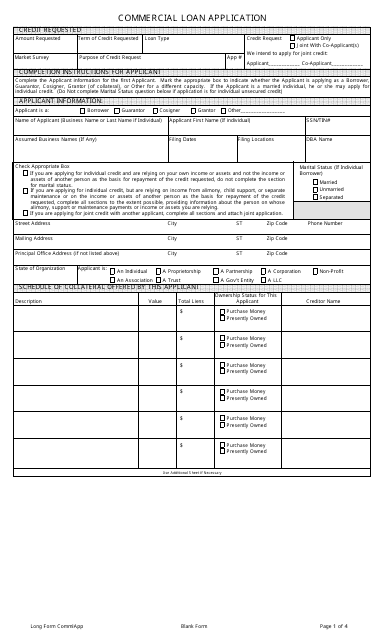

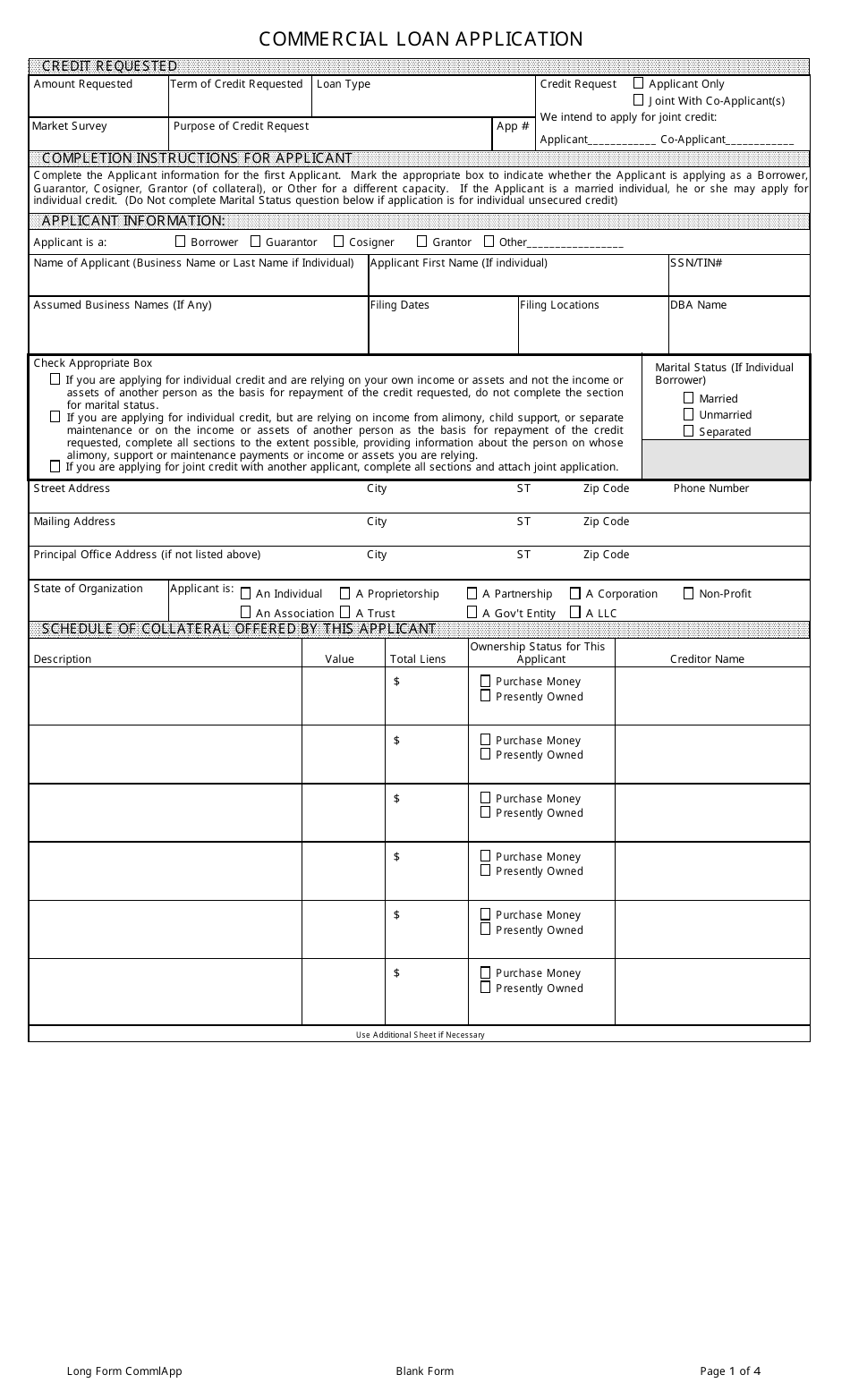

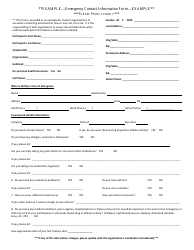

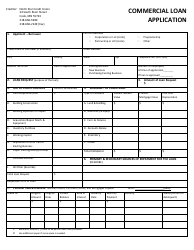

Commercial Loan Application Form

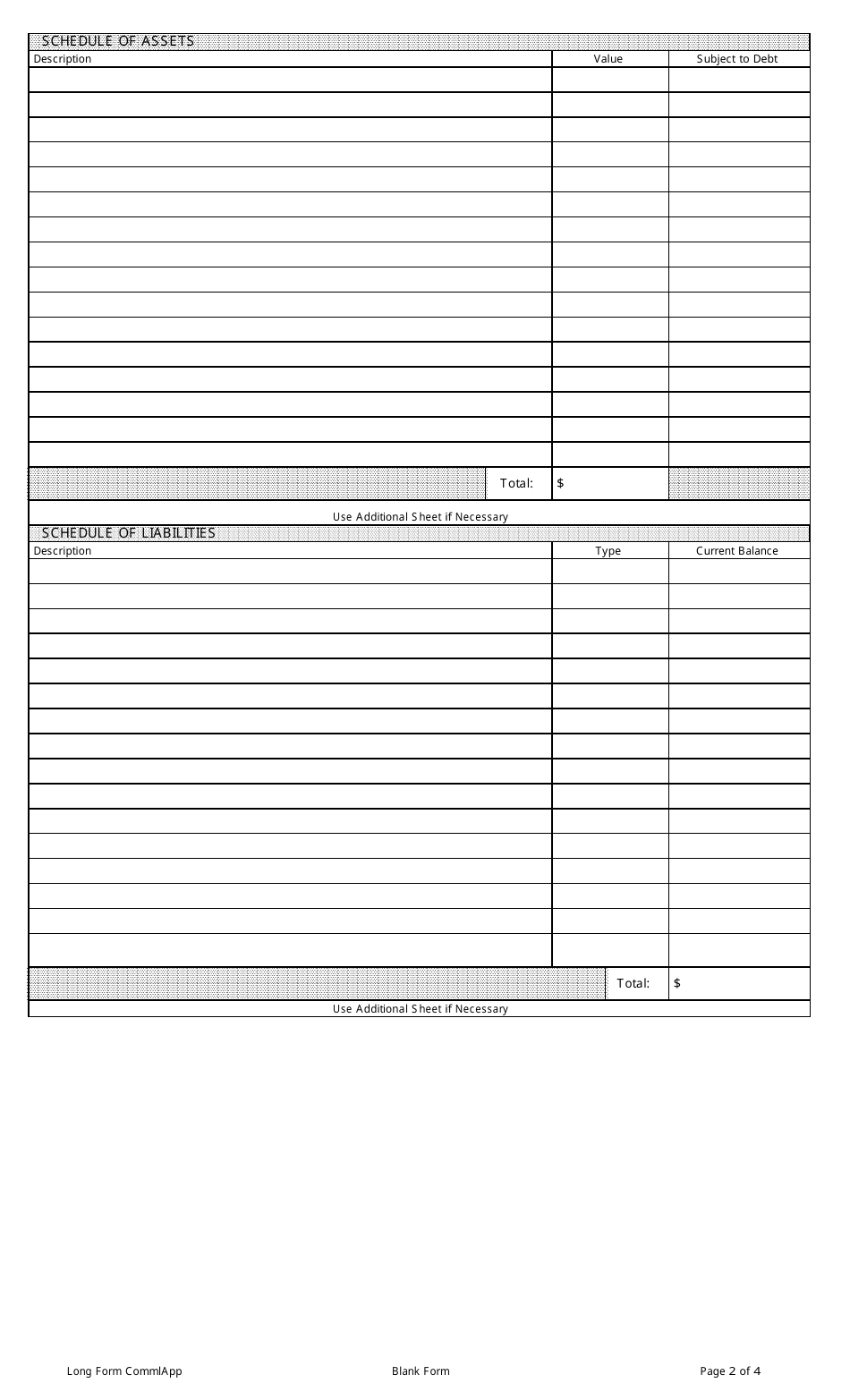

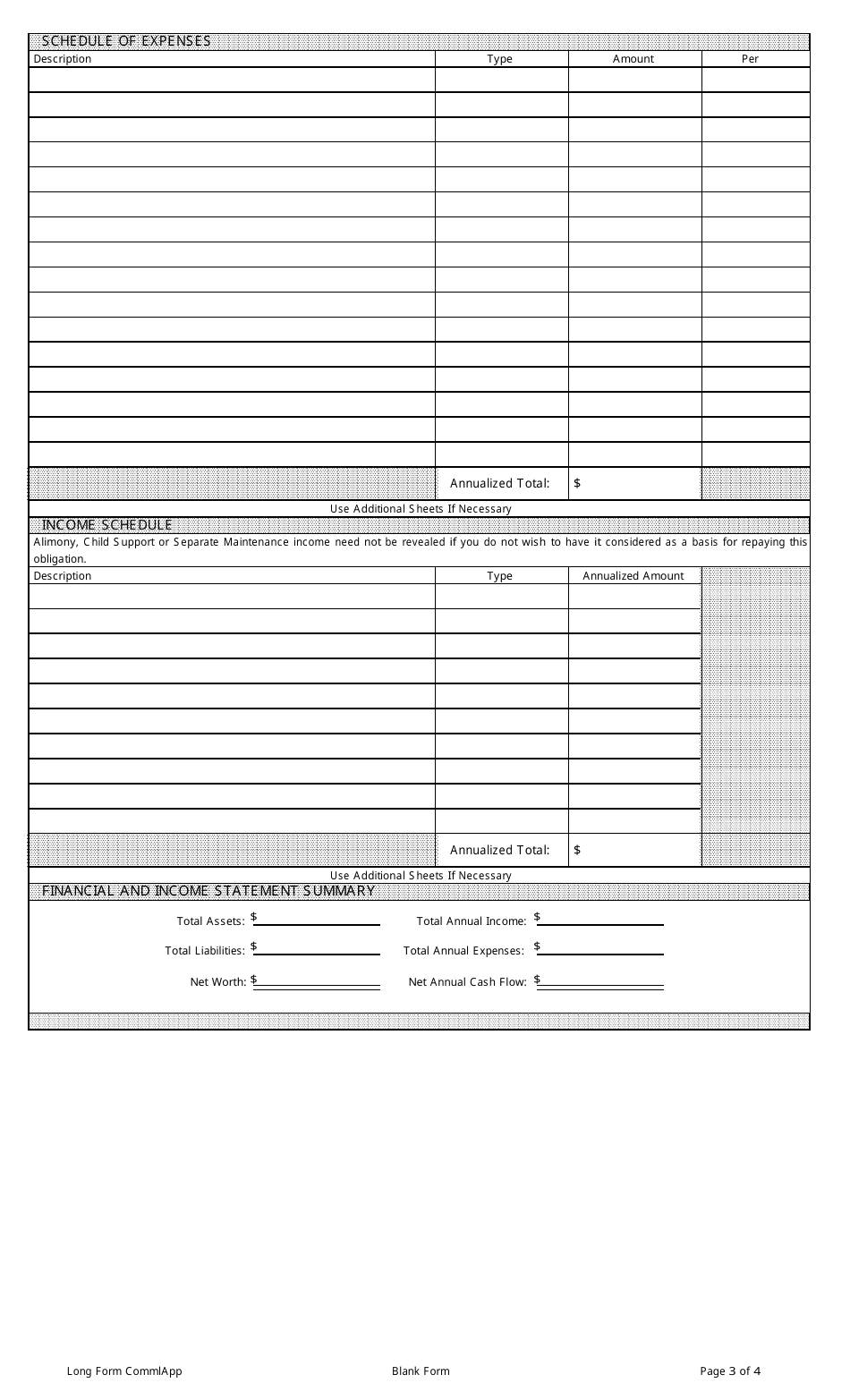

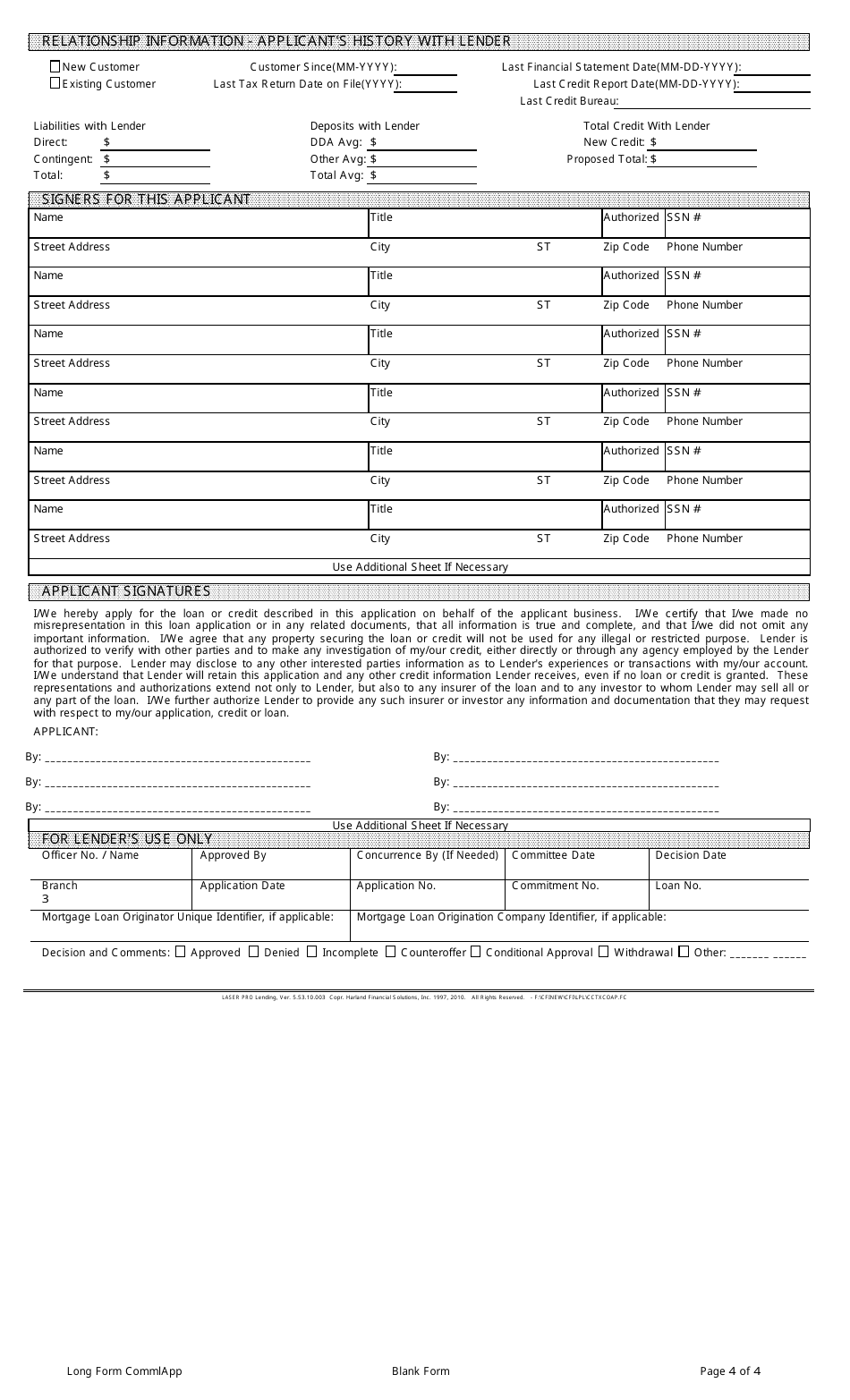

A Commercial Loan Application Form is used by businesses to apply for a loan from a bank or financial institution. It gathers information about the business, its financials, and the purpose of the loan to help the lender assess the business's creditworthiness and determine the terms of the loan.

The commercial loan application form is typically filed by the individual or business seeking the loan.

FAQ

Q: What is a commercial loan application form?

A: A commercial loan application form is a document that is used to apply for a loan for business purposes.

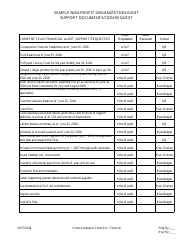

Q: What information is typically required on a commercial loan application form?

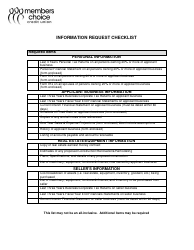

A: A commercial loan application form typically requires information about the applicant's personal and business information, financial statements, income and expenses, and details about the purpose of the loan.

Q: Do I need to provide collateral for a commercial loan?

A: Collateral requirements for commercial loans can vary depending on the lender and the specific loan terms. It is common for lenders to require collateral to secure a commercial loan.

Q: What can a commercial loan be used for?

A: A commercial loan can be used for various business purposes such as purchasing equipment, expanding a business, refinancing existing debt, or funding working capital.