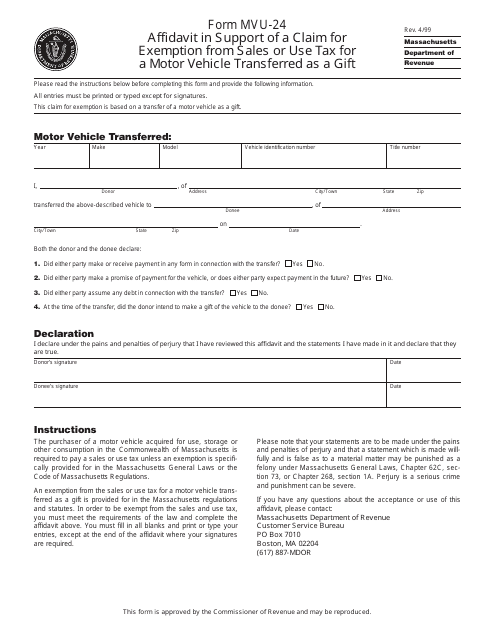

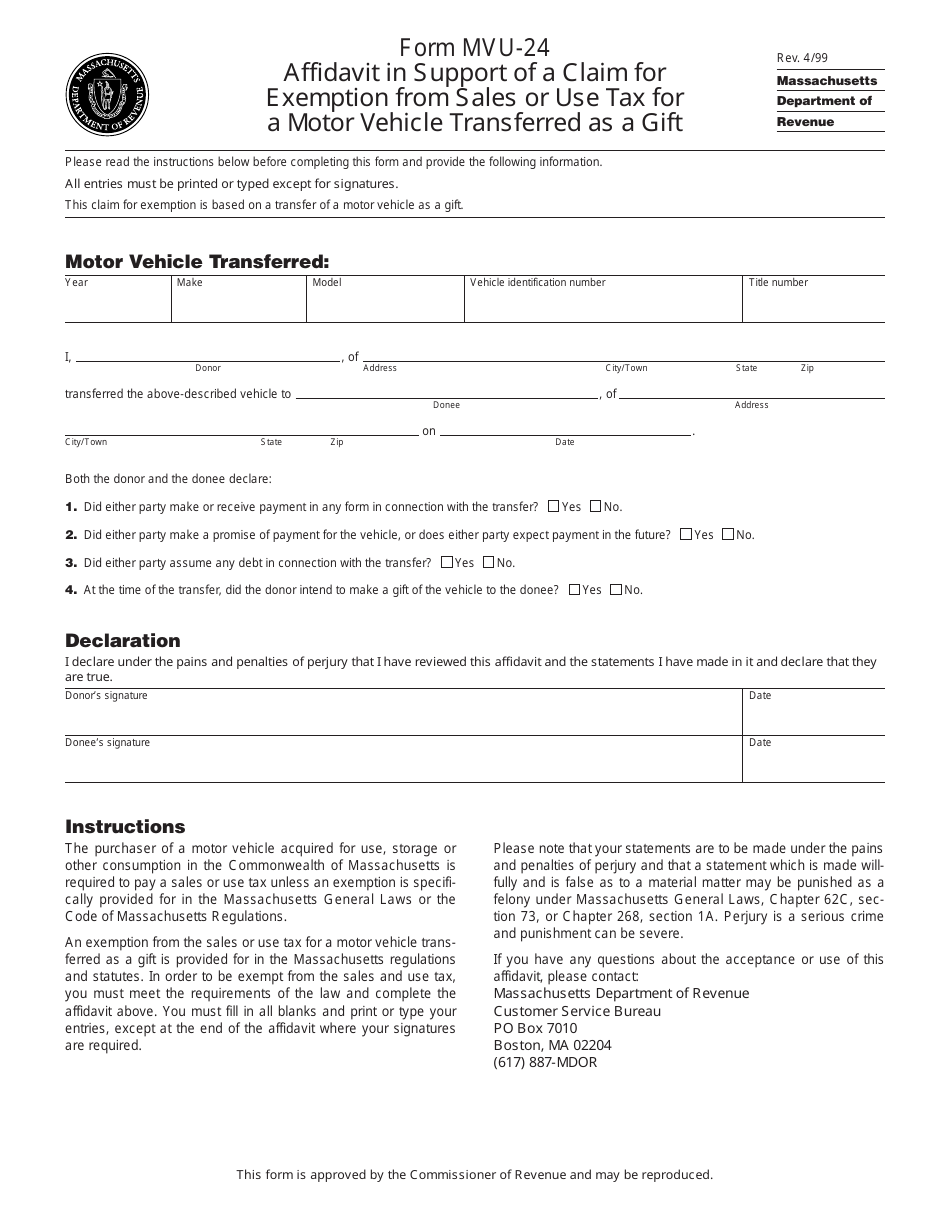

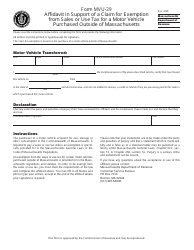

Form MVU-24 Affidavit in Support of a Claim for Exemption From Sales or Use Tax for a Motor Vehicle Transferred as a Gift - Massachusetts

Form MVU-24, Affidavit in Support of a Claim for Exemption From Sales or Motor Vehicle Transferred as a gift , is a Motor Vehicle Sales and Use (MVU) Tax Form which is used in Massachusetts when a donee (a recipient of the automobile) needs to verify they are exempt from paying tax on a received vehicle as a gift from a non-family member. The document is supposed to be filled out by a donor (a person who gifted an automobile) and signed by both the donor and donee. Transferring full ownership of the automobile to the donee is exempt from taxes if a donor paid Massachusetts sales tax before.

Form MVU-24 is issued by the Massachusetts Department of Revenue and was last revised on April 1, 1999 . A fillable MVU-24 Form is available for download below.

Form MVU-24 Instructions

If a donee receives an automobile from a family member, then another document is applicable - Form MVU-26, Affidavit in Support of a Claim for Exemption from Sales or Use Tax for a Motor Vehicle Transferred Within a Family. Form MVU-24 contains a claim exemption, which is based on receiving a vehicle by donee as a gift. It also contains:

- Information, identifying the automobile.

- Names and addresses of donor and donee.

- Several questions concerning transferring automobile as a gift.

- Statements, in which the donor and donee declare that the information indicated in the application is valid.

- Instructions on how tofill out the application.

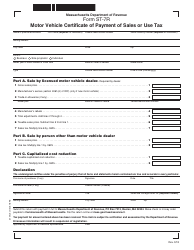

Where to Mail Form MVU-24 (Massachusetts)?

Depending on the reasons of the applicant, an application can be submitted to:

- Any Registry of Motor Vehicles (RMV) Service Center in Massachusetts. When obtaining registration and title of the vehicle, Form MVU-24 should be submitted to any RMV Service Center along with other documents;

- The Massachusetts Department of Revenue (DOR). When requesting a motor vehicle sales or use tax abatement, Form MVU-24 should be submitted to the DOR with a filled-out Form ABT (Application for Abatement).