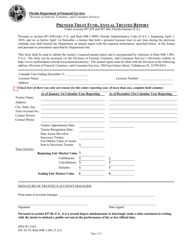

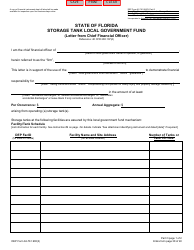

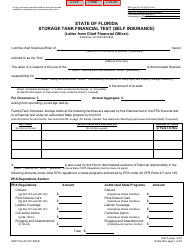

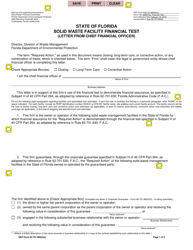

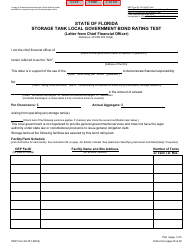

Form DFS-J1-1009 Public Depositor Annual Report to the Chief Financial Officer - Florida

What Is Form DFS-J1-1009?

This is a legal form that was released by the Florida Department of Financial Services - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

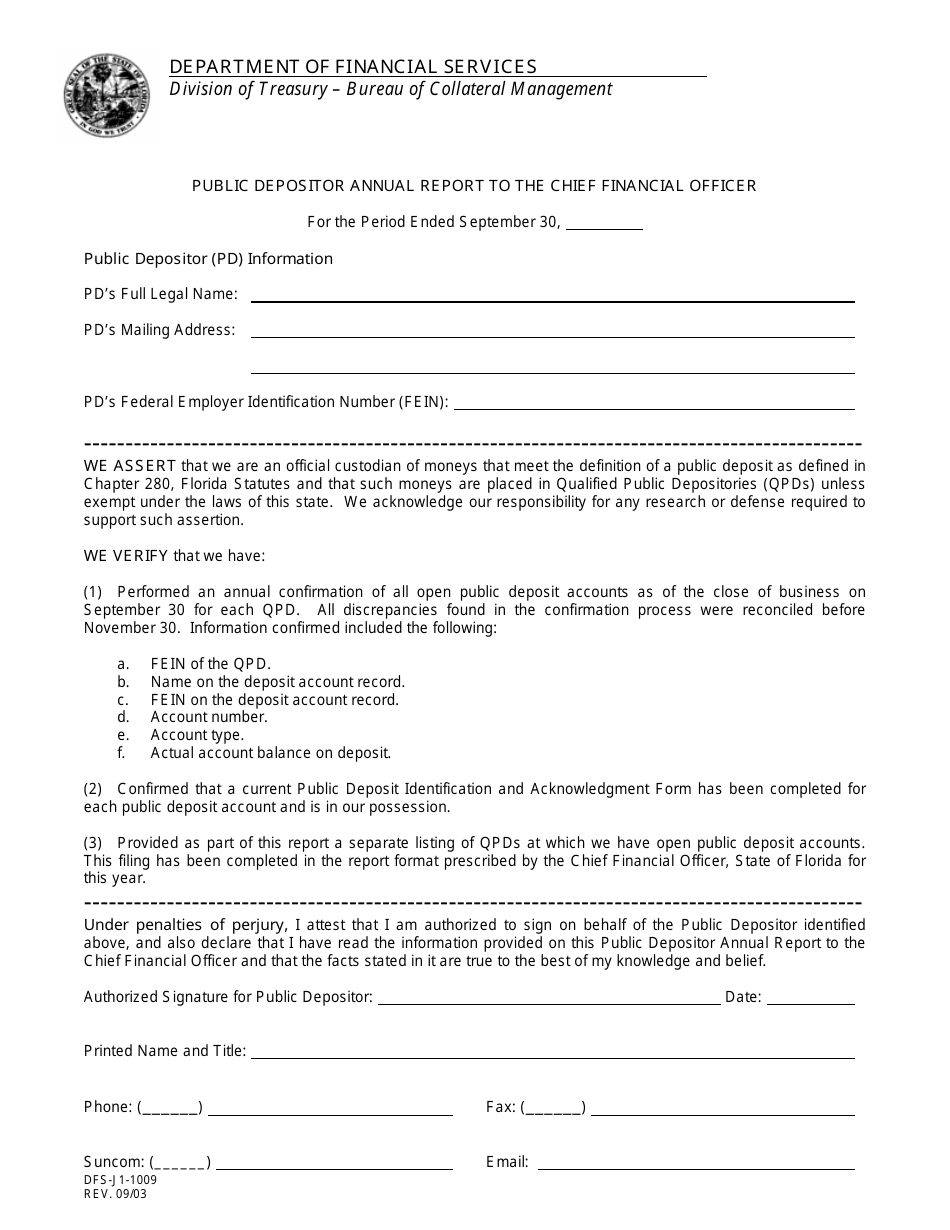

Q: What is the purpose of Form DFS-J1-1009?

A: The purpose of Form DFS-J1-1009 is to provide an annual report to the Chief Financial Officer of Florida regarding public deposits.

Q: Who needs to fill out Form DFS-J1-1009?

A: Financial institutions that hold public deposits in Florida need to fill out Form DFS-J1-1009.

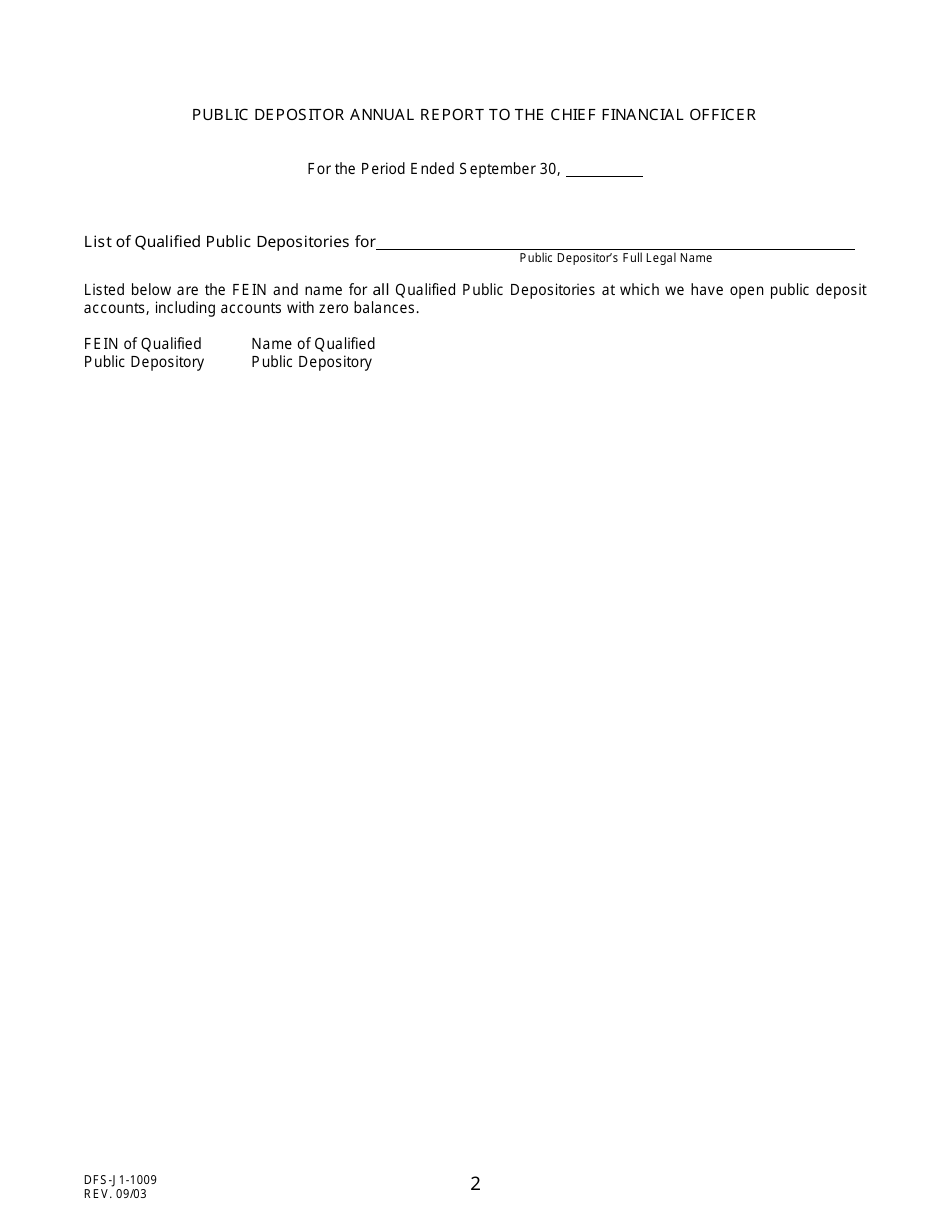

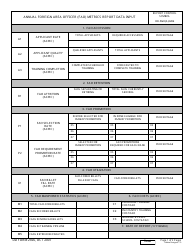

Q: What information is required on Form DFS-J1-1009?

A: Form DFS-J1-1009 requires information about the amount of public deposits held, interest earned, fees paid, and other relevant financial data.

Q: When is Form DFS-J1-1009 due?

A: Form DFS-J1-1009 is due on or before January 31st of each year.

Q: Are there any penalties for not filing Form DFS-J1-1009?

A: Yes, there are penalties for not filing Form DFS-J1-1009 or for filing it late. It is important to submit the form on time to avoid penalties.

Q: Is Form DFS-J1-1009 confidential?

A: No, Form DFS-J1-1009 is not confidential. It is a public report that provides information about public deposits held by financial institutions in Florida.

Form Details:

- Released on September 1, 2003;

- The latest edition provided by the Florida Department of Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DFS-J1-1009 by clicking the link below or browse more documents and templates provided by the Florida Department of Financial Services.