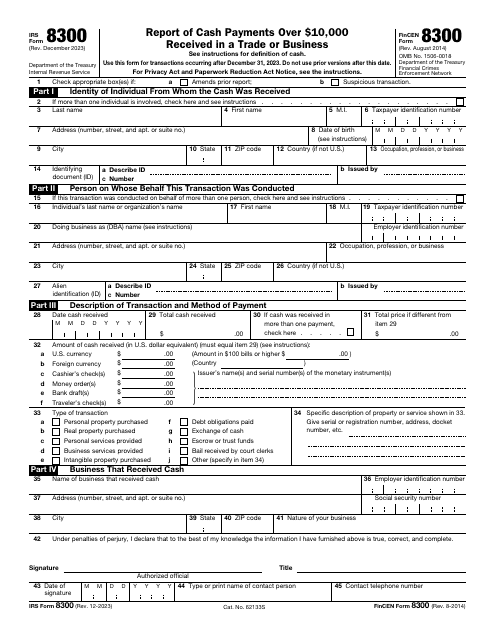

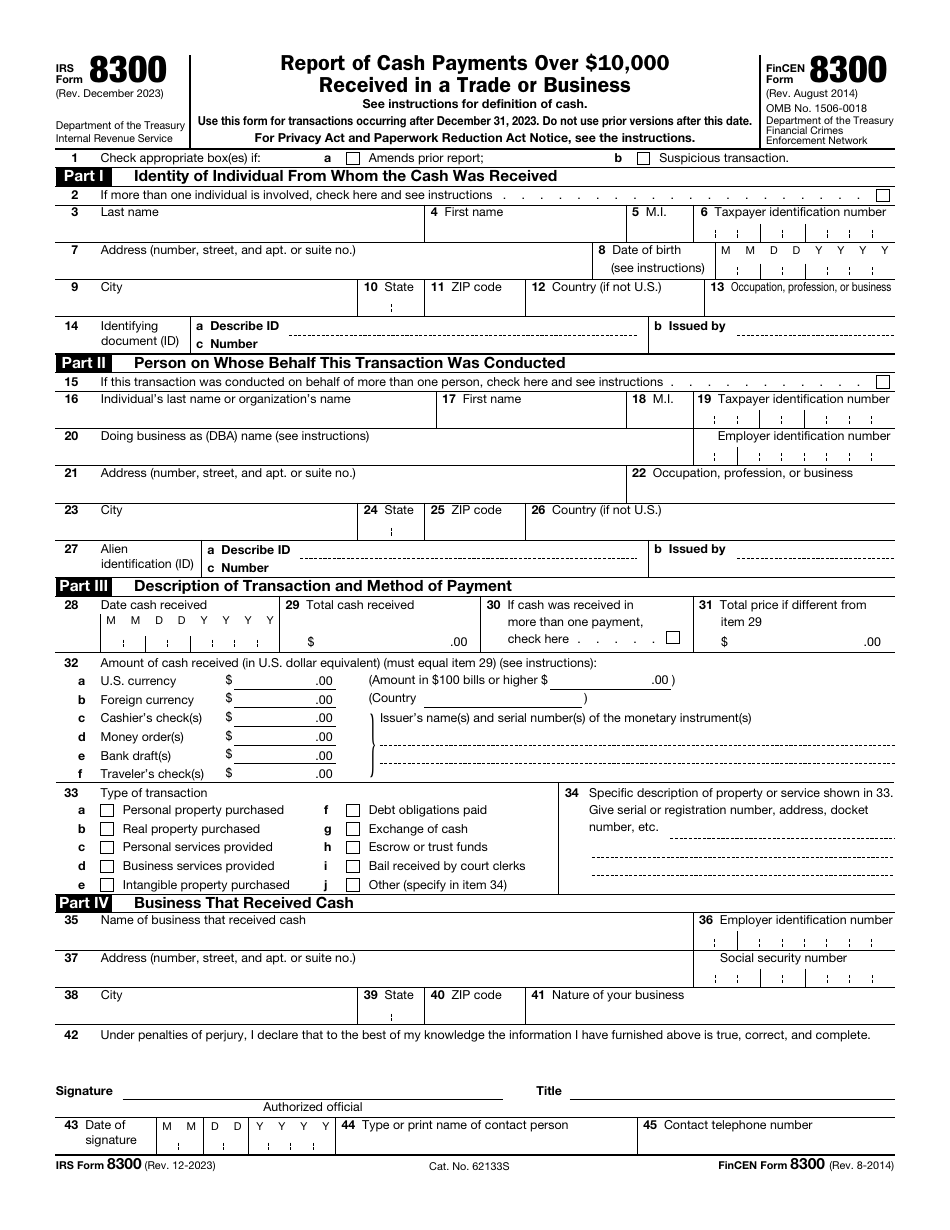

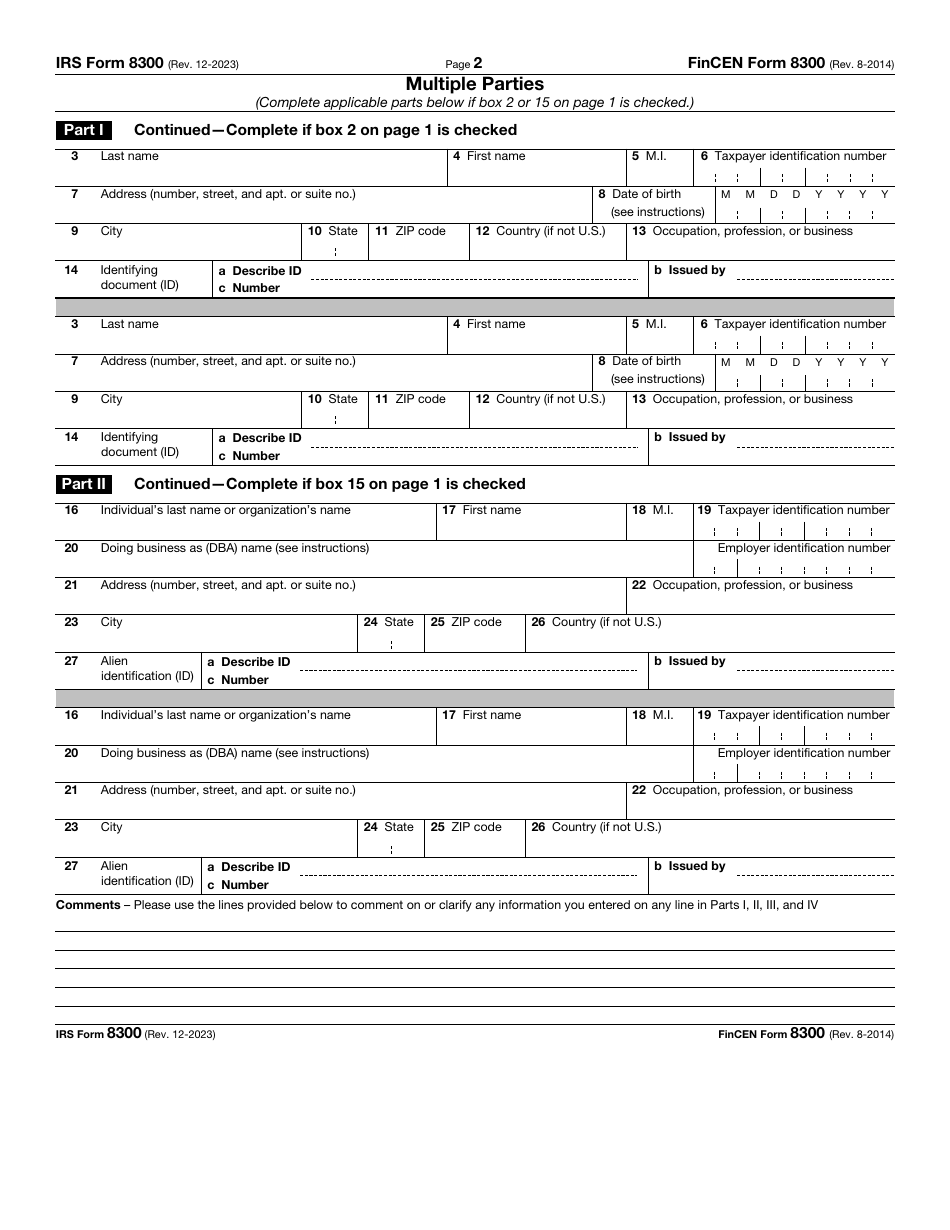

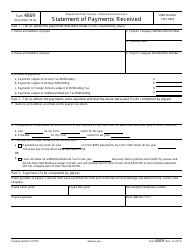

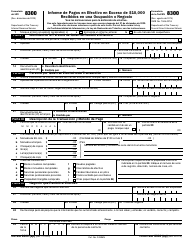

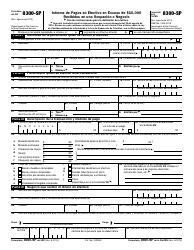

IRS Form 8300 Report of Cash Payments Over $10,000 Received in a Trade or Business

Fill PDF Online

Fill out online for free

without registration or credit card