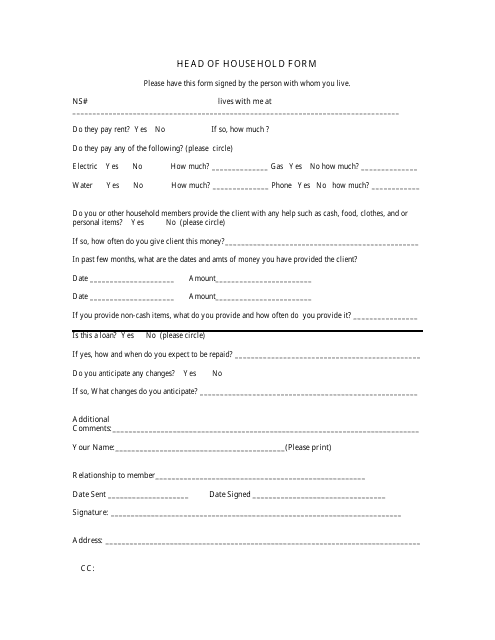

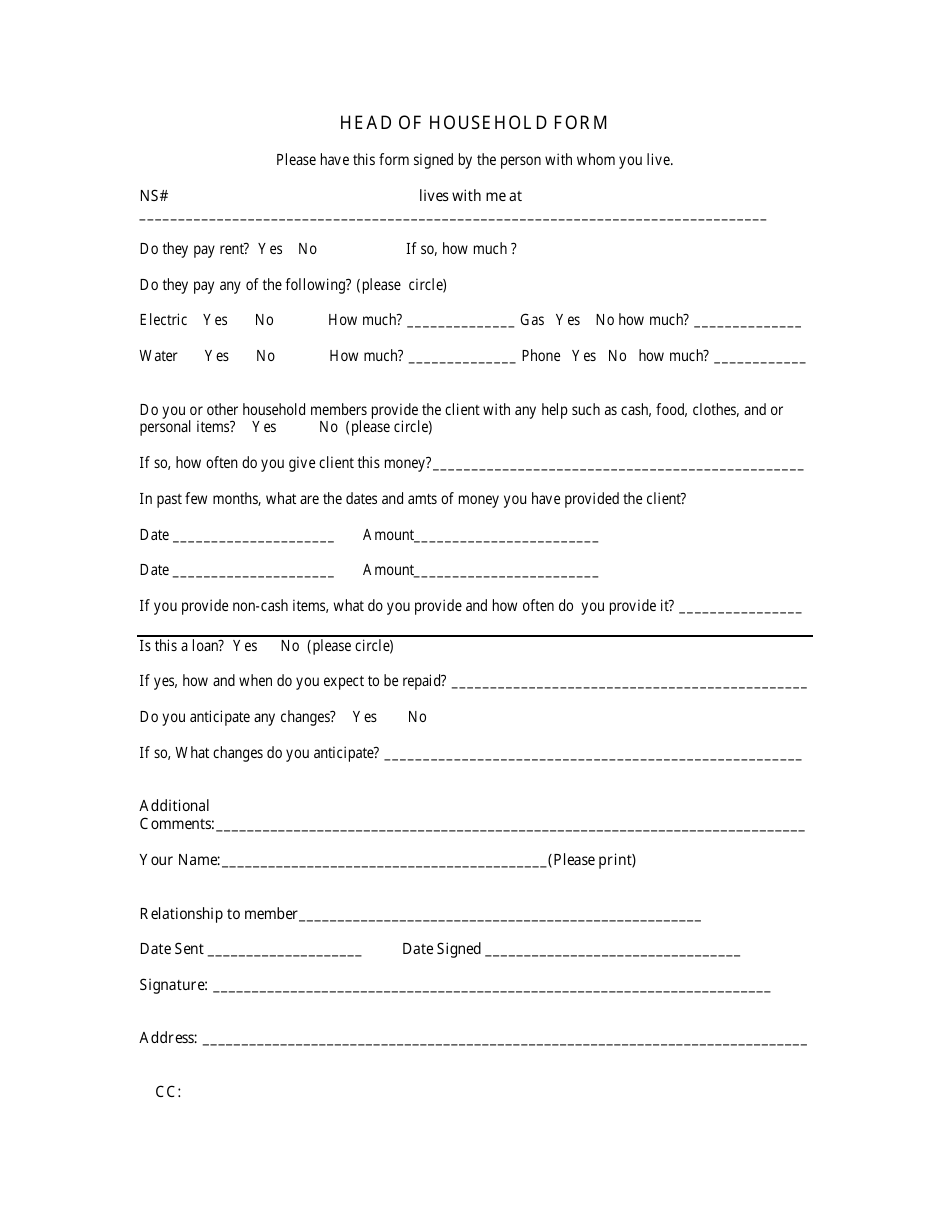

Head of Household Form

The Head of Household form is used for individuals who are unmarried and financially support a household. It allows them to claim certain tax benefits such as a higher standard deduction and potentially lower tax rates.

The head of household form, also known as Form 1040, is generally filed by unmarried taxpayers who financially support a household, such as providing for children or other dependents.

FAQ

Q: What is the Head of Household form?

A: The Head of Household form is a filing status on the US federal income tax return.

Q: Who can file as Head of Household?

A: To file as Head of Household, you must be unmarried or considered unmarried on the last day of the tax year and have paid more than half the cost of keeping up a home for yourself and a qualifying person.

Q: What are the benefits of filing as Head of Household?

A: Filing as Head of Household may result in a lower tax rate and a higher standard deduction compared to other filing statuses.

Q: What is considered a qualifying person for Head of Household?

A: A qualifying person for Head of Household can be your child, grandchild, sibling, or a dependent parent, as long as they meet certain criteria.

Q: Can I claim Head of Household if I am married?

A: Under certain circumstances, you may be able to file as Head of Household if you are married, but living apart from your spouse and meet the other criteria.

Q: Do I need to provide proof for filing as Head of Household?

A: You should keep records and documents that support your eligibility for filing as Head of Household, such as receipts for household expenses or documentation regarding custody arrangements.

Q: Is the Head of Household form available for Canadian residents?

A: No, the Head of Household form is specific to US federal income tax returns and is not applicable to Canadian residents.