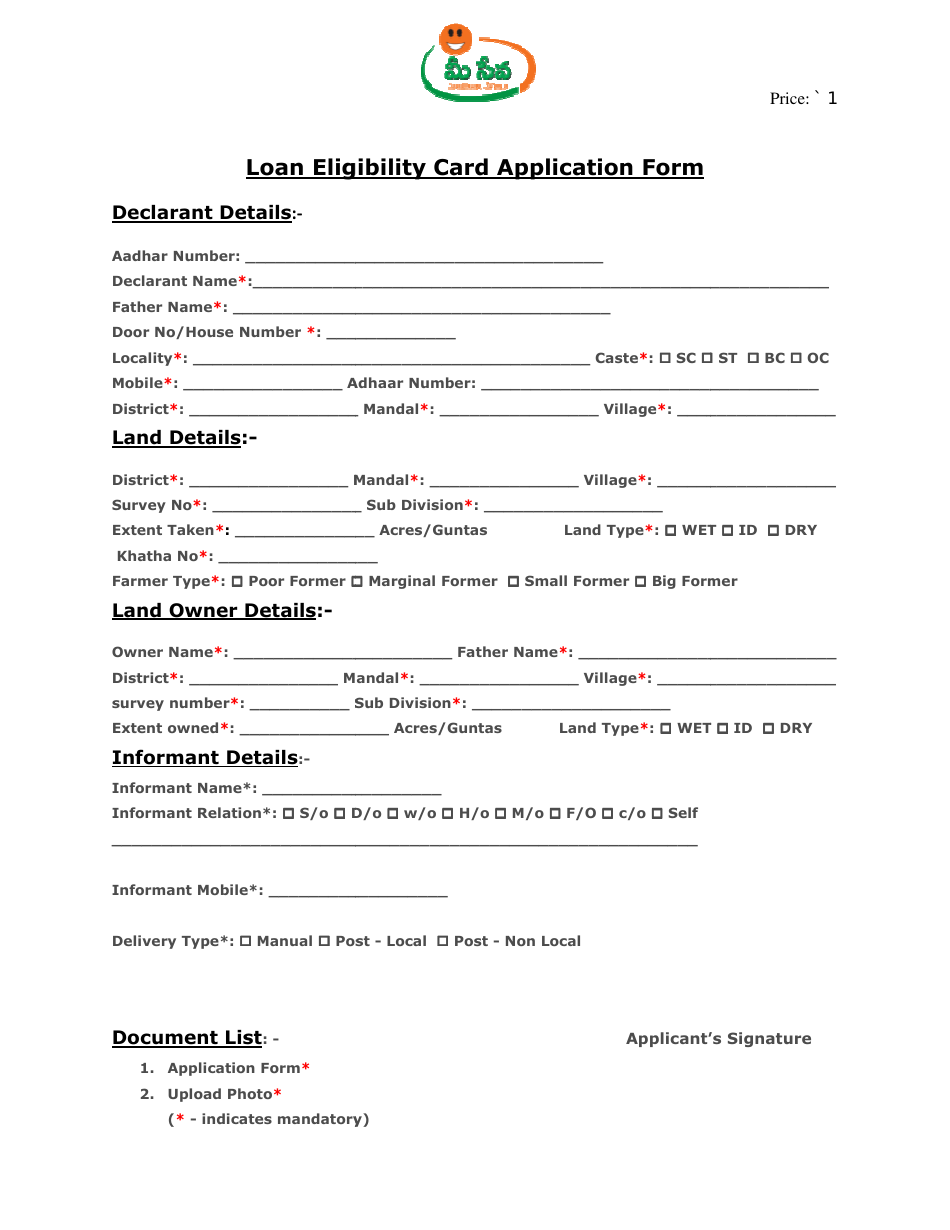

Loan Eligibility Card Application Form - India

The Loan Eligibility Card Application Form in India is used to apply for a loan eligibility card. This card helps individuals determine their eligibility for different types of loans offered by financial institutions in India.

In India, the loan eligibility card application form is typically filed by the individual seeking the loan.

FAQ

Q: What is a loan eligibility card?

A: A loan eligibility card is a document that determines whether an individual is eligible to apply for a loan.

Q: How can I apply for a loan eligibility card?

A: As an US resident, you cannot apply specifically for a loan eligibility card in India.

Q: Is a loan eligibility card required in the USA?

A: No, loan eligibility cards are not required in the USA. The eligibility for loans is usually determined by credit score and income.

Q: What are the eligibility criteria for loans in the USA?

A: Eligibility criteria for loans in the USA typically include a good credit score, steady income, and a low debt-to-income ratio.