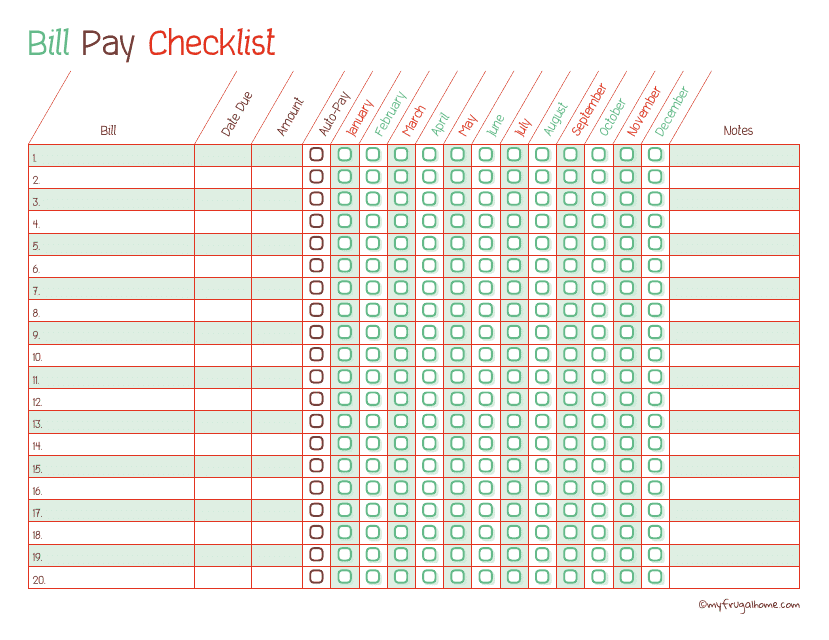

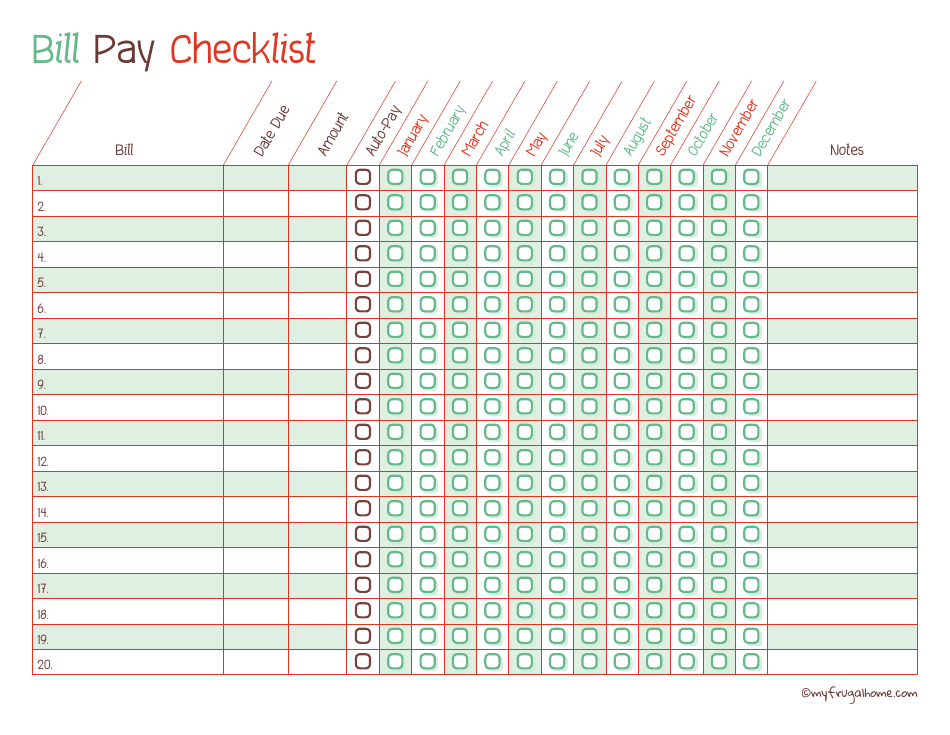

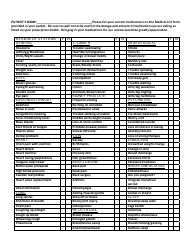

Bill Pay Checklist Template

A Bill Pay Checklist Template is a tool used to keep track of your bills and payments. It helps you ensure that you don't miss any payments and stay organized with your finances.

The bill pay checklist template can be filed by anyone who prefers to keep a record of their bill payments. It is typically used by individuals to stay organized and keep track of their monthly expenses.

FAQ

Q: What is a bill pay checklist?

A: A bill pay checklist is a tool used to keep track of your bills and ensure they are paid on time.

Q: Why is a bill pay checklist useful?

A: A bill pay checklist helps you stay organized and avoid late payments or missed bills.

Q: How do I use a bill pay checklist?

A: You can use a bill pay checklist by listing your bills and due dates, and checking them off as you pay them.

Q: What should I include in a bill pay checklist?

A: In a bill pay checklist, you should include the name of each bill, the due date, the amount due, and a space to check off when it is paid.

Q: How often should I update my bill pay checklist?

A: It is best to update your bill pay checklist at least monthly, or whenever there are changes to your bills or due dates.

Q: What are the benefits of using a bill pay checklist?

A: Using a bill pay checklist helps you stay organized, avoid late fees, and maintain a good credit score by ensuring your bills are paid on time.

Q: Can I use a bill pay checklist for both personal and business bills?

A: Yes, you can use a bill pay checklist for both personal and business bills by listing them separately or using different sections of the checklist.

Q: Is there a specific format for a bill pay checklist?

A: There is no specific format for a bill pay checklist as long as it includes all the necessary information about your bills and due dates.

Q: Can I set up reminders for bill payments using a bill pay checklist?

A: Yes, you can set up reminders for bill payments by using calendar alerts or task management apps in addition to your bill pay checklist.