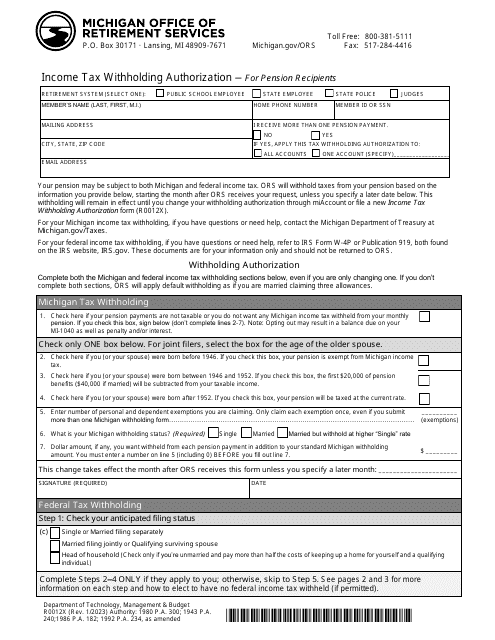

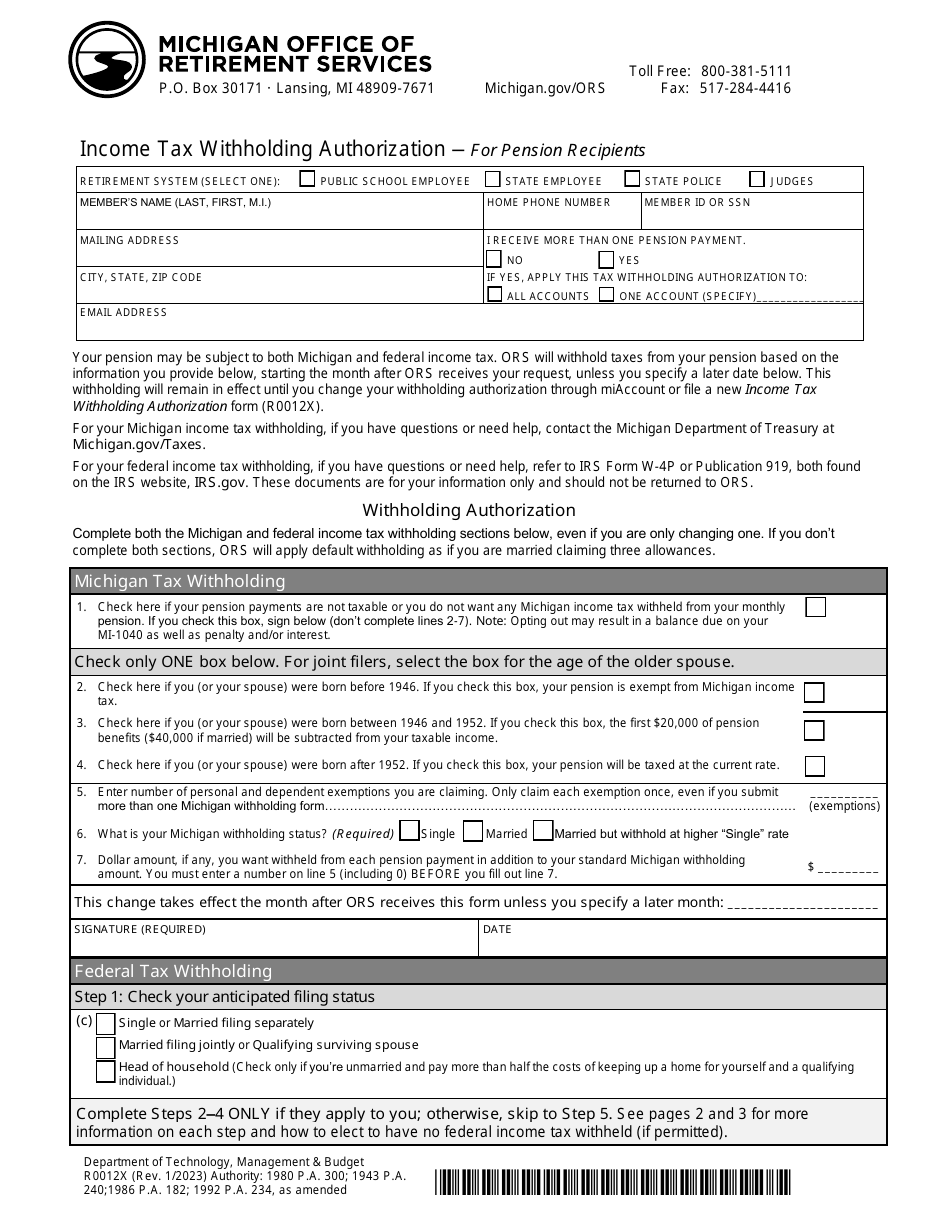

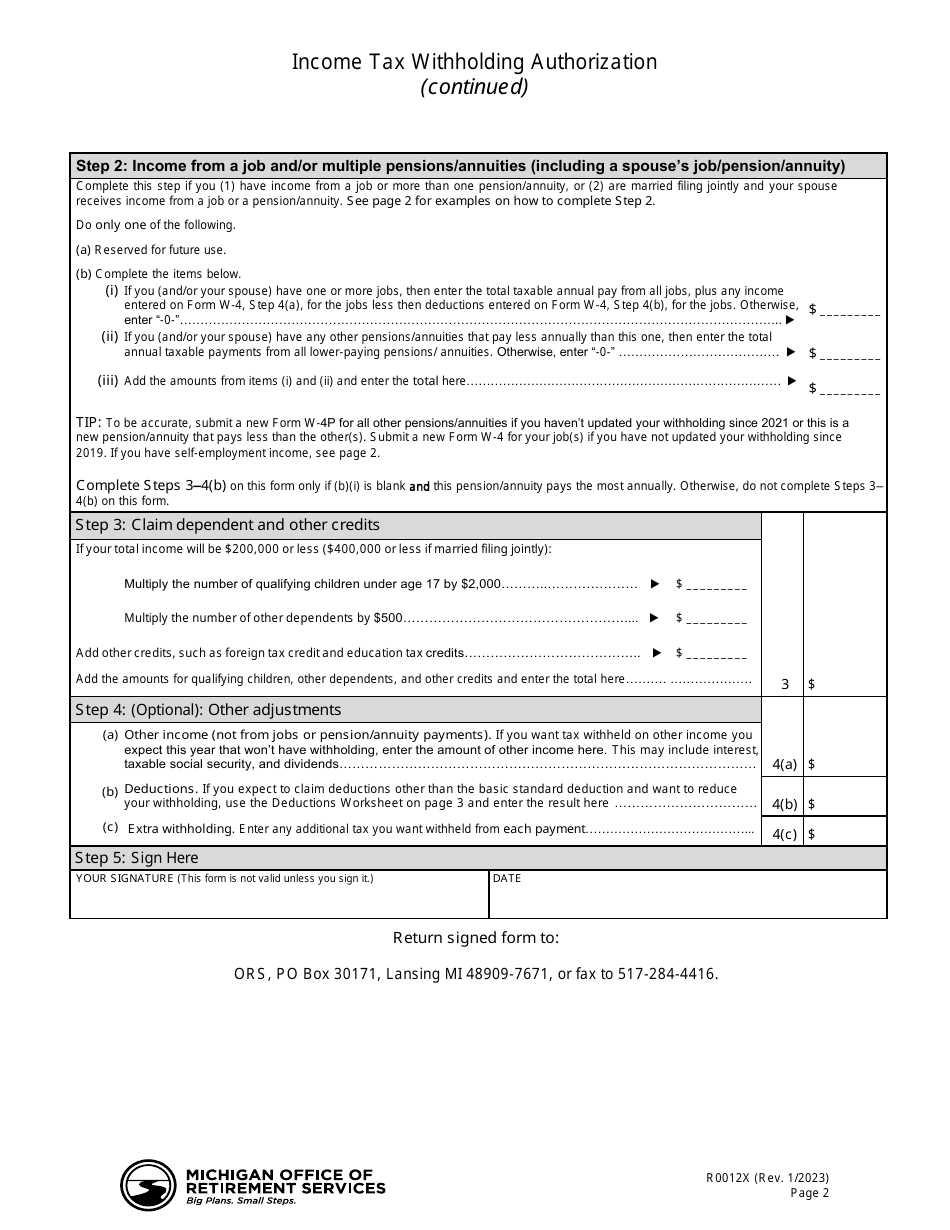

Form R0012X Income Tax Withholding Authorization for Pension Recipients - Michigan

Fill PDF Online

Fill out online for free

without registration or credit card