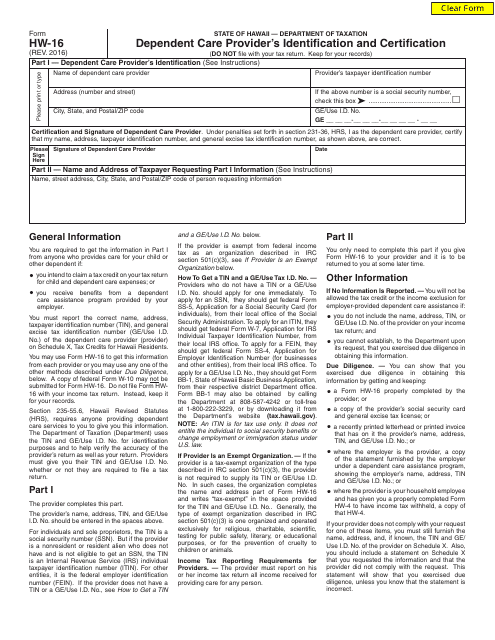

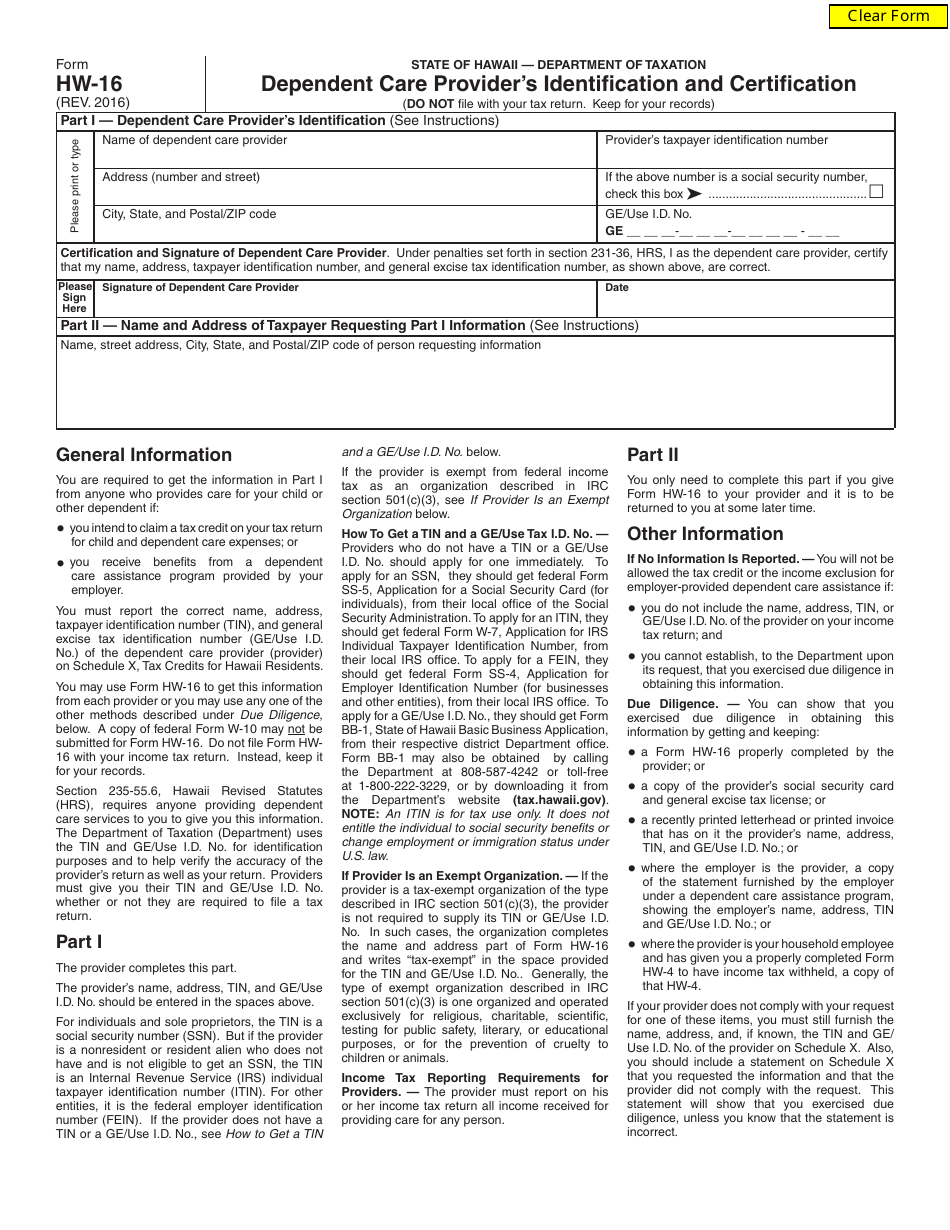

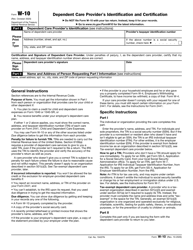

Form HW-16 Dependent Care Provider's Identification and Certification - Hawaii

What Is Form HW-16?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HW-16?

A: Form HW-16 is the Dependent Care Provider's Identification and Certification form for Hawaii.

Q: What is the purpose of Form HW-16?

A: Form HW-16 is used to provide information about a dependent care provider in Hawaii.

Q: Who needs to fill out Form HW-16?

A: Anyone who paid for dependent care services in Hawaii and wants to claim the dependent care tax credit needs to fill out Form HW-16.

Q: What information is required on Form HW-16?

A: Form HW-16 requires information about the dependent care provider, including their name, address, and tax identification number.

Q: When is Form HW-16 due?

A: Form HW-16 is due on or before the due date of your Hawaii income tax return.

Q: Can I submit Form HW-16 electronically?

A: No, Form HW-16 must be submitted by mail with your Hawaii income tax return.

Q: What happens if I don't submit Form HW-16?

A: If you don't submit Form HW-16, you may not be able to claim the dependent care tax credit for the expenses you paid.

Q: Is Form HW-16 only for residents of Hawaii?

A: Form HW-16 is specifically for Hawaii residents who paid for dependent care services.

Q: Are there any additional forms or attachments required with Form HW-16?

A: No, Form HW-16 does not require any additional forms or attachments.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HW-16 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.