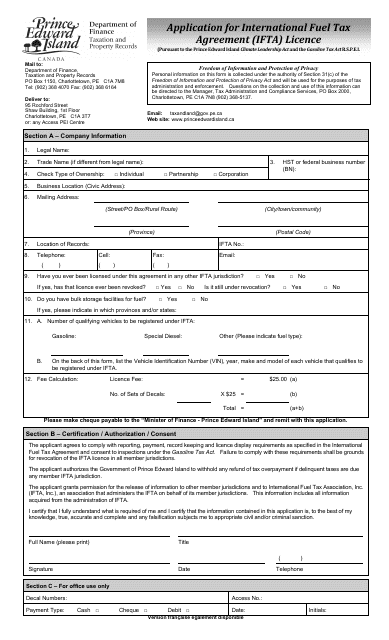

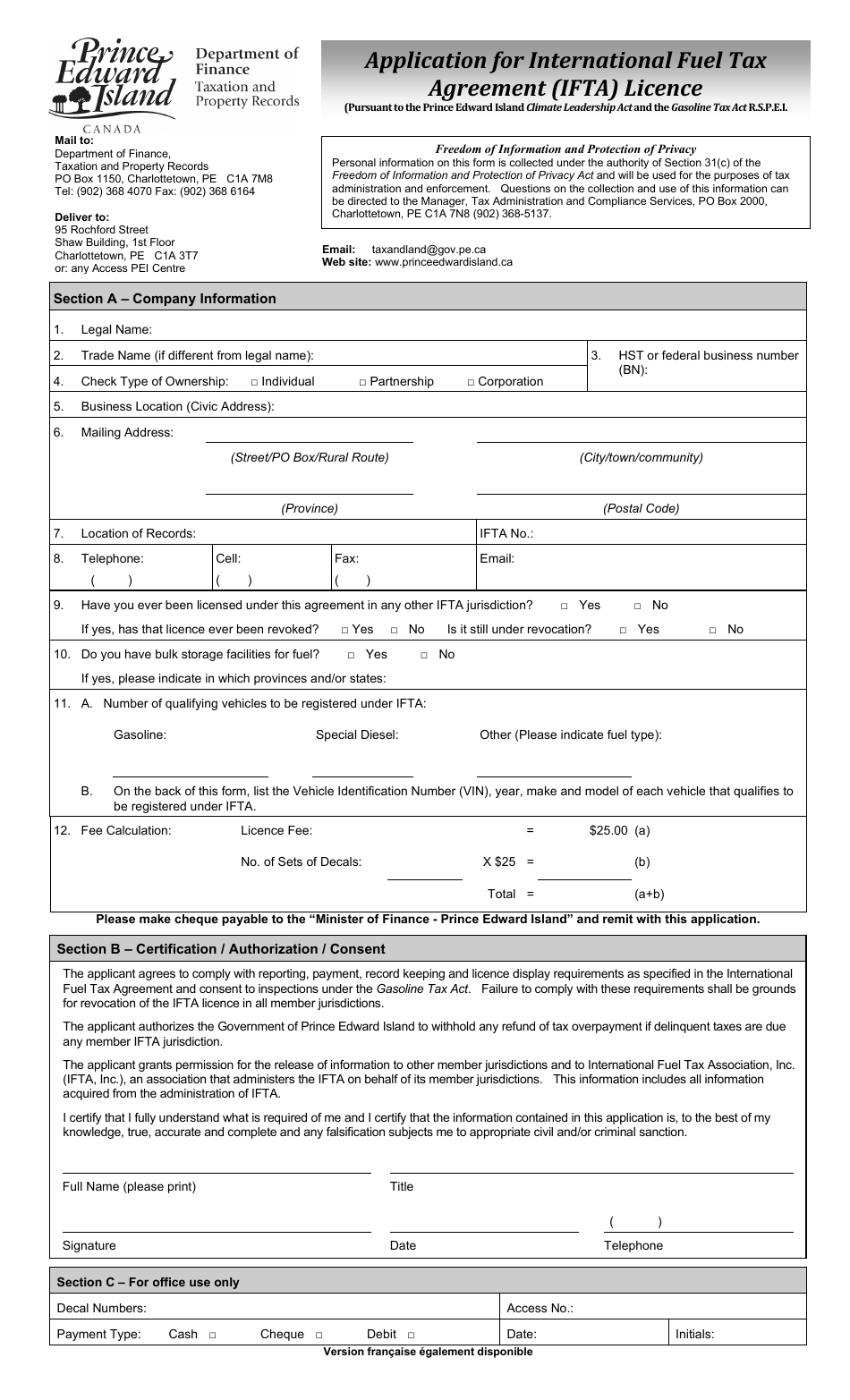

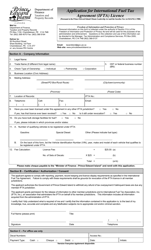

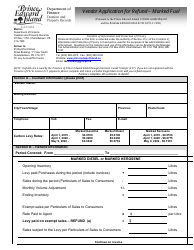

Application for International Fuel Tax Agreement (Ifta) Licence - Prince Edward Island, Canada

Fill PDF Online

Fill out online for free

without registration or credit card