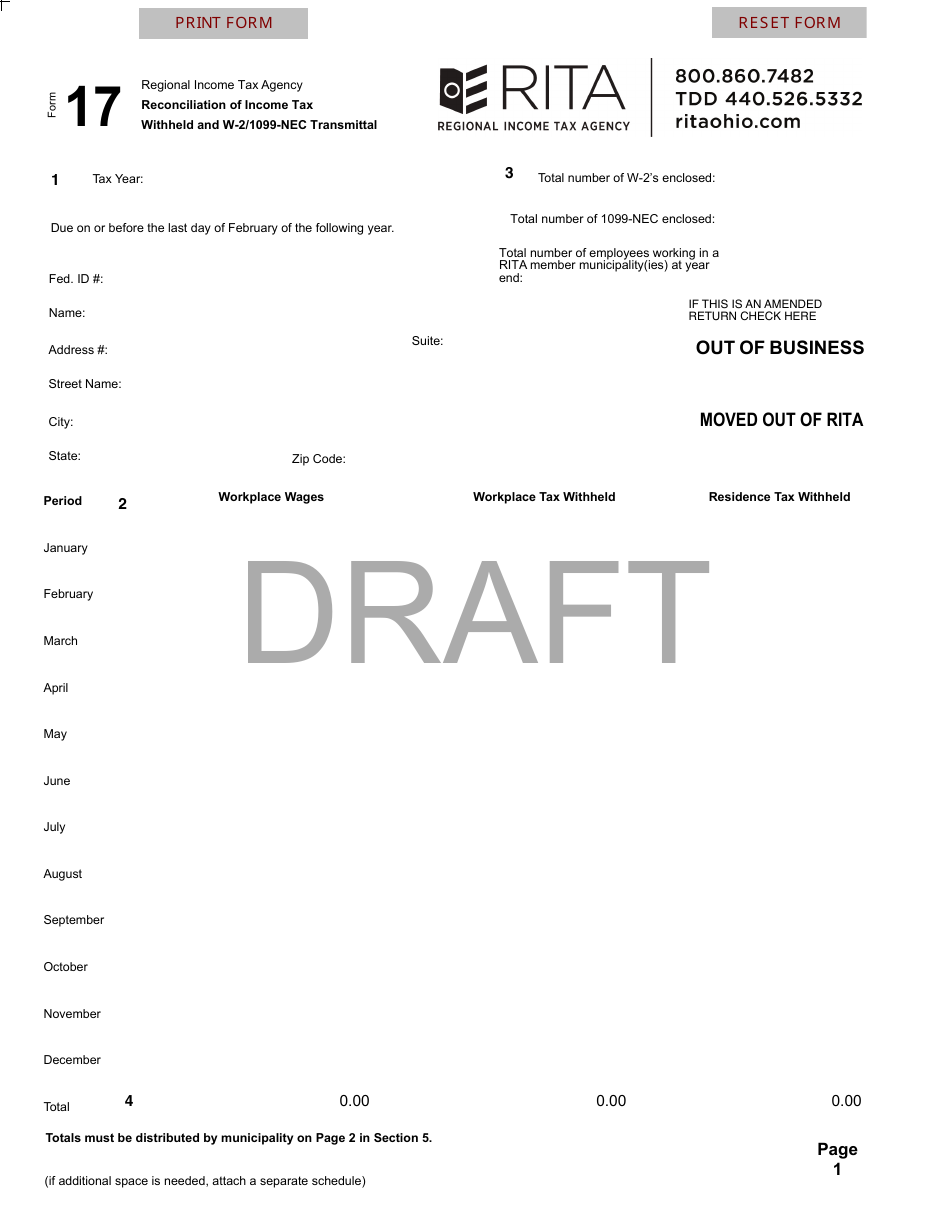

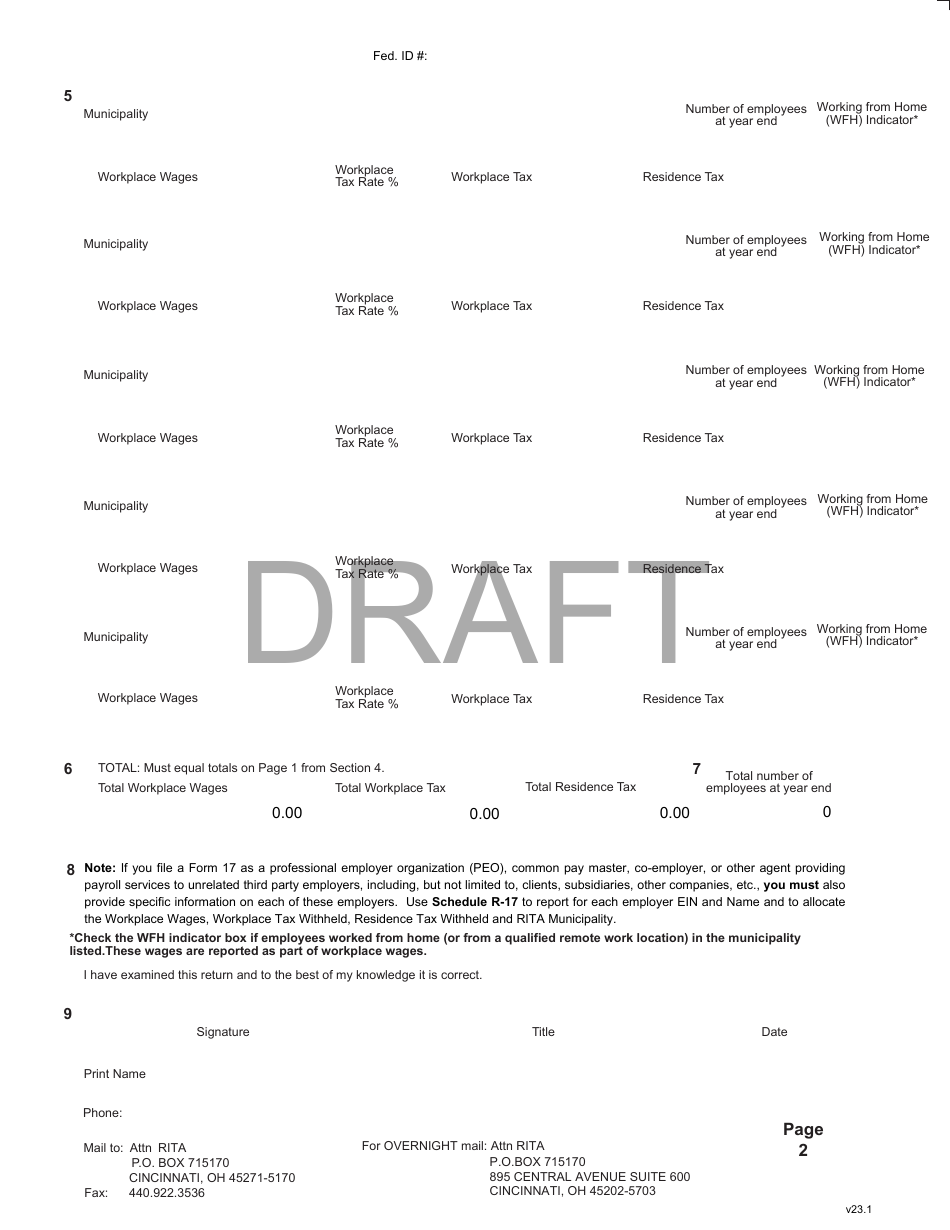

Form 17 Reconciliation of Income Tax Withheld and W-2 / 1099-nec Transmittal - Draft - Ohio

Fill PDF Online

Fill out online for free

without registration or credit card