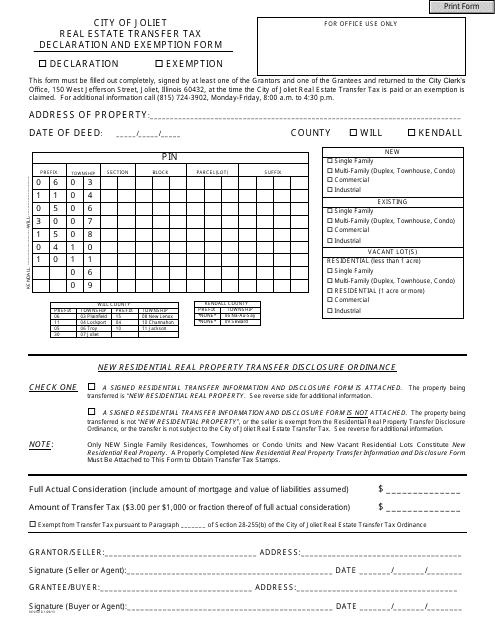

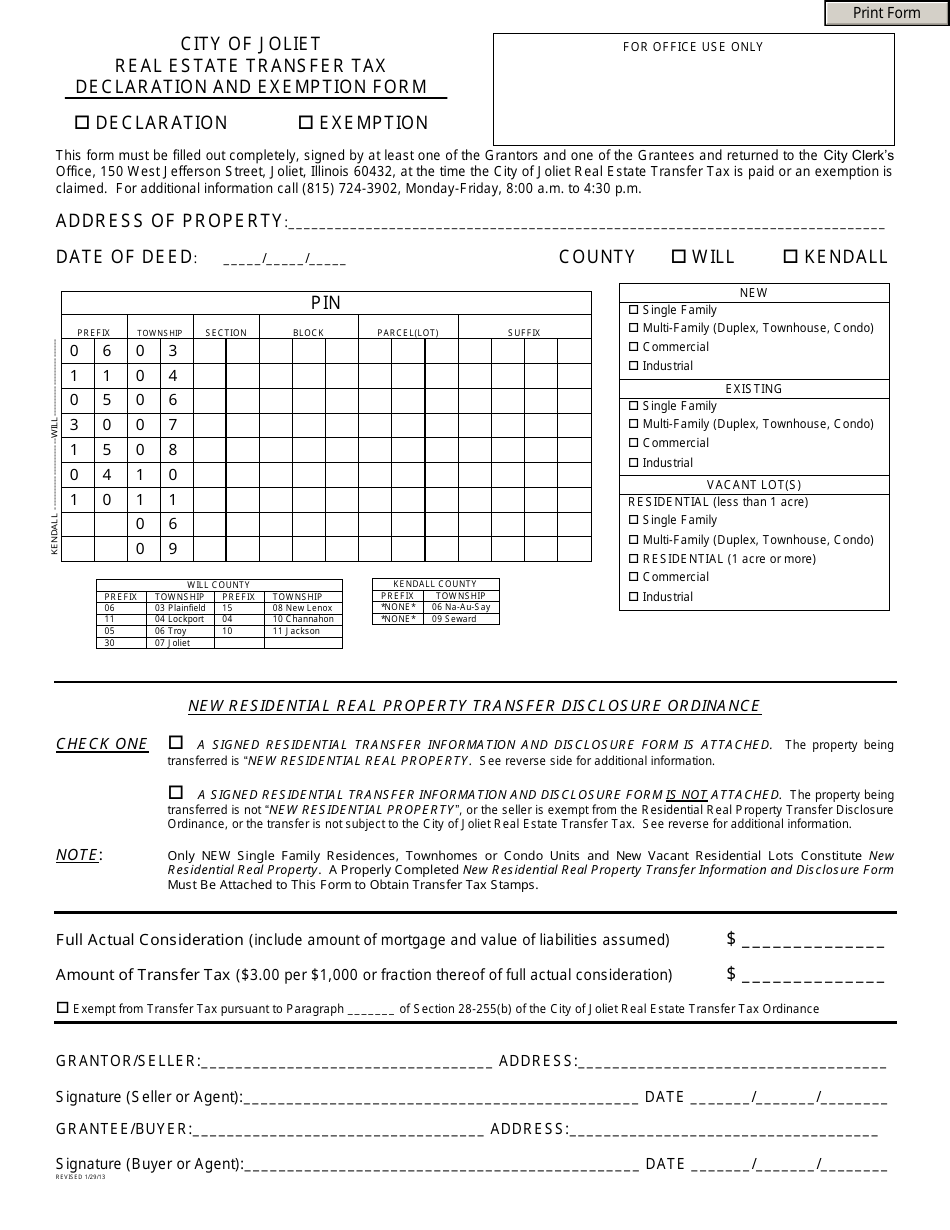

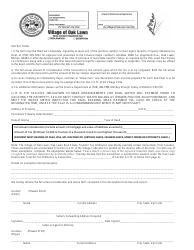

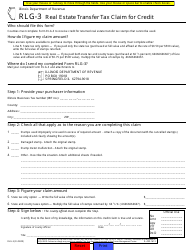

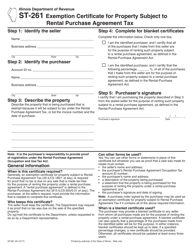

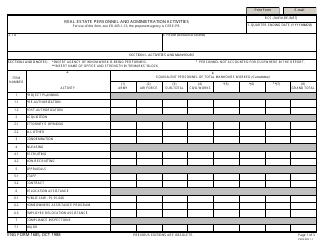

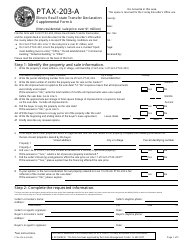

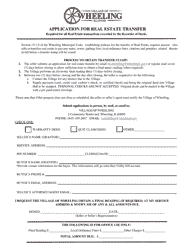

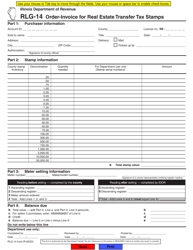

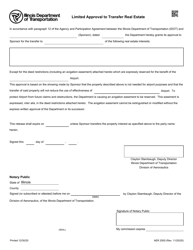

Real Estate Transfer Tax Declaration and Exemption Form - City of Joliet, Illinois

Real Estate Transfer Tax Declaration and Exemption Form is a legal document that was released by the Illinois Department of Revenue - a government authority operating within Illinois. The form may be used strictly within City of Joliet.

FAQ

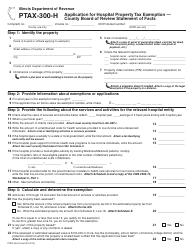

Q: What is the Real Estate Transfer Tax Declaration and Exemption Form?

A: The Real Estate Transfer Tax Declaration and Exemption Form is a document used in the City of Joliet, Illinois to declare and claim exemptions for the payment of real estate transfer taxes.

Q: What is a real estate transfer tax?

A: A real estate transfer tax is a tax imposed on the transfer of property ownership from one party to another.

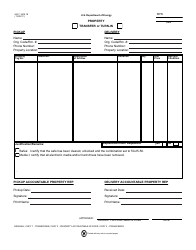

Q: Who is required to fill out the Real Estate Transfer Tax Declaration and Exemption Form?

A: Both the buyer and seller of a property in the City of Joliet, Illinois are required to fill out this form.

Q: Why do I need to fill out this form?

A: Filling out this form is necessary to comply with the city's regulations and to declare any exemptions for the payment of real estate transfer taxes.

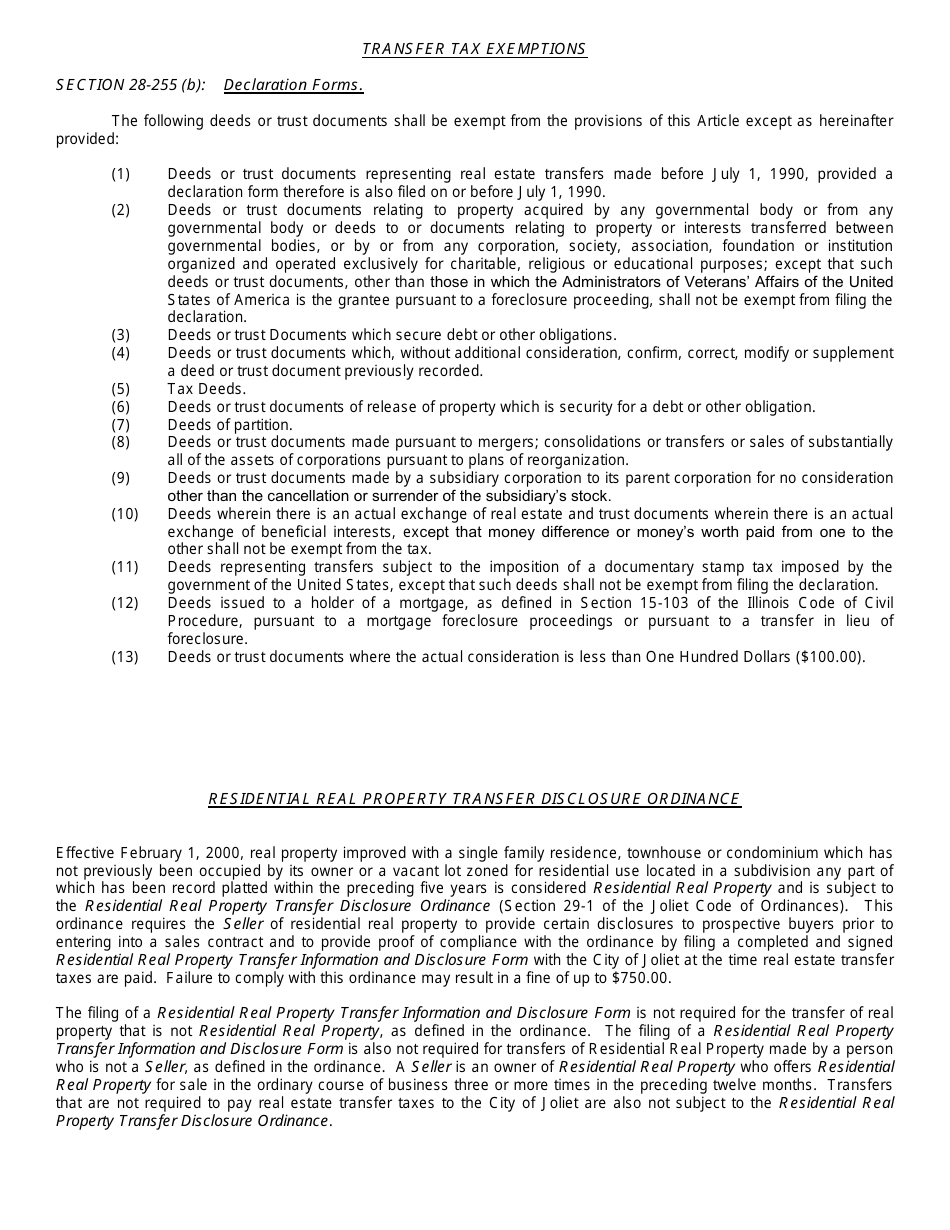

Q: What exemptions can be claimed on the form?

A: The form allows for various exemptions, such as transfers between family members, transfers between spouses, and certain types of government transfers. The specific exemptions and eligibility criteria are outlined in the form itself.

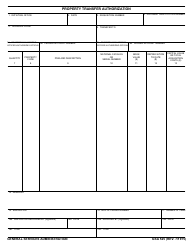

Q: Is there a deadline for submitting the form?

A: Yes, the form must be submitted within a certain time frame after the property transfer. The specific deadline is typically mentioned in the form instructions or can be obtained from the local government office.

Q: What happens if I don't submit the form or pay the required transfer taxes?

A: Failure to submit the form or pay the necessary transfer taxes can result in penalties, fines, or other legal consequences. It is important to comply with the city's regulations to avoid any issues.

Q: Can I get help or guidance in filling out the form?

A: If you are unsure about how to fill out the form or have any questions, you can seek assistance from the local government office responsible for real estate transfers or consult a real estate professional or attorney.

Q: Are there any additional fees associated with the Real Estate Transfer Tax Declaration and Exemption Form?

A: While the form itself may not have any additional fees, there may be other fees associated with the overall real estate transfer process. It is advisable to check with the local government office or consult a real estate professional for more details.

Form Details:

- Released on January 29, 2013;

- The latest edition currently provided by the Illinois Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.