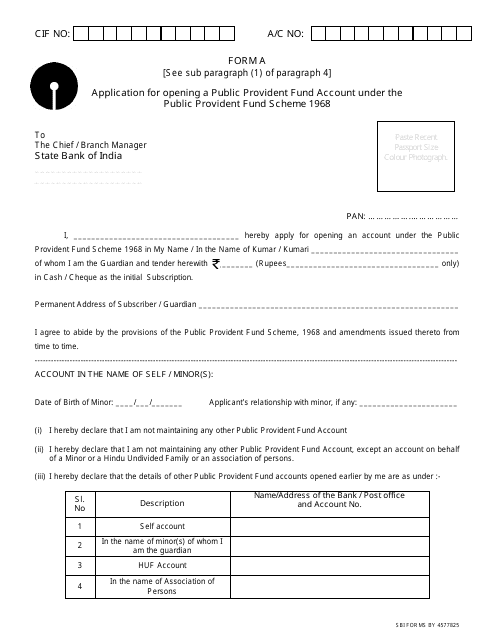

Form A Application for Opening a Public Provident Fund Account Under the Public Provident Fund Scheme - State Bank of India - India

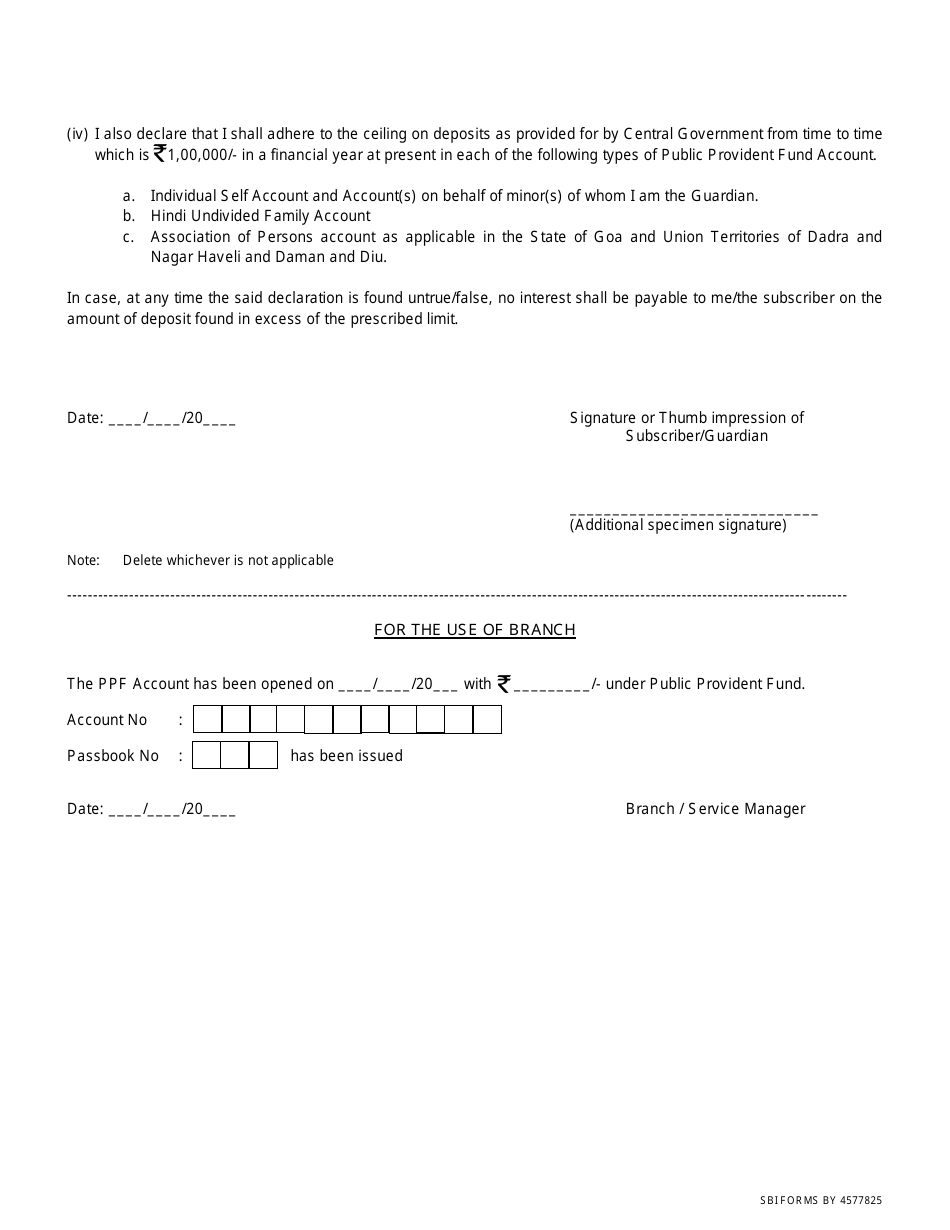

The Form A Application for Opening a Public Provident Fund Account Under the Public Provident Fund Scheme is used to apply for opening a Public Provident Fund Account with the State Bank of India. This scheme is a long-term savings option with tax benefits available to residents of India.

The Form A application for opening a Public Provident Fund account under the Public Provident Fund Scheme in India can be filed by individuals directly at the designated bank, which in this case is the State Bank of India.

FAQ

Q: What is the Public Provident Fund Scheme?

A: The Public Provident Fund Scheme is a long-term investment scheme in India.

Q: What is Form A?

A: Form A is the application form for opening a Public Provident Fund account.

Q: What is the purpose of opening a Public Provident Fund Account?

A: The purpose of opening a Public Provident Fund account is to save for long-term financial goals and enjoy tax benefits.

Q: What are the eligibility criteria for opening a Public Provident Fund Account?

A: Any resident Indian individual can open a Public Provident Fund account.

Q: What documents are required to open a Public Provident Fund Account?

A: You will need to submit Form A along with identity proof, address proof, and a passport-sized photograph to open a Public Provident Fund account.

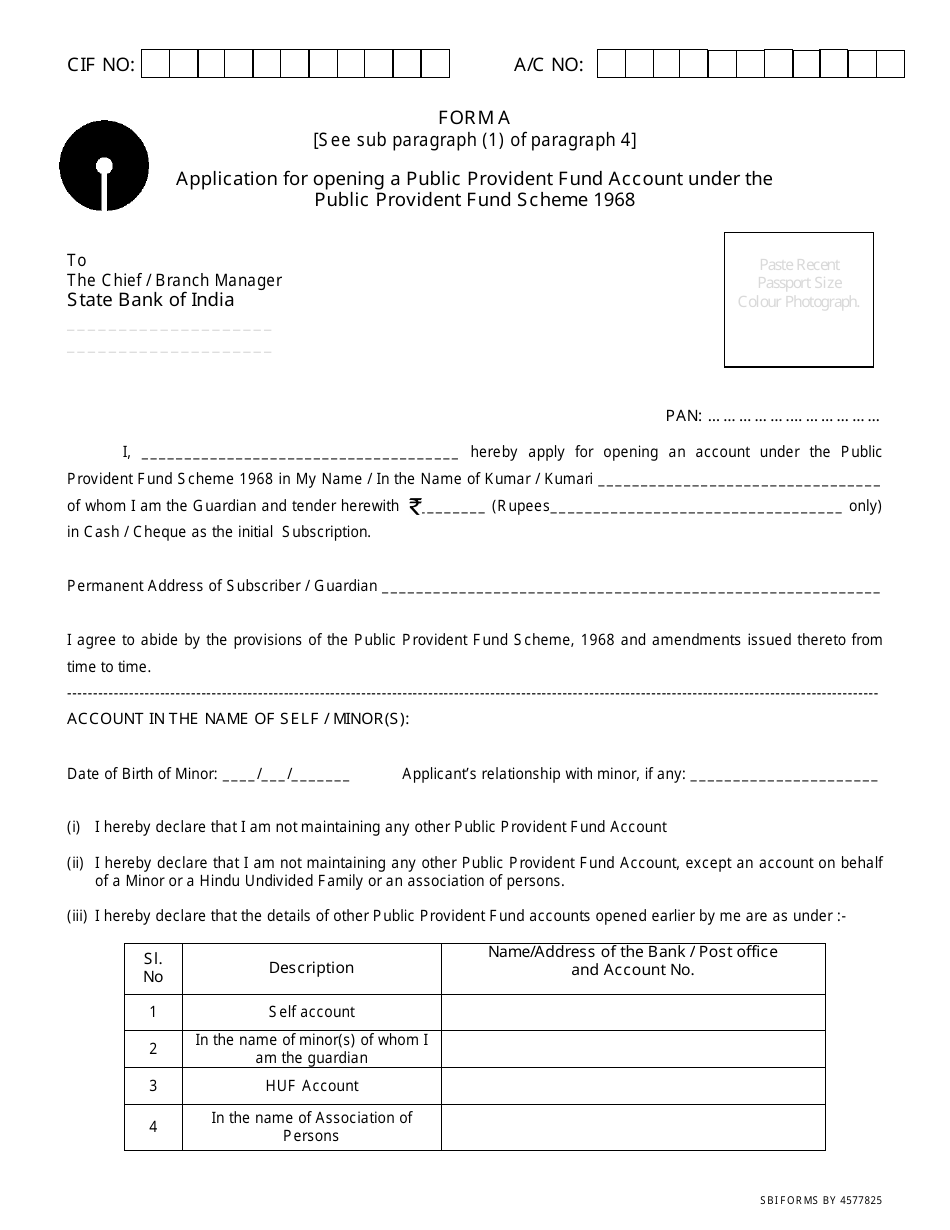

Q: What is the minimum and maximum investment limit in a Public Provident Fund Account?

A: The minimum investment limit in a Public Provident Fund account is Rs. 500 per year, and the maximum investment limit is Rs. 1.5 lakh per year.