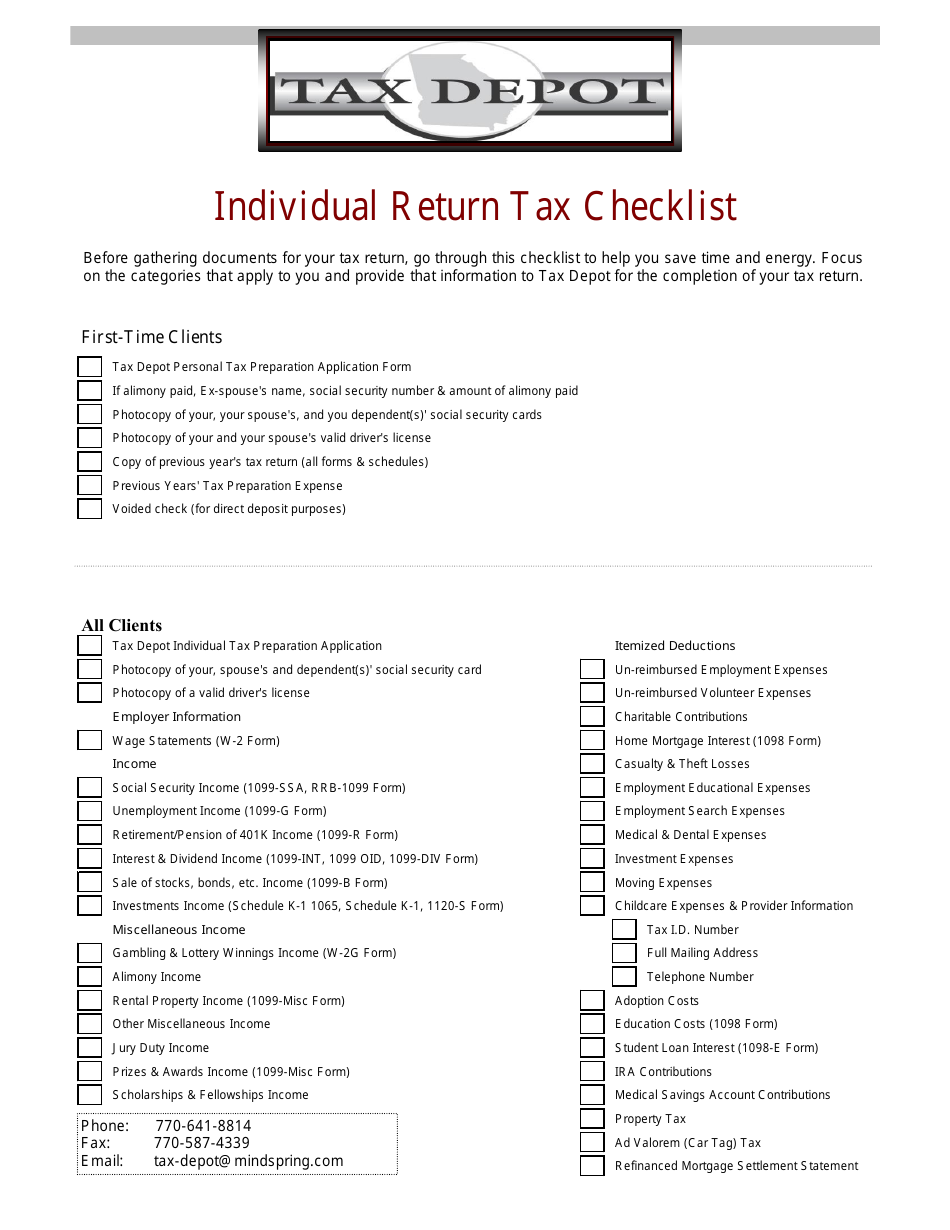

Q: Can I claim deductions and credits on the tax depot form?

A: Yes, you can claim eligible deductions and credits on the Tax Depot form based on your individual circumstances.

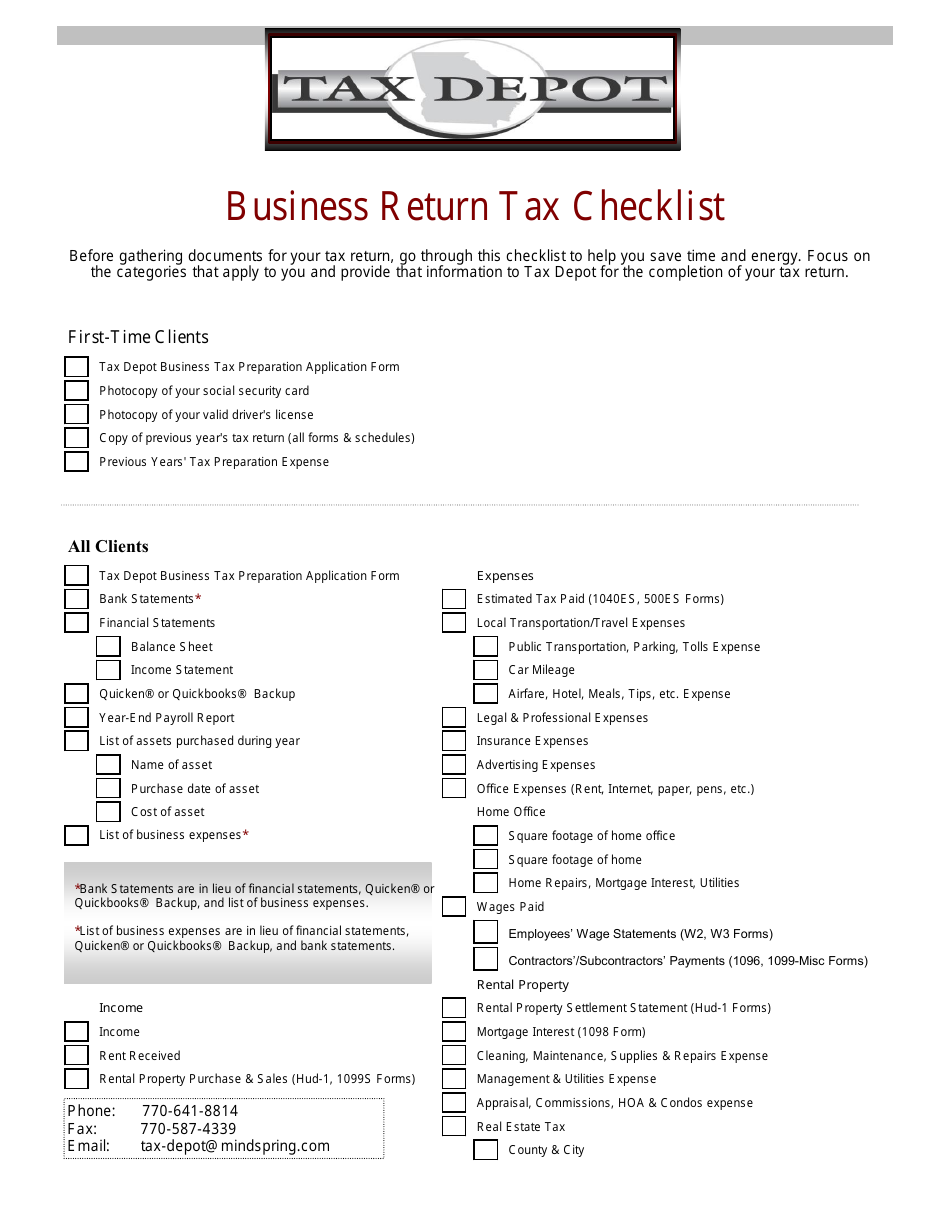

Q: Can I file my taxes using the tax depot form if I have complex tax situations?

A: Tax Depot is designed for individuals with relatively simple tax situations. If you have complex tax situations, it is recommended to consult a tax professional.

Q: Can I amend my tax return after using the tax depot form?

A: Yes, you can amend your tax return even after using the Tax Depot form. Please refer to the instructions provided on the form or contact Tax Depot for guidance.