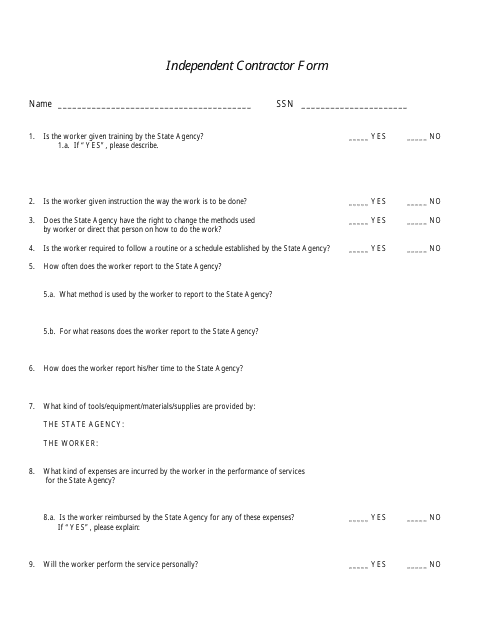

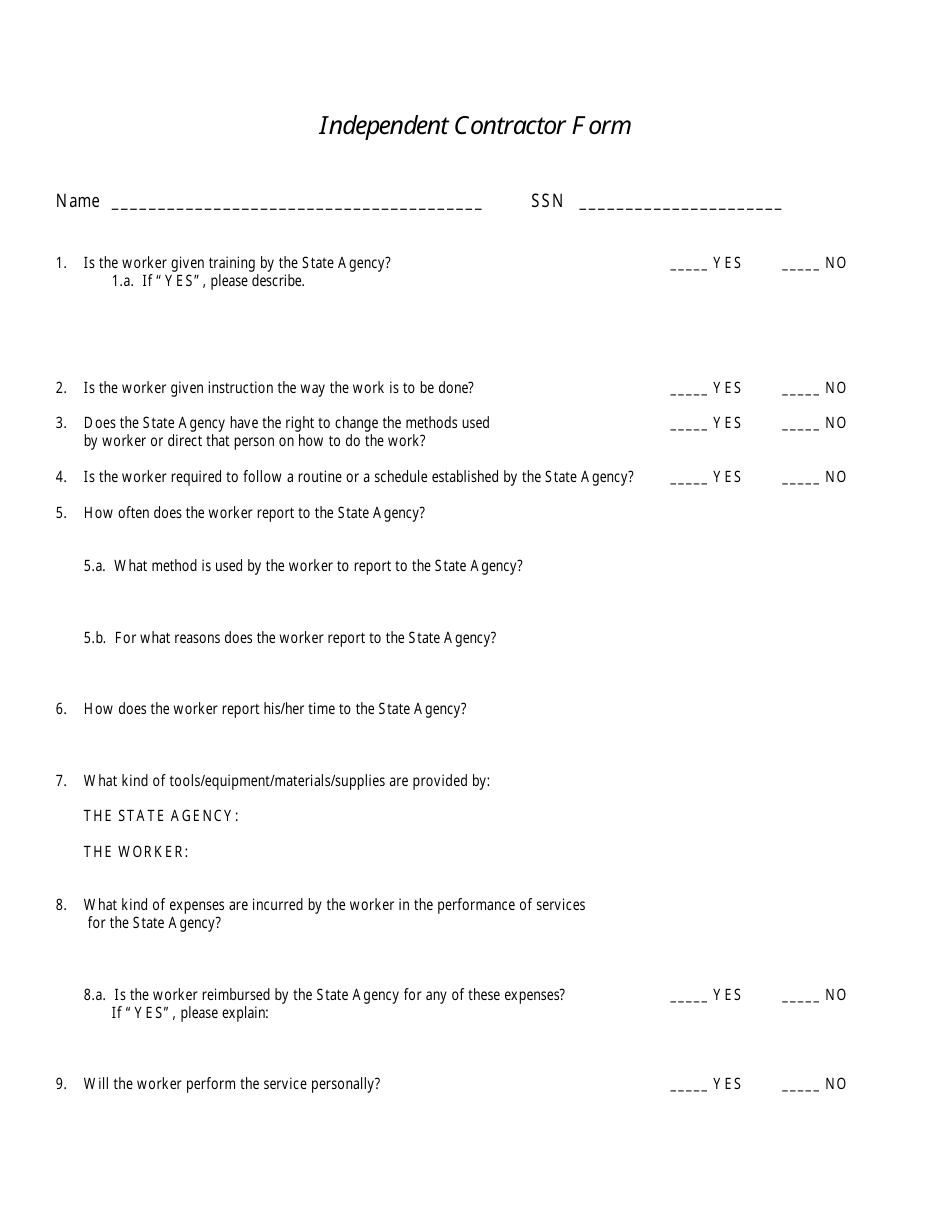

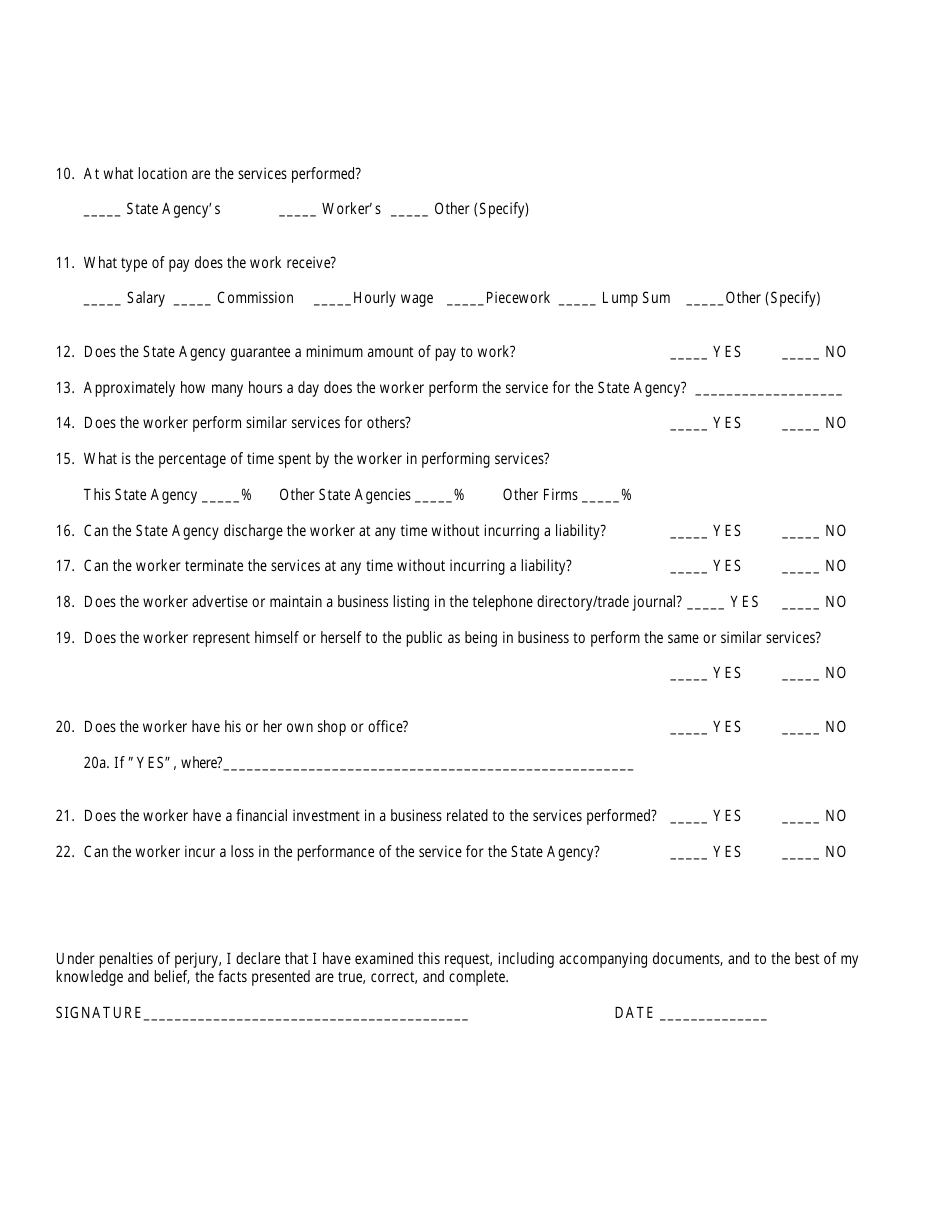

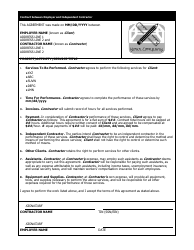

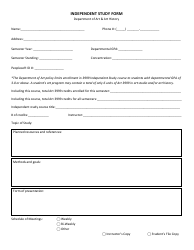

Independent Contractor Form

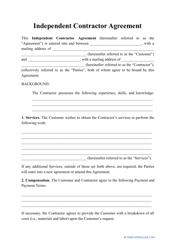

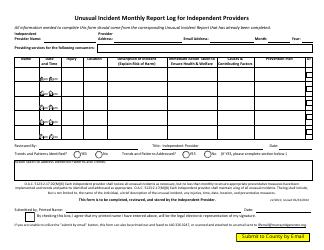

The Independent Contractor Form is a document used to establish and define the working relationship between a company or individual hiring an independent contractor. It specifies the terms of the agreement, including payment, obligations, and responsibilities.

The independent contractor form, also known as Form 1099, is typically filed by the person or company that pays the contractor for their services.

FAQ

Q: What is an independent contractor form?

A: An independent contractor form is a document used to establish the legal relationship between a company and an individual who will be working for them as an independent contractor.

Q: Why is an independent contractor form necessary?

A: An independent contractor form is necessary to clearly define the rights and responsibilities of both the company and the independent contractor, and to establish their legal relationship.

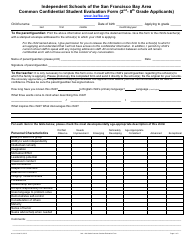

Q: What information is typically included in an independent contractor form?

A: An independent contractor form typically includes details such as the names of the company and the independent contractor, the scope of work, compensation, confidentiality agreements, and any other relevant terms.

Q: Is an independent contractor form legally binding?

A: Yes, an independent contractor form is a legally binding document and serves as a contract between the company and the independent contractor.

Q: What are the advantages of using an independent contractor form?

A: Using an independent contractor form helps to clarify the relationship between the company and the independent contractor, minimizes disputes, ensures compliance with regulations, and protects both parties' rights.

Q: Can an independent contractor form be modified?

A: Yes, an independent contractor form can be modified to meet the specific needs and requirements of the company and the independent contractor, as long as both parties agree to the modifications.

Q: Should I consult an attorney before using an independent contractor form?

A: It is recommended to consult with an attorney before using an independent contractor form to ensure that it meets all the necessary legal requirements and adequately protects the interests of both parties.

Q: Are there any risks associated with hiring independent contractors?

A: Hiring independent contractors can carry certain risks, such as misclassification issues and potential legal liabilities. It's important for companies to properly classify their workers and comply with all applicable laws and regulations.