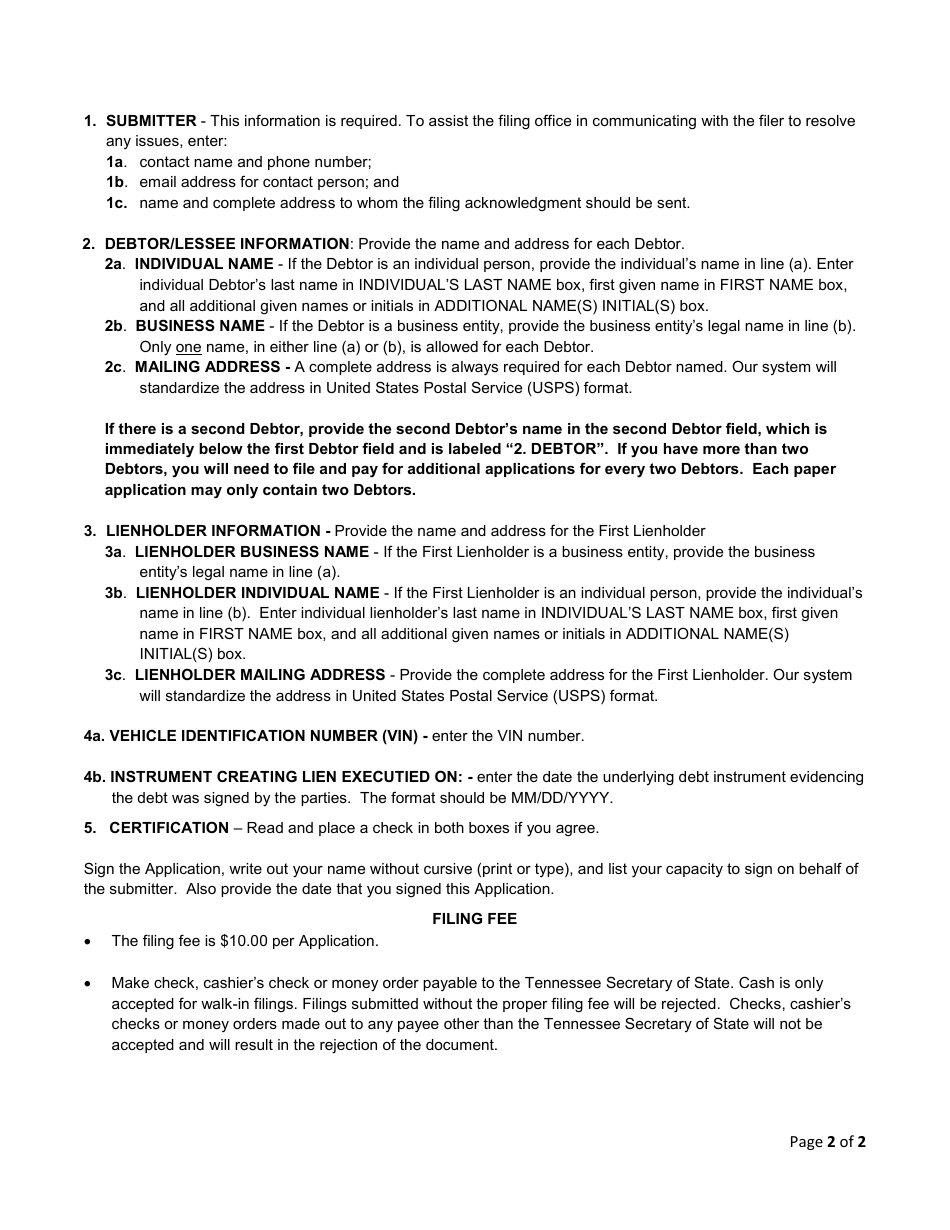

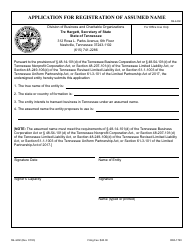

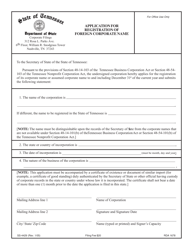

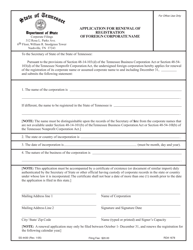

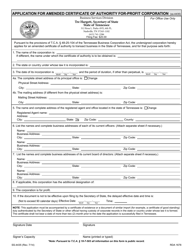

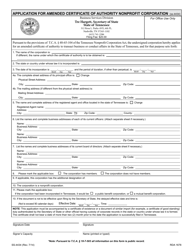

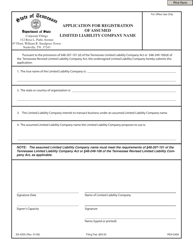

Form SS-4258 Application for Motor Vehicle Temporary Lien - Tennessee

What Is Form SS-4258?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-4258?

A: Form SS-4258 is the Application for Motor Vehicle Temporary Lien in Tennessee.

Q: What is the purpose of Form SS-4258?

A: The purpose of Form SS-4258 is to apply for a temporary lien on a motor vehicle in Tennessee.

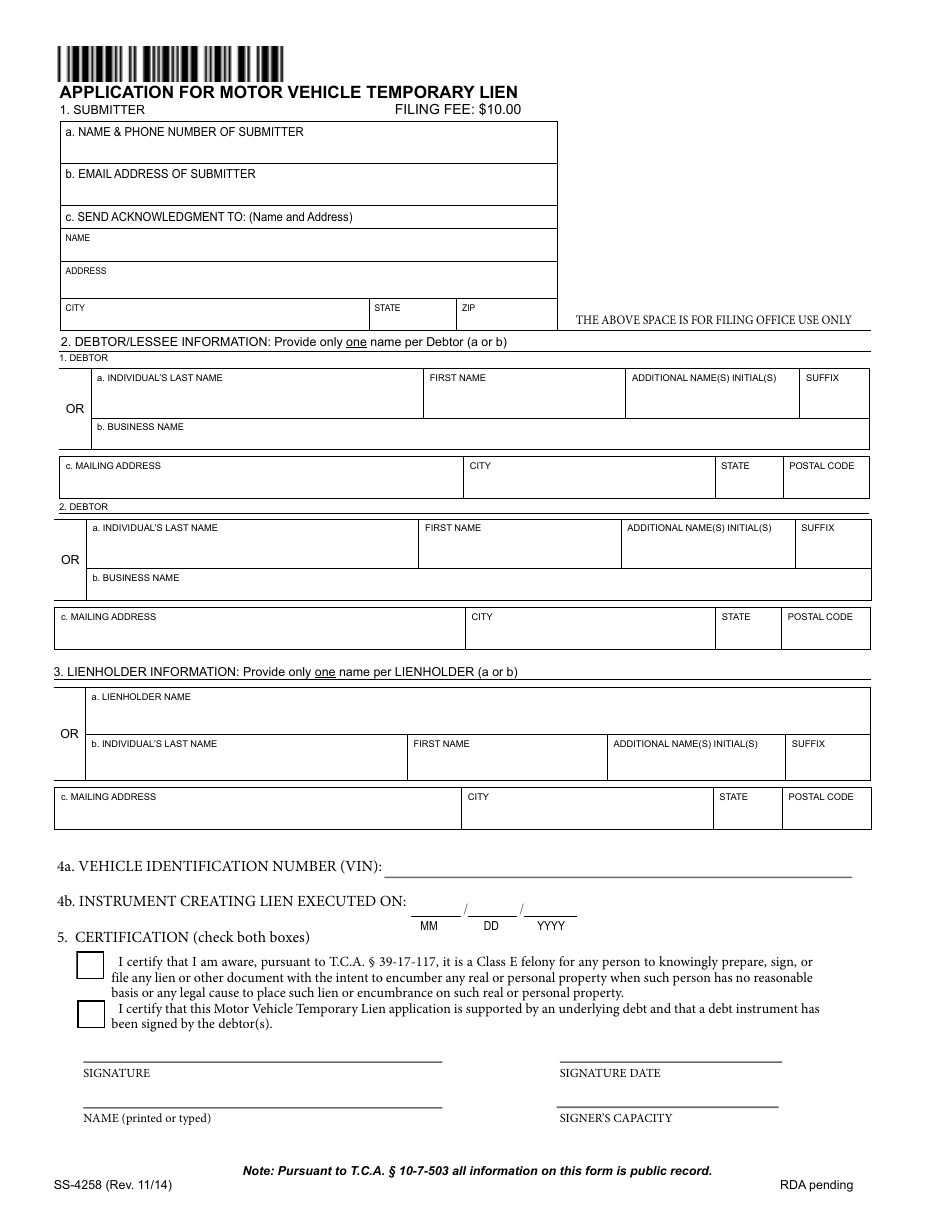

Q: What information is required on Form SS-4258?

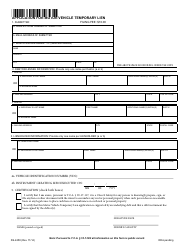

A: Form SS-4258 requires information such as the vehicle identification number, owner's name and address, lienholder's name and address, and the reason for the temporary lien.

Q: Is there a fee for filing Form SS-4258?

A: Yes, there is a fee for filing Form SS-4258. The fee amount may vary, so it is best to contact your local county clerk's office for the exact amount.

Q: How long does the temporary lien last?

A: The temporary lien typically lasts for 30 days, but it can be extended for an additional 15 days upon request.

Q: Can I remove the temporary lien before it expires?

A: Yes, you can remove the temporary lien before it expires by submitting a Release of Lien form to the Tennessee Department of Revenue.

Q: What happens if the temporary lien is not released?

A: If the temporary lien is not released within the required time frame, the vehicle owner may face penalties and the lienholder may have legal rights to the vehicle.

Q: Can I transfer the vehicle with a temporary lien?

A: No, you cannot transfer the vehicle with a temporary lien. The lien must be released before the vehicle can be transferred to a new owner.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-4258 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.